Midcaps Heat Up, Legacy Tokens Rotate, and Korea Holds Steady

1. Market Overview

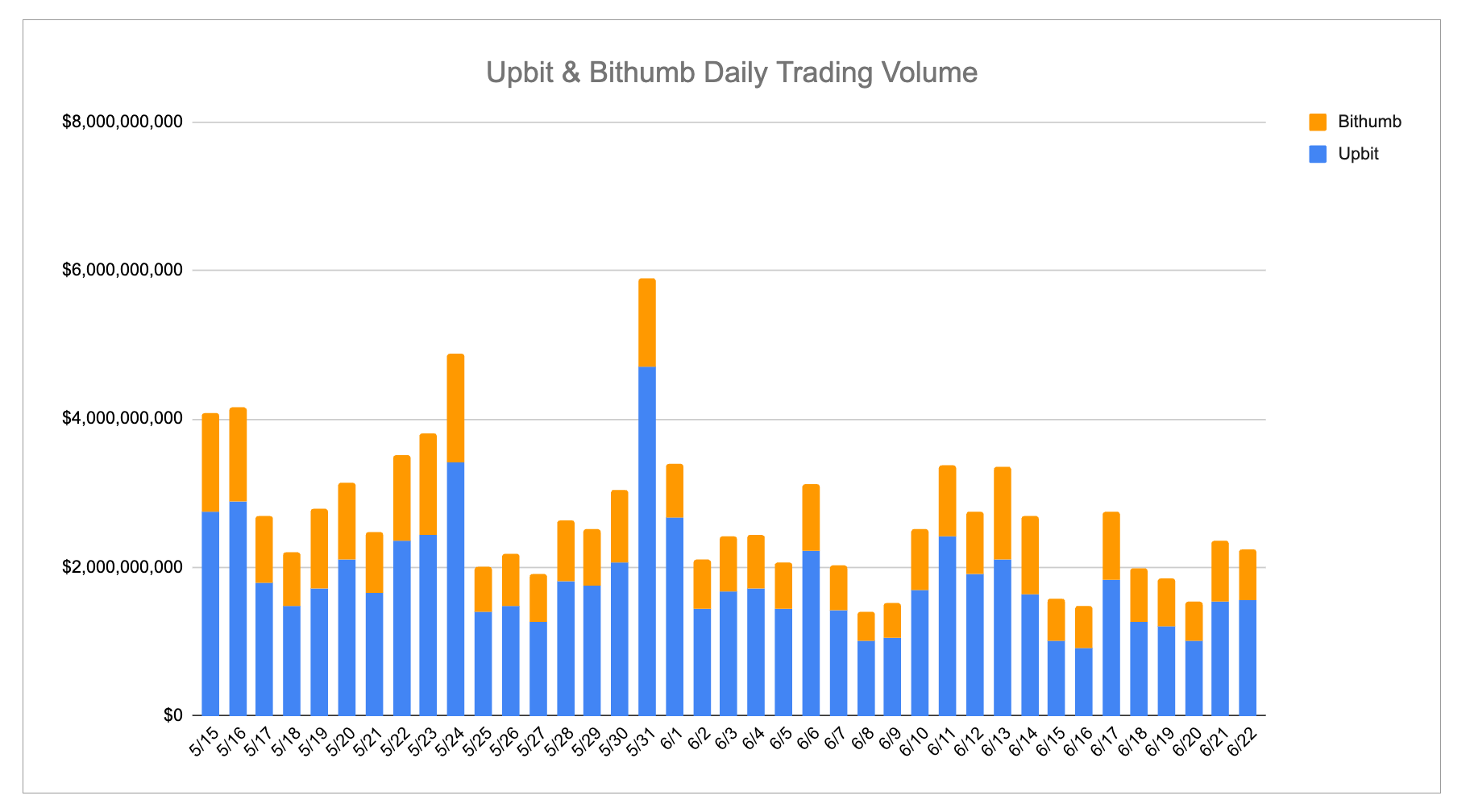

Last week, Korean exchanges continued to show healthy trading activity, with Upbit leading in altcoin liquidity and Bithumb maintaining stablecoin-heavy flows. XRP once again dominated volume across both platforms, while mid-cap tokens like SNT, AERGO, ALT, and LAYER surged in activity—indicating a shift in retail attention toward legacy narratives and modular infrastructure plays. Upbit also introduced AltLayer and Raydium, two older-generation tokens whose listings were seen as “homework catch-up,” but whose local marketing proved effective. Bithumb, on the other hand, added Spark, Huma Finance, and Forta, reinforcing its trend of niche, high-rotation listings.

Top gainers reflected these dynamics: Upbit’s list favored infrastructure tokens and legacy projects with moderate gains, while Bithumb saw sharper speculative movements—ELX soared over 60%, and KAIA and SEI delivered strong double-digit returns. Overlap on names like T, AERGO, and SEI suggests cross-exchange traction, while stablecoin KRW pairs even saw rare appreciation amid safety positioning. Altogether, while overall sentiment stayed cautiously optimistic, trading patterns showed clear momentum building in midcaps and community-driven narratives.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed AltLayer and Raydium.

- Bithumb listed Spark, Huma Finance and Forta.

| Date | Upbit | Bithumb |

|---|---|---|

| 6/16 (Mon) | AltLayer (ALT) | |

| 6/17 (Tue) | Spark (SPK) | |

| 6/18 (Wed) | ||

| 6/19 (Thu) | Raydium (RAY) | Huma Finance (HUMA), Forta (FORT) |

| 6/20 (Fri) |

Key Marketing Strategies & Takeaways

AltLayer and Raydium, which were listed on Upbit last week, are projects that held their TGE quite a while ago. In the Korean community, when coins like these are listed after a long delay, people often refer to it as “catching up on overdue homework.”

That said, AltLayer’s marketing in Korea seems to have been quite successful.

🔹 AltLayer (ALT)

AltLayer is a project that introduced the concept of the Restaked Rollup. Although the technology is complex and difficult to explain, it managed to gain attention through effective marketing.

