Korean Crypto Sentiment Remains Flat with Weak Momentum

1. Market Overview

This week, the Korean crypto market showed a mixed performance, with a slight increase in trading volume, but overall sentiment remained weak. Major cryptocurrencies such as XRP and AERGO saw notable trading activity, but the broader market continued to show uncertainty. XRP recorded strong volumes, while AERGO saw impressive gains, though the overall market direction remained bearish.

Bithumb listed Babylon (BABY) this week, which sparked significant interest, but it failed to create sustained momentum. Both Upbit and Bithumb saw XRP and AERGO dominate the trading volume charts, with AERGO's volume surging by 197% on Upbit. Despite this, the market overall remained sluggish.

Community activity remained low, with the ETH Seoul event being the only major highlight. Various Web3 projects hosted AMAs and side events, but there was minimal buzz surrounding recent listings. Shinhan Bank also conducted tests for a Stablecoin-based system for KRW-JPY remittance, which could have an impact on the Korean crypto market. Additionally, Dunamu won a significant tax dispute, marking an important development in the regulation of the Korean crypto industry.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced one new listing:

- Bithumb listed Babylon(BABY)

| Date | Upbit | Bithumb |

|---|---|---|

| 4/7 (Mon) | ||

| 4/8 (Tue) | ||

| 4/9 (Wed) | ||

| 4/10 (Thu) | ||

| 4/11 (Fri) | Babylon (BABY) |

Key Marketing Strategies & Takeaways

🔹 Babylon (BABY)

Babylon, a project that enables Bitcoin staking, began to gain significant recognition in the Korean market in Q1 2024. The idea of utilizing Bitcoin in a PoS-like mechanism itself had a strong impact on local market participants, as it introduced a novel use case for the traditionally passive BTC asset.

In addition, Korean community members tend to favor projects backed by YZi Labs (formerly Binance Labs), largely due to expectations around potential Binance listings. Babylon’s investment announcement during this period played a meaningful role in fueling interest.

This anticipation led to massive participation in Babylon’s first testnet. Unlike other testnets, the Babylon testnet had two key hurdles:

- Difficulty in acquiring testnet tokens

- A relatively unfamiliar process of Bitcoin staking

Despite this, a majority of Korean KOLs actively participated and provided detailed guides, which greatly contributed to onboarding and engagement within the local community.

Babylon didn’t seem to engage in any direct marketing efforts beyond this point. However, since most Bitcoin staking-related protocols were built on top of Babylon, organic exposure continued, with users consistently tracking the project in anticipation of a future airdrop.

After the listing, the FDV (fully diluted valuation) turned out to be lower than what had been expected, which led to some disappointment among early supporters. However, overall interest in the project remains high within the Korean market.

