Speculation Spikes in Korea as Altcoin Volumes Hit New Highs

1. Market Overview

Last week, Korea’s crypto market spotlighted new listings and surging retail momentum. Upbit introduced Hyperlane and Ethena, while Bithumb listed Hyperlane and Resolv. Among them, Hyperlane stood out by driving massive speculative interest on Upbit, quickly ranking second in weekly trading volume. Trading activity on both exchanges surged notably, especially after July 10th, peaking on July 11th with a combined volume near $9 billion. XRP continued to dominate across both platforms, but mid-cap tokens like HYPER, PENGU, and BONK contributed significantly to the week’s altcoin rally, showing growing appetite for lower-cap narratives among Korean traders.

Top gainers reflected this speculative mood, with Upbit’s XLM, PENGU, and KNC posting gains of 70–90%, alongside meme and ecosystem tokens like BONK and 1INCH. Bithumb displayed a similar pattern, with OMNI and PENGU leading gains, while newer names like INIT and KERNEL gained traction. Social sentiment mirrored market activity, with Upbit’s tick size rollback, token rallies like CROSS, M, PENGU, and ongoing KRW stablecoin discussions keeping local traders highly engaged. From heavy trading in altcoins to growing debate on stablecoin policy, Korea’s market showed a clear risk-on shift.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Hyperlane and Ethena.

- Bithumb listed Hyperlane and Resolv.

| Date | Upbit | Bithumb |

|---|---|---|

| 7/7 (Mon) | ||

| 7/8 (Tue) | ||

| 7/9 (Wed) | ||

| 7/10 (Thu) | Hyperlane (HYPER) | Hyperlane (HYPER) |

| 7/11 (Fri) | Ethena (ENA) | Resolv (RESOLV) |

Key Marketing Strategies & Takeaways

🔹 Ethena (ENA)

Ethena entered the Korean market in early 2024. While there weren’t any major marketing efforts at the time, the project drew strong attention thanks to its solid lineup of VC investors, partners, and backers. Many users participated in the campaign by staking assets in anticipation of an airdrop.

After a successful TGE, Ethena kept in touch with the Korean market through KOL channels, regularly sharing how USDe stands apart from other stablecoins, how the $ENA token can be used, and what the future roadmap looks like.

Because USDe is a yield-bearing stablecoin, Ethena needed to consistently prove its stability. They delivered those messages to users through KOLs as well. One example was during the Bybit hack incident. USDe briefly showed signs of depegging, but there was no actual loss. Ethena responded quickly by explaining that funds were already being managed through external custody solutions.

Ethena seems to have a strong understanding of the Korean Web3 user base, especially those focused on staking and farming. It's a good example of strategic and efficient KOL-driven marketing tailored to the local market.

🔹 Hyperlane (HYPER)

Hyperlane has been a well-known project in the Korean market for quite some time, especially for its airdrop tasks. During the peak of airdrop-farming activity in Korea, it gained attention as one of the projects that required users to generate on-chain transactions. The fact that it was backed by Circle Ventures also played a big role in driving early hype.

However, Hyperlane didn’t actively engage in major marketing efforts in Korea, neither before nor immediately after its TGE.

Recently though, there have been some signs of renewed interest in the Korean market. A research report about Hyperlane was published through a local research firm, and KOLs began creating related content based on that report, aiming to introduce the project and share its current status with Korean users.

