Orderly, SynFutures, Virtual, and a Shifting Korean Market Pulse

1. Market Overview

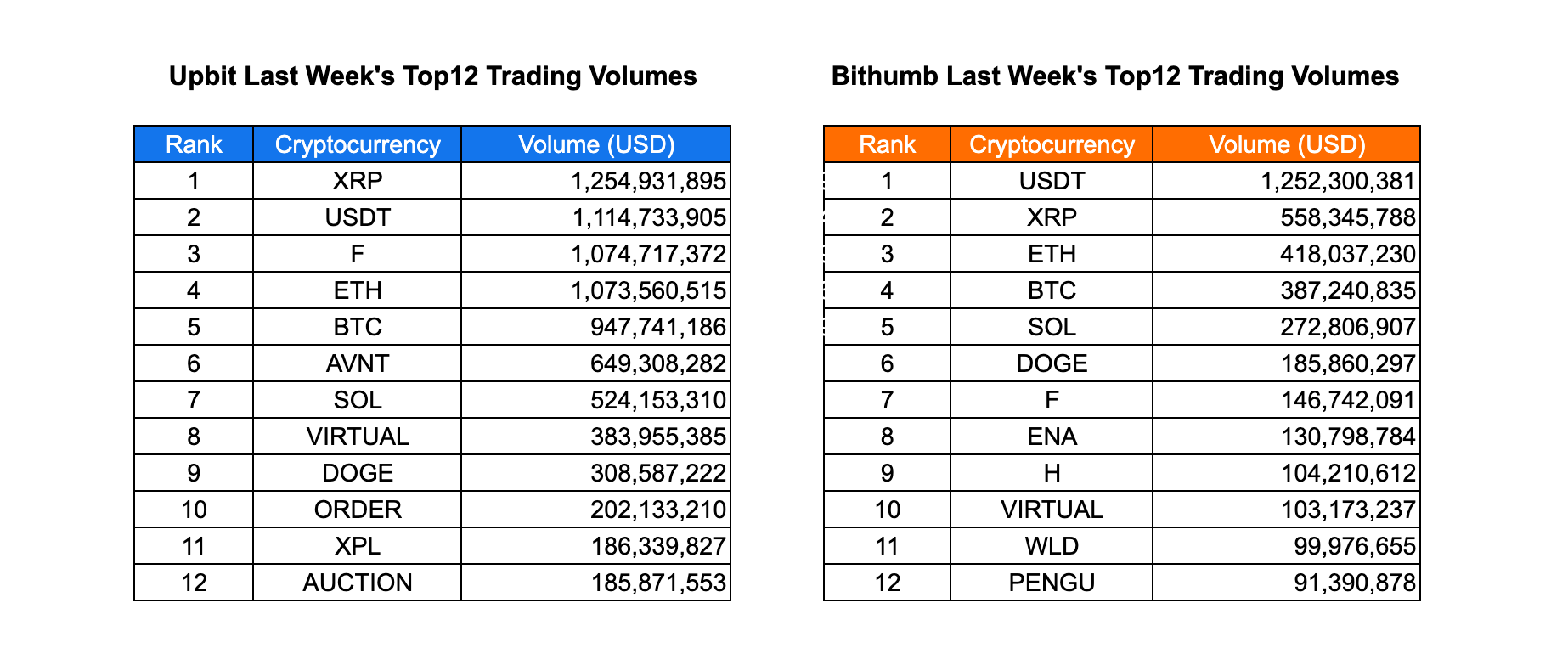

Last week, major Korean exchanges continued their aggressive listing pace, with Upbit adding SynFutures (F), Clearpool (CPOOL), and Orderly (ORDER), while Bithumb introduced Zora (ZORA), Recall (RECALL), and Clearpool (CPOOL). Trading activity remained dominated by large-cap assets: XRP led Upbit with $1.25B in weekly volume, followed by USDT ($1.11B) and F ($1.07B), while ETH, BTC, and AVNT maintained solid liquidity above half a billion dollars each. Mid-caps like SOL, ORDER, and VIRTUAL also drew steady attention, reflecting consistent retail speculation despite moderating overall market volatility.

