Speculation Rises, Traders Shift, and Korea Eyes Stablecoin Future

This week, Korean crypto trading saw strong interest in both major tokens and speculative mid-caps. On Upbit, XRP, BTC, and CBK led volumes, while memecoins like MOODENG and BONK showed notable activity. Bithumb mirrored these trends, with rising retail attention on PENGU, MEV, and other niche assets. Top gainers included CBK, BONK, and STRIKE, all posting 50%+ weekly gains, highlighting a continued appetite for high-risk, high-reward plays across Korean exchanges.

Meanwhile, social buzz centered on Upbit’s collaboration with Naver Pay for a KRW stablecoin, sparking discussions on the future of digital payments. The launch of short-selling services on Upbit and Bithumb also drew heated debate among traders. Meanwhile, retail excitement grew as Korea’s stock market hit new highs, raising questions about capital shifting back from crypto to equities.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed MOODENG.

- Bithumb listed Humanity Protocol and Mantra.

| Date | Upbit | Bithumb |

|---|---|---|

| 6/30 (Mon) | ||

| 7/1 (Tue) | ||

| 7/2 (Wed) | ||

| 7/3 (Thu) | MOODENG (MOODENG) | Humanity Protocol (H), Mantra (OM) |

| 7/4 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Humanity Protocol (H)

Humanity Protocol is a good example of a project that carried out short-term but intensive marketing in the Korean market over a span of two to three months.

Backed by well-known VCs like Pantera Capital and Jump Crypto, Humanity initially approached the Korean community with its unique palm-based identity verification method, attractive valuation, and an easy-to-join testnet. Rather than relying solely on KOL marketing, the team took a more multifaceted approach.

One of the most distinctive strategies, apart from KOL collaborations, was external engagement. They hosted regular AMAs with generous rewards, co-organized a hackathon with Korea University’s blockchain society, and held several offline meetups to maintain consistent public interest.

Even their KOL marketing stood out. Instead of one-off promotions, they formed closer partnerships with influencers, running various events across multiple channels to onboard users from different segments of the community.

Lastly, Humanity’s founder Terence Kwok showed a strong personal interest in Korea. He not only visited Korea in person for the meetup, but also made a clear effort to engage with the Korean community. He even went as far as setting his X profile picture to that of a Korean celebrity who resembled him.

