Recent Crypto Listings and Market Trends in Korea: Kaito, Plume, Avalon, and More

1. Market Overview

Last week, Korean exchanges saw several new listings, with Upbit adding Kaito and Bithumb listing Plume, Cow Protocol, and Avalon. Kaito, which first debuted on Bithumb on February 20, expanded its presence with an Upbit listing, maintaining strong engagement despite the usual post-TGE decline. Its momentum is driven by continued Yapper Launchpad activity and the growing trend of social engagement-based airdrops, where Kaito plays a key role in tracking participation.

Plume ramped up its KOL-driven marketing in late 2024, positioning itself in the RWA sector as a stable investment opportunity. The team built trust through strong investor backing and strategic collaborations, sustaining interest post-TGE with staking updates and product developments.

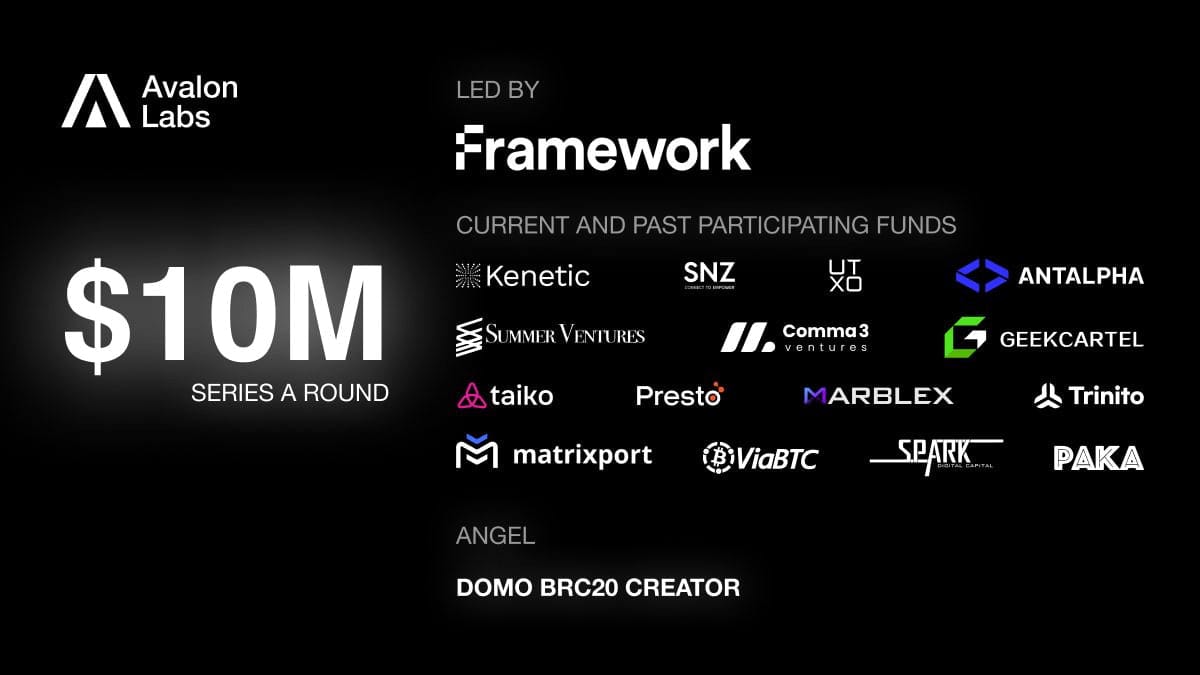

Avalon gained traction in Q3 2024 amid rising BTCFi demand, marketing itself as an efficient BTC staking platform with a multi-farming model. Following its Bithumb listing, Avalon saw strong trading volume, ranking third behind XRP and USDT, highlighting its successful Korean market strategy.

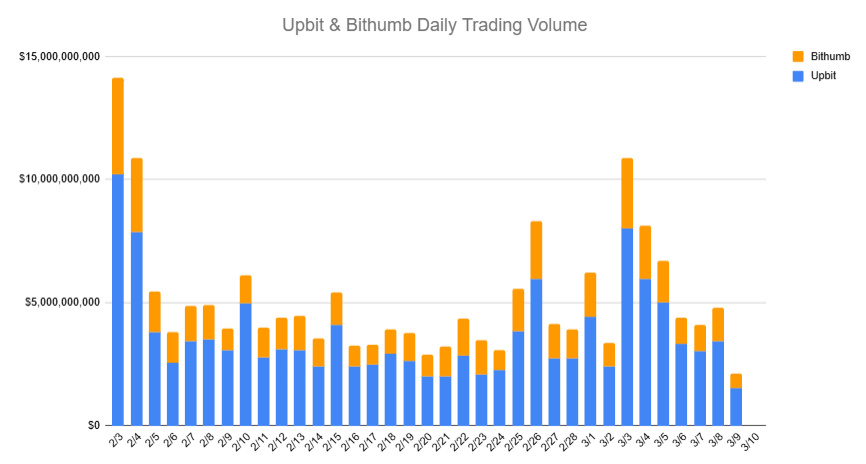

Meanwhile, daily trading volume on Upbit and Bithumb reached 5.9 billion KRW, up 1 billion KRW from the previous week. These two exchanges dominate 95% of Korea’s crypto market. Coins associated with Trump’s strategic asset narrative performed well, with XRP seeing strong community support, while ONDO, DOGE, TRUMP, and SUI also recorded high volumes.

