Wave of New Listings Drives Speculation and Shifts in Korea

1. Market Overview

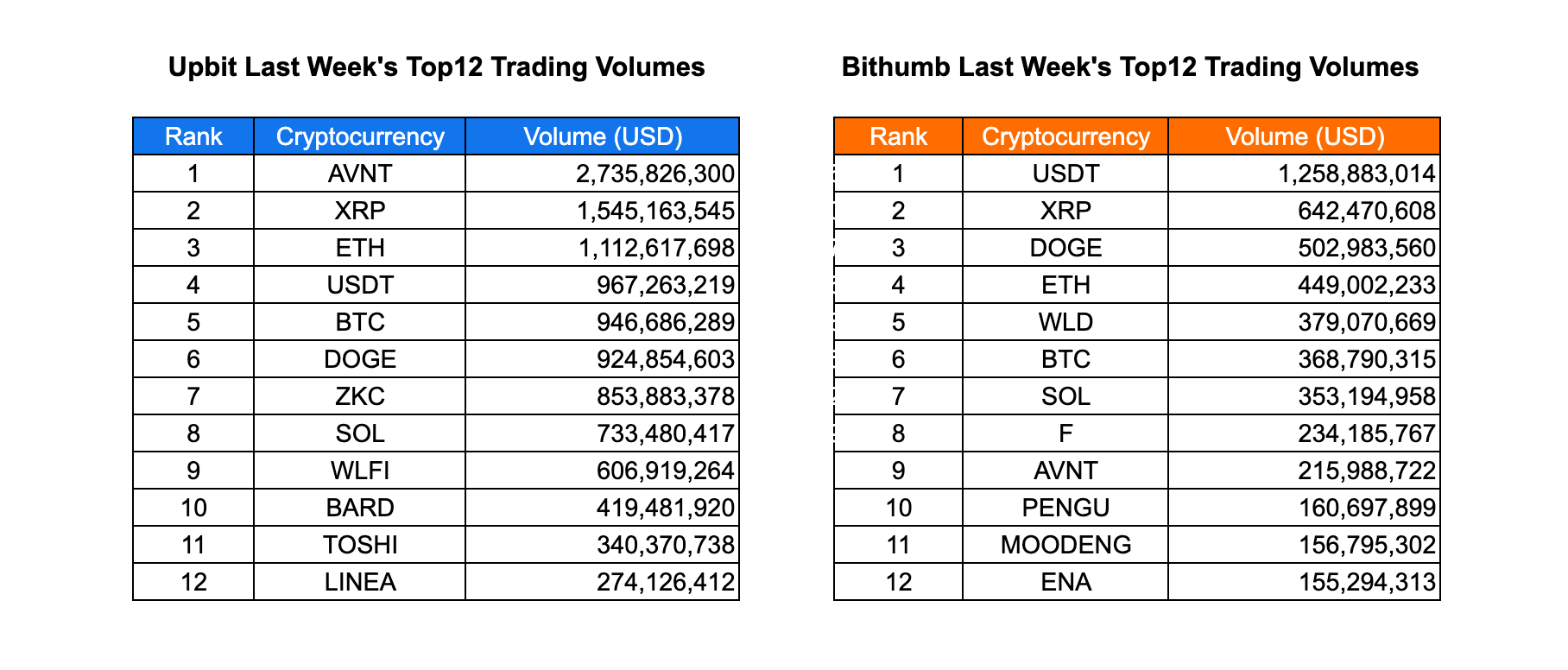

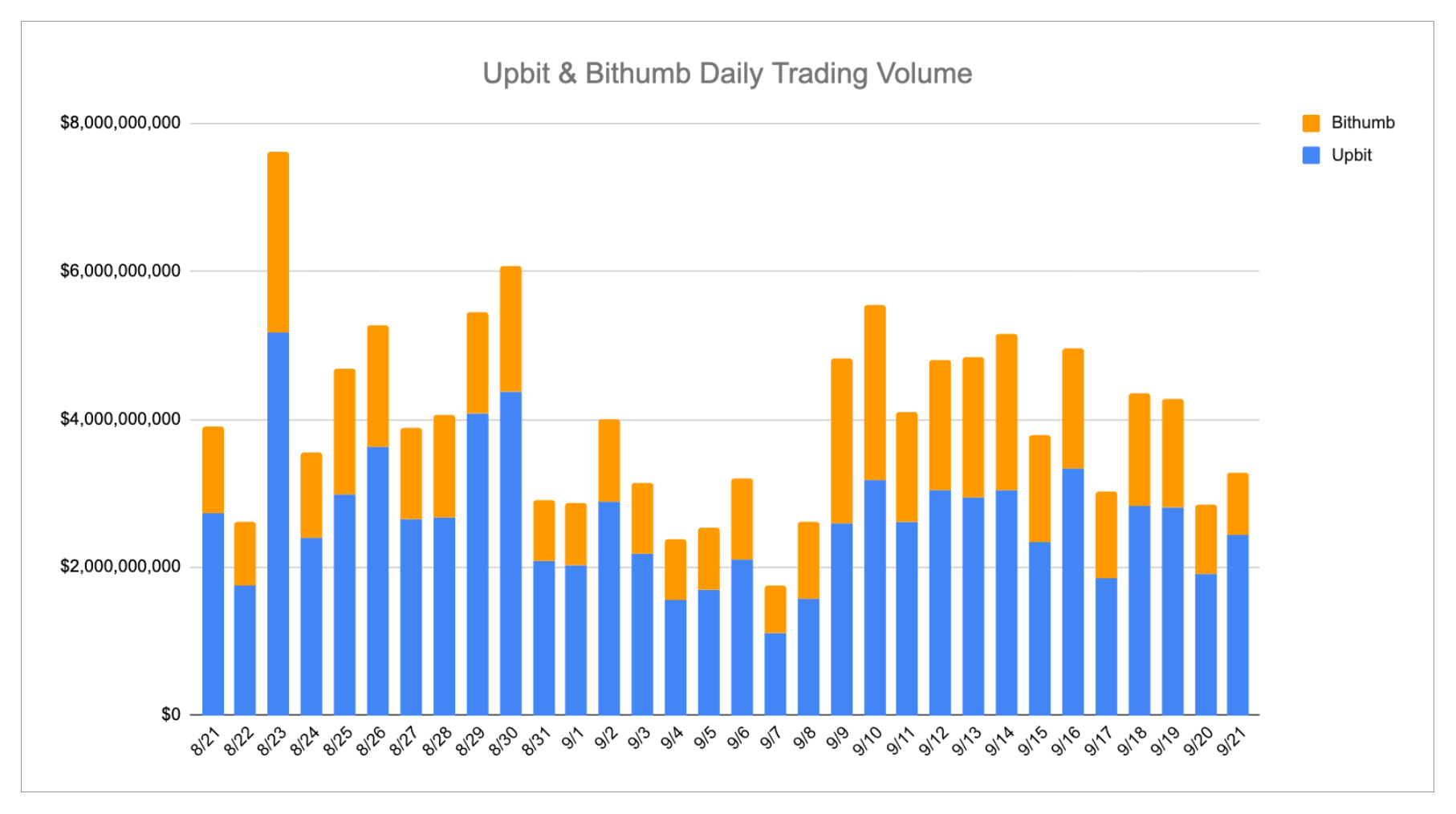

Last week, Korean exchanges saw an unusually high wave of listings. Upbit added Avantis, Boundless, Toshi, Lagrange, Lombard, EtherFi, Resolv, Initia, and Spark, while Bithumb listed Avantis, Boundless, Toshi, Holoworld AI, Lombard, Bittensor, and Kamino Finance. Trading activity reflected this momentum: on Upbit, AVNT led volumes with $2.74B, well ahead of XRP ($1.55B) and ETH ($1.11B), with majors like USDT, BTC, and DOGE each near the $1B mark. Mid-tier names such as ZKC, WLFI, TOSHI, and LINEA also drew notable activity. On Bithumb, USDT led with $1.26B, followed by XRP ($640M) and DOGE ($500M), while WLD, AVNT, and PENGU highlighted retail-driven trading across new and emerging assets.

