Quiet Momentum and Regulatory Shifts

1. Market Overview

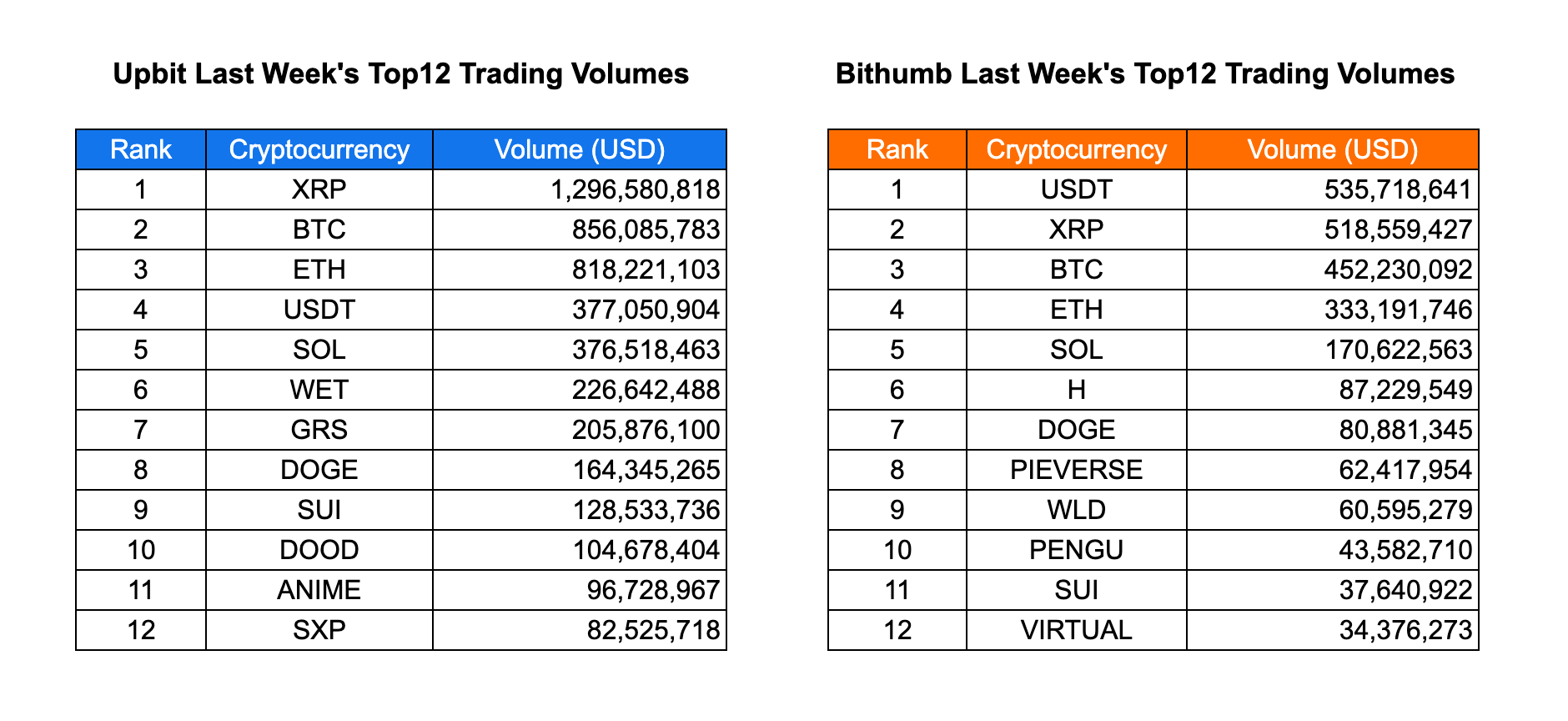

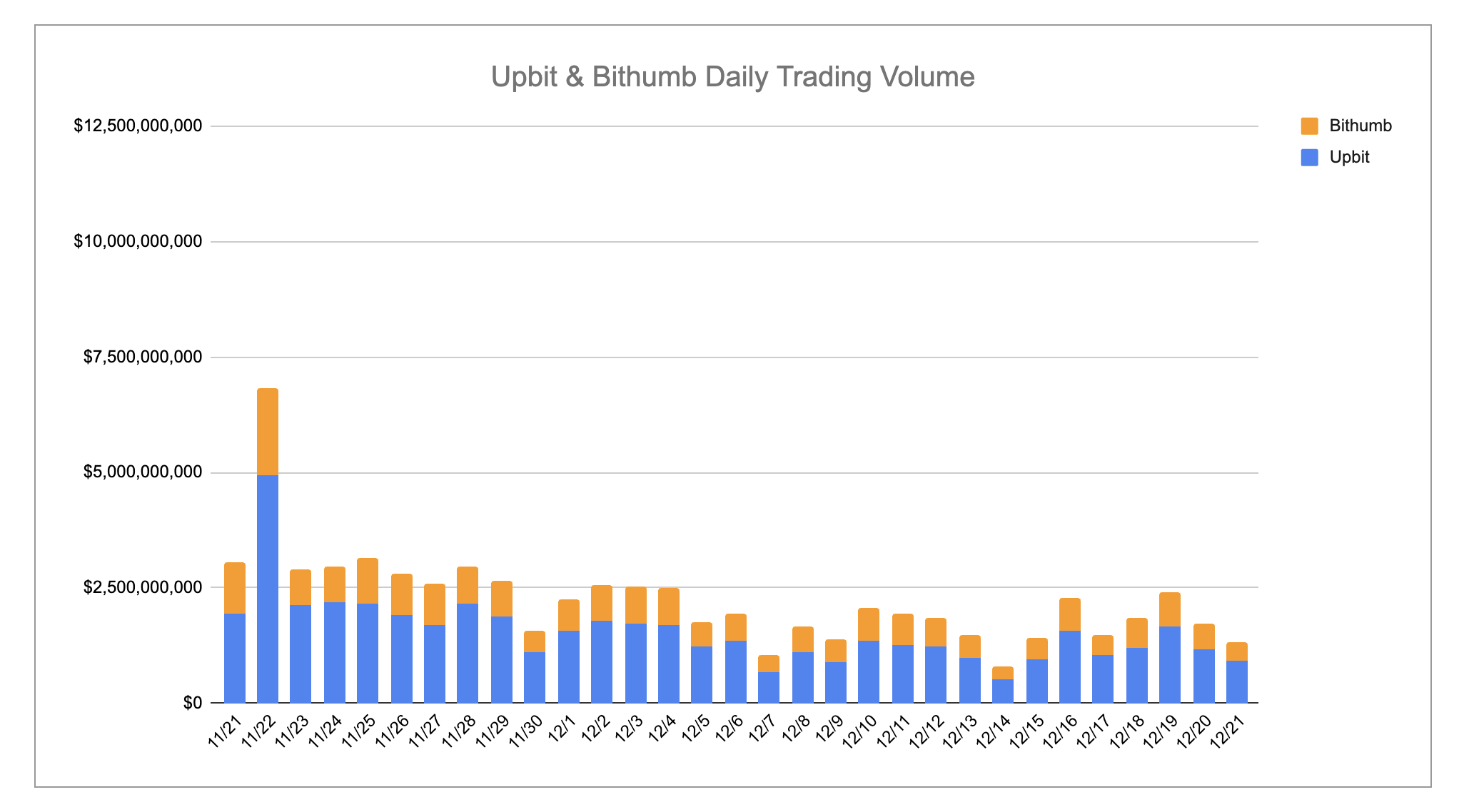

Last week’s market activity in Korea remained structurally stable but highly selective, with limited new listings (Upbit: WET; Bithumb: WET, EDEN, DEXE) and trading volume continuing to concentrate around major assets. On Upbit, XRP led decisively with approximately $1.30B in weekly volume, followed by BTC ($856M) and ETH ($818M), confirming that liquidity remained anchored in large-cap, high-confidence tokens. Notably, USDT and SOL traded at similar levels (~$377M each), suggesting that retail capital was split between stable positioning and continued exposure to higher-beta Layer 1 assets rather than rotating aggressively into risk.

