Korean Crypto Market Sees Rising Volume Amid New Listings & Volatility

1. Market Overview

The Korean cryptocurrency market from February 24 to March 3 showed significant activity with several new listings and notable market movements driven largely by Trump-related news. During this period, Upbit listed Cow Protocol (COW), while Bithumb introduced Ethena (ENA) and MyShell ($SHELL). The combined weekly trading volume between Upbit and Bithumb reached 35 billion, with Upbit accounting for 24.3 billion and Bithumb for 10.2 billion, showing an increase from the previous week's trading volume.

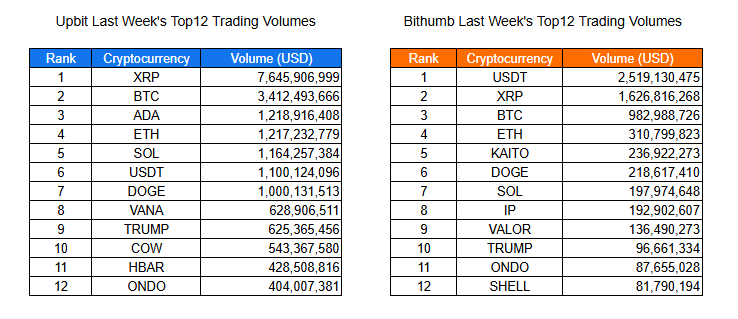

XRP (XRP) continued to dominate trading volumes on Upbit, recording an impressive 7.6 billion in volume, while USDT (USDT) maintained its position as the most traded asset on Bithumb with 2.5 billion in volume. The market saw significant interest in Trump-related assets, with both Upbit and Bithumb showing substantial trading volumes for Official Trump Token (TRUMP) and Hedera (HBAR).

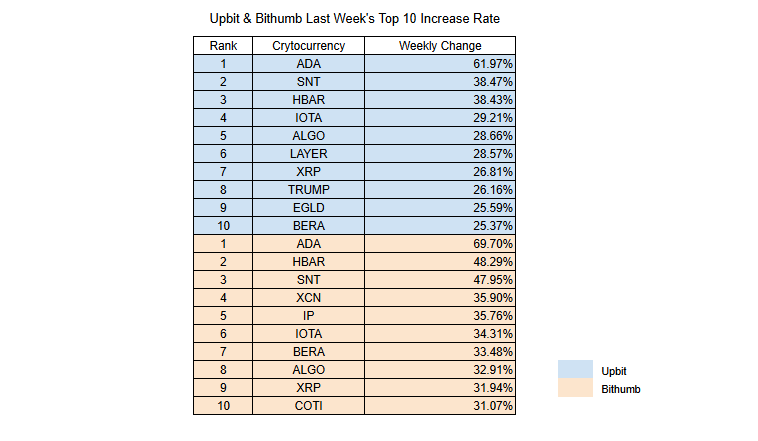

The week's standout performer was Cardano (ADA), which surged 62% on Upbit and nearly 70% on Bithumb after being included in former President Trump's 'Crypto Strategic Reserve' plan. Similarly, Hedera (HBAR) recorded the second-highest returns on both exchanges, benefiting from Trump-related positive sentiment as it's classified in the enterprise blockchain sector. Other notable gainers included Status Network Token (SNT), IOTA (IOTA), and Algorand ($ALGO).

Among the new listings, Ethena (ENA) launched with strong momentum, backed by the hype surrounding USDe and a solid list of investors. The project maintained an active communication strategy through KOL channels and continued to stay visible in the Korean market up to the recent launch of Ethereal. In contrast, Cow Protocol (COW), despite initial discussions linking it to Safe (formerly Gnosis Safe), saw interest quickly fade after its listing. MyShell ($SHELL) made its debut on Bithumb at the end of the week.

The broader market experienced extreme volatility, with the Fear and Greed Index dropping to 10. Bitcoin saw significant price swings, dropping $16K and then recovering the same amount, while most altcoins declined by over 20%. Despite this bearish sentiment, new altcoins like $LAYER, $BERA, $KAITO, and $IP outperformed expectations, suggesting traders remain eager for fresh opportunities. In regulatory news, the Financial Intelligence Unit (FIU) imposed a three-month restriction on new user deposits and withdrawals at Upbit following KYC violations, prompting Dunamu to file a lawsuit seeking to overturn the suspension.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Cow Protocol.