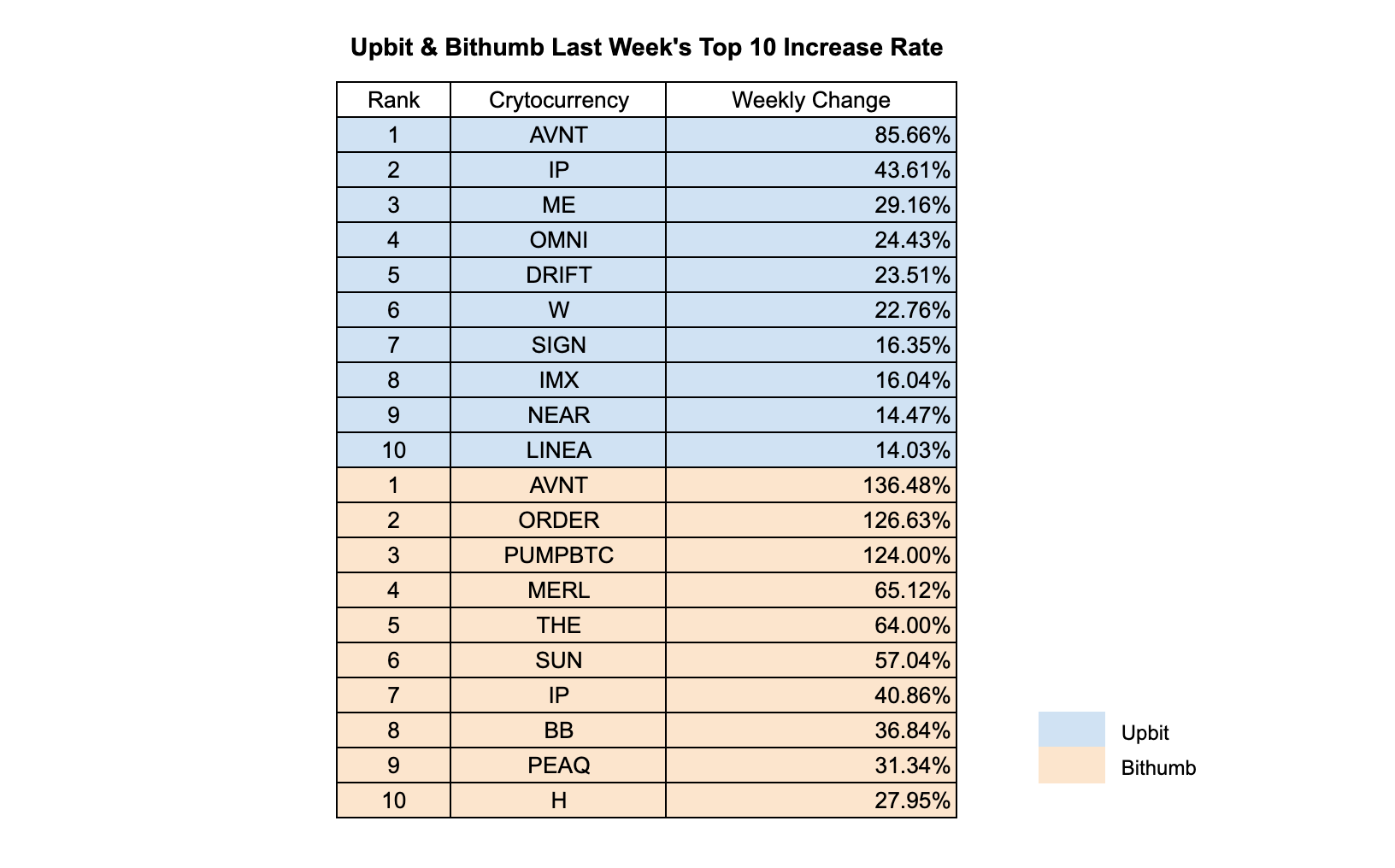

Price action further underlined the divergence between the two exchanges. On Upbit, AVNT surged 85.7%, with IP (+43.6%), ME (+29.2%), and OMNI, DRIFT, and W each adding 20%+, reflecting steady mid-cap momentum. In contrast, Bithumb was defined by sharp speculative rallies, with AVNT (+136%), ORDER (+127%), and PUMPBTC (+124%) leading extreme gains, alongside strong moves in MERL, THE, and SUN. The overlap in winners like AVNT and IP shows broad conviction, but the magnitude of Bithumb’s spikes underscores its higher-risk environment compared to Upbit’s more measured altcoin growth.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Avantis, Boundless, Toshi, Lagrange, Lombard, EtherFi, Resolv, Initia and Spark.

- Bithumb listed Avantis, Boundless, Toshi, Holoworld AI, Lombard, Bittensor and Kamino Finance.

| Date | Upbit | Bithumb |

|---|---|---|

| 9/15 (Mon) | Avantis (AVNT), Boundless (ZKC) | Avantis (AVNT), Boundless (ZKC) |

| 9/16 (Tue) | - | - |

| 9/17 (Wed) | Toshi (TOSHI) | Toshi (TOSHI), Holoworld AI (HOLO) |

| 9/18(Thu) | Lagrange (LA), Lombard (BARD) | Lombard (BARD), Bittensor (TAO) |

| 9/19 (Fri) | EtherFi (ETHFI), Resolv (RESOLV), Initia (INIT), Spark (SPK) | Kamino Finance (KNMO) |

Key Marketing Strategies & Takeaways

🔹 Lombard (BARD)

Lombard emerged as one of the early Bitcoin deposit projects shortly after the launch of Babylon, which enabled DeFi activities using Bitcoin.