2-2. Trading Volume

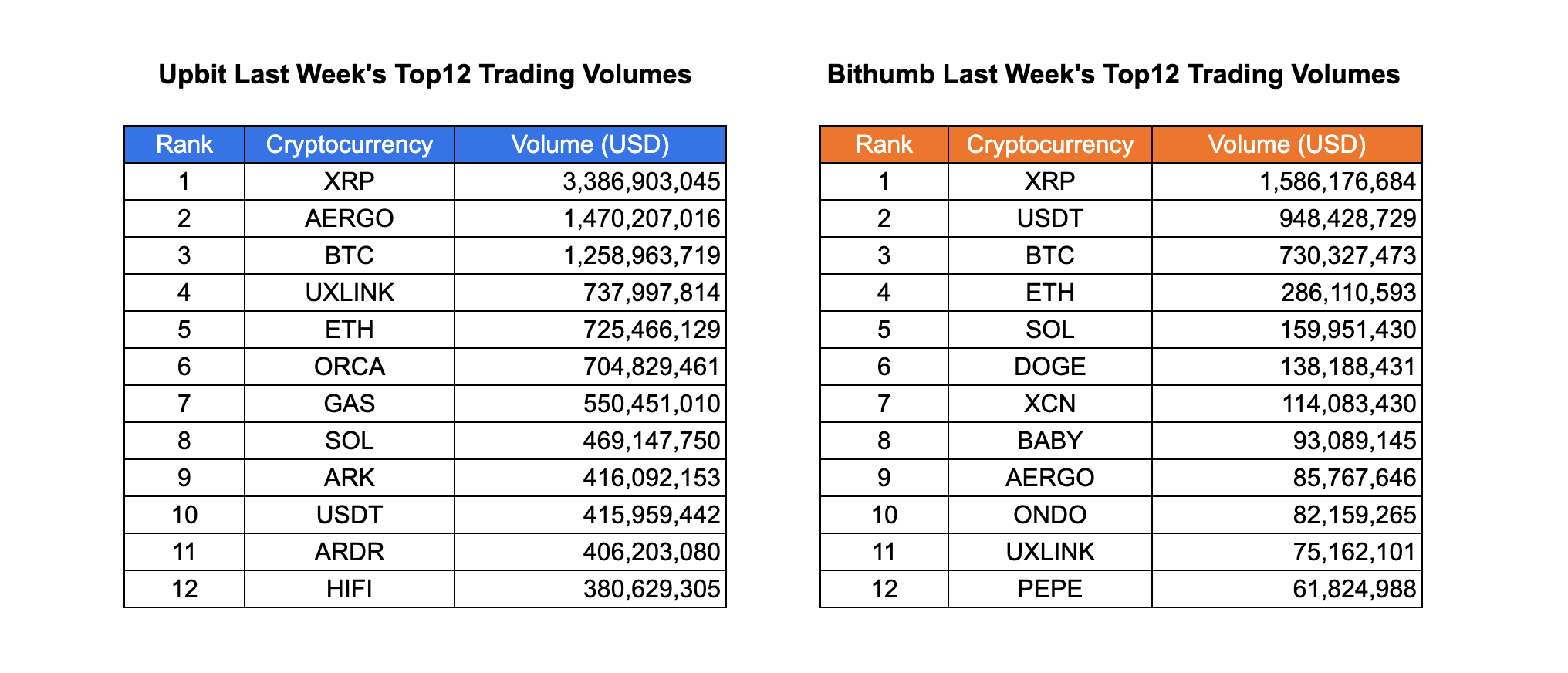

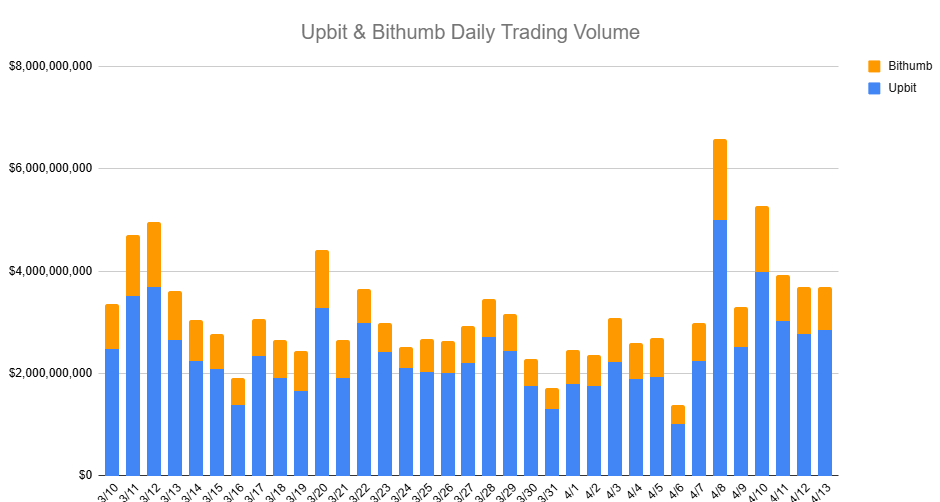

Trading activity on South Korea's top two cryptocurrency exchanges, Upbit and Bithumb, showed daily average volumes of $3.2 billion and $1 billion respectively last week. While overall trading volume increased compared to the previous week, the market exhibited bearish characteristics, with trading activity notably concentrated around a few select assets, particularly XRP, which topped the trading volume rankings on both platforms.

On Bithumb, XRP recorded a staggering $1.59billion in trading volume, far surpassing USDT at $948 million and Bitcoin (BTC) at $730 million. Meanwhile, Upbit also showed similar trends, with XRP leading at $3.4 billion, followed by BTC at $1.26 billion.

