Midcaps Shine, Community Gathers, and Korea Stays Risk-On

1. Market Overview

Korean exchanges continued to push new listings last week: Upbit added Axelar, while Bithumb listed dogwifhat (WIF) and Pocket Network (POKT)—the latter fueling strong trading momentum and leading Upbit’s top gainers with a 42.6% weekly rise.

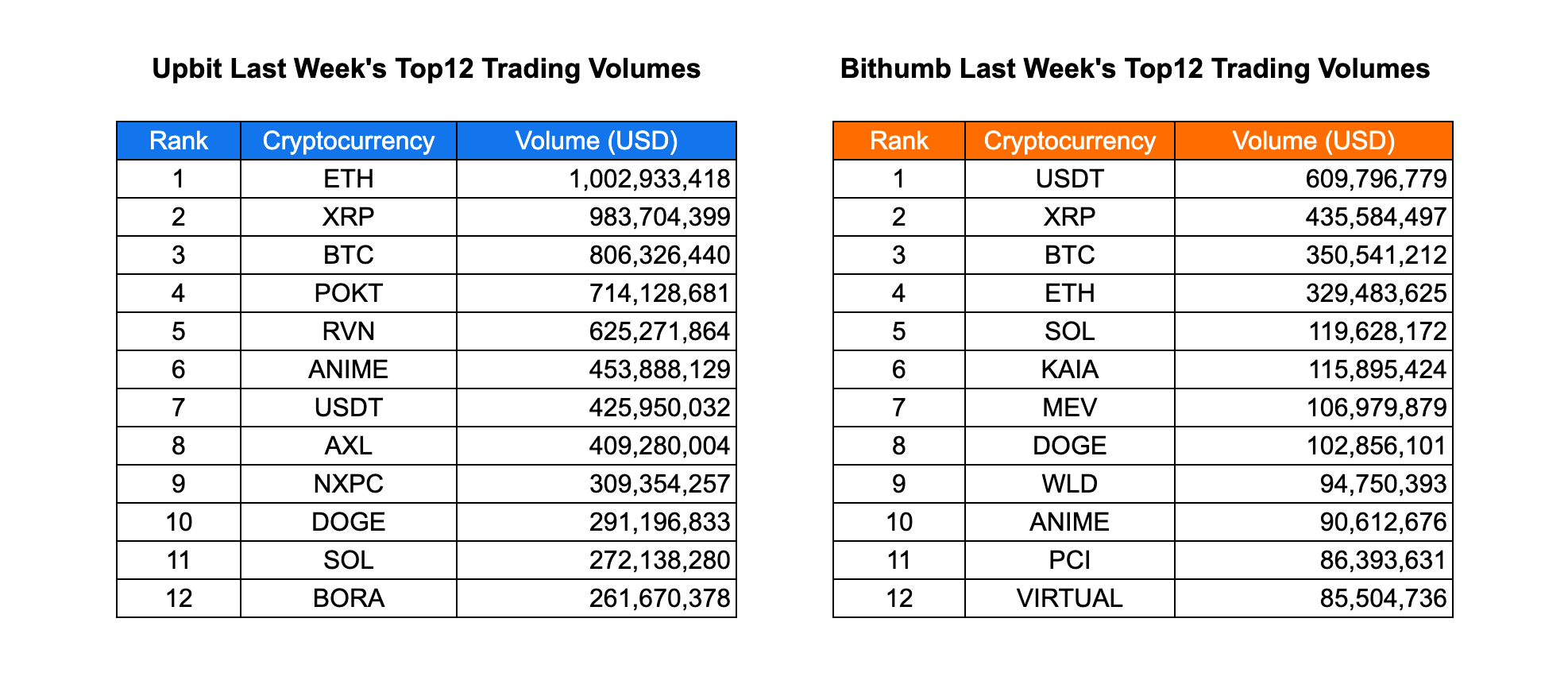

In trading activity, ETH, XRP, and BTC remained dominant on Upbit, with POKT, RVN, and ANIME standing out among mid-cap tokens. Bithumb saw high volumes in USDT, KAIA, and PCI, reflecting more speculative flows.

Social buzz included optimism around Korea’s new pro-crypto policy direction, and a viral moment when a well-known KOL donated ₩100M worth of $HYPE—blending institutional signals with community-driven narratives.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Axelar.

