Selective Risk, Shared Conviction in Korea’s Crypto Market

1. Market Overview

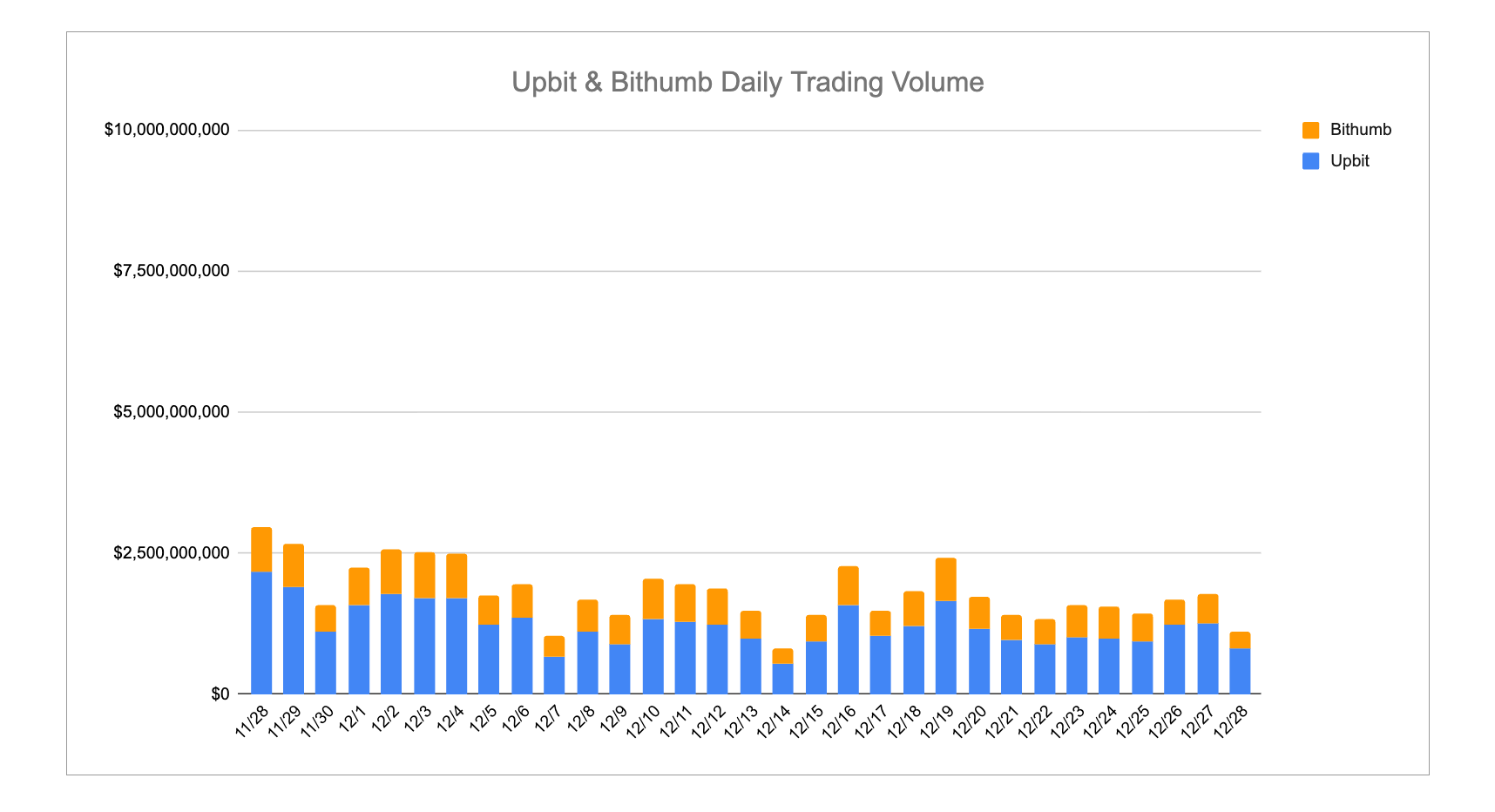

Last week’s Korean crypto market showed a rare alignment between liquidity and performance, with zkPass newly listed on both Upbit and Bithumb acting as a symbolic anchor for broader narrative-driven trading. Upbit continued to dominate directional flow, led by XRP, BTC, and ETH, but the more notable signal came from mid-cap assets like AVNT, 0G, ZBT, and ZKP, which posted volumes comparable to majors—indicating active conviction rather than defensive rotation. Bithumb, by contrast, remained stablecoin-centric, with USDT absorbing the largest share of volume and more isolated speculative activity appearing in exchange-specific names. This divergence carried into price action, yet the week stood out for its unusual cross-exchange convergence: ZBT and AVNT ranked among the top gainers on both platforms, supported by strong volume, suggesting structurally backed momentum rather than thin liquidity spikes. Overall, the market leaned cautious but selective—capital consolidated into a small set of high-consensus assets, signaling a temporary shift away from fragmented speculation toward more unified, liquidity-supported themes.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced new listings:

| Date | Upbit | Bithumb |

|---|---|---|

| 12/22 (Mon) | ||

| 12/23 (Tue) | Theoriq (THQ) | |

| 12/24 (Wed) | ||

| 12/25 (Thu) | ||

| 12/26 (Fri) | zkPass (ZKP) | zkPass (ZKP) |

Key Marketing Strategies & Takeaways

🔹 zkPass (ZKP)

Although zkPass has intermittently appeared within the Korean community since 2023, its first full-scale marketing push began in 2025 alongside the launch of the Kaito Launchpad token sale.

The timing of the sale announcement was well aligned with market conditions. Engagement from the Korean community toward token sales was relatively high, the ZK narrative was strongly established, and zkPass had already gained visibility by appearing multiple times as an identity verification solution during airdrop registrations and claims.

Also the sale FDV was set at $100M, a level considered reasonable given the market environment at the time. Combined with these favorable conditions, zkPass executed KOL-driven yet organic marketing, successfully amplifying FOMO and encouraging strong participation in the token sale.

As a result, the sale raised approximately 40x the target amount, recording one of the highest participation rates in Kaito Launchpad’s history.

Following the sale, zkPass continued its momentum in the Korean market by running AMAs, campaigns, and events that rewarded participants with token airdrops and gift cards, and also hosted offline meetups, a proven staple of the Korean crypto market.

In parallel, zkPass actively operated a dedicated Korean Telegram community and a Korean Twitter account, maintaining close communication with local users. This sustained engagement drove strong participation from Korean users and ultimately contributed to successful KRW listings on both Upbit and Bithumb.