One of the first things they did was launch a cute otter-themed NFT collection called "Oh Ottie!" through giveaways on Korean KOL channels. It wasn’t a whitelist event, but rather a giveaway of NFTs that had token allocations, which made it especially popular. As a result, the name “AltLayer” quickly spread throughout the community.

Of course, the buzz wasn’t just driven by the NFT campaign. Investments from well-known firms such as Polychain Capital and Jump, along with notable angel investors, also played a major role in raising awareness.

Not long after, the NFT collection went through a minting process and maintained a floor price higher than the mint price.

Following that, AltLayer continued to engage users through Galxe campaigns and OATs. About two years after its initial appearance, the project finally held its TGE.

In summary, this is a good example of how a technically complex project managed to gain and sustain user participation by initially using more accessible tools like NFTs and Galxe OATs.

🔹 Huma Finance (HUMA)

Huma Finance conducted a relatively short period of marketing in Korea. Around the time interest in stablecoins was rising following the U.S. presidential election, Huma Finance made its official entry into the Korean market in May.

To get to the point, Huma Finance held its TGE less than three weeks after entering the Korean scene. Despite the short window, many people in Korea participated and received the airdrop, leaving the project with a generally positive image.

Huma Finance initially allowed users to deposit stablecoins through the PayFi Network. Although the cap was already full, it was reopened twice during the Korean marketing phase. This move quickly went viral through Korean KOL channels, and each time, the cap was filled almost immediately.

Another participation method was through Kaito. By allocating airdrops within the Kaito ecosystem, Huma Finance provided an additional way to get involved beyond just stablecoin deposits.

At the time, Kaito-related activity was at its peak in Korea. As a result, many Korean accounts began posting content about Huma Finance, and overall engagement continued to rise.

Huma Finance’s case suggests that even when a TGE is just around the corner, marketing efforts in the Korean market can still be effective and impactful.