- Bithumb listed dogwifhat and Pocket Network.

| Date | Upbit | Bithumb |

|---|---|---|

| 6/9 (Mon) | ||

| 6/10 (Tue) | Axelar (AXL) | dogwifhat (WIF), Pocket Network (POKT) |

| 6/11 (Wed) | ||

| 6/12 (Thu) | ||

| 6/13 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Axelar (AXL)

Unlike many projects that have recently been listed on Korean exchanges, Axelar can be seen as an example of a project that has steadily built a presence in Korea over a relatively long period of time.

Axelar has been known in the Korean market for over three years. In early 2022, when cross-chain bridge airdrop farming was trending, Axelar gained even more attention thanks to strong backing from well-known venture capital firms like Dragonfly Capital and Polychain Capital.

Despite the hype, many users participated in the airdrop tasks and token sale, but Axelar did not make a major impact at the time of its token generation event.

Over time, Axelar was listed on the BTC pair on Upbit in December 2023 and on Bithumb in January 2024. However, it did not manage to achieve the most sought-after milestone among current projects, which is a KRW pair listing on Upbit.

Even so, Axelar continued to maintain its Korean community channels and regularly shared updates by forwarding announcements to local KOL channels. Through additional content, the team also highlighted the security of its interoperability infrastructure and emphasized its relevance for institutional adoption and the emerging real world asset narrative.

In addition to sharing information about the project, they also organized community events to encourage participation and consistently attract users.

It is also worth noting that Axelar's bridge has been live for a long time without any hacking incidents, which strengthens its credibility.

Thanks to this consistent effort and proven track record, AXL has finally succeeded in securing a KRW listing on Upbit.

2-2. Trading Volume

Upbit’s top traded tokens this week were led by ETH ($1.00B), XRP ($983M), and BTC ($806M), with each showing strong liquidity despite the broader market consolidation. POKT ($714M) and RVN ($625M) followed closely, the latter boosted by retail-driven momentum after being the top gainer on Bithumb. ANIME ($453M) also entered the high-volume ranks on both exchanges, showing alignment between price growth and user interest.

Bithumb's volume rankings showed a different composition, with USDT ($609M) at the top, reflecting increased stablecoin inflow possibly linked to positioning ahead of anticipated events. XRP and BTC followed, though at relatively lower volumes than on Upbit. Notably, KAIA, MEV, and VIRTUAL made the top 12 solely on Bithumb, indicating exchange-specific retail activity or promotions. ANIME and PCI also appeared here, reflecting synchronized trading interest across platforms.

