Organic Momentum and Strategic Listings Shape Korean Crypto Market

1. Market Overview

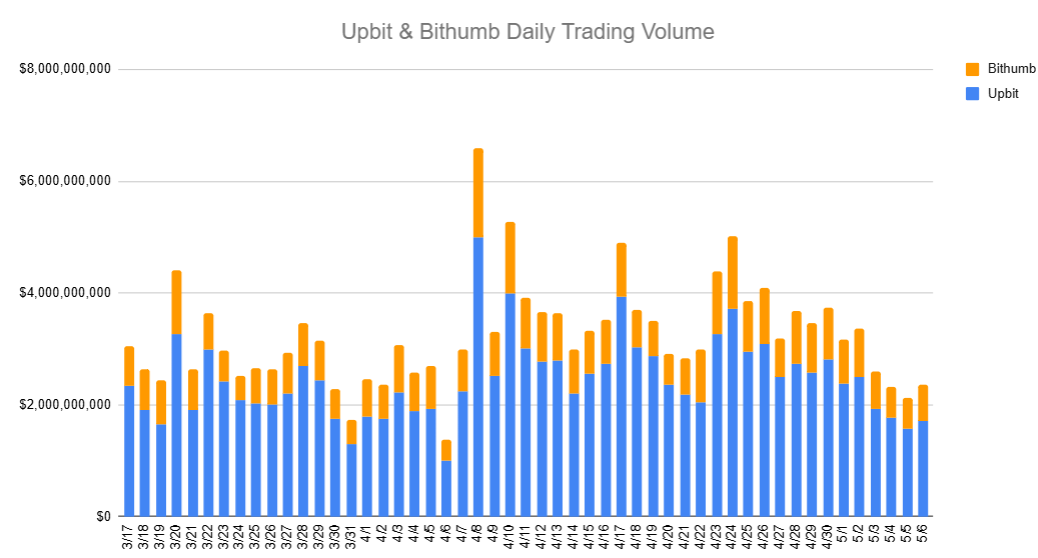

Last week, South Korea's crypto market saw a notable slowdown in overall trading volume, with Upbit averaging $2.3 billion and Bithumb $808 million in daily trades—a decline compared to the previous period. Despite this pullback, activity around newly listed tokens provided localized momentum. The standout among them was Sign (SIGN), which captured significant attention not only due to its dual listings on Upbit and Bithumb but also thanks to a unique community-driven marketing strategy that bypassed conventional paid promotions and leveraged Telegram KOLs, local offline events, and symbolic SBT rewards to fuel engagement.