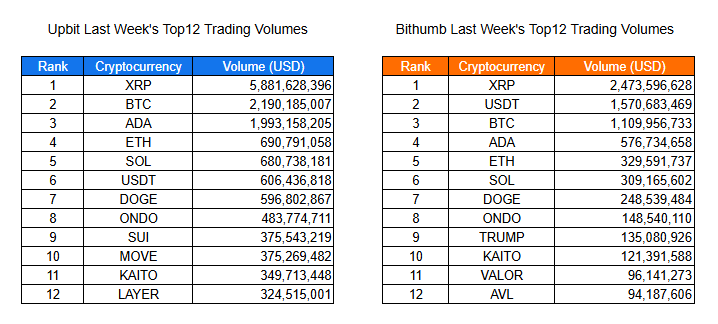

The top traded cryptocurrencies last week were XRP, BTC, ADA, ETH, SOL, USDT, DOGE, ONDO, SUI, MOVE, KAITO, and LAYER. In terms of weekly returns, Bounce Token (AUCTION) led with a 36% gain on Upbit and 45.67% on Bithumb, while BCH and MOVT also posted strong gains. WEMIX surged despite being placed on a "Trading Warning" list.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Kaito.

- Bithumb listed Plume, Cow Protocol, Avalon.

| Date | Upbit | Bithumb |

|---|---|---|

| 3/3 (Mon) | ||

| 3/4 (Tue) | ||

| 3/5 (Wed) | Kaito (KAITO) | Plume (PLUME), Cow Protocol (COW) |

| 3/6 (Thu) | ||

| 3/7 (Fri) | Avalon (AVL) |

Key Marketing Strategies & Takeaways

🔹 Kaito(KAITO): Sustaining Momentum Beyond TGE

Kaito, which was first listed on Bithumb on February 20, has now made its way to Upbit, further expanding its presence in the Korean market. Despite many projects experiencing declining hype post-TGE, Kaito has managed to maintain strong engagement, particularly within the Korean crypto community.

A key factor behind this sustained interest is its InfoFi positioning, which continues to attract active discussions among KOLs and retail users. While KOL engagement has shifted from aggressive farming to a more passive Twitter presence, Kaito remains a focal point due to its ongoing ecosystem developments.

Two major reasons explain why Kaito’s momentum hasn’t faded:

- Yapper Launchpad Expansions – The second Yapper Launchpad includes major projects like MapleStory Universe, Succinct, and Soon, ensuring continuous community engagement. As long as high-profile non-TGE or airdrop-eligible projects exist, Kaito is unlikely to see a sudden drop in interest.

- The Rise of Social Engagement-Based Airdrops – More projects are now allocating airdrop rewards to social engagement activities, and Kaito plays a crucial role in tracking and validating these interactions, reinforcing its utility beyond speculation.

🔹 Plume(PLUME): RWA Strength in the Korean Market

Plume has been targeting the Korean market since early 2023, but its full-scale KOL-driven marketing push began in Q4 2024. Recognizing the solid investment appeal of the RWA (Real World Asset) sector, Plume positioned itself as a stable and credible investment opportunity—a key narrative that resonates well in Korea’s market.

The project built its credibility by focusing on team background, investment rounds, and RWA integrations, ensuring its name remained consistently visible within the community. It then followed up with airdrop campaigns and strategic collaborations, leveraging KOL marketing to drive user participation.

Even after its TGE, Plume has maintained strong performance by continuing to communicate product updates, staking opportunities, and ecosystem developments through KOL channels. This strategy has helped sustain positive price action, reinforcing its reputation in the RWA narrative.

🔹 Avalon(AVL): RWA Strength in the Korean Market

Avalon’s marketing in Korea began in Q3 2024, right when BTCFi staking demand surged. KOLs positioned Avalon as an efficient BTC staking solution, emphasizing its Multiple Farming model and differentiators from other BTCFi platforms.

Since then, Avalon has maintained strong communication efforts, addressing user concerns about long-term asset lock-ups by consistently updating the community on its developments.

Following its listing on Bithumb, Avalon quickly gained traction, ranking #3 in trading volume behind XRP and USDT. This performance underscored the effectiveness of its Korean marketing strategy and the community’s strong participation.

🔹 Cow Protocol (COW): Please refer to last week’s report (link)

2-2. Trading Volume

Last week, the combined daily average trading volume on Upbit and Bithumb reached approximately 5.9 billion, which is 1 billion dollars more than the previous week. The cumulative trading volume over the 7-day trading period totaled 41 billion, with Upbit and Bithumb recording 30.2 billion and 10.9 billion respectively.