2-2. Trading Volume

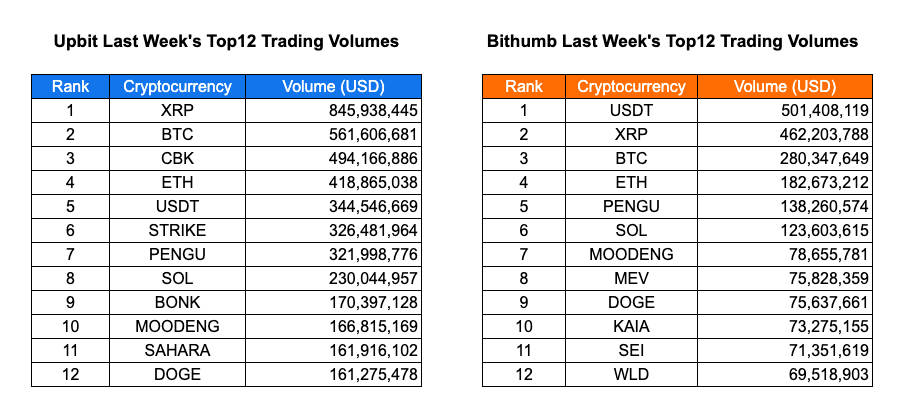

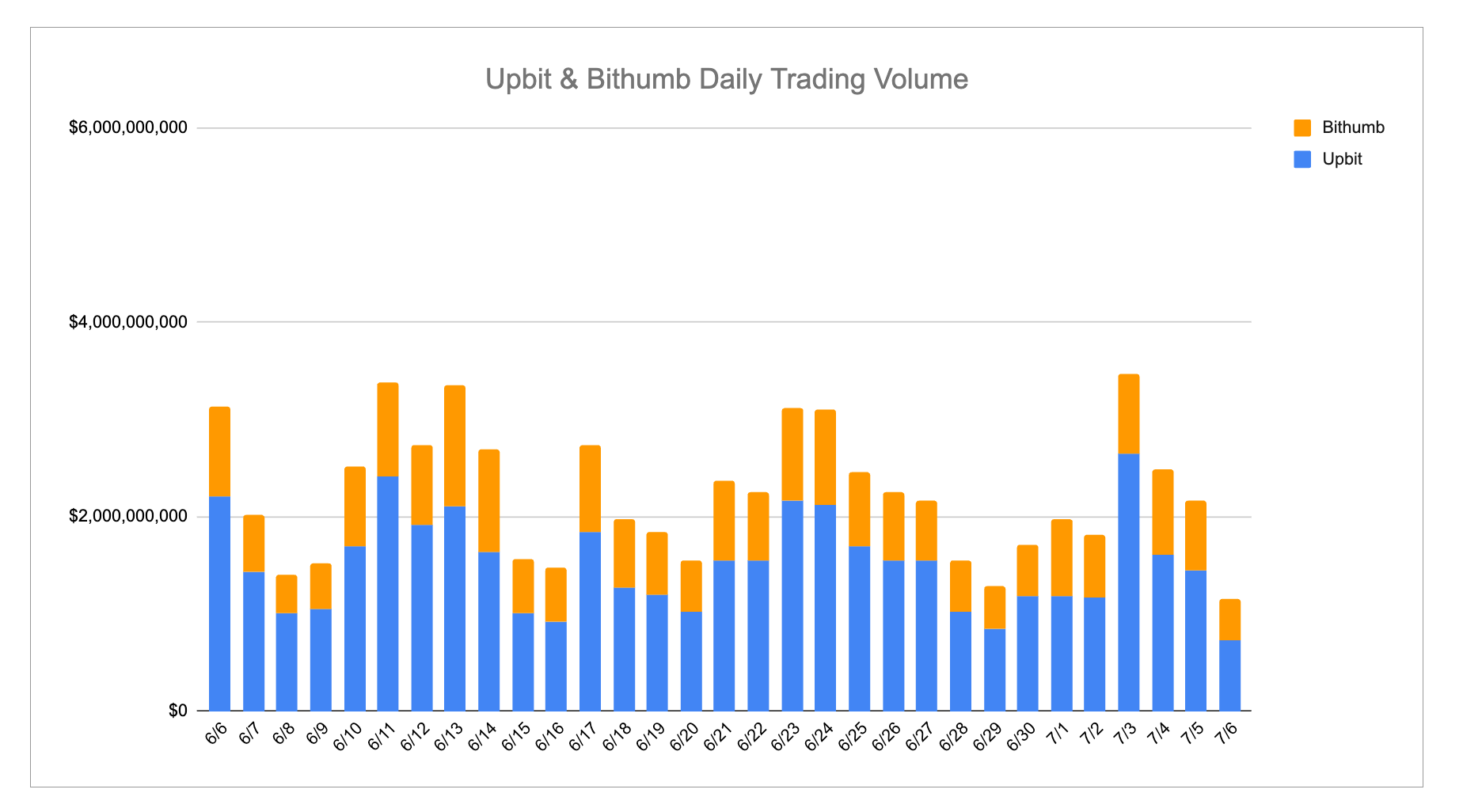

Upbit’s weekly trading volume remained concentrated in high-liquidity tokens, with XRP leading at $845.9M, followed by BTC at $561.6M and CBK at $494.2M, the latter seeing a notable surge in activity. ETH and USDT recorded steady volumes at $418.9M and $344.5M respectively, while STRIKE and PENGU saw nearly identical volumes around $320M, suggesting rising interest in emerging or trend-driven assets. The presence of MOODENG, SAHARA, and BONK among the top 12 further illustrates a shift toward speculative and community-driven tokens, each exceeding $160M in weekly volume. Despite the presence of majors, the overall distribution highlights a diversified appetite from Korean retail traders.

Bithumb's volume ranking also showed strong activity in XRP ($462.2M), USDT ($501.4M), and BTC ($280.3M), but diverged in mid-tier listings, with PENGU ($138.3M), MOODENG ($78.7M), and MEV ($75.8M) gaining significant traction. The recurrence of DOGE, SOL, and SEI in both exchanges’ top 12 suggests sustained interest in mainstream altcoins, while KAIA and WLD rounded out Bithumb’s list with $73.3M and $69.5M respectively. Weekly volumes were overall lower compared to peak periods in Q2, and the 1-month volume chart on CoinGecko indicates a slight downtrend, potentially signaling a short-term cooldown in domestic trading intensity.