BTC continues to serve as a stable central pillar in the market, while ETH also recorded significant trading volumes of $725 million on Upbit and $286 million on Bithumb. Although ETH and BTC trading volumes ranked high, this appears to be due to the lack of notable trading activity in other coins rather than particular strength in these assets.

In the case of Aergo, concerns regarding potential delisting from domestic exchanges were reflected in its trading activity following news of its delisting from Binance and the announcement of two governance-related developments.

2-3. Top 10 Gainers

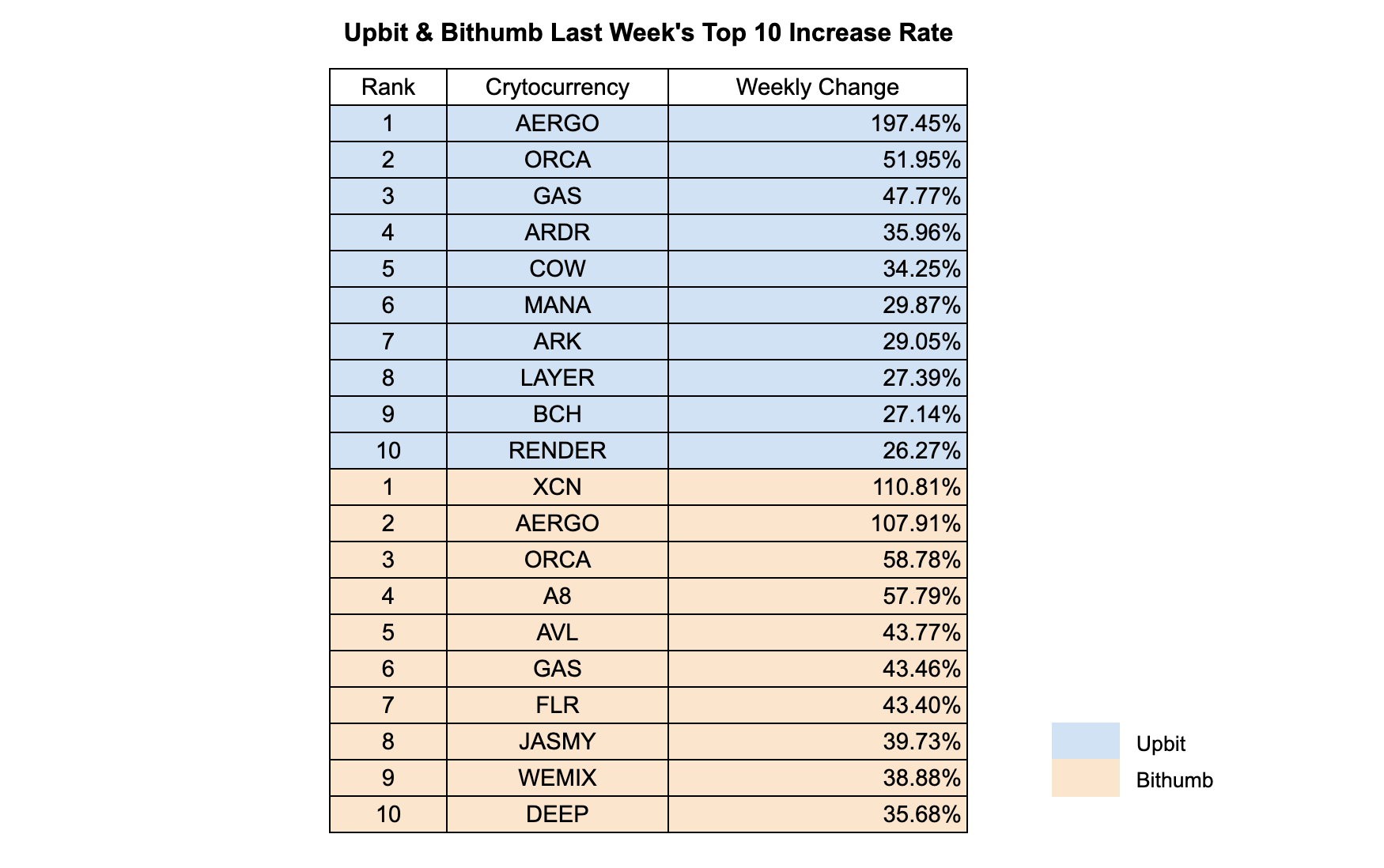

Amid a relatively muted market, XCN and AERGO emerged as the top performers on South Korea’s leading exchanges.