- Bithumb listed Ethena and MyShell.

| Date | Upbit | Bithumb |

|---|---|---|

| 2/24 (Mon) | ||

| 2/25 (Tue) | Cow Protocol (COW) | Ethena(ENA) |

| 2/26 (Wed) | ||

| 2/27 (Thu) | ||

| 2/28 (Fri) | MyShell(SHELL) |

Key Marketing Strategies & Takeaways

🔹 Ethena(ENA)

Ethena launched with strong momentum, backed by the hype surrounding USDe and a solid list of investors. From the beginning, it quickly built a high TVL, with many Korean KOLs actively promoting it to secure referral rewards. This naturally led to increased engagement from the Korean community.

After its launch, Ethena maintained an active communication strategy, regularly updating users through KOL channels. Even after its TGE, the project continued to stay visible in the Korean market, keeping the momentum going up to the recent launch of Ethereal. This consistent exposure appears to have contributed to the strong pre-deposit performance for Ethereal.

🔹 MyShell(SHELL)

MyShell strategically launched its KOL marketing campaign in Korea after the AI market gained significant momentum. Since the project aligned well with the prevailing AI narrative, KOLs found it easier to promote.

Instead of using a one-size-fits-all approach, MyShell tailored its strategy by assigning different roles to different KOLs—some focused on introducing the product, while others showcased its real-world applications. Rather than emphasizing comparisons with other AI projects, MyShell positioned itself by highlighting practical use cases.

The platform’s generative AI tools allowed KOLs to create content and host community events, naturally increasing MyShell’s exposure within the Korean market. This hands-on engagement helped establish the project as a recognizable name in the AI space.

🔹 Cow Protocol(COW)

Despite being listed on Binance Spot in November 2023, Cow Protocol had little to no marketing presence in Korea before its Upbit listing. As a result, awareness of the project among local traders was minimal.

However, when it debuted on Upbit, a prominent KOL made a viral post leveraging the Korean word for cow ("Hanwoo"—premium Korean beef) to celebrate the listing. The post humorously suggested that since Cow Protocol was now listed in Korea, it had become "Hanwoo."

This lighthearted approach gained traction, drawing short-term attention to the project. When the token price surged post-listing, the same KOL doubled down, joking that it wasn’t just regular Hanwoo—it was "2++ Hanwoo" (the highest quality grade).

While the initial campaign successfully created buzz, interest faded quickly due to the lack of follow-up marketing, leading to a steady decline in price and engagement.

2-2. Trading Volume

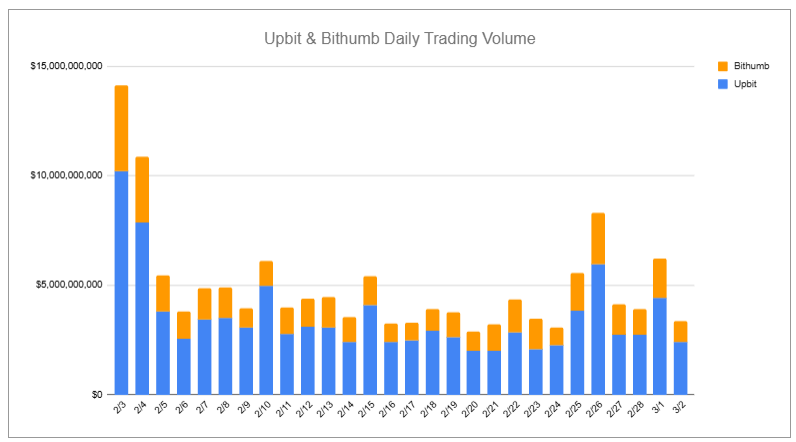

Last week, the combined daily average trading volume on Upbit and Bithumb reached approximately 4.9 billion. This doesn't fully reflect the impact as it was right before Trump's strategic reserve statement. (Based on Korean time before Trump's remarks) The cumulative trading volume over the 7-day trading period totaled 35 billion, with Upbit and Bithumb recording 24.3 billion and 10.2 billion respectively. Upbit and Bithumb are the dominant cryptocurrency exchanges among the five major platforms that have obtained Korea's Virtual Asset Service Provider (VASP) certification, representing approximately 95% of the domestic market share.

Domestic exchange trading volumes reflected the bearish market similar to last week, with Ripple and Tether ranking at the top of trading activity

Comparing Upbit and Bithumb data, XRP dominates Korean exchange volume while USDT shows high liquidity on Bithumb, with Trump-related assets (TRUMP, HBAR) and established tokens (BTC, ETH, SOL) maintaining strong investor interest across both major exchanges, reflecting a market balancing between speculation and stability.

A notable coin on Upbit is Cardano (ADA). It recorded the 3rd highest trading volume on Upbit while simultaneously achieving the highest weekly return of 62% on the platform.