2-2. Trading Volume

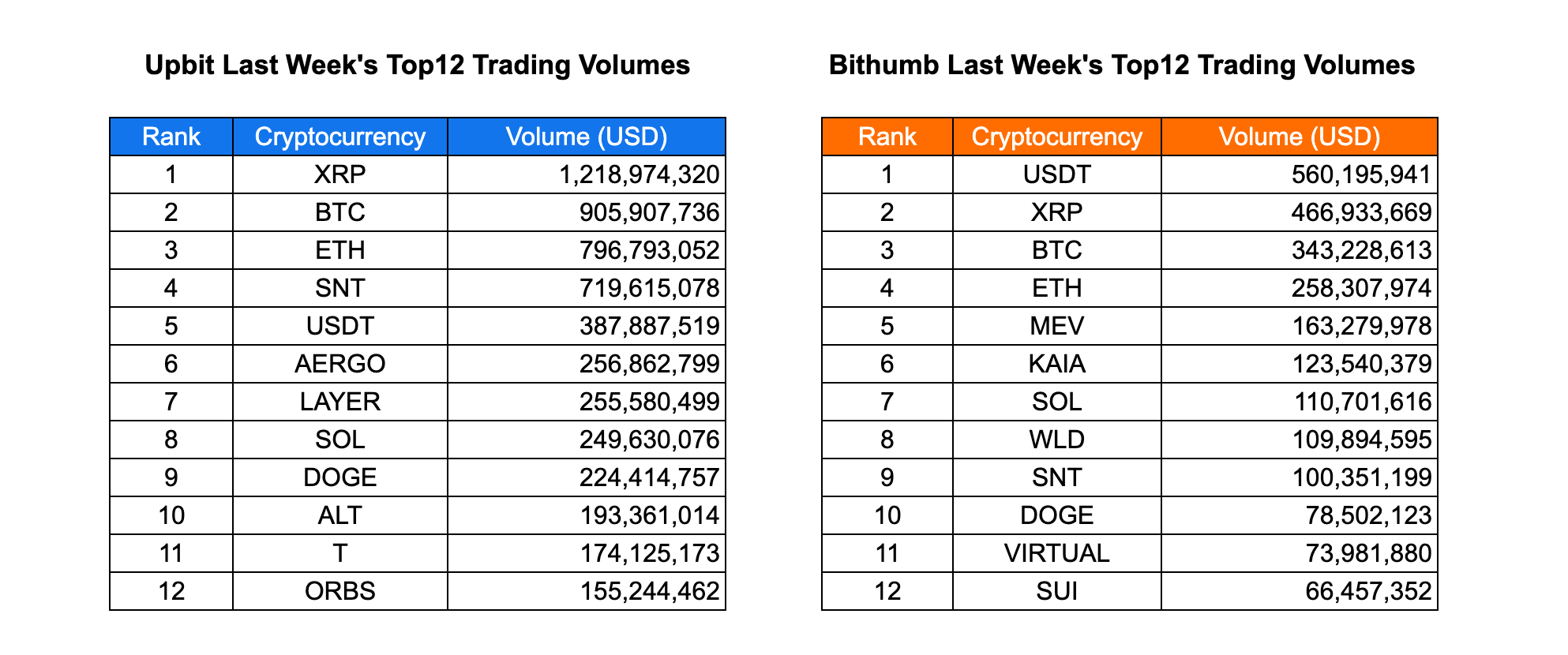

Upbit maintained robust trading activity this week, led by XRP with a dominant $1.21B in weekly volume, followed by BTC at $905M and ETH at $796M. SNT notably surged into fourth place with $719M, driven by both speculative interest and short-term rotation into legacy altcoins. Mid-cap tokens like AERGO, LAYER, and ALT also recorded high volumes above $190M, hinting at increased retail participation in non-mega-cap narratives. Despite a minor dip in Upbit’s 30-day trading trend per CoinGecko, these mid-tier names sustained notable momentum.