On Upbit, AERGO emerged as the week's biggest gainer, taking the top spot with a remarkable 197% gain, followed by ORCA at 52%, and GAS at 48%. Several other as showed moderate gains in the range of 20-30% during the same period.

On Bithumb, XCN recorded 111% gain over the week, followed by AERGO at 108%, and ORCA at 59%. Following these top performers, assets with returns in the 30-50% range dominated the rankings, showing similar patterns across both exchanges.

Despite the relatively low market momentum, a handful of tokens managed to generate significant weekly returns, especially AERGO and ORCA, which ranked in the top three across both exchanges.

3. Key News from Social Media

3-1. Tariff Jitters Shake Korean Crypto Sentiment

Last week, both crypto and equities experienced serious volatility following renewed tariff tensions from the Trump campaign, and the Korean community felt the impact. Investors debated whether it was time to reallocate portfolios, while social sentiment remained largely gloomy.

Most agreed that tariffs were the immediate catalyst, but many were torn between thinking “it can’t get worse from here” and “this doesn’t feel like the bottom yet.”

In crypto specifically, concerns around Ethereum's performance resurfaced, while some traders favored short-term plays on newly listed altcoins, leveraging valuation cycles. Overall, attention shifted away from project-level analysis and toward macro factors dominating the global market.

One widely shared perspective came from Ray Dalio, whose commentary resonated across Telegram and X. He suggested that tariffs are just a symptom of much deeper structural shifts — including rising debt levels, the changing global monetary order, technological disruption, and a declining U.S. hegemony.

3-2. Is Stablecoin the Next Big Narrative?

A new Virtual Asset Framework Act is in the works in Korea, aiming to restrict the issuance of fiat-pegged stablecoins without approval from the Financial Services Commission (FSC). This mirrors regulatory moves seen in the EU and Japan, where legal requirements for issuers have already been established.

Meanwhile, Shinhan Bank announced its participation in a pilot program for KRW-JPY remittances using stablecoins, marking the first cross-border test involving a KRW-pegged digital asset. The test aims to validate improvements in cost, processing speed, and settlement stability, potentially paving the way for future stablecoin-powered financial services in Korea.

3-3. Court Sides with Dunamu Over $10M Tax Dispute

A major legal win made headlines as the Seoul High Court ruled in favor of Dunamu (operator of Upbit), canceling a 13.4 billion KRW (~$10 million) corporate and income tax bill issued by the National Tax Service in January 2023.

The ruling became final on February 7, 2025, after the tax authority declined to appeal the decision. The case centered around withholding tax for foreign users, and its resolution was seen as a notable regulatory milestone in the Korean crypto industry.

4. Events

ETH Seoul event is approaching, and we’re starting to see Web3 projects gradually announce AMAs and side event updates!

Starting this week, ETH Seoul has officially kicked off. The INF team has also begun hosting side events for our partners and those looking to collaborate with us. The first event was an RWA-related gathering held over the weekend. Our second event, "Road to an Agentic Future," is coming up on Tuesday(April 15th)—don’t miss it!

Many other projects also have events scheduled throughout the week. We hope that many Web3 team members, global Web3 project teams, enthusiasts, and professionals will take this opportunity to attend the events, gain valuable insights and updates, and strengthen their networks—with both familiar faces and new connections.

4.1. All about ETH Seoul’s Side Event!

Starting today (April 14), ETH Seoul has officially kicked off. Here is the link where all the side events will be listed daily throughout the week.

4.2. Our Events at ETH Seoul

Even over the weekend, the INF team was busy hosting the RWA-related event, "Building Real Finance On-chain." Speakers from RWA-focused projects such as Plume, Injective, MANTRA, and LayerZero participated in the event. We are also deeply grateful to everyone who made the effort to attend, despite the cold weather that brought cherry blossoms, snow, and rain all at once.

We sincerely thank each and every one of you who attended. We hope to see your continued interest in the upcoming "Road to an Agentic Future" event on April 15.

To register, please click here

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!