Upbit Hack Distorts Trading Flow as Naver–Dunamu Deal Advances

1. Market Overview

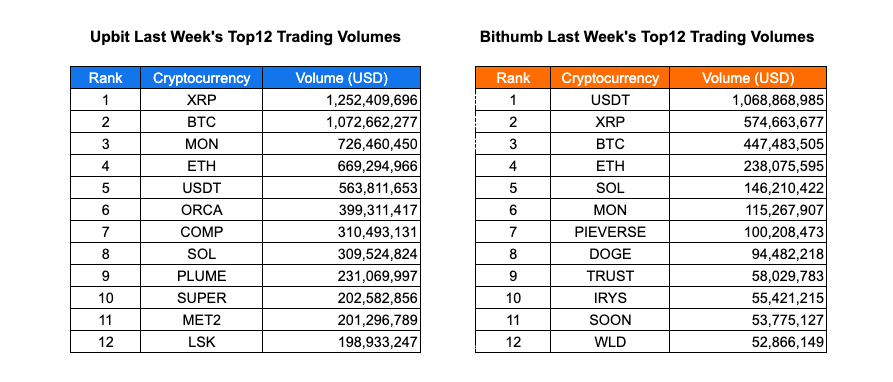

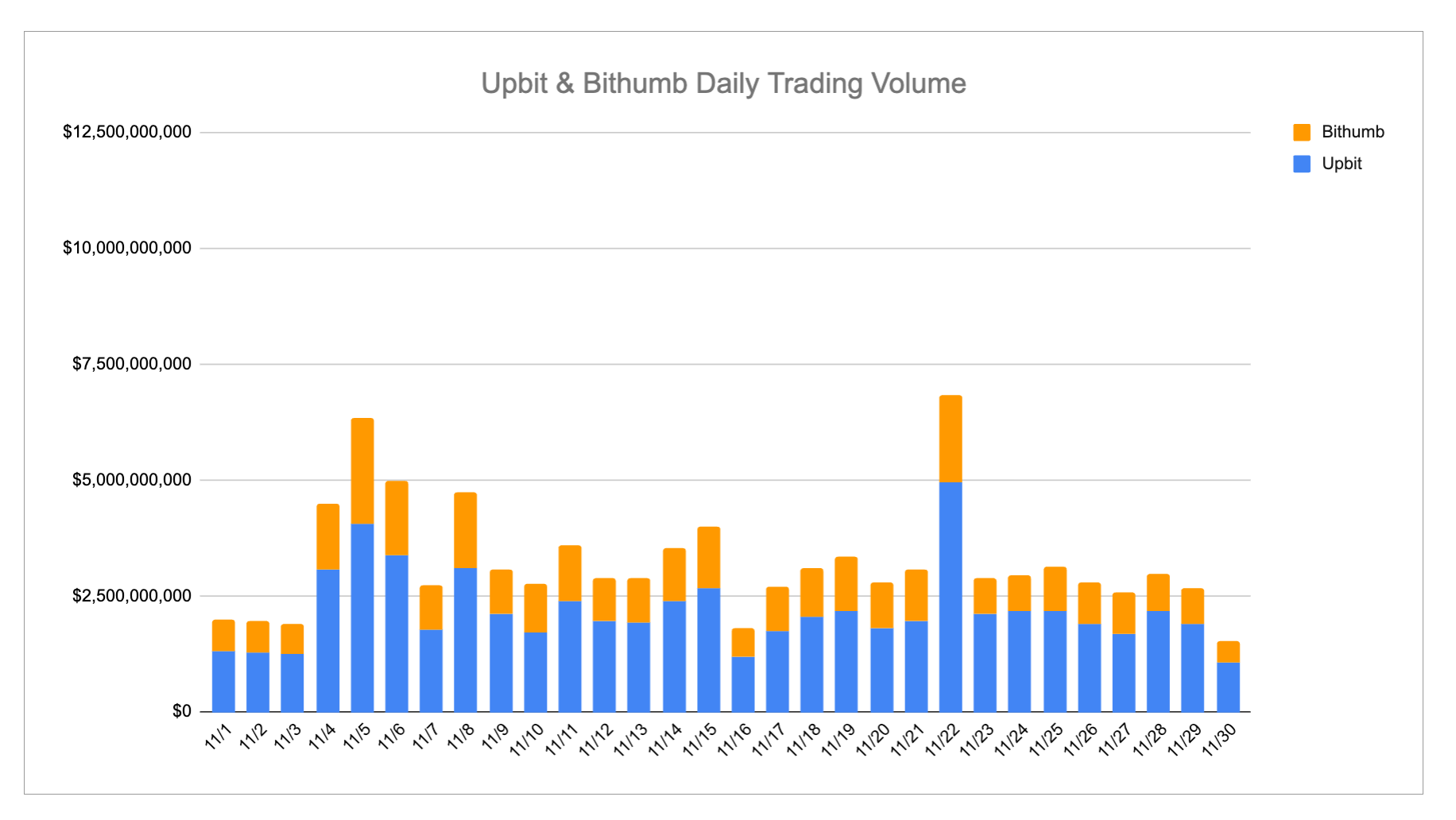

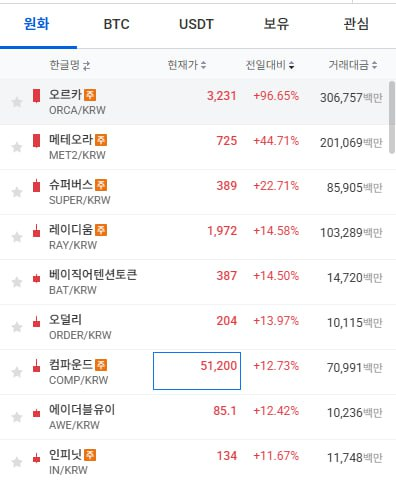

Last week, trading activity across Upbit and Bithumb remained steady, with XRP, BTC, and ETH continuing to dominate volumes. On Upbit, XRP recorded approximately $1.25B, followed by BTC at $1.07B and MON at $726M. Bithumb again showed its characteristic stablecoin-heavy flow, with USDT at $1.06B, followed by XRP and BTC at $574M and $447M, respectively. Upbit saw significantly higher activity in thematic tokens such as ORCA, PLUME, SOL, and NXPC, partially influenced by temporarily restricted withdrawals following the Upbit security incident, which created intensified internal trading conditions and short-term price distortions.