2-2. Trading Volume

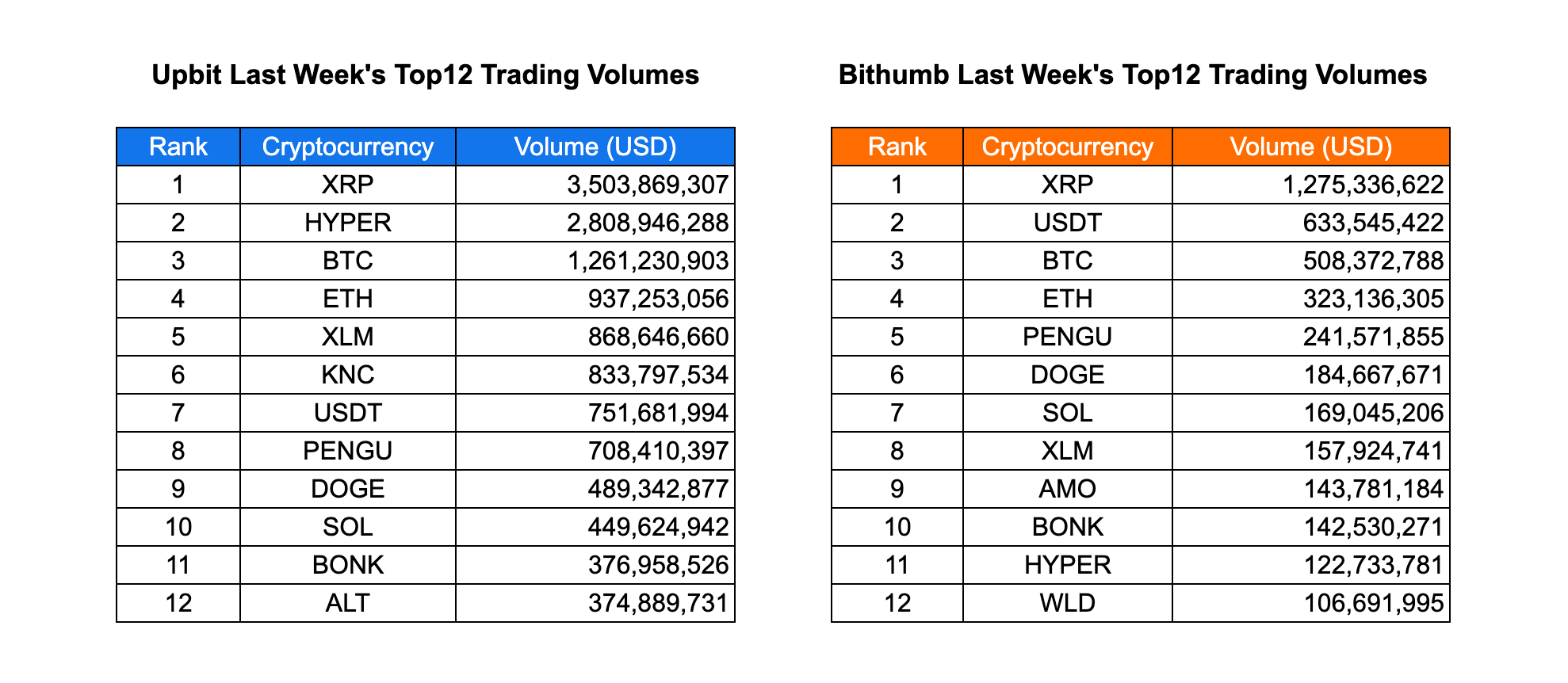

Trading volume on Upbit and Bithumb showed a remarkable surge over the past week, with total volumes peaking on July 11th. Upbit recorded the highest weekly trading volume at over $3.5 billion in XRP alone, followed by HYPER ($2.8B), BTC ($1.26B), and ETH ($937M). Meanwhile, Bithumb’s top performer was also XRP with $1.28B, trailed by USDT ($633M) and BTC ($508M), indicating a strong preference for high-liquidity tokens on both exchanges.

Upbit’s trading activity was notably driven by speculative momentum in mid-cap tokens such as HYPER, PENGU, and BONK, which collectively contributed over $1.5B in volume. Bithumb showed a slightly more balanced distribution, with PENGU, AMO, and BONK all making the top 10, suggesting growing user engagement with altcoins outside the top market cap range.