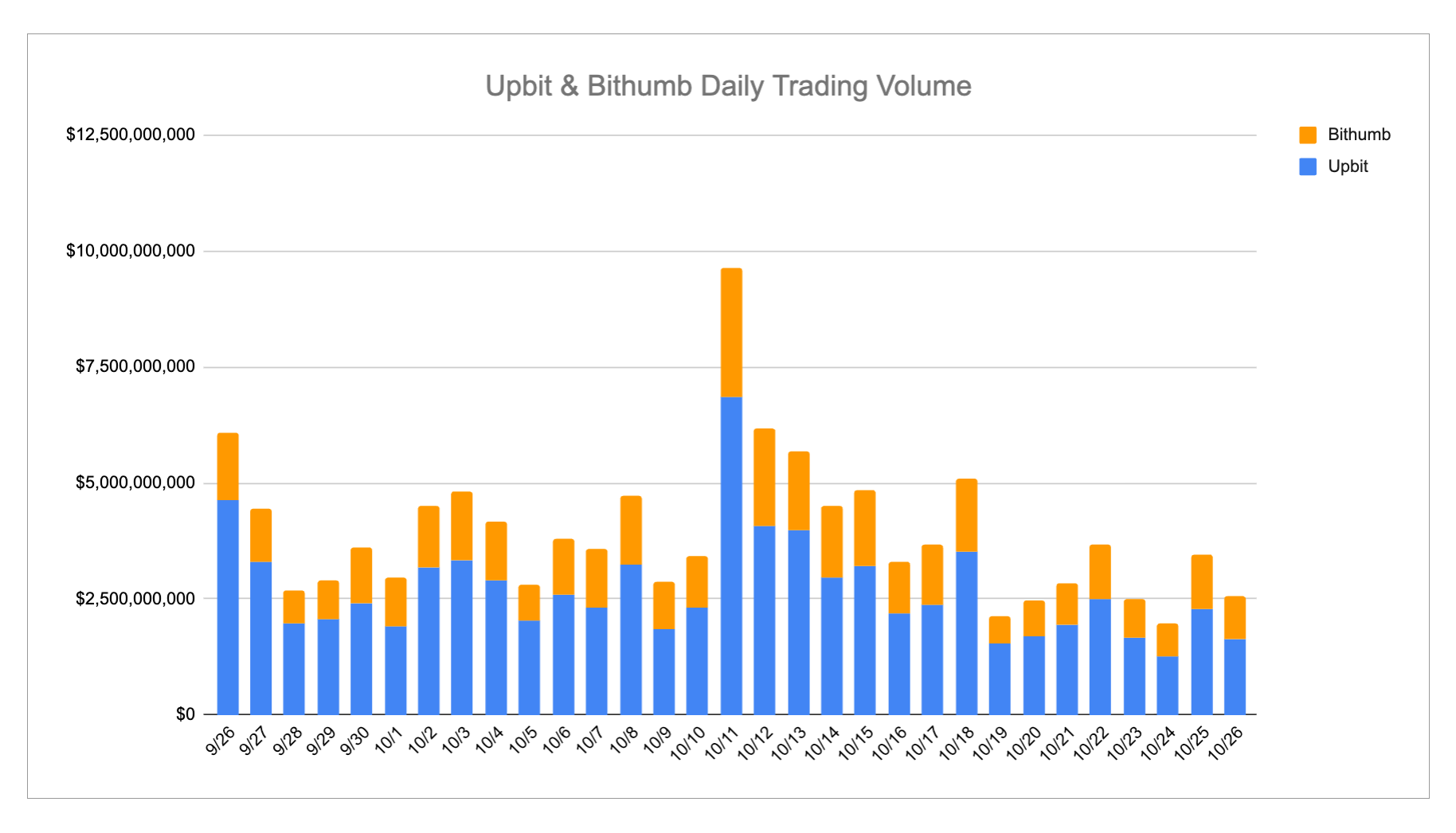

Bithumb’s volumes showed a similar concentration around top-tier tokens, with USDT ($1.25B), XRP ($558M), and ETH ($418M) at the forefront. While large-cap trading remained dominant, growing participation in altcoins such as ENA, H, and VIRTUAL indicated increased risk appetite among traders. Daily market turnover fluctuated under $5B. Upbit once again accounted for the majority of total trading, reinforcing its position as Korea’s leading retail exchange and key driver of domestic liquidity.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Synfutures, ClearPool and Orderly

- Bithumb listed Zora, Recall and ClearPool.

| Date | Upbit | Bithumb | |

|---|---|---|---|

| 10/20 (Mon) | |||

| 10/21 (Tue) | Synfutures (F) | Zora (ZORA), Recall (RECALL) | |

| 10/22 (Wed) | ClearPool (CPOOL) | ClearPool (CPOOL) | |

| 10/23 (Thu) | |||

| 10/24 (Fri) | Orderly (ORDER) |

Key Marketing Strategies & Takeaways

🔹 Orderly (ORDER)

Orderly Network has been consistently running marketing campaigns in Korea for over 17 months, and following its previous listing on Bithumb, it has now secured an additional listing on Upbit.

Back in 2024, Orderly emerged around the same time as Hyperliquid, Synfutures, and LogX, during the height of the Perp DEX airdrop wave. The project mainly leveraged major Korean KOL channels to promote trading campaigns and guide users through Galxe, Zealy, and other quest missions, with many KOLs themselves actively participating — driving strong user engagement across the Korean community.

After the mainnet launch, Orderly conducted its TGE, but did not achieve listings on the top-tier exchanges that many investors had anticipated.

Nevertheless, the team continued to push forward with both development and marketing, emphasizing how token utility and benefits were designed to heavily reward stakers. They also kept up steady communication through partnership announcements, offline meetups, AMAs, and community events.