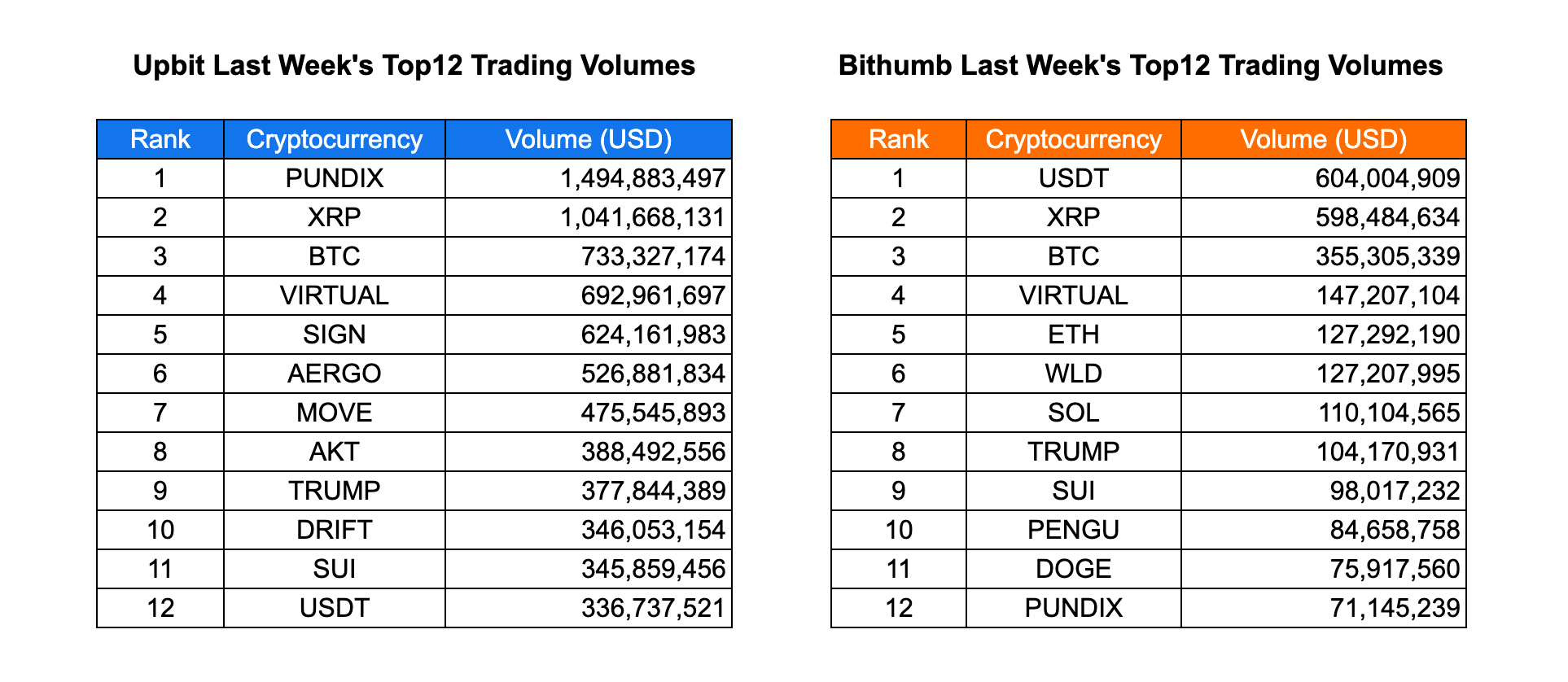

On the exchange front, Bithumb led new listings by adding AI16Z, SIGN, and Haedal, while Upbit introduced only SIGN. The listing of SIGN on both platforms was accompanied by a remarkable surge in trading volume, landing it in the top 5 traded assets on both exchanges. PUNDIX dominated weekly trading on Upbit with $1.5 billion in volume, driven by local interest and momentum, followed by XRP and BTC. Meanwhile, VIRTUAL and TRUMP also sustained strong trading levels, reflecting global narratives echoed locally. On Bithumb, USDT surprisingly topped the volume chart, with XRP, BTC, and emerging tokens like WLD and TRUMP following closely.

The standout story remains SIGN’s marketing trajectory. As the first investment by Binance Labs' rebranded YZi Labs and a core tech provider behind Kaito’s viral X airdrop, SIGN tapped into the Korean crypto community's preference for narrative-backed, VC-supported tokens. Its low-barrier PFP tools, recurring AMAs, and casual offline events differentiated the project while fostering high-quality, consistent engagement. This culminated in a rare blend of viral organic growth and post-TGE retention, suggesting a replicable model for future token launches in Korea.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Sign.

- Bithumb listed AI16Z, Sign and Haedal.

| Date | Upbit | Bithumb |

|---|---|---|

| 4/28 (Mon) | ||

| 4/29 (Tue) | Sign (SIGN) | AI16Z (AI16Z) |

| 4/30 (Wed) | Sign (SIGN) | |

| 5/1 (Thu) | ||

| 5/2 (Fri) | Haedal (HAEDAL) |

Key Marketing Strategies & Takeaways

🔹 Sign (SIGN)

Sign’s marketing efforts in Korea can be seen as a benchmark for successful project launches in 2024–2025. The standard formula followed by these projects typically involves:

“3–5 months of intensive marketing and engagement opportunities leading up to the TGE.”

What sets Sign apart, however, is that all of its Korean marketing was driven organically by local Telegram KOLs, entirely voluntarily.

Sign’s momentum was fueled by two major milestones early on:

- It was the first investment made by Binance Labs following its rebranding to YZi Labs.

- TokenTable, one of Sign’s flagship products, was used in the X airdrop campaign by Kaito, a project that redefined crypto-native social engagement.

For Korean communities, where VC backing carries significant weight, these two factors resonated strongly. On top of that, KOLs naturally linked Sign with Kaito, positioning it as “the next Kaito”, a powerful narrative in a fast-moving crypto market where clear signals from trusted KOLs often carry more weight than measurable metrics.

Another key to Sign’s success was the organic formation of a unique community. A simple tool that added Sign-branded sunglasses to users’ PFPs lowered entry barriers and sparked participation. By hosting frequent AMAs and Twitter Spaces, Sign made sure that everyone had consistent and accessible opportunities to participate. While the idea is simple, it is rarely carried out this effectively.