Bithumb’s volume landscape was anchored by USDT at $560M, indicating persistent demand for stablecoin liquidity likely tied to off-ramping or strategic positioning. XRP and BTC followed closely, reflecting market-wide alignment with Upbit. MEV, KAIA, and WLD stood out as Bithumb-specific high-volume tokens, suggesting targeted community or promotional interest. SNT ($100M) and DOGE also secured dual-exchange presence, validating their relevance across broader Korean retail markets.

While overall market appetite remains stable, the trading volume patterns on both exchanges suggest an ongoing redistribution from major caps to niche tokens with news-driven or campaign-based catalysts. XRP’s dominance across both platforms continues to reflect its unique positioning among Korean traders, while Upbit’s broader depth of active tokens underscores its lead in altcoin liquidity provisioning.

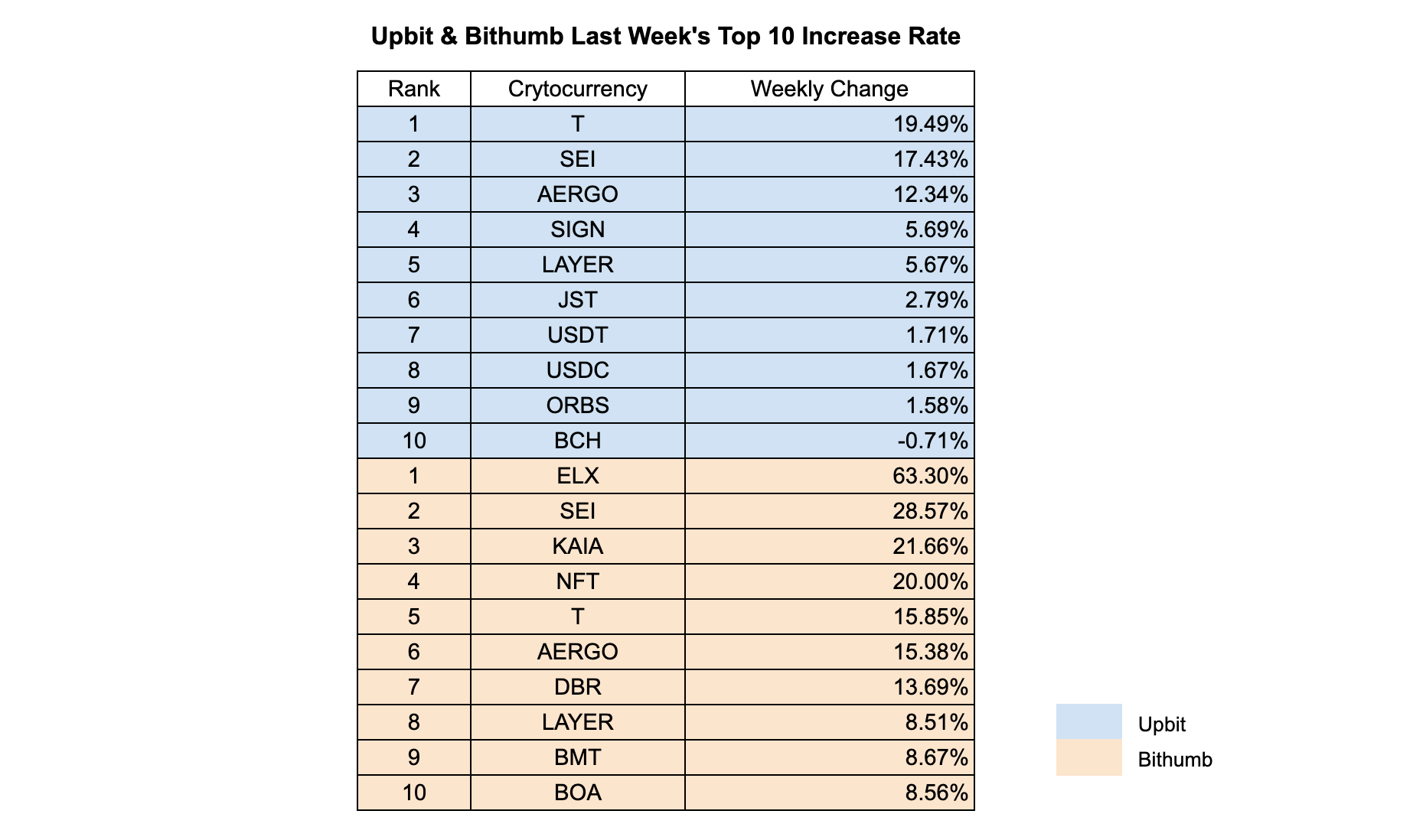

2-3. Top 10 Gainers

This week’s top gainer list on Upbit was led by T (+19.49%), SEI (+17.43%), and AERGO (+12.34%), with each showing strong price momentum on the back of elevated trading activity and localized narratives. The presence of LAYER (+5.67%) and SIGN (+5.69%) suggests continued user interest in modular infrastructure and interoperability themes. Notably, USDT and USDC also appeared in the green, a rare case where stablecoin KRW pairs appreciated slightly, likely due to demand-driven price premiums amidst flight-to-safety positioning.