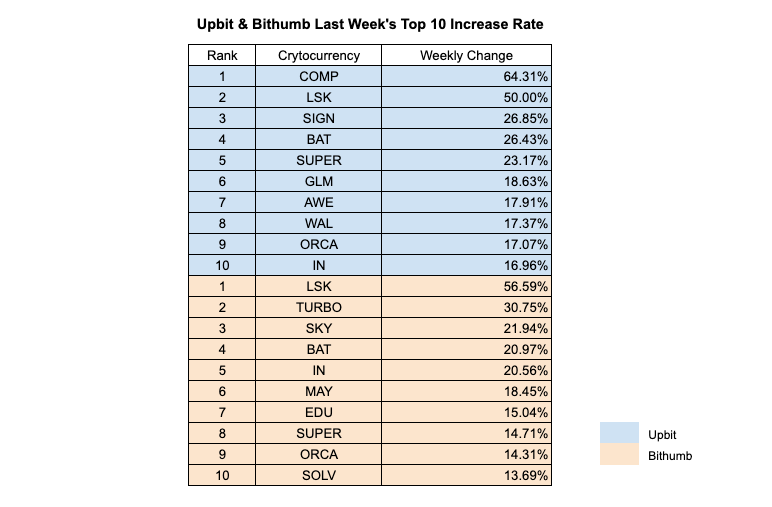

In performance, Upbit’s top gainer was COMP at +64.31%, followed by LSK (+50.00%) and BAT (+26.43%). Bithumb showed similar trends, with LSK (+56.59%) and TURBO (+30.75%) leading the week. Mid-caps like SUPER, ORCA, BAT, and WLFI appeared among the strongest gainers across both platforms. Overall, the market environment was shaped not only by normal trading dynamics but also by heightened retail engagement driven by the Upbit hack discussions and the evolving narrative around the Naver–Dunamu integration.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced a new listing:

- Upbit listed Monad, Plume.