As a result, the project achieved a Bithumb listing in December 2024, and has continued to revisit the Korean market regularly with AMAs, meetups, and local events, while sharing progress on development and partnerships. With the Perp DEX sector gaining renewed attention, this momentum culminated in its KRW listing on Upbit.

Overall, Orderly serves as a strong example showing that consistent marketing and engagement in the Korean market, combined with sector timing, can pave the way for additional exchange listings down the line.

2-2. Trading Volume

Upbit maintained its lead over Bithumb in overall trading activity last week, driven by strong demand for large-cap assets. XRP topped the Upbit chart with $1.25B in volume, followed closely by USDT ($1.11B) and F ($1.07B), all showing consistent liquidity throughout the week. ETH and BTC also remained among the most traded tokens, while mid-cap coins such as AVNT ($649M) and SOL ($524M) sustained moderate engagement. Newer listings like VIRTUAL, ORDER, and AUCTION also secured notable positions, signaling continued retail interest in emerging tokens.

On Bithumb, USDT recorded the highest volume at $1.25B, followed by XRP ($558M), ETH ($418M), and BTC ($387M), indicating that the exchange’s activity remains concentrated around major market pairs. SOL and DOGE maintained steady traction, while ENA, H, and VIRTUAL appeared within the top 10, highlighting growing exposure to newer assets among Bithumb traders.

Daily trading volume across both exchanges fluctuated between $3B and $9B, with a pronounced spike on October 10 that briefly surpassed $10B before moderating in the following days. Upbit consistently contributed the larger share of the total, underscoring its dominance in Korea’s spot trading landscape and its central role in driving domestic market liquidity.