2-2. Trading Volume

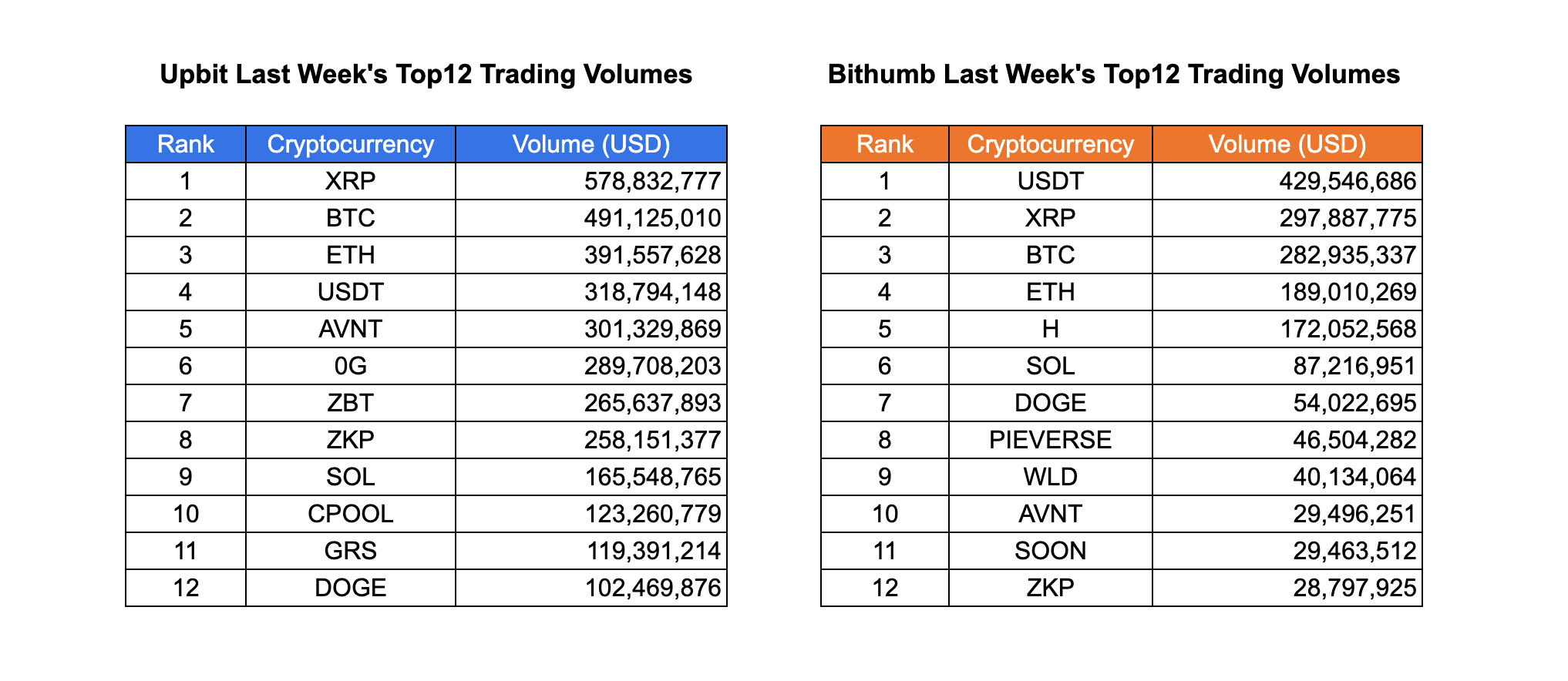

Last week’s trading activity reinforced Upbit’s dominance in directional liquidity, while Bithumb exhibited a defensive, stablecoin-heavy flow structure. On Upbit, XRP retained its position as the primary volume driver with approximately $578M in turnover, maintaining a significant lead over BTC ($491M) and ETH ($391M). A key differentiator for Upbit was the robust participation in mid-cap assets; AVNT ($301M), 0G ($289M), and ZBT ($265M) recorded volumes comparable to major assets. This depth implies that Upbit traders are not merely rotating capital defensively but are actively pricing in specific narratives with substantial liquidity support. The presence of ZKP ($258M) and CPOOL ($123M) further illustrates a diverse risk appetite across the platform.

In contrast, Bithumb’s flow profile remained anchored in stablecoin pairing, with USDT topping the chart at $429M—significantly outpacing the exchange’s crypto-native flows. While XRP ($297M) and BTC ($282M) commanded respectable volumes, the steep drop-off in ETH activity ($189M) relative to Upbit suggests a lack of institutional-grade conviction in Ethereum on the platform. Interestingly, Bithumb displayed unique idiosyncratic flows, such as H ($172M) and PIEVERSE ($46M), which saw concentrated activity despite being absent from Upbit’s top tier. This confirms Bithumb’s role as a venue for isolated, exchange-specific speculative plays, distinct from the broader market trends observed on Upbit.