- Bithumb listed Pieverse, Monad, Xion, Irys.

| Date | Upbit | Bithumb |

|---|---|---|

| 11/24 (Mon) | Monad (MON) | Pieverse (PIEVERSE), Monad (MON) |

| 11/25 (Tue) | ||

| 11/26 (Wed) | Plume(PLUME) | Xion(XION) |

| 11/27 (Thu) | Irys(IRYS) | |

| 11/28 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Plume (PLUME)

Plume conducted its TGE in early 2025 and was listed on Bithumb with a KRW pair in March 2025. After months of trading on Bithumb, the project has now successfully achieved an Upbit KRW listing.

Even after being listed on Bithumb, Plume continued active marketing efforts in Korea, primarily through KOL marketing and PR activities.

They collaborated with research institutions to publish Korean-language reports and used these reports as the basis for community events with prize offerings. These campaigns were amplified through major Telegram KOL channels, helping Plume reach a broad audience and drive active participation.

As a result of these efforts, Plume first secured an Upbit BTC market listing. Following that, they continued similar marketing initiatives while sharing regulatory-related updates from the U.S.—including the notable announcement that Plume received “money transmitter” approval from the SEC.

Plume also launched a points-based airdrop program that allowed users to participate via deposits, successfully drawing in Korean retail users.

Ultimately, these continuous marketing and PR activities led to Plume’s successful Upbit KRW listing. This makes Plume a strong case study of how sustained engagement in the Korean market can produce meaningful, positive outcomes.

🔹 Irys(IRYS)

Irys has essentially executed all major forms of marketing within the Korean market.

This includes meetups, AMAs, ambassador programs, Kaito Yapping, Korean community management, community events, Discord operations, merch production, and even storytelling content.

Across all of these, Irys successfully leveraged KOL marketing to amplify distribution. In addition, by showcasing real testnet participation, games, and hands-on engagement, they were able to drive genuinely organic user activity.

A distinctive aspect of Irys’s strategy was the creation of its own unique culture. They invested heavily in merch, producing designs inspired by Japanese anime, which led to the formation of a strong fanbase.

Irys also tapped into a wide pool of KOLs, utilizing each KOL’s strengths appropriately. This included hosting multiple AMAs on different themes, publishing research-focused or technically oriented content about Irys, and running participation-driven posts designed to encourage real user involvement.

As a result, by the time of TGE, the Korean community broadly expressed hope that the token would list on Upbit—Korea’s most influential exchange. (Notably, Korean communities generally do not express this kind of expectation unless they genuinely believe the possibility exists.)

2-2. Trading Volume

Last week’s trading activity on Upbit was significantly shaped by the aftermath of the temporary withdrawal freeze following the security breach on November 27. With on-chain transfers halted for a period of time, liquidity became locally concentrated within Upbit, resulting in heightened internal trading volume — especially for tokens with active speculation potential. XRP led with $1.25B, followed by BTC at $1.07B and MON at $726M, with mid-tier tokens such as ORCA, COMP, SOL, and PLUME also showing unusually elevated volumes between $230–399M, partly influenced by this isolated trading environment.

On Bithumb, market behavior followed more natural liquidity patterns, with USDT at $1.06B leading the week, followed by XRP at $574M, BTC at $447M, and ETH at $238M. Altcoins such as SOL, MON, and PIEVERSE recorded moderate trading between $100M–146M, reflecting steady but less speculative trading compared to Upbit. Notably, TRUST and other tokens that surged internally on Upbit showed comparatively lower volume on Bithumb, reinforcing the difference between open-flow market activity and temporarily closed liquidity conditions.

Overall, major assets maintained strong engagement across both exchanges, but Upbit’s unique post-incident environment amplified trading in select tokens — creating brief internal momentum pockets — while Bithumb volumes remained more balanced and externally influenced.