2-3. Top 10 Gainers

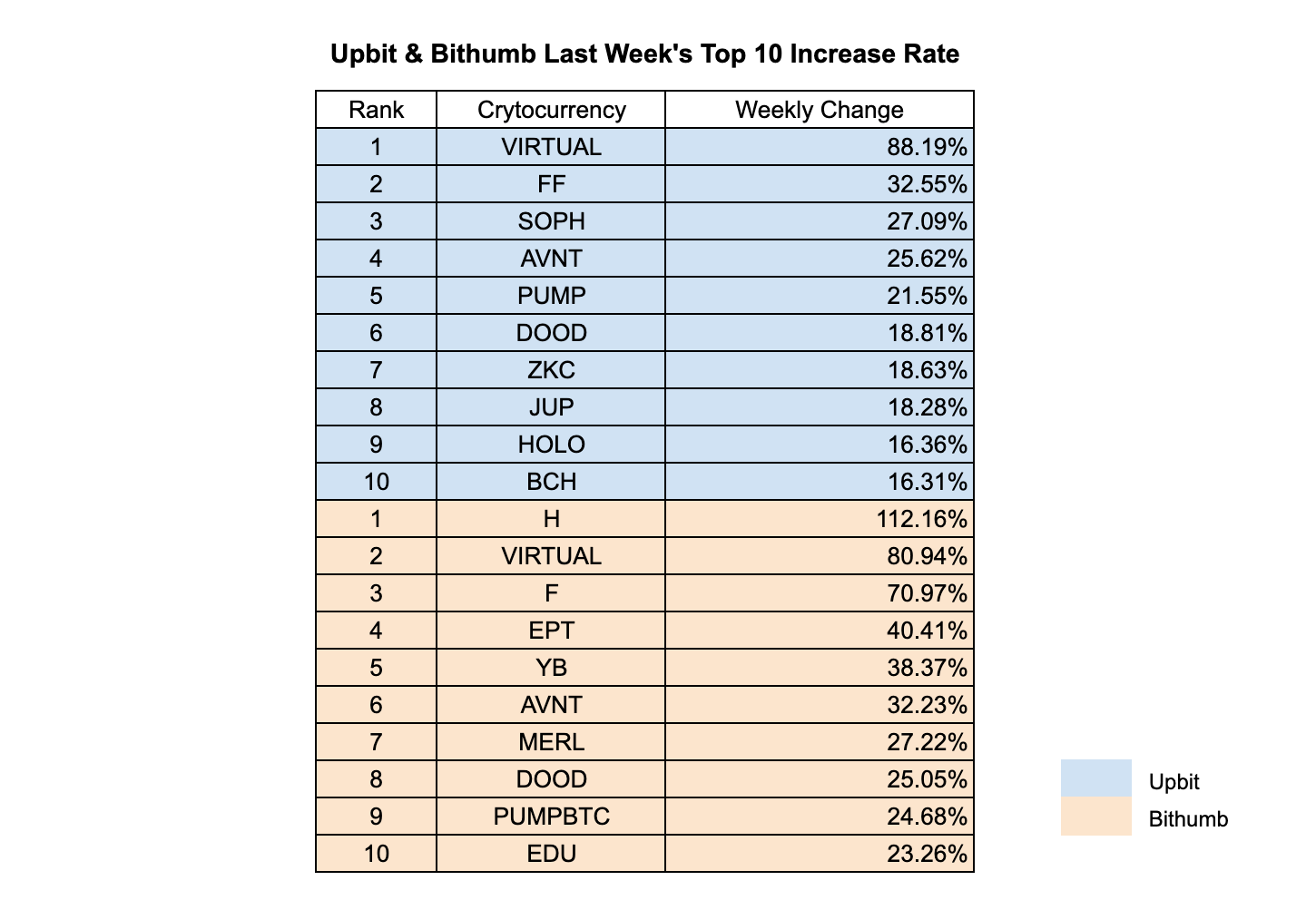

VIRTUAL dominated the Upbit market with an impressive 88.19% weekly surge, reflecting heightened retail interest and speculative trading momentum. FF (+32.55%) and SOPH (+27.09%) followed as strong performers, supported by steady volume and short-term accumulation. Mid-cap tokens like AVNT (+25.62%) and PUMP (+21.55%) also posted notable gains, while DOOD, ZKC, and JUP saw modest but steady appreciation between 18–19%, driven by renewed liquidity rotation into smaller-cap assets. HOLO and BCH rounded out Upbit’s top 10, signaling broad-based price recoveries across altcoins.