With the introduction of this new DeFi concept of generating yield through Bitcoin deposits, many users actively participated in such deposit-based opportunities at the time.

Lombard was regarded as one of the representative platforms for Bitcoin deposits during that period, and there was also strong native participation from the Korean community.

As Lombard attracted a growing user base, it began to actively pursue KOL marketing in the Korean market. Recognizing that many users only associated it with simple BTC deposits, Lombard focused on communicating the broader scope of its activities.

At the same time, it emphasized data points such as TVL, market share within BTCFi, DeFi adoption of LBTC, and user growth.

As the TGE approached, Lombard promoted its token sale on the Buidlpad platform through KOL channels, ultimately raising around $94M — surpassing its initial target by 1,403%.

Lombard has since maintained exposure within the Korean community by sharing updates on ecosystem expansion and new partnerships. In particular, the announcement of a partnership with KODA, Korea’s leading institutional custody provider, highlighted Lombard’s alignment with the growing institutional demand in the Korean market.

2-2. Trading Volume

Last week, Upbit recorded AVNT as the clear leader with USD 2.74 billion in trading activity, followed by XRP (USD 1.55 billion) and ETH (USD 1.11 billion). Core assets such as USDT (USD 0.97 billion), BTC (USD 0.95 billion), and DOGE (USD 0.92 billion) also maintained strong liquidity, while SOL (USD 0.73 billion) and ZKC (USD 0.85 billion) further underlined demand beyond top-layer tokens. Mid-tier names including WLFI, BARD, TOSHI, and LINEA showed meaningful volumes, reflecting sustained investor activity across both majors and smaller-cap assets.

On Bithumb, USDT topped trading with USD 1.26 billion, followed by XRP (USD 0.64 billion), DOGE (USD 0.50 billion), and ETH (USD 0.45 billion). Interest also concentrated around WLD (USD 0.38 billion) and BTC (USD 0.37 billion), while SOL (USD 0.35 billion) remained an active large-cap. The appearance of tokens such as F, AVNT, PENGU, MOODENG, and ENA in the top twelve highlighted growing traction in newly listed and retail-driven assets.

Overall, trading activity revealed a distinct exchange preference: Upbit volumes leaned heavily toward AVNT and other mid-cap tokens, while Bithumb showed stronger positioning in USDT and a mix of newer listings. The presence of both blue-chip cryptocurrencies and speculative tokens across rankings underscores a diversified landscape, with robust participation from both retail and institutional players.

2-3. Top 10 Gainers

Last week, Upbit saw AVNT lead price growth with an 85.66% increase, followed by IP (43.61%) and ME (29.16%), while OMNI, DRIFT, and W also posted solid gains above 20%, reflecting strong momentum in both mid-cap and emerging tokens. SIGN, IMX, NEAR, and LINEA rounded out the top ten, showing continued investor interest across diverse sectors including infrastructure and ecosystem tokens.

On Bithumb, AVNT surged dramatically by 136.48%, with ORDER (126.63%) and PUMPBTC (124.00%) following closely, highlighting speculative rallies in niche assets. MERL (65.12%), THE (64.00%), and SUN (57.04%) also recorded strong weekly gains, while IP (40.86%) extended its positive momentum across both exchanges. BB, PEAQ, and H completed the top ten, signaling heightened interest in newly listed and community-driven projects.

Overall, the week’s top gainers illustrate a broad mix of established and speculative tokens fueling market activity. The overlap of AVNT and IP across both Upbit and Bithumb suggests strong cross-exchange investor conviction, while sharp surges in tokens such as ORDER and PUMPBTC point to heightened volatility driving short-term trading opportunities.

3. Korean Community Buzz

3-1. Endless Listings, Growing Fatigue

As covered above, both Upbit and Bithumb had another busy week of listings — 9 on Upbit and 7 on Bithumb — creating what many in the community called a “listing rally.” Traders noted a pattern of competitive overlap, with coins like $PUMP and $AVNT debuting first on Bithumb and then on Upbit, while $ZKC went in the reverse order. While some see this competition as ultimately beneficial for investors, others expressed fatigue over the constant stream of new tokens. Observers also pointed out a recurring cycle: new projects often debut on Binance Futures, then move to spot once volumes rise, and eventually find their way to Korean exchanges, where the two local giants often mirror each other’s listings.