Altcoin activity reflected a clear pattern of selective engagement rather than broad speculation. On Upbit, WET ($226M) and GRS ($206M) recorded disproportionately high turnover relative to market size, while DOOD, ANIME, and SXP appeared in both volume and top-gainer rankings—indicating that price moves were supported by real liquidity. Bithumb, by contrast, remained more stablecoin-centric, with USDT ($536M) dominating and a sharper drop-off after the top few assets. Smaller names such as H, PIEVERSE, WLD, and PENGU stood out, reinforcing Bithumb’s role as a venue for short-term, retail-driven repricing. Overall, the week highlighted a calm but cautious market, where capital stayed concentrated in majors while rotating tactically into a narrow set of altcoins rather than chasing broad upside.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced new listings:

| Date | Upbit | Bithumb |

|---|---|---|

| 12/15 (Mon) | Humidifi (WET) | Humidifi (WET) |

| 12/16 (Tue) | OpenEden (EDEN) | |

| 12/17 (Wed) | ||

| 12/18 (Thu) | ||

| 12/19 (Fri) | DeXe (DEXE) |

Key Marketing Strategies & Takeaways

🔹 Humidifi (WET)

Humidifi is a notable case that achieved strong performance during a challenging market environment by securing high visibility in a short period of time.

Although early interest in token sales had been relatively high, Humidifi emerged at a time when overall market momentum had cooled and participants were approaching token sales more conservatively.

Despite these conditions, Humidifi demonstrated clear strengths on the exchange listing front from the outset, having been added to the Coinbase roadmap and listed on Bybit’s pre-market. In addition, the project reinforced community trust through its Jupiter DFT sale.

However, due to its rapid emergence, many market participants were initially unfamiliar with the project. To address this, Humidifi conducted a Korea-focused AMA, offering substantial rewards to drive participation. Beyond simply introducing the project, the team strategically highlighted background narratives and contextual information designed to capture user interest.

Furthermore, key selling points—including a pre-market price trading at approximately 2x the public sale price, confirmed listings on major exchanges, a relatively low token sale valuation, and a no-VC structure—were effectively communicated through KOL channels. As a result, the public sale sold out almost instantly.

2-2. Trading Volume

Trading activity last week showed a clear bifurcation between majors-driven flow and selective narrative concentration, with Upbit maintaining significantly heavier turnover than Bithumb across most large-cap assets. On Upbit, XRP led decisively with approximately $1.30B in trading volume, followed by BTC at $856M and ETH at $818M, confirming that directional liquidity remained anchored in high-liquidity majors. Notably, USDT and SOL traded at similar levels near $377M, indicating that capital was split between stablecoin-based positioning and continued engagement with high-beta L1 exposure rather than rotating aggressively into a single risk bucket.

Beyond majors, Upbit’s mid-tier volume distribution provides important context for recent price action, as WET ($226M) and GRS ($206M) recorded substantial turnover relative to their market size, while DOGE ($164M) and SUI ($129M) sustained consistent participation. The appearance of DOOD ($105M), ANIME ($97M), and SXP ($83M) within the top 12 aligns closely with their presence in the top gainers list, suggesting that last week’s upside in these names was supported by real liquidity rather than purely thin order-book spikes.

Bithumb, by contrast, exhibited a more stablecoin-centric and retail-skewed flow structure, with USDT topping the chart at $536M, followed closely by XRP at $519M and BTC at $452M. While ETH ($333M) and SOL ($171M) remained active, the relative drop-off after the top five was steeper than on Upbit, highlighting more concentrated trading behavior. The inclusion of H ($87M), PIEVERSE ($62M), WLD ($61M), and PENGU ($44M) underscores Bithumb’s role as a venue for sharper, short-term repricing in smaller names, while SUI’s comparatively lower volume ($38M) versus Upbit points to exchange-specific participation patterns rather than uniform market conviction.