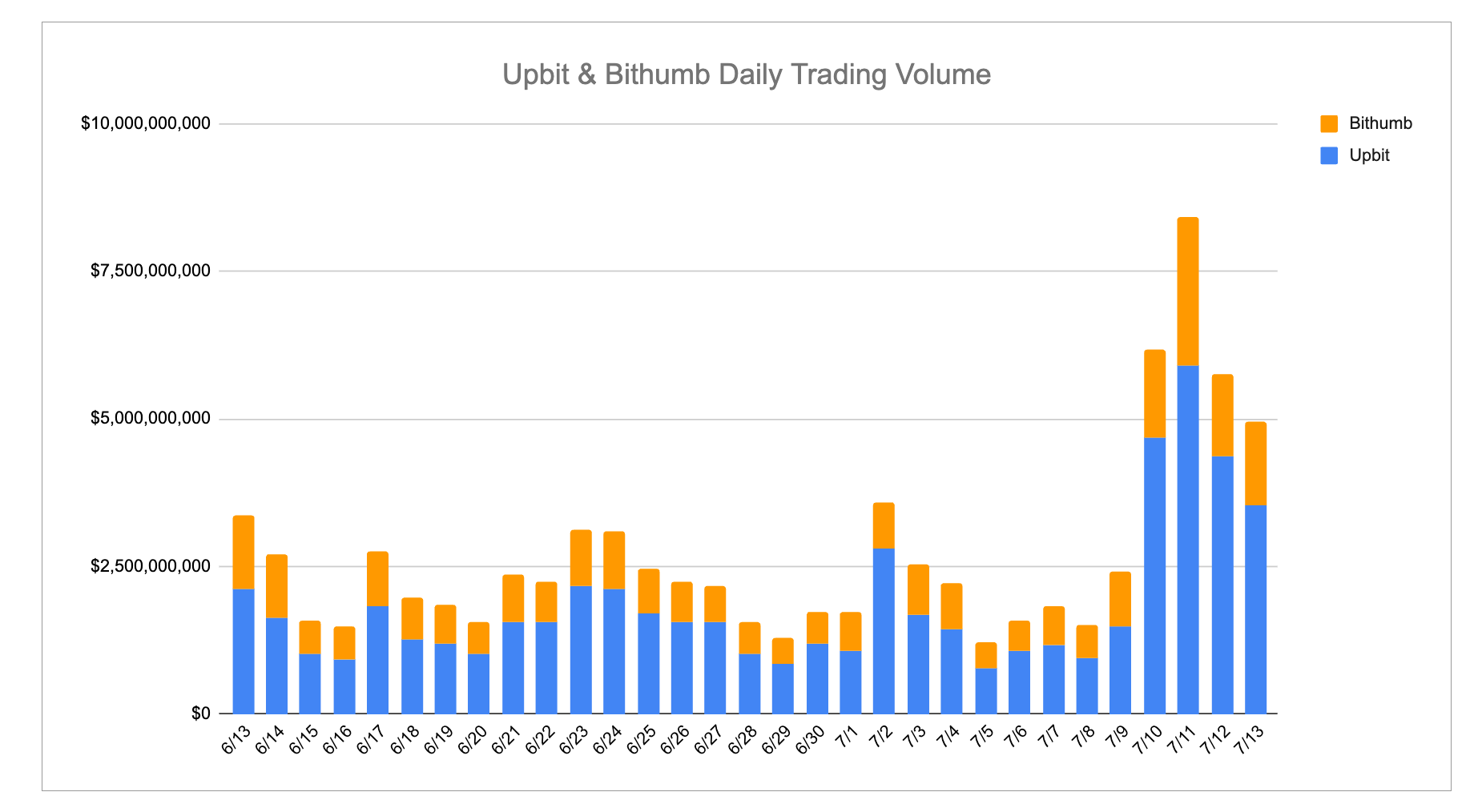

On a daily basis, volumes spiked dramatically starting July 10, with Upbit contributing the lion’s share to the combined peak of nearly $9B on July 11. This surge appears to correlate with a broader retail influx and heightened volatility across altcoin markets. Overall, Upbit continues to lead in volume dominance, capturing significant user activity particularly in newer and lower-cap assets.