Bithumb’s leaderboard saw ELX take the top spot with an impressive +63.3% weekly gain, hinting at a speculative frenzy or a platform-specific campaign. SEI and KAIA also posted strong double-digit gains, mirroring some alignment with Upbit but still demonstrating Bithumb’s unique community trends. T and AERGO appeared on both exchanges' top gainer lists, confirming broader market interest and cross-platform validation. Projects like NFT and DBR added to the diversity, suggesting that narratives beyond L1s—such as NFTs and DePIN—are gaining traction among Korean traders.

In summary, while Upbit’s gainers were more skewed toward infrastructural plays and modest gains, Bithumb exhibited higher volatility and speculative breakouts. The overlap on SEI, T, and AERGO points to converging themes, while exchange-specific standouts reflect differentiated community dynamics.

3. Korean Community Buzz

3-1. Upbit Pop-up Craze

From June 17–23, Upbit launched a week-long offline pop-up store, attracting long lines and major attention. Visitors could enjoy activities like crypto MBTI tests, typing games, quizzes, and stopwatch challenges. For each completed mission, participants earned a mock BTC coin—up to five in total—which could be exchanged for exclusive Upbit merchandise.

The highlight? A limited-edition Samsung Galaxy S25 Edge, co-branded with Upbit. Demand was so high, attendees reportedly waited over an hour just to participate in the raffle.