On Bithumb, H led the weekly rally with a sharp 112.16% increase, significantly outperforming the broader market. VIRTUAL followed closely with +80.94%, mirroring its strong showing on Upbit and confirming cross-exchange trader enthusiasm. F (+70.97%), EPT (+40.41%), and YB (+38.37%) also recorded double-digit gains, reflecting momentum-driven buying among retail participants. AVNT (+32.23%), MERL (+27.22%), and DOOD (+25.05%) sustained upward trends, while PUMPBTC and EDU completed the list, each rising over 23%. The overlap of tokens like VIRTUAL, AVNT, and DOOD across both exchanges underscores synchronized market sentiment and shared interest among Korean traders.

3. Korean Community Buzz

3-1. Financial Regulators Move Toward Public Oversight of Exchange Listings

Korea’s Financial Services Commission (FSC) announced plans to transition crypto exchange listing reviews from self-regulation to public oversight, introducing disclosure standards similar to those used in stock markets. The goal is to strengthen transparency and investor protection by mandating detailed listing, delisting, and trading suspension criteria.

The proposed framework is expected to appear in the upcoming “Virtual Asset Law 2.0,” which will also include stablecoin regulations and comprehensive guidelines for market operators and users. The move follows concerns over “listing spikes” and loose internal standards. The FSC previously suggested requiring minimum circulating supply and limiting market orders immediately after listings — measures now likely to be formalized.

Community reactions were quick: many traders interpreted the recent listing surge on Upbit and Bithumb as “a rush before regulation,” with posts reading “Now it makes sense why the listing spree happened.”

3-2. Analyzing Upbit’s Listing Strategy

Community discussions intensified over Upbit’s recent listing patterns, particularly its addition of tokens previously listed on Bithumb such as Orderly, SynFutures, and Bio. Some speculate that this may relate to Upbit’s ongoing stock exchange deal with Naver, aiming to expand market share and outpace Bithumb’s rapid growth.

Others believe Upbit is being selective in timing — listing tokens only after vesting periods end and projects demonstrate sustained development activity. Many traders describe it as a “filtered second wave” of listings designed to maintain reliability while capturing liquidity from trending assets.

3-3. Cambodia’s Crypto Crime Nexus Raises Red Flags

Korea’s National Intelligence Service (NIS) released a report revealing the scale of Cambodian organized crime operations, estimating illicit revenue at $12.5 billion—nearly half the nation’s GDP. Among the 200,000 individuals involved, 1,000–2,000 are believed to be Korean nationals, many not victims but active participants.

Alarmingly, the report indicates a surge in USD stablecoin inflows and outflows between Cambodian and Korean exchanges in 2024–2025, suggesting possible money laundering and illegal remittance routes. Several local firms, including Huiyuan and Prince Group, are now under scrutiny for potential involvement. The revelations have reignited debates about Korea’s limited access to derivatives markets and regulatory gaps that may be pushing capital offshore.

4. How many event updates are waiting for us this week?

4.1 Spacecoin AMA with Wecrypto

✔️Date: Oct 27th

✔️Time: 20:00 PM KST

✔️Space: Wecrypto Twitter

4.2 Aptos AMA with Wecrypto

✔️Date: Oct 27th

✔️Time: 22:00 PM KST

✔️Space: Wecrypto Twitter

4.3 ETHGas Korea Meet Up

✔️Date: Oct 28th

✔️Time: 18:00 PM - 23:30 PM KST

✔️RSVP

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!