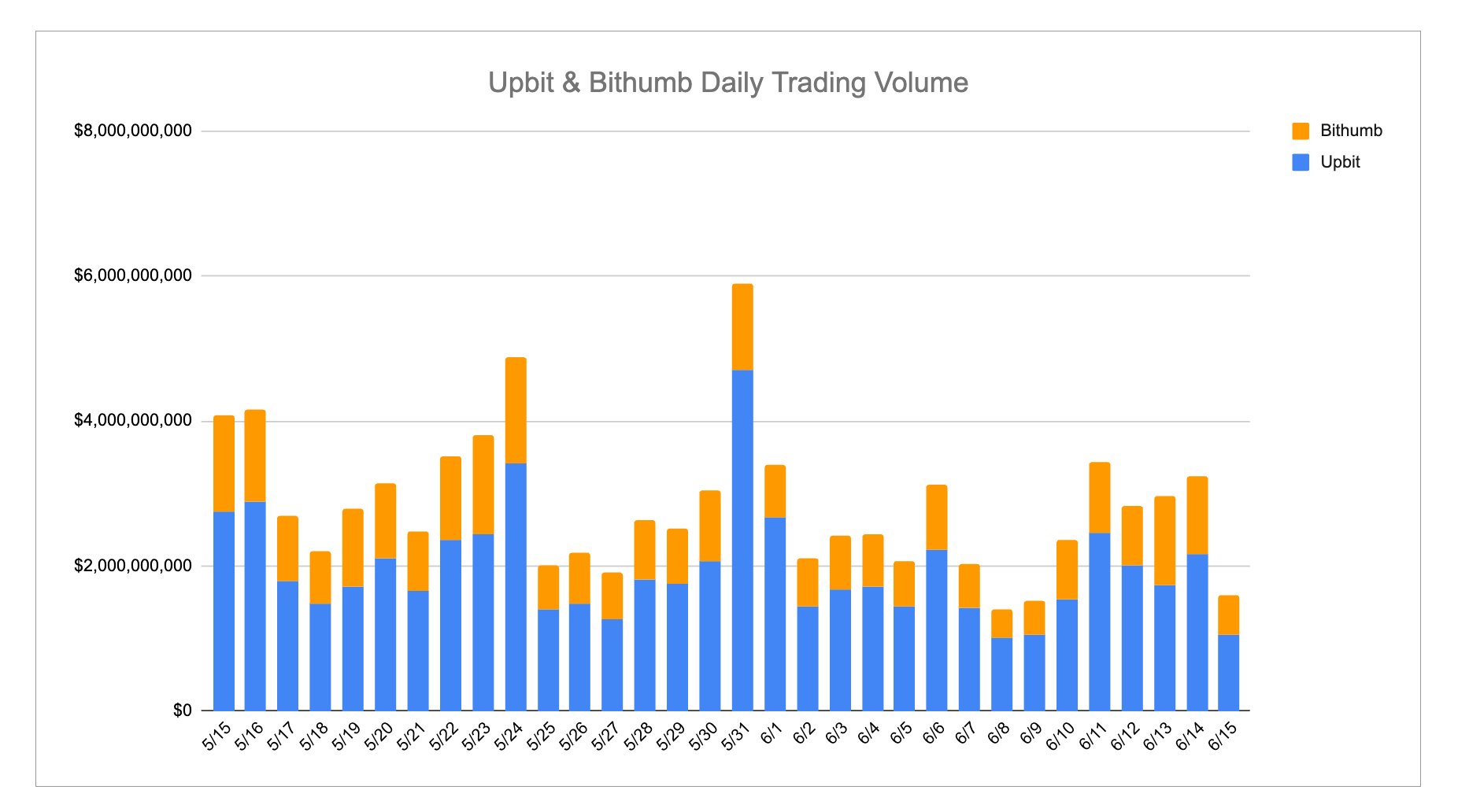

Overall, Upbit maintained dominant trading activity with a visible dip in monthly volume per CoinGecko’s data, suggesting short-term caution among Korean retail traders despite intermittent altcoin rallies. The presence of tokens like RVN, ANIME, and PCI in both volume and gainers lists shows that temporary retail narratives still drive rotation behavior in the market.