2-3. Top 10 Gainers

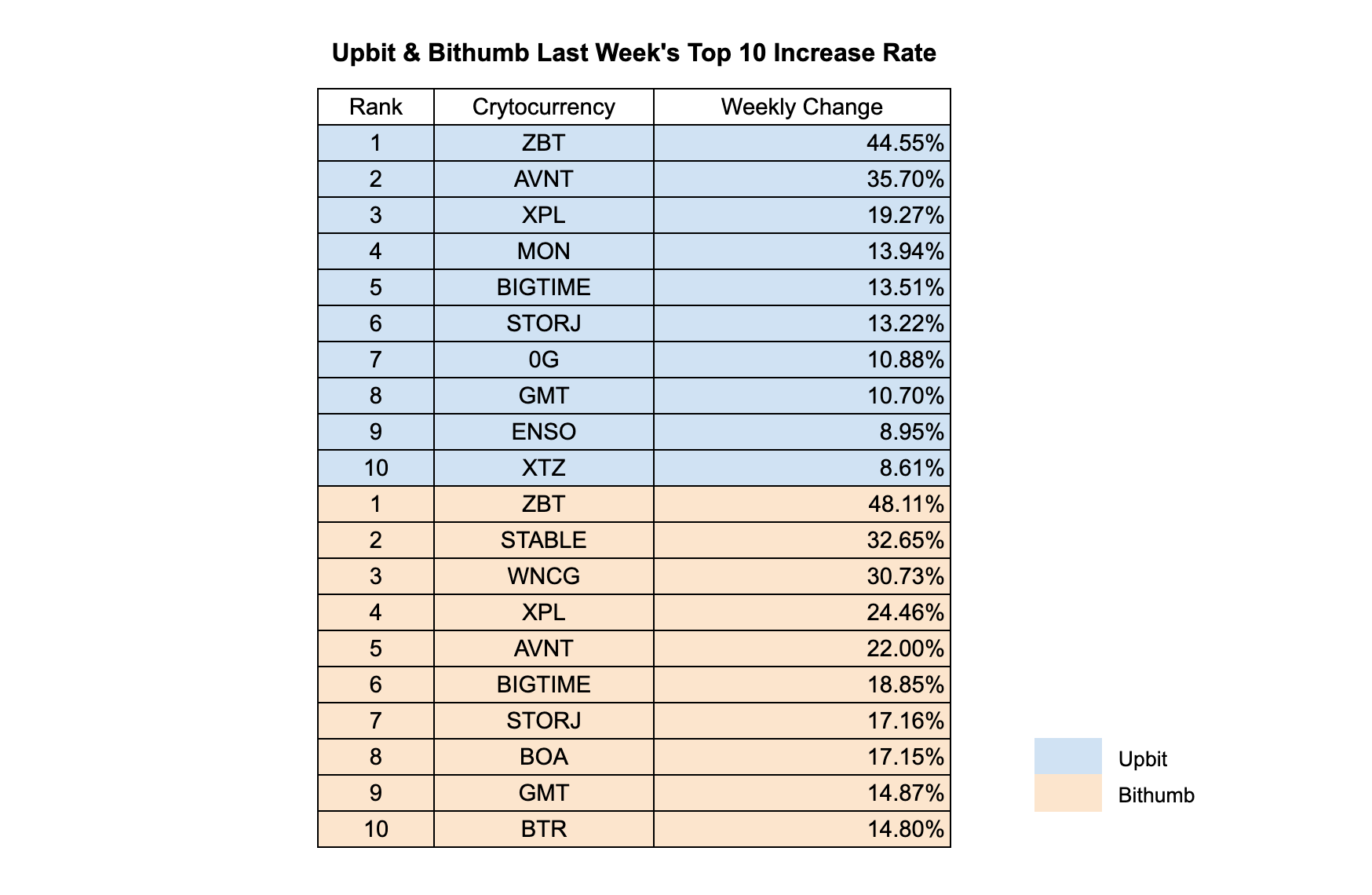

The top gainers list this week highlighted a rare and decisive convergence in momentum between the two exchanges, signaling high-conviction trends rather than isolated order-book manipulations. ZBT emerged as the undisputed market leader, claiming the top spot on both platforms with gains of +44.55% on Upbit and +48.11% on Bithumb. This rally is particularly notable given its high volume profile on Upbit, validating the price action as "high-quality" upside backed by real turnover. Similarly, AVNT demonstrated strong cross-exchange synergy, rising +35.70% on Upbit (Rank 2) and +22.00% on Bithumb (Rank 5), confirming that its momentum was structural rather than fleeting.

While the primary narratives were shared, the tail-end of the performance distribution revealed platform-specific preferences. Upbit saw consistent strength in gaming and infrastructure plays like XPL (+19.27%), MON (+13.94%), and BIGTIME (+13.51%), showing a tightly clustered return profile indicative of sector-wide rotation. Bithumb, meanwhile, exhibited slightly higher volatility in unique names such as STABLE (+32.65%) and WNCG (+30.73%), which outperformed broader market peers within that specific venue. However, the recurring presence of ZBT, AVNT, XPL, BIGTIME, and STORJ across both top lists serves as a strong signal; it suggests that the market has temporarily moved away from fragmented, low-liquidity pumps and is instead consolidating capital into a few select assets with unified market consensus.

3. Korean Community Buzz

3-1. Mirae Asset × Korbit: TradFi–Crypto Convergence in Focus

According to industry sources, Mirae Asset Group is reportedly in discussions to acquire stakes in Korbit from its largest shareholders, NXC (60.5%) and SK Planet (31.5%), with the total deal size estimated at KRW 100–140 billion. While Korea’s exchange market is largely dominated by Upbit and Bithumb, Korbit has struggled to generate meaningful synergy under its current ownership structure.