2-3. Top 10 Gainers

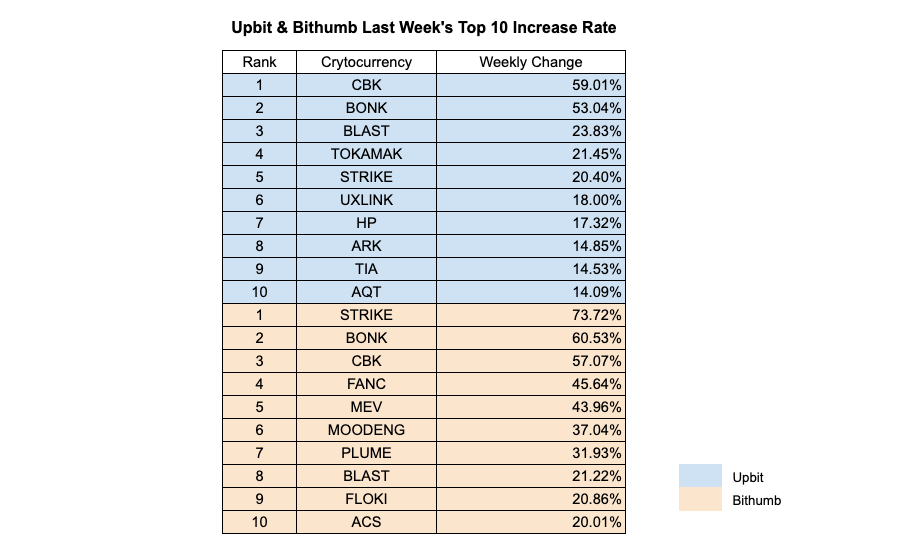

This week’s top gainers on Upbit were dominated by high-volatility tokens, led by CBK with a 59.01% weekly gain, followed closely by BONK at 53.04%. BLAST (+23.83%), TOKAMAK (+21.45%), and STRIKE (+20.40%) also saw double-digit growth, highlighting momentum in both memecoins and lesser-known infrastructure projects. Notably, UXLINK, HP, and ARK each gained between 14% and 18%, signaling renewed interest in mid-cap tokens. The appearance of TIA and AQT among the top 10 suggests a broadening of trader attention beyond short-term narratives.

On Bithumb, STRIKE stood out with a remarkable 73.72% increase, followed by BONK at 60.53% and CBK at 57.07%, mirroring Upbit’s bullish sentiment around the same assets. Additional strong performers included FANC (+45.64%), MEV (+43.96%), and MOODENG (+37.04%), pointing to a rising appetite for speculative and retail-driven tokens. PLUME, FLOKI, and ACS also posted 20%+ gains, confirming that retail momentum continues to rotate rapidly across trending assets. The overlap across exchanges in tokens like BONK, CBK, STRIKE, and BLAST reinforces their current dominance in Korean trader focus.

3. Korean Community Buzz

3-1. Upbit & Naver Pay Team Up on KRW Stablecoin Plans

Upbit and Naver Pay are set to collaborate on launching a Korean won-pegged stablecoin, signaling a significant move in Korea’s digital asset landscape. According to Dunamu, Naver Pay will take the lead with Upbit providing support, with details to be finalized once a regulatory framework is established. The announcement follows Naver Pay’s disclosure of a stablecoin consortium during its 10th-anniversary event in May.

The community responded with excitement: “The top two players teaming up… that’s huge,” and “With Upbit x Naver Pay, other players don’t stand a chance.”

(Source)

3-2. Upbit & Bithumb Introduce Crypto Lending

For the first time in Korea, Upbit and Bithumb have launched services allowing users to borrow coins like Bitcoin and short-sell them, starting July 4. Users can deposit collateral and borrow assets to bet on price declines. Currently, Upbit only supports BTC, but plans to expand. Bithumb offers a wider selection, including BTC, ETH, XRP, SOL, DOGE, and USDT.

The community debated: “Isn’t this just shorting with a fancy name?” and “Is Korea preparing to legalize crypto derivatives to keep funds domestic?”

3.3. Retail Investors Flock Back to Stocks

The Korean stock market hit new highs last week, with the KOSPI closing at 3116.27—its highest in nearly four years. Investor deposits surged to over 70 trillion KRW, while crypto trading volumes have slumped.

Community chatter included: “Time to cash out and get back into crypto before stocks correct!” and “As long as stock returns stay like this, it’s hard to argue against moving funds there.”

(Source)

4. Events

We have a full lineup of exciting events waiting for us this week! In fact, some of the Luma registration links are already closed. But don’t worry — here are the events that are still open for registration!

4.1. XRPL Korea Ambassador & Builder Meetup

XRPL Korea Ambassador Program, featuring blockchain student societies from leading Korean universities and builders from the XRPL ecosystem. 😊

Whether you're interested in meeting the next generation of XRPL leaders or you're a company, developer, or planner curious about the XRPL ecosystem, we welcome your interest and participation!

🕔 Date: Tuesday, July 8th, from 7 PM to 9 PM (KST)

4.2. Nibiru Block Party in Korea

Nibiru is a high-performance blockchain ecosystem featuring an EVM-equivalent execution engine, parallel execution, and a new Multi-VM architecture. It’s designed to offer scalability, ease of use, and support for a wide range of Web3 applications.

To celebrate the launch of its EVM, the Nibiru team is coming to Seoul to host a Block Party! Join us for a vibrant evening where the team will connect with the community, share their vision and roadmap, and enjoy a variety of engaging programs.

🕔 Date: Wednesday, July 9, 6:00 PM – 9:00 PM (KST)

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!