2-3. Top 10 Gainers

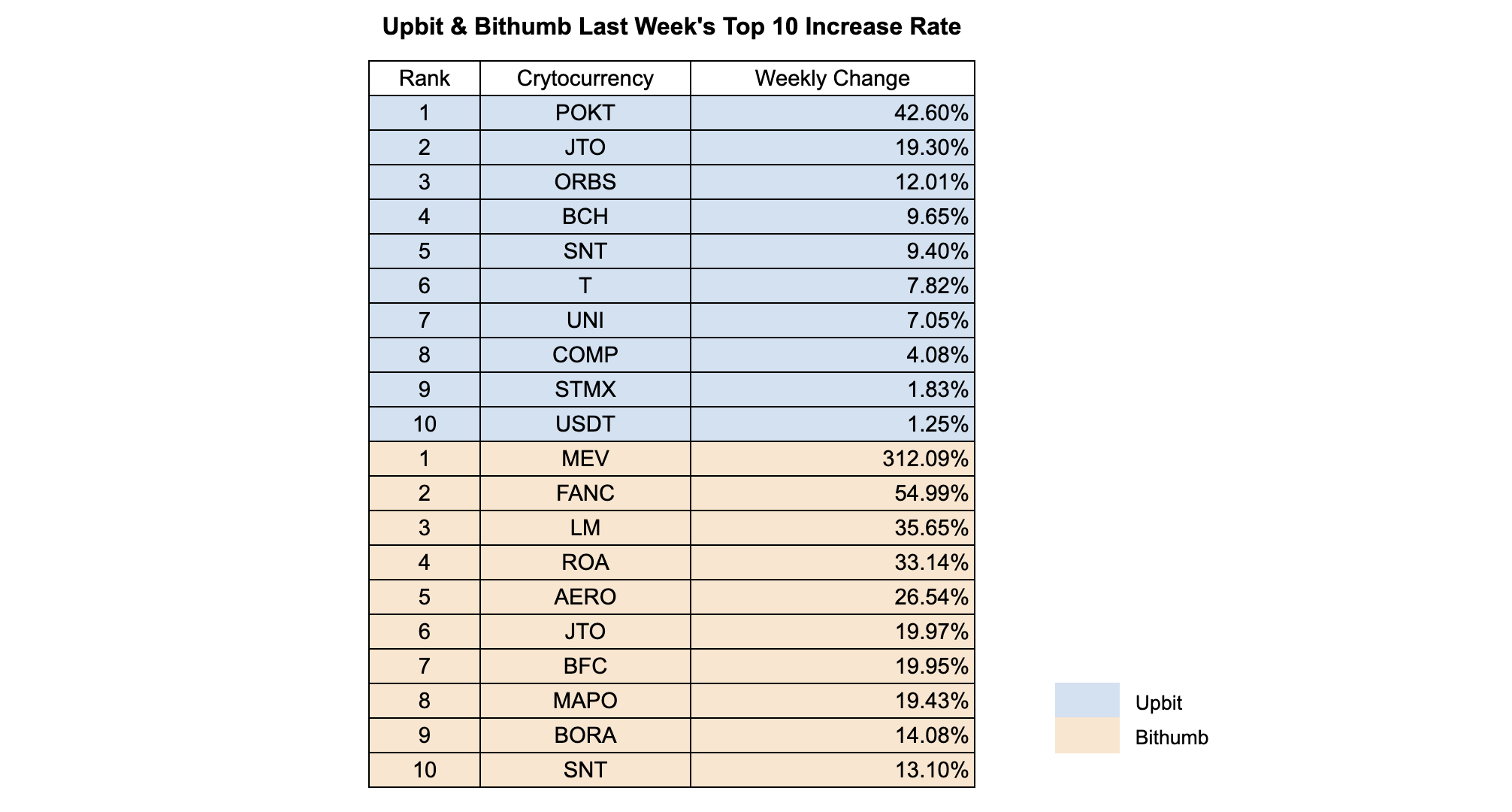

On Upbit, POKT led the weekly gains with a sharp 42.6% rise, bolstered by both volume momentum and heightened community interest following its consistent presence in the exchange’s top traded list. JTO and ORBS followed with gains of 19.3% and 12.01% respectively, reflecting broader rotation into mid-cap tokens. BCH (+9.65%) and SNT (+9.4%) also saw renewed inflows, likely influenced by Bitcoin fork narratives and legacy token speculation. UNI (+7.05%) and COMP (+4.08%) maintained moderate uptrends, supported by DeFi sector resilience, while stablecoin USDT surprisingly entered the gainers list with a minor uptick, possibly due to KRW-USDT pair arbitrage dynamics.

Bithumb’s top gainers showed a different tilt, favoring small-to-mid cap tokens. While detailed figures weren’t available at the time of review, community signals suggest strong performances from tokens like RVN, PCI, and VIRTUAL in the prior week have rotated into newer narratives, with a continued presence of niche altcoins experiencing exchange-specific traction. The variance between Upbit and Bithumb top gainers underlines the fragmented nature of Korean retail sentiment, with each platform exhibiting distinct trading flows depending on liquidity and retail push.

The divergence in gainers across exchanges reinforces the need for projects to monitor listing-specific dynamics, as tokens gaining traction on one exchange do not necessarily trend on the other. POKT’s performance on Upbit, however, remains a notable exception, exhibiting both price appreciation and sustained volume, signaling deeper market alignment.