2-3. Top 10 Gainers

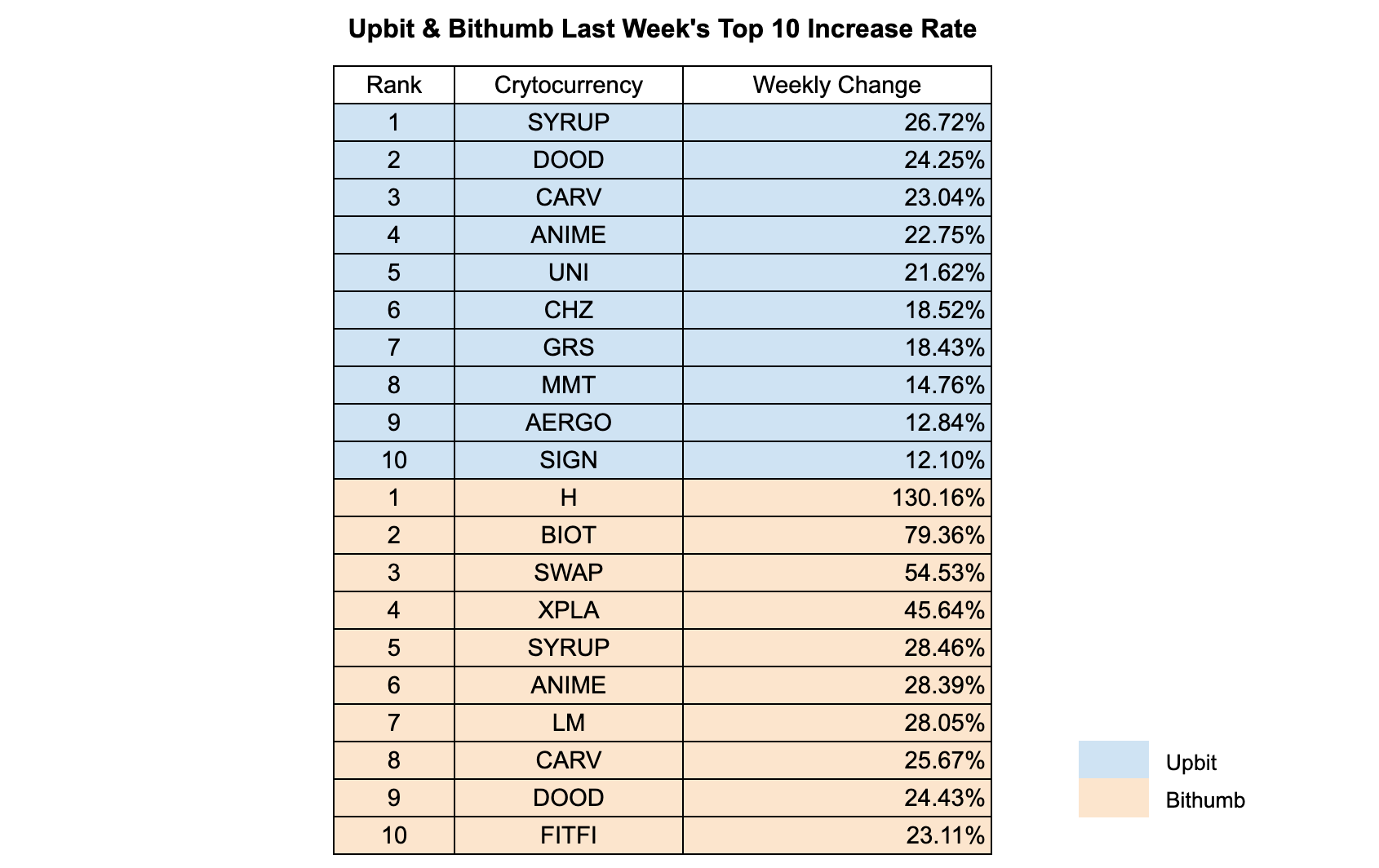

Last week’s top gainers highlighted an unusually sharp divergence in momentum intensity between Upbit and Bithumb, underscoring how price discovery is increasingly shaped by exchange-specific liquidity pockets rather than unified market trends. On Upbit, gains were broadly distributed across multiple mid-cap and narrative-driven tokens, with SYRUP (+26.72%), DOOD (+24.25%), CARV (+23.04%), and ANIME (+22.75%) forming a tightly clustered performance band. The inclusion of UNI (+21.62%) alongside smaller names suggests selective rotation rather than pure speculative chasing, as traders appeared willing to reprice both established DeFi exposure and newer thematic assets within a relatively controlled upside range.

In contrast, Bithumb exhibited far more extreme dispersion, led by H’s outsized +130.16% weekly surge and followed by BIOT (+79.36%) and SWAP (+54.53%), signaling aggressive short-term repricing in thin-liquidity environments. While such moves point to heightened speculative activity, the overlap of SYRUP, ANIME, CARV, and DOOD across both exchanges is notable, as it indicates that certain narratives managed to sustain momentum beyond isolated order books. This cross-exchange recurrence implies that these assets benefited from broader attention rather than purely mechanical price spikes.

Overall, the top gainers profile suggests a market favoring asymmetric, event-driven opportunities over sustained trend continuation. Upbit’s relatively compressed return distribution reflects cautious but active rotation, while Bithumb’s tail-heavy gains reveal a higher tolerance for volatility among short-term traders. Taken together, this dynamic reinforces the view that current upside is fragmented and tactical, with conviction concentrated in a small set of themes rather than across the broader altcoin universe.