2-3. Top 10 Gainers

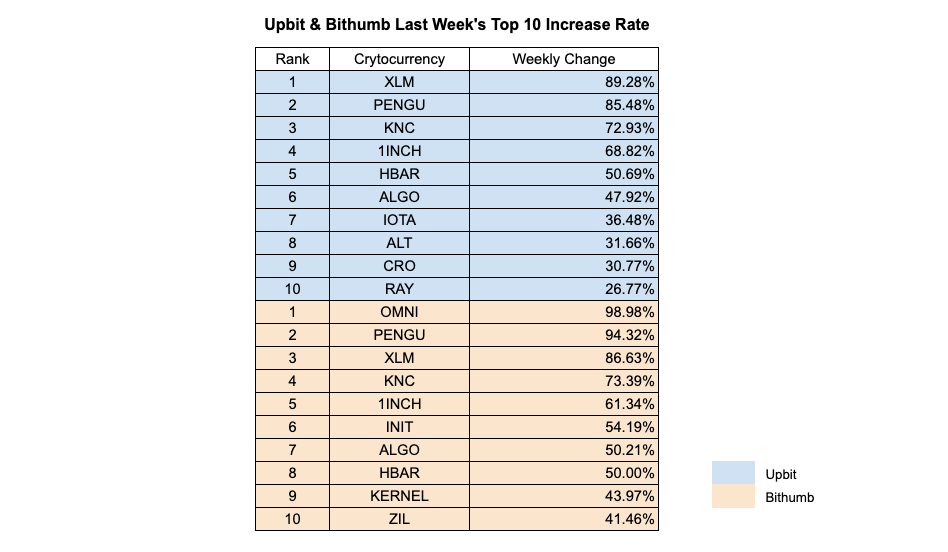

This week’s Korean exchange markets saw a strong rally across mid-cap and ecosystem tokens, with both Upbit and Bithumb recording triple-digit surges in certain assets. On Upbit, XLM led the chart with an 89.28% increase, closely followed by PENGU (+85.48%), KNC (+72.93%), and 1INCH (+68.82%), showing renewed interest in older Layer 1 and DEX-related tokens. HBAR, ALGO, and IOTA also posted gains of 35–50%, reflecting a broader altcoin resurgence.

Bithumb showed a similar trend with OMNI spiking by 98.98% and PENGU by 94.32%, underscoring strong market enthusiasm around speculative or meme-associated tokens. XLM and KNC repeated their strong performance here, gaining 86.63% and 73.39% respectively, indicating synchronized demand across both platforms. Newer entrants like INIT and KERNEL also made it into the top gainers, suggesting that users are actively exploring emerging narratives.

The week’s gainers indicate a clear pivot by Korean retail users toward high-volatility, narrative-driven plays. The concentration of similar tokens across both Upbit and Bithumb suggests momentum was not isolated to one exchange, but reflected a market-wide appetite for mid-cap upside and ecosystem resurgence trades.

3. Korean Community Buzz

3-1. Upbit’s Tick Size Rollback Sparks Bull Market Hopes

Upbit announced changes to its KRW market tick sizes starting July 31st, rolling back increments in certain price brackets. The update was welcomed by the community, with many calling it a “bull market signal.”

Traders especially pointed out the new 5,000 KRW tier, joking that XRP and other favorite tokens like XRL could benefit if they break previous highs. Comments like “Time to fly to 5,000 KRW!” and “Even the exchange is hyping the bull market” were common. On top of that, Upbit also lowered BTC withdrawal fees from 0.0008 to 0.0002 BTC, adding more fuel to the positive vibes.