3. Korean Community Buzz

1. Korean Equities & Local Tokens Surge Post-Election

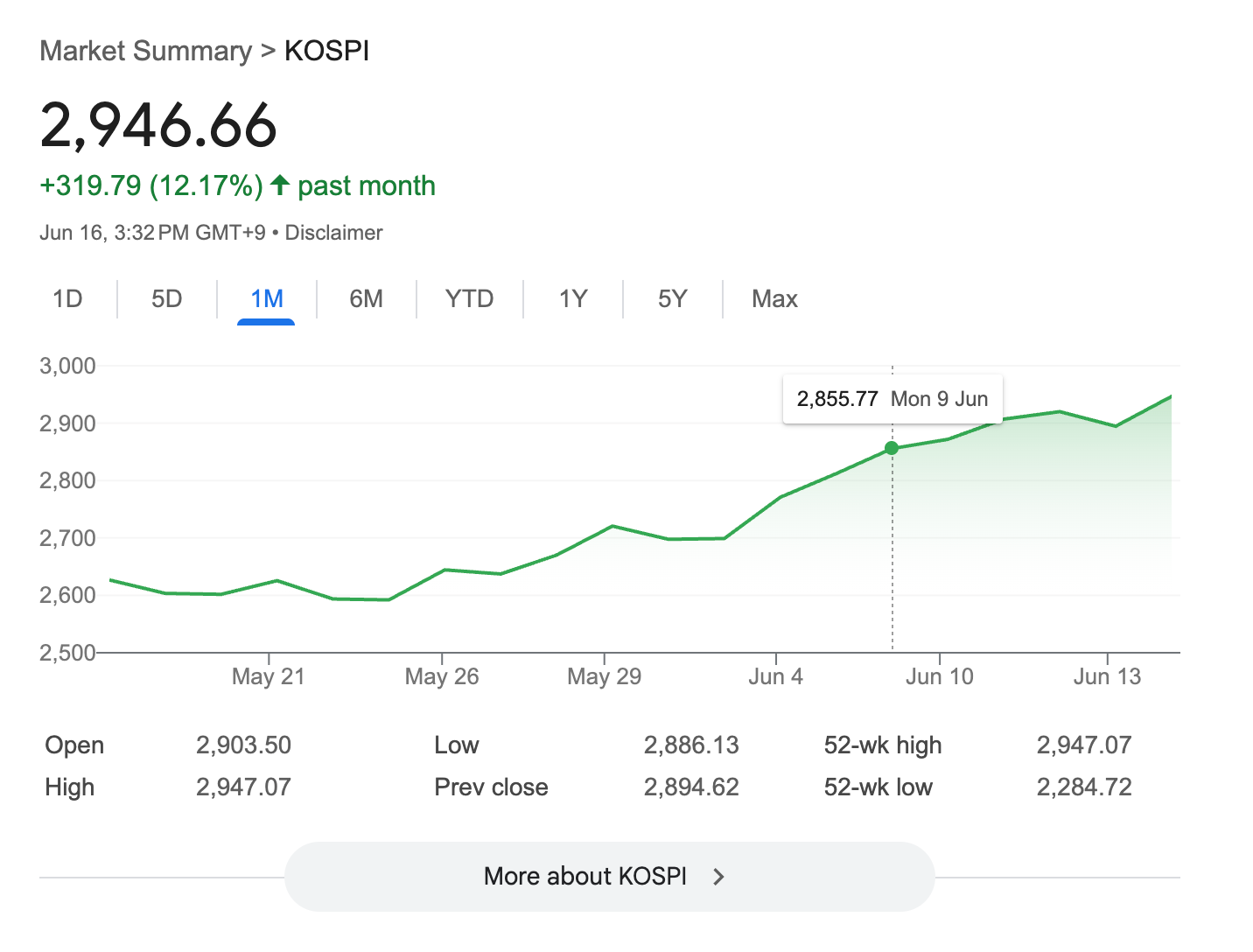

Following South Korea’s presidential election, investor sentiment turned bullish—not only in traditional equities but also in Korea-related crypto tokens. Domestic stocks saw a notable uptick, and in the crypto world, tokens like Paycoin (PCI), KLAY, and BORA posted strong gains.

Community reaction leaned optimistic, with posts like “Is the Korean stock market pumping? Should I finally open a brokerage account?” circulating widely. While the broader market remains cautious, the political shift has sparked renewed interest in both crypto and traditional assets in Korea.

2. KBW 2024 Drops First Lineup: Sui, 0G, and More

Korea Blockchain Week 2024 is officially heating up. Scheduled for September 23–24 at the Walkerhill Hotel in Seoul, the main conference will be partnered by Sui, Stable, and 0G, among others.

The first speaker lineup includes major names:

- Bo Hines, former head of crypto policy under the Trump administration and current executive at the White House Digital Assets Committee

- Arthur Hayes, BitMEX co-founder and recurring KBW crowd-favorite

- Caroline Pham, acting commissioner of the CFTC

Crypto insiders welcomed the lineup with excitement, especially noting the mix of government regulators and DeFi OGs. The vibe? “KBW isn’t just another Web3 event—it’s becoming a global policy forum.”