3-2. Kaito Launchpad Sparks Controversy

Last week’s Boundless Kaito allocation turned into a heated topic despite delivering double returns on principal. The controversy stemmed from the structure: instead of proportional allocation, a $250K hard cap left whale participants frustrated. Further, even after the sale ended, the platform distributed tokens on a first-come-first-served basis, which many traders saw as unfair and nonsensical. Adding fuel to the fire, Kaito unilaterally expanded the sale amount without adjusting disclosures, making prior investment data irrelevant. Combined with ongoing complaints about past distribution and claim issues, this launchpad round left many community members skeptical, despite its initial profitability.

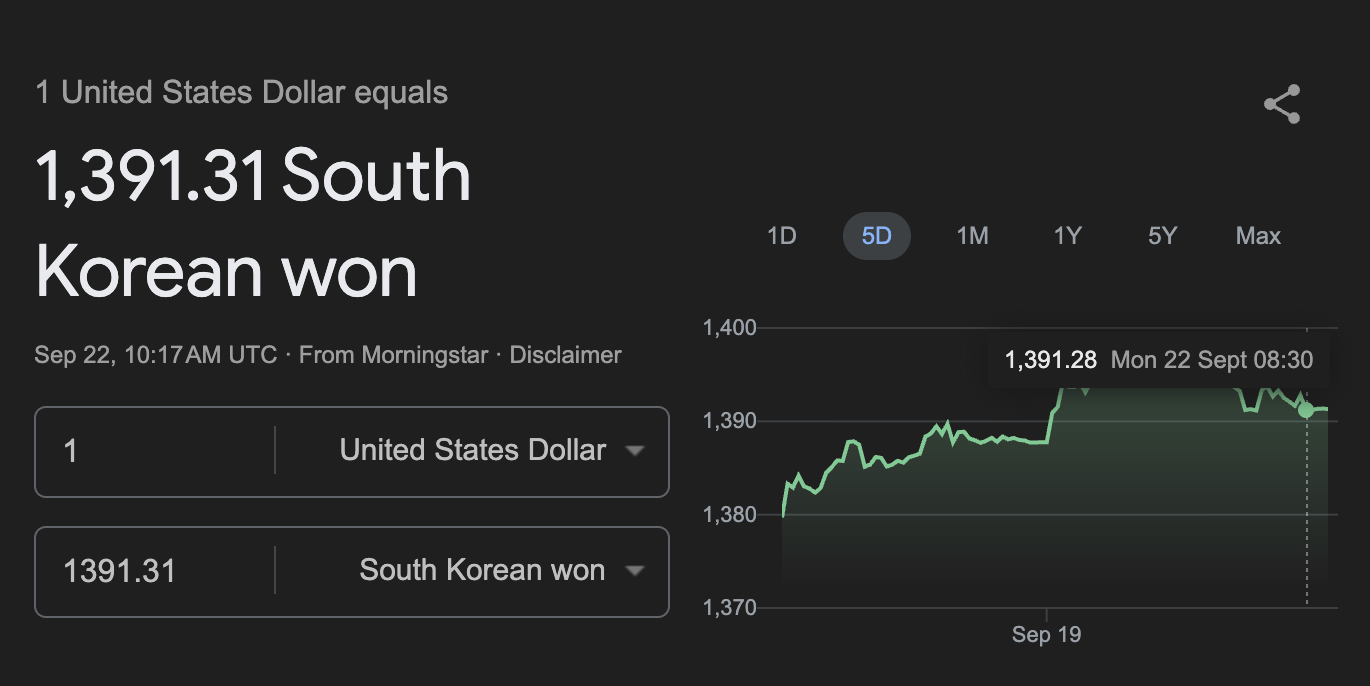

3-3. KRW/USD Nears 1,400 — Tether Stays Firm

With the KRW/USD exchange rate hovering near 1,400, Korean crypto traders — who often hold significant amounts of USDT — are watching closely. Even without a strong kimchi premium, tether prices have remained resilient, buoyed by broader dollar strength and expectations around domestic stimulus measures, including a second round of government support. Community sentiment leaned toward risk aversion in KRW, with comments like “holding won feels dangerous” resonating widely. The strong tether defense reinforced the perception that traders are hedging away from local currency risk, aligning crypto positions with macroeconomic concerns.

4. Web3 Event

Finally, the busy Korea Blockchain Week has been started! Throughout this month, starting from mid-September, a variety of Web3 side events are expected to take place. To make it easier for you to keep track, we are sharing the KBW Sheet.

Through this sheet, you can check events, registrations, locations, and more throughout the month.

✅ All about Korea Blockchain Week 2025 ➡ Link

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!