3-2. $KAIA’s Price Action

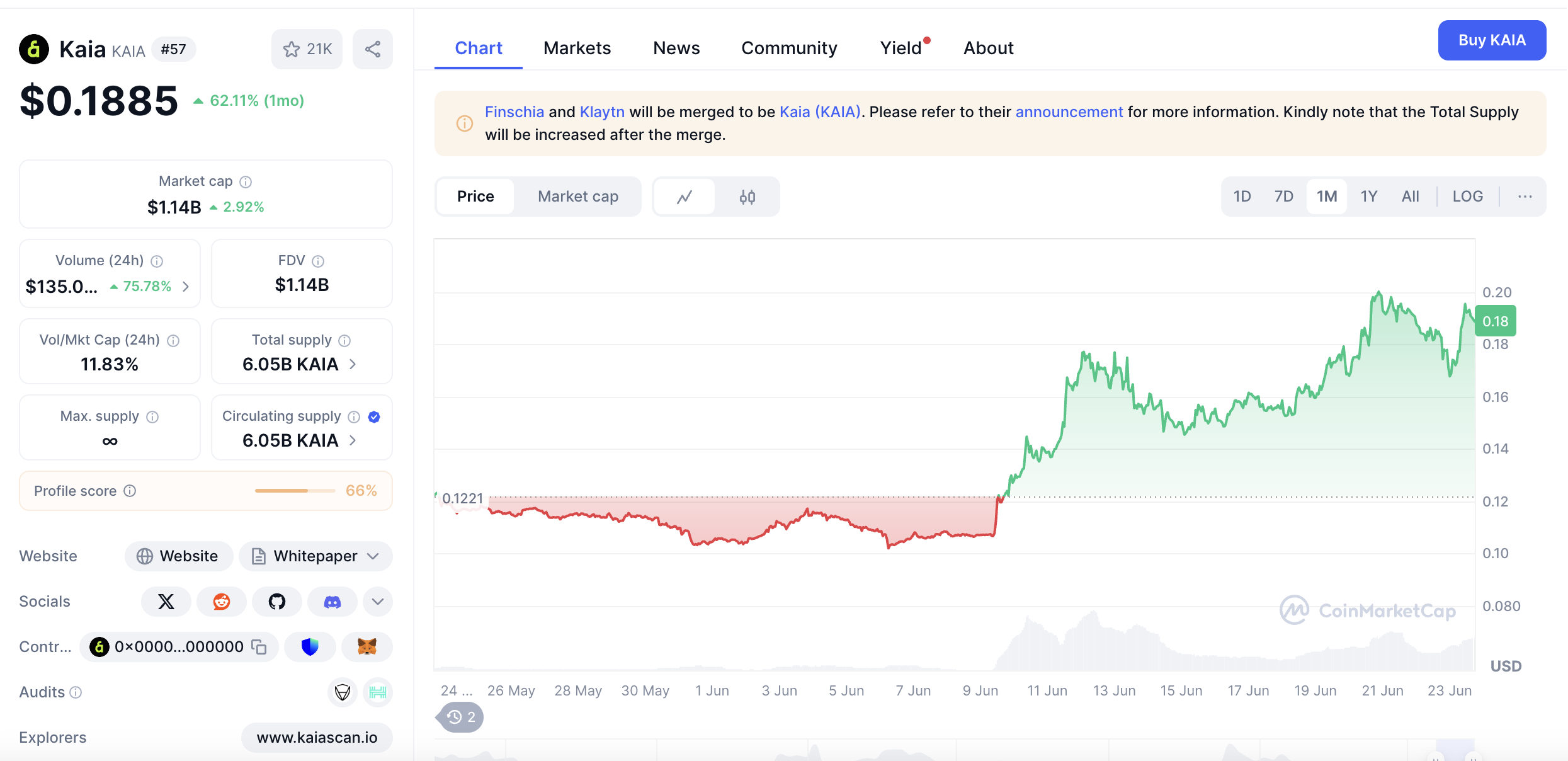

Following Korea’s regime change and renewed discussions around KRW stablecoins, tokens like KAIA saw notable price movements.

Timed with the momentum, KAIA hosted an in-depth offline meetup covering marketing plans, liquidity expansion, DeFi integration, and Japan growth strategy. The event ran over three hours and reflected KAIA’s attempt to match market buzz with substance.

3-3. Mira’s Mascot Goes Public

Mira revealed its new mascot, Veri, which drew unexpected attention in Korean crypto circles. Some community members noted its resemblance to Korea’s traditional "face tile" from the Silla dynasty—famous for its peaceful smile and cultural symbolism. While there’s no official connection, the resemblance sparked positive reactions and added an unexpected layer of local relevance.

4. Events

This week is packed with both offline events and an AMA happening at the same time! What exciting events are waiting for us?