2-3. Top 10 Gainers

Last week, domestic exchanges were similarly influenced by how closely assets were related to 'Donald Trump,' which determined the top performers in terms of returns.

ADA, which recorded the highest gains among domestic exchanges surged ahead of Bitcoin (BTC) and Ethereum (ETH) after being included in former President Trump's 'Crypto Strategic Reserve' plan.

Hedera (HBAR), which recorded the second-highest returns on both Upbit and Bithumb, benefited from Trump-related positive sentiment as it's classified in the enterprise blockchain sector. It appears to have been considered a Trump-related asset in the domestic market. For reference, according to the UBCI (Upbit Blockchain Index), during the period from Donald Trump's presidential election victory to his inauguration, the top-performing sector index (out of 36 total) was the 'Enterprise Blockchain' index, which showed a 558.11% increase.

3. Key News from Social Media

3-1. Fear and Greed Index at 10

Bitcoin experienced extreme volatility over the past two weeks, dropping 16K and then recovering the same amount. The broader market felt the impact, with most altcoins declining by over 20%, fueling concerns that the cycle might be coming to an end.

However, there were signs of renewed confidence. Major U.S. financial players increased their exposure to crypto, with BlackRock adding BTC ETFs to its flagship MODEL ETF. Meanwhile, Donald Trump, who was once critical of crypto, mentioned digital asset reserves, signaling a shift in stance.

One notable trend was the market’s enthusiasm for new altcoins. Despite the overall bearish sentiment, tokens like $LAYER, $BERA, $KAITO, and $IP outperformed expectations. This suggests that traders remain eager for fresh opportunities, particularly in anticipation of airdrops.

The Korean community, as always, reacted quickly to market shifts. This downturn affected KOLs and retail investors alike, and for now, the correction appears to be ongoing.

3-2. Upbit’s Restrictions and Legal Response

The Financial Intelligence Unit (FIU) recently imposed a three-month restriction on new user deposits and withdrawals at Upbit. It also issued a reprimand to Dunamu CEO Lee Seok-woo and took disciplinary action against nine compliance officers. The decision followed an investigation that uncovered KYC violations and transactions with unregistered VASPs during Upbit’s license renewal process.

In response, Dunamu filed a lawsuit on February 27, seeking to overturn the suspension and requesting a stay of execution. While the restrictions have raised concerns, they apply only to new users, meaning the overall impact on existing operations and global projects may be limited.

3-3. Story Protocol Expands Its Music Catalog

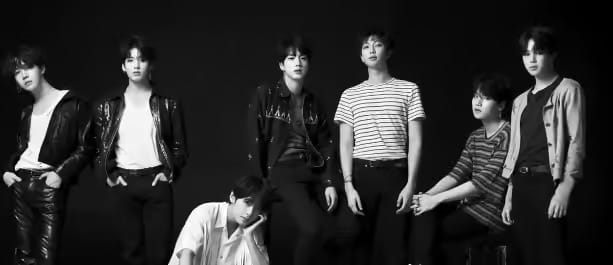

Aria Protocol, an application within the blockchain-based intellectual property management platform Story Protocol, announced on February 26 that it has acquired partial rights to The Truth Untold, a collaboration between BTS and Steve Aoki.

The track has recorded over 670 million streams and was featured on the first BTS album to reach No.1 on the Billboard 200 chart. With this acquisition, Aria Protocol’s music catalog now includes over 90 tokenized songs, featuring artists such as BTS, BIGBANG, BLACKPINK, Justin Bieber, Miley Cyrus, Katy Perry, and Dua Lipa.

Story Protocol has positioned music copyrights as an emerging asset class alongside traditional investments like U.S. Treasury bonds, real estate, private credit, and commodities. Through continued investment in music IP, the platform aims to expand the role of tokenized intellectual property in the broader financial landscape.

4. Events

Recently, many Web3 projects have been using AMAs to introduce their projects to Korean users, share updates, and expand into the Korean market. Here's a recap of the Web3 events that took place over the past week, with a focus on two major highlight AMAs hosted by KOLs.

4-1. [KOL AMA] WecryptoTogether x Orderly

An AMA was conducted where the introduction of Orderly, its advantages as a Web3 Perp DEX, updates on the upcoming incentive program, and the benefits users will receive were briefly shared.

4.2. [KOL AMA] Wecrypto x Monad

The introduction of Monad, updates on the Monad testnet, and the news that the number of sign-up wallets has reached 4M, along with other general updates prepared by the Monad team, were shared.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!