What further distinguished Sign were its offline events like karaoke nights and cherry blossom picnics, organized by team members based in Korea. These lighthearted, approachable gatherings offered a fresh contrast to the often formal or transactional events hosted by other projects, diversifying the ways people could get involved.

At the heart of all this was the project’s use of SBTs (Soulbound Tokens), granted exclusively to genuinely active community members. Instead of relying on the usual tactics like airdrop farming or token staking, Sign chose to recognize users who deeply engaged with the project whether online or offline, with a symbolic token of honor.

This approach created a powerful synergy: open and inclusive participation led to strong community bonds, which in turn helped sustain momentum even after the successful TGE. Today, Sign continues to enjoy an active and loyal community presence.

2-2. Trading Volume

Trading activity on South Korea's top two cryptocurrency exchanges, Upbit and Bithumb, showed daily average volumes of $2.3 billion and $808 million respectively last week. Compared to the previous week, trading volumes in Korean won have declined, with most altcoins experiencing a drop in trading activity.

PUNDIX recorded the highest trading volume among all assets last week, reaching $1.5 billion, accounting for more than half of the total weekly trading volume. Following PUNDIX, XRP maintained its position as the second most traded asset on both exchanges, with Upbit’s trading volume nearly double that of Bithumb.

Other notable assets in terms of trading volume included VIRTUAL, SIGN, TRUMP, and WLD. The surge in SIGN’s trading volume on both Upbit and Bithumb can be attributed to its recent listing. Meanwhile, VIRTUAL, TRUMP, and WLD showed strong performance due to positive developments related to the assets themselves, reflecting a trend consistent with global market sentiment.