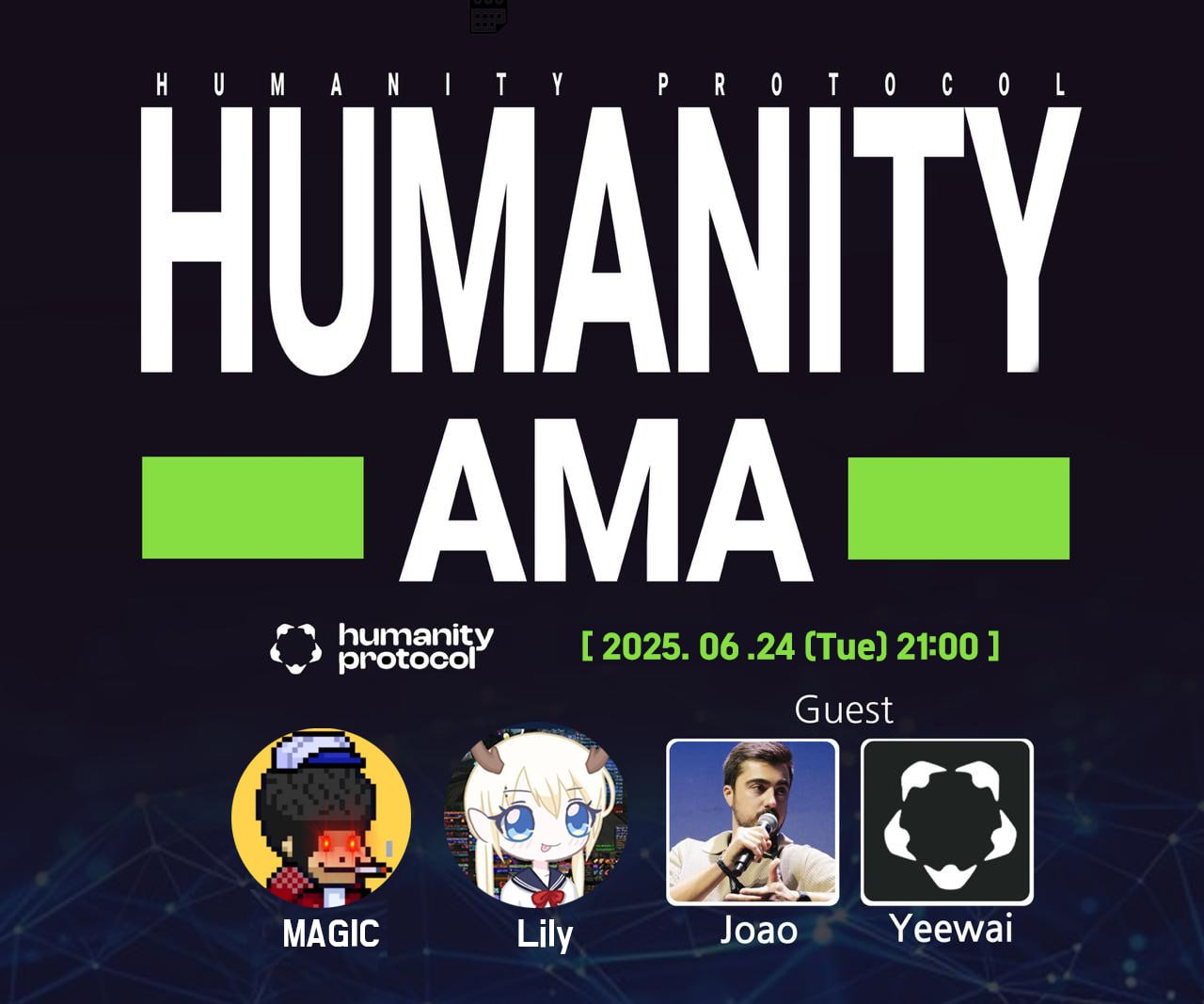

4.1. Humanity AMA with Magic

On June 24th at 9 PM (KST), Magic will be hosting an AMA with Humanity.

Users who submit pre-AMA questions have a chance to win a gift card, so if you're interested, be sure to participate!

With Humanity’s TGE and exchange listing scheduled for the 25th, this AMA—happening right before the launch—is definitely one to watch.

4.2. OpenLedger Ai Connect - Offline Event

An offline event will be held by OpenLedger on June 24th at 6:30 PM.

It’ll be a great opportunity to learn more about OpenLedger, and there will be plenty of exciting prizes — including an iPhone, Apple Watch, Nintendo Switch 2, AirPods, and spa coupons!

We hope to see your interest and participation!

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!