The potential entry of Mirae Asset — a major traditional financial institution — has sparked interest across the community. Many compared the situation to the recent Naver–Dunamu narrative, viewing it as another sign that legacy finance and crypto infrastructure in Korea are beginning to intersect more directly, rather than operating in parallel silos.

(Four Pillars Commet: https://4pillars.io/ko/comments/mirae-asset-korbit)

3-2. Upbit Introduces Self-Certification Process Under CARF Rules

Upbit announced the introduction of a self-certification process in line with Korea’s implementation of the Crypto-Asset Reporting Framework (CARF). The measure requires users to confirm overseas tax residency and related information, enabling the automatic exchange of crypto asset and transaction data between jurisdictions.

Within the Korean crypto community, the move is widely interpreted as preparatory groundwork for crypto taxation, with many expecting data collection to begin around 2026 and taxation to follow in 2027. Reactions ranged from resignation to dark humor, with some joking about relocating to Dubai, Singapore, or Hong Kong to avoid future tax burdens.

3-3. Government Intensifies FX Defense as KRW Volatility Eases

As the KRW–USD exchange rate recently approached the 1,500 level, Korean authorities stepped up efforts to stabilize the currency. While concerns emerged that liquidity expansion was driving the depreciation, the Bank of Korea pushed back, attributing the move instead to structural shifts such as increased overseas investment and corporate USD hoarding.

Following coordinated government measures and strategic FX hedging by the National Pension Service, the exchange rate fell for three consecutive sessions, stabilizing in the 1,430 range. This also led to a sharp drop in USDT prices in Korea, falling from the high 1,490s to the mid-1,440s within a week.

Crypto users discussed the irony of the situation: a stronger KRW is positive for the economy, yet unfavorable for those holding assets denominated in stablecoins.

4. Upcoming Meetup

Mantle Korea EOY Meet up

📆 Date: 12. 29(Mon) 18:00 ~ 22:00

💼 Host: Mantle

Luma: https://luma.com/z8yobgki?tk=WsPbuI

Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!