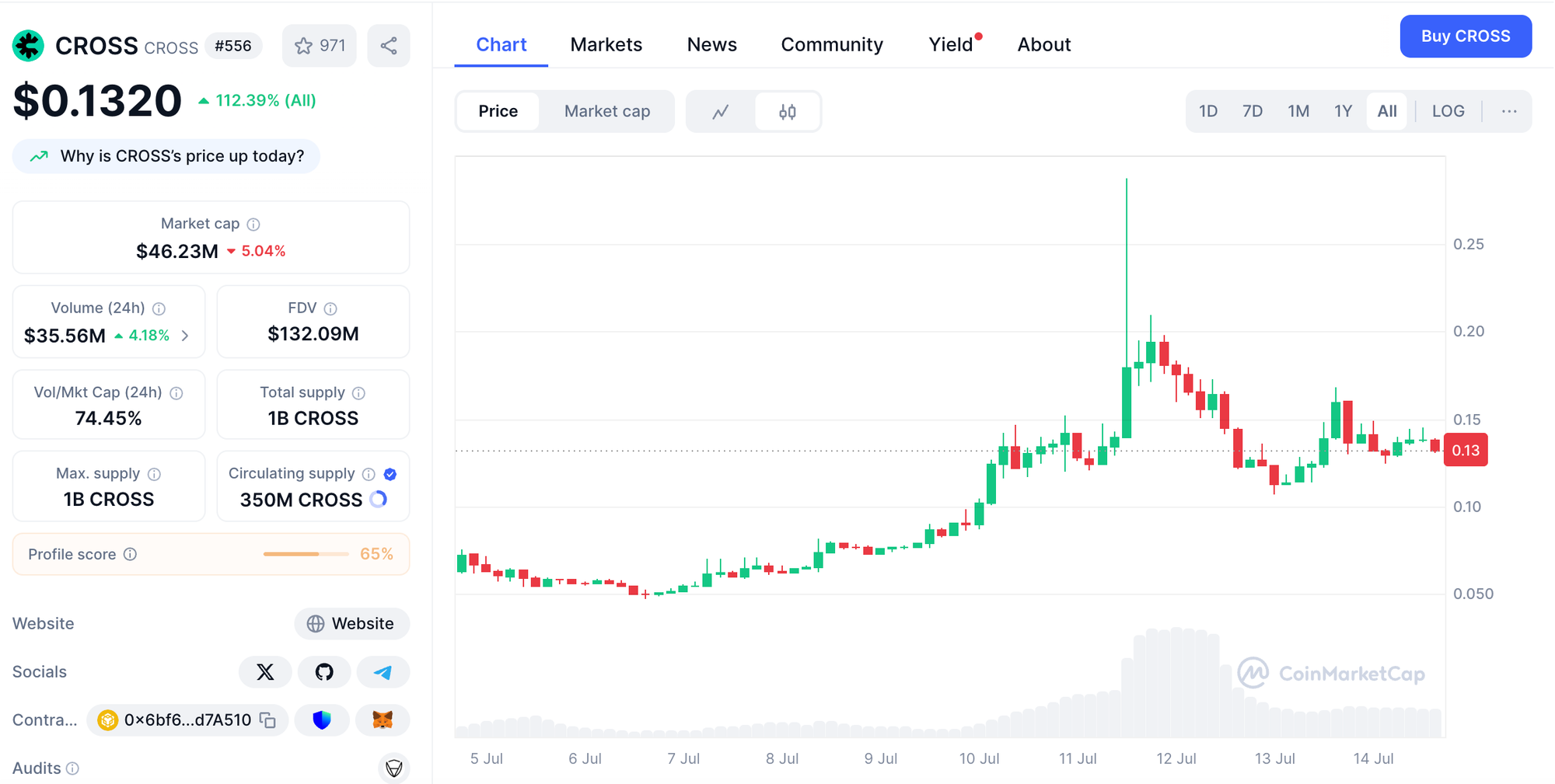

3-2. $CROSS TGE, and Everyone Saved

CROSS, a token backed by the well-known Korean Web3 figure Jang Hyun-guk, made a surprising comeback. After dipping below its token sale price, CROSS rallied back above the sale level and even briefly doubled. This led to a popular community meme about “everyone being rescued.”

Posts like “Should’ve bought the dip,” “Captain Jang never disappoints,” and “Everything pumps in a bull market!” were everywhere. KOLs flooded Telegram with profit screenshots and chart memes, and traders mentioned $CROSS alongside $M and $PENGU as the breakout tokens of the week.

3-3. Stablecoin Sandbox Talk Heats Up Local Debate

The Korean government and financial regulators are reportedly exploring a sandbox program for KRW stablecoins, potentially involving banks, fintech firms, crypto exchanges, and platforms like Upbit and Naver Pay. While some see this as a way to strengthen monetary sovereignty and boost Korea’s fintech competitiveness, others warned about the heavy responsibility of reserve management and issuer transparency.

(Source)

One funny moment? After this news broke, the SAND token jumped +8%—not because of real involvement but just because of the name. Community reactions were full of jokes like “Wrong sandbox, guys” and “Korean stock traders always find a way to misread the market.”

4. Events

It looks like this Monday marks a busy start to the week, with both an AMA and a meetup scheduled on the same day. Most users will likely find themselves attending the event while also tuning into the AMA — making for an interesting situation or perhaps some fierce competition for attention.

So, what else is in store for this week?

4.1. Mira Seoul Meetup

Mira Network is hosting a meetup in Korea. Mira Network is a protocol aimed at building the trust layer for AI by adding a decentralized verification layer to the AI stack.

During this event, the team will provide an overview of Mira Network, share its vision and roadmap, and engage directly with Korean users.

🕔 Date: Monday, July 14th at 7:00 PM (KST)

4.2. GRVT AMA with Humbleman + Magon

GRVT, the on-chain peer-to-peer investment marketplace, is hosting an AMA session.

In this AMA, the team will share insights into the upcoming Vault ecosystem and their roadmap toward becoming a DeFi hub within the zkSync ecosystem. If you’ve had any questions about GRVT, this will be a great opportunity to hear directly from the team.

🕔 Date: Monday, July 14th at 8 PM (KST)

AMA: [Abstract – Link to be announced soon]

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!