3. Korean Community Buzz

3-1. Korea moves to allow domestic token issuance after 9 years

Korea is preparing to lift its long-standing ban on domestic token issuance for the first time since 2017, potentially as early as next year. Under the Financial Services Commission’s proposed Digital Asset Basic Act, domestic ICOs would be allowed again, provided projects meet strict disclosure requirements. At the same time, the term “virtual assets” will be standardized as “digital assets,” and foreign stablecoin issuers such as USDT and USDC may face trading restrictions on Korean exchanges unless they establish a local presence.

The new framework significantly raises accountability. Any false or omitted information in whitepapers could trigger liability not only for issuers, but also for key participants such as operators and market makers, aiming to prevent fraudulent token launches using proxy entities. Community reactions were mixed, ranging from “finally” to frustration that many builders have already failed or moved overseas, with some noting that the policy shift feels late despite its symbolic importance.

(Source)

3-2. Upbit runs five quiz events in a single day

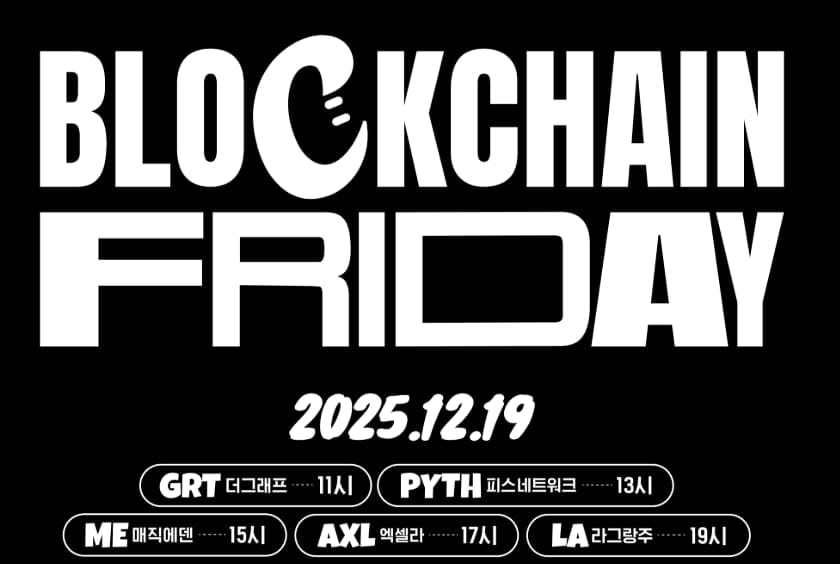

Following a period of reduced activity after the recent hack, Upbit designated December 19, 2025, as “Blockchain Friday” and ran five quiz events in one day. Participating projects included GRT, PYTH, ME, AXL, and LA, with token rewards distributed across each session.

Korean crypto communities were highly active throughout the day, sharing answers, participation screenshots, and timing tips. Each quiz closed within minutes, turning the day into a rare burst of engagement after weeks of quieter sentiment, and reinforcing how incentive-based campaigns can quickly reignite retail participation.

3-3. Upbit investment contest highlights generational trading preferences

Upbit’s ongoing trading competition drew attention this week as the platform released data on returns and coin preferences by age and gender. The breakdown showed clear generational patterns: younger users leaned toward higher-beta or newer assets, while older cohorts favored large-cap or stable assets.

Notably, rookie league rankings were dominated by MON and TRUST regardless of age group, suggesting that newer participants are gravitating toward a narrow set of momentum-driven tokens. The data sparked discussion across Korean channels, with many users noting how sharply trading behavior differs by generation—even within the same retail-heavy market.

4. Upcoming Meetup

Unibase Korea Meetup 💙🇰🇷

📆 Date : 12. 21, 14:00 ~ 17:00

💼 Host: Unibase

Luma: https://luma.com/bgjaf7c7?tk=nc2rax

Builder Night l Seoul Summit: AI × Web3 x Stablecoin

📆 Date : 12. 22 (Mon) 18:00 ~ 22:00

💼 Host: Quak AI

Luma: https://luma.com/2u5ofykj?tk=cAgS9B

Arc & Circle Developer Platform 과 함께하는 Korea Builder 온라인 밋업📆 Date : 12. 23 (Tue) 19:00 ~ 20:30

💼 Host: Arc, Nodit

Luma: https://luma.com/cp0qesx0?tk=EBqVMu

Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!