2-3. Top 10 Gainers

Last week, COMP led the gains on Upbit with a 64.31% weekly increase, followed by LSK at 50.00%, while SIGN and BAT rose 26–27%. Mid-cap assets such as SUPER, GLM, AWE, and WAL also recorded strong double-digit growth. It’s worth noting that part of the upward momentum — especially in tokens like ORCA — was influenced by temporarily restricted withdrawals on Upbit following the security incident, which intensified internal trading and contributed to sharp short-term price movements.

On Bithumb, LSK similarly emerged as the top performer with a 56.59% rise, followed by TURBO and SKY at 30–22%, while BAT and IN delivered consistent gains in the 20% range. Other altcoins such as MAY, EDU, SUPER, ORCA, and SOLV saw 13–18% increases, demonstrating positive but comparatively more organic price action unaffected by liquidity containment.

Overall, the market showed strong selective momentum in mid-cap and community-driven assets, though some of the weekly performance — particularly on Upbit — must be viewed in the context of temporarily isolated liquidity and intensified on-platform buying pressure rather than purely macro-driven market demand.

3. Korean Community Buzz

3-1. Upbit hack sparks isolated internal market rally

On November 27, Upbit suffered a security breach involving the unauthorized withdrawal of ~445 billion KRW (approx. $40M) in digital assets. The exchange detected abnormal withdrawals on the Solana network at 4:41 a.m. and immediately reported the incident to KISA (Korea Internet & Security Agency) and financial regulators, while temporarily freezing all deposits and withdrawals.

With external transfers blocked, traders were unable to move assets off the exchange, resulting in localized price surges as liquidity was trapped internally. Certain tokens such as ORCA surged over 100% within a day, driven purely by internal demand. Upbit’s total trading volume jumped from ~$1.6B to ~$2.3B in 24 hours.

Meanwhile, Bithumb posted a public notice warning users about the Upbit hack — and stating that transfers to Upbit may be unavailable — which attracted significant attention from traders. Deposits and withdrawals have since resumed.

3-2. Naver–Dunamu share exchange approaches conclusion

Naver Financial and Dunamu (Upbit’s parent company) are moving toward finalizing their share transfer structure. The current projected valuation ratio of around 1 : 3.3–3.4 in favor of Dunamu is reportedly higher than previously expected. With this transaction, Dunamu will become a wholly owned subsidiary of Naver Financial.

Naver aims to build a next-generation financial platform combining blockchain and AI, extending beyond payments into broader financial and lifestyle services. The companies plan to invest 10 trillion KRW (~$7.5B) over the next five years into Web3 and AI ecosystem development, with an emphasis on global expansion rather than internal restructuring under Naver’s main corporate entity.

(Source)

3-3. Financial authorities tighten AML enforcement — Travel Rule expansion

Korea’s Financial Services Commission announced that it will expand the Travel Rule to apply even to transactions below the current 1 million KRW threshold, closing common loopholes that previously allowed users to avoid identification requirements by splitting transactions. The FSC also stated that domestic exchanges will be restricted from interacting with overseas platforms classified as high-risk for potential money laundering activities.

Community reaction has largely been frustration and resignation, as users expect stricter monitoring and fewer transfer workarounds going forward — but the move aligns Korea with increasingly stringent global AML standards.

(Source)

4. Upcoming Meetups

Talus in Seoul: Community Night

📆 Date: 12. 02 (Tue) 19:00 ~ 22:00

💼 Host: Talus

Luma: https://luma.com/cb7j31iy?tk=B142hJ

$AKE Holders hold 'em night

📆 Date : 12. 04 (Thu) 18:00 ~ 23:00

💼 Host: AKEDO

Luma: https://luma.com/7whbas9e?tk=mExJxR

Decibel x Merkle: Seoul Christmas Perp Day 🎄

📆 Date: 12. 13 (Sat) 12:00 ~ 15:00

💼 Host: Decibel, Merkle

Luma: https://luma.com/ip5hkvfw?tk=WrsNU2

The Web3 Year-End Gala: Seoul 2025

📆 Date : 12. 18 (Thu) 19:00 ~ 00:00

💼 Host: Zoomex

Luma: https://luma.com/yiayus1r?tk=hoFsyd

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!