2-3. Top 10 Gainers

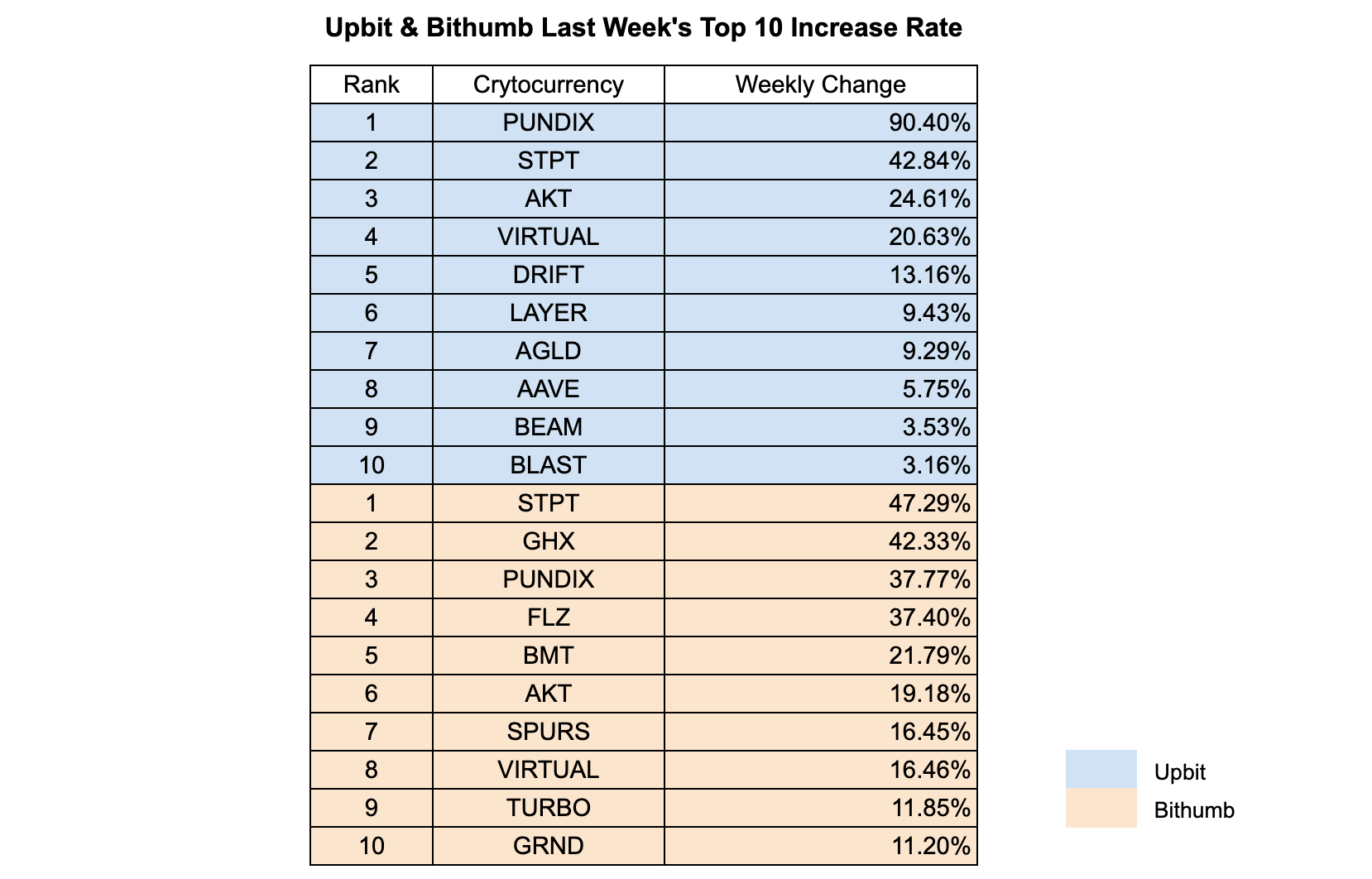

The overall market demonstrated relatively subdued returns compared to the previous period. On Upbit, the majority of assets posted single-digit returns, with only five assets managing to exceed this threshold. Notably, three assets—PUNDIX, STPT, and AKT—emerged as the primary outperformers among those listed on both exchanges.

PUNDIX led the market with a notable gain of 90.4% on Upbit, while achieving a more modest 37.8% increase on Bithumb. STPT secured the second position, delivering a 42.8% return on Upbit and an impressive 47.3% on Bithumb, where it ranked first in terms of performance. AKT followed, recording a 24.6% gain on Upbit and ranking sixth on Bithumb with a 19.2% gains

Aside from the assets listed on both exchanges, several assets exclusively listed on Bithumb exhibited stronger performance. Notable among these were FLZ, GHX, BMT, SPURS, Turbo, and GRND, which showed comparatively higher returns, further highlighting the divergence in market dynamics between the two exchanges.

3. Korean Community Buzz

1. SIGN Airdrop Brings the Heat

SIGN launched its long-awaited airdrop checker, and with the token getting listed on Korea’s top three exchanges back-to-back, the community was buzzing all week. KOLs and community members who received the drop celebrated by sharing gifts like coffee and oranges with their followers. The excitement spiked when SIGN’s listing price hit nearly double its OTC value. Airdrop recipients—including AMA winners, SBT holders, and active community members—publicly shared their reward amounts, sparking a wave of congratulations and envy. Many also pointed out that if other projects want a shot at getting listed on Upbit, they’d better not overlook the Korean community.

2. Korea Tightens Listing Rules

On May 1, Korea’s Virtual Asset Committee, under the Financial Services Commission, introduced new listing standards for crypto exchanges. According to the latest updates, newly listed tokens must secure a minimum amount of liquidity before trading begins, aiming to reduce the infamous "listing pump" phenomenon. Meme coins will also face stricter scrutiny—only those with sufficient trading history or volume on reputable global exchanges will be considered for listing. The days of random meme coins mooning on a whim in Korea may be numbered.

source: https://n.news.naver.com/mnews/article/421/0008226054

3. Grok and the Meme Market Slowdown

Despite Elon Musk himself changing his profile to Gork and tweeting about it, the token still failed to break $100M in market cap. This was a wake-up call for many in the community. It felt like a signal that even with heavy shilling, meme coins are losing steam fast. The once-explosive Solana meme coin scene also appears to be fizzling out—tokens like $BOOP and $HOUSE brought short-term hype, but didn’t lead to a lasting market push. The overall sentiment? Retail players are either out of energy or cashing out faster than ever.

4. Events

This week, Korea observed an extended holiday lasting around 6 to 7 days.

At the same time, the Token 2049 event took place in Dubai, attracting a large number of Web3 industry team and KOLs who attended in person and actively participated in various events.

As a result, there were fewer AMAs compared to the previous week.

4.1. HUMA Finance AMA with Wecrypto

HUMA is set to conduct its Token Generation Event (TGE) as the first project featured on Jupiter's new product, Jupiter LFG V2. Scheduled for Q2, Huma Finance plans to launch its token through this newly introduced platform by Jupiter.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!