Upbit and Bithumb are the dominant cryptocurrency exchanges among the five major platforms that have obtained Korea's Virtual Asset Service Provider (VASP) certification, representing approximately 95% of the domestic market share.

Both exchanges recorded high trading volumes for the 5 assets mentioned by President Trump as strategic reserve assets. Among these, Ripple (XRP) trading volume stood out significantly due to its strong Korean community support.

Overall, there was notable temperature difference across various cryptocurrencies. In addition to the five strategic assets, trading volumes were dominated by US or Trump-related coins such as Ondo Finance (ONDO), Dogecoin (DOGE), Trump (TRUMP), and Sui (SUI). Beyond these, Kaito (KAITO) recorded significant trading volumes on both exchanges following its listing on Upbit.

2-3. Top 10 Gainers

Last week, cryptocurrencies listed on domestic exchanges mostly recorded negative returns, reflecting the overall market weakness. Particularly on Upbit, all coins except for seven recorded negative cumulative weekly returns.

Bounce Token (AUCTION) recorded the highest returns on both Upbit and Bithumb last week with gains of 36% and 46% respectively. This performance appears to be driven by the launch of its launchpad platform in early March.

Following Bounce Token, Movement (MOVT) and Bitcoin Cash (BCH) also showed strong returns. Movement's performance appears to reflect market anticipation ahead of its mainnet launch scheduled for this week.

A notable anomaly was Wemix (WEMIX), which is listed on both Bithumb and Coinone. After being designated as a "trading caution" cryptocurrency on March 4, it experienced significant volatility due to concerns about potential delisting. Interestingly, as the overall market conditions deteriorated, Wemix paradoxically recorded relatively high returns, demonstrating the unusual market dynamics at play during downturns.

3. Key News from Social Media

3-1. Trump’s Bitcoin Executive Order

Trump’s Bitcoin executive order stirred mixed reactions in the Korean crypto space. While the move confirmed that the U.S. won’t sell its BTC holdings, the lack of a clear buying plan led to disappointment, causing BTC to dip below $85K before rebounding to $87K.

Some saw it as bullish long-term, arguing that the U.S. holding BTC could prevent other governments from selling. Others were skeptical, noting that without active accumulation, this was more symbolic than market-moving.

While the full impact remains to be seen, Trump’s move has kept Bitcoin firmly in the political spotlight. The broader market is still trying to digest the news, yet one thing is clear—Trump’s executive order has kept Bitcoin firmly in the political spotlight, and the Korean community is closely watching for what comes next.

3-2. Bithumb Overtakes Upbit in Liquidity but Faces FIU Scrutiny

For the first time, Bithumb has surpassed Upbit in liquidity, with deeper order book depth and higher daily trading volume ($1.1B vs. $1B) among the top 30 traded assets. The shift has sparked discussions about whether Bithumb’s aggressive listing strategy and institutional inflows are changing Korea’s exchange landscape.

However, the FIU is launching a 10-day investigation into Bithumb starting March 17, focusing on KYC compliance and overseas VASP transactions. This follows its recent crackdown on Upbit, which resulted in a 3-month restriction on new user deposits/withdrawals. Some speculate Bithumb’s recent hiring of two senior financial regulators was a preemptive move to strengthen compliance.

Meanwhile, Bithumb has started sending daily market updates via KakaoTalk, shocking the community. A message predicting "XRP’s potential rise to $27" sparked jokes that Bithumb is turning into a crypto signal group, leaving traders wondering about its new approach.

3-3. The ‘Meetup Hunters’ Controversy

A growing issue in the Korean Web3 scene is “meetup hunters”—attendees who register for events just for free food, ignoring the actual content. These individuals, dubbed "Meetup-ttoogis", use platforms like LUMA to sign up for every possible event, arriving only to eat and leave.

Event organizers shared frustrations about food shortages, as these silent vacuum eaters strike during keynote speeches when attention is elsewhere. Some noted that while they act discreetly in bright venues, they get bolder in dim settings, sometimes skipping plates altogether.

Speculation about their identities suggests they are either retail traders recovering from losses or frugal opportunists. The rise of meetup hunters has many organizers considering invite-only events, while some are already worried about KBW becoming their next hunting ground. With Web3 priding itself on inclusivity, the community is debating how to keep events open while deterring freeloaders.

4. Events

Many projects have hosted AMAs again this week. This section was initially planned to be replaced with other content if there were no AMAs, but since they continue to take place every week, it seems unlikely that a replacement will be needed.

4-1. [KOL AMA] WecryptoTogether x Sign

We've heard that the AMA started with an introduction to the Sign project and later included some singing together. If you haven't listened to the AMA yet or are curious about the Sign project, I recommend checking it out.

4.2. [KOL AMA] Mocaverse

It was an AMA session focused on introducing the latest updates from Mocaverse. Key topics included the partnership with SK Planet, Moca 3.0 & digital ID management, the role and importance of the $MOCA token, and goals for 2025.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!