3. Korean KOL Donates ₩100M Worth of $HYPE

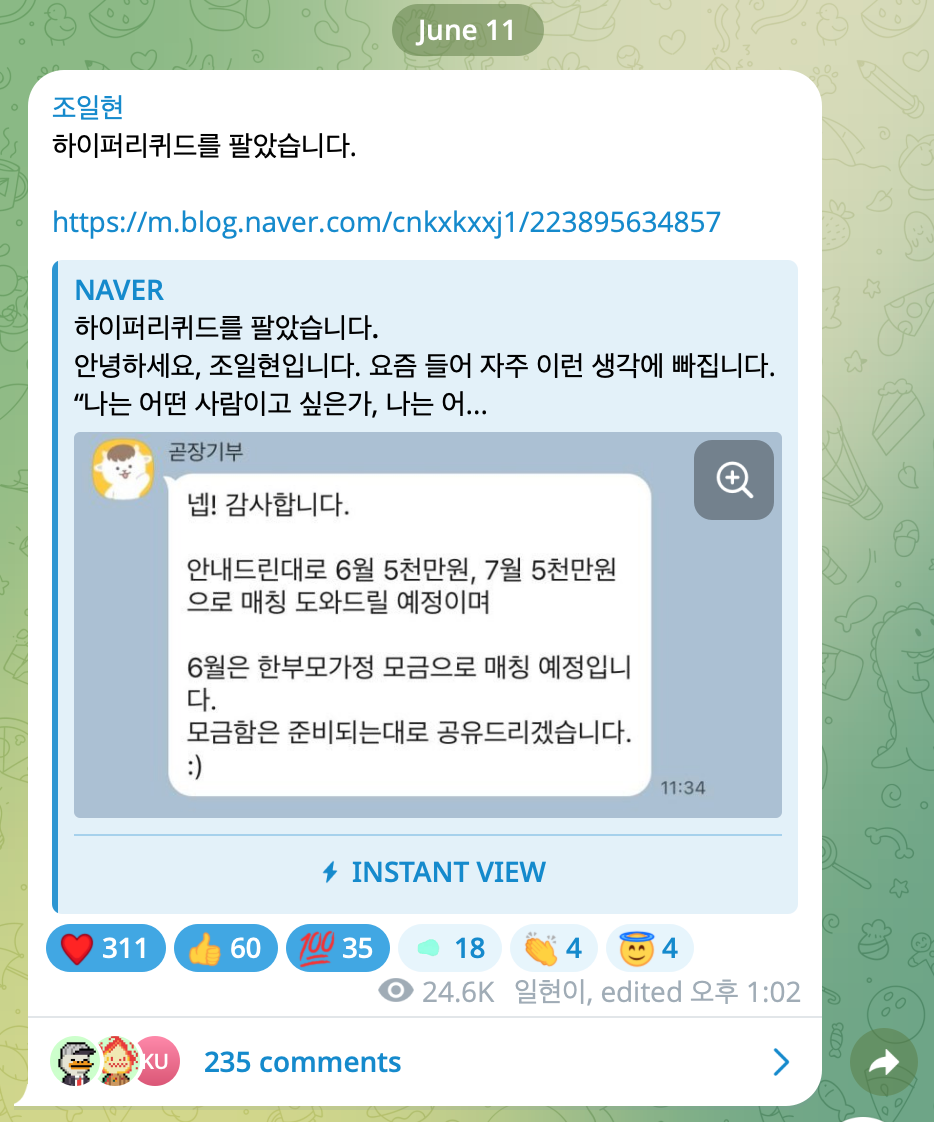

In a moment that moved many, Ilhyun Jo, a prominent Korean KOL known for championing Hyperliquid, announced he had sold a portion of his $HYPE tokens—worth approximately ₩100 million (around $74,000)—to make a charitable donation.

His post quickly went viral on Korean crypto Telegram channels, garnering over 25,000 views, hundreds of reactions, and reposts from fellow KOLs across the community. The story became a beacon of “degen with a heart,” showing that even in the fast-paced world of crypto, moments of generosity can truly resonate.

4. Events

Airdrops, Octopus, and... Skirts?

Following the success of Lagrange’s airdrop-powered meetup, attention in Korea has shifted to events offering tangible rewards—and last week was no exception.

SOON and Satlayer both held community meetups. SOON’s event, despite the buzz, fell short for some attendees due to the limited venue size, which couldn't accommodate the demand. Satlayer, on the other hand, surprised many by giving out a custom skirt as part of their event swag. While some found it puzzling, it definitely caught people’s attention. More importantly, the food quality was widely praised, earning the project positive word-of-mouth within the community.

Meanwhile, OpenLedger hosted a private dinner for Korean KOLs. Held at a seafood restaurant that served live octopus, the experience was both thematic and memorable—perfectly aligned with their octopus mascot. The event drew a wave of social media posts and community buzz, reinforcing OpenLedger’s strong branding and connection to local influencers.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!