Korean Crypto Market Heats Up: Key Listings & DeFi Surge

1. Market Overview

Last week, the Korean crypto market saw several new listings on major exchanges. Orbiter Finance, Elixir, and Arkham stood out due to their strategic market positioning and community engagement.

- Orbiter Finance (OBT) reinforced its dominance in the bridging sector with a strong KOL-driven educational campaign in Korea. This effort aligned with the rising DeFi narrative post-Trump's election, positioning Orbiter as a critical player in cross-chain liquidity solutions. A report from Tiger Research further amplified its impact.

- Elixir (ELX) capitalized on growing institutional interest in decentralized market-making. Its marketing strategy targeted Korean investors through KOL collaborations, AMAs, and engagement campaigns, leading to a strong debut on Bithumb with high initial trading volumes.

- Arkham (ARKM) saw a dramatic surge in interest following Trump’s election victory, as traders turned to on-chain intelligence tools to track political and financial movements. The KRW pair listing on Upbit triggered a 100% price increase, suggesting strong local demand for blockchain analytics platforms.

Overall, the latest listings demonstrated a clear trend towards DeFi infrastructure and analytics, with strategic marketing efforts driving heightened engagement and trading activity in the Korean market.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Arkham.

- Bithumb listed Elixir, Orbiter.

| Date | Upbit | Bithumb |

|---|---|---|

| 3/10 (Mon) | ||

| 3/11 (Tue) | Arkham (ARKM) | Elixir (ELX) |

| 3/12 (Wed) | ||

| 3/13 (Thu) | ||

| 3/14 (Fri) | Orbiter (OBT) |

Key Marketing Strategies & Takeaways

🔹 Orbiter Finance(OBT)

Orbiter Finance has long been a well-known bridge platform in Korea, recognized for its strong performance and reliability. Its point system further accelerated user adoption, but many didn’t fully understand its position in the broader bridging market.

To address this, Orbiter ramped up KOL marketing in early 2025, focusing on educating the Korean community rather than just promoting its bridge. With performance already proven, the campaign emphasized Orbiter’s market share, upcoming features, and its role in DeFi infrastructure.

The timing aligned perfectly with the DeFi narrative gaining momentum after Donald Trump’s election victory, fueling broader expectations for the sector. Orbiter leveraged this trend by highlighting its utility in a fragmented DeFi landscape, positioning itself as a key player in cross-chain liquidity.

Additionally, Tiger Research, known for publishing high-quality reports in both Korean and global markets, released an in-depth analysis of Orbiter Finance. This was effectively distributed through KOLs, making it digestible and engaging for local retail users.

🔹 Elixir(ELX)

Elixir (ELX) has gained traction in the decentralized market-making sector, focusing on providing liquidity to various blockchain ecosystems. Its unique decentralized liquidity infrastructure has been particularly well-received in the Korean market, where institutional interest in on-chain market-making is steadily increasing.

Leading up to its listing on Bithumb, Elixir’s marketing efforts targeted the Korean audience by collaborating with KOLs and emphasizing its ability to enhance liquidity across various DeFi protocols. The team also hosted a series of community AMAs (Ask Me Anything sessions) and reward campaigns to drive early engagement.

As a result, Elixir saw a notable spike in initial trading volume on Bithumb, with Korean investors showing strong interest in its decentralized approach to liquidity provisioning.

🔹 Arkham(ARKM)

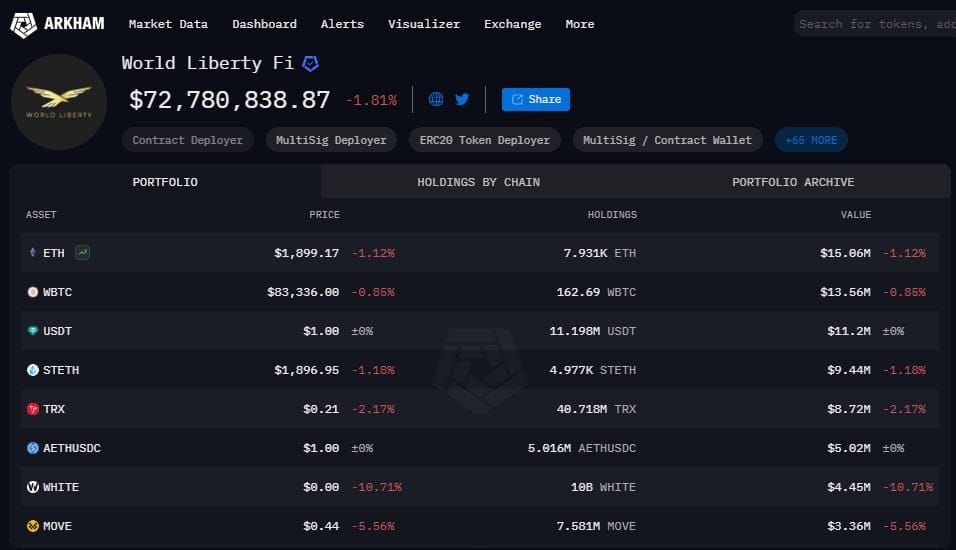

Arkham has always been a widely used on-chain intelligence platform, frequently appearing in KOL content for wallet tracking, suspicious activity reports, and blockchain analytics. Its intuitive UI/UX made it a go-to tool for on-chain sleuthing.

However, interest in Arkham surged dramatically after Trump’s election victory, as many in the market began tracking the financial movements of Trump’s family and World Liberty Financial. This spike in usage led to a major visibility boost for Arkham in Korea.

Despite already being listed on Upbit’s BTC pair, Arkham’s KRW pair listing brought renewed attention, triggering a 100% surge on Upbit and a 52% increase on Binance. Trading volume comparisons showed a stark contrast:

- Upbit: $6M

- Binance: $142M

Some speculate that Korean traders may not have realized Arkham was already listed on Upbit under the BTC pair, explaining the massive reaction to its KRW listing. The strong performance further reinforced Arkham’s growing influence in the on-chain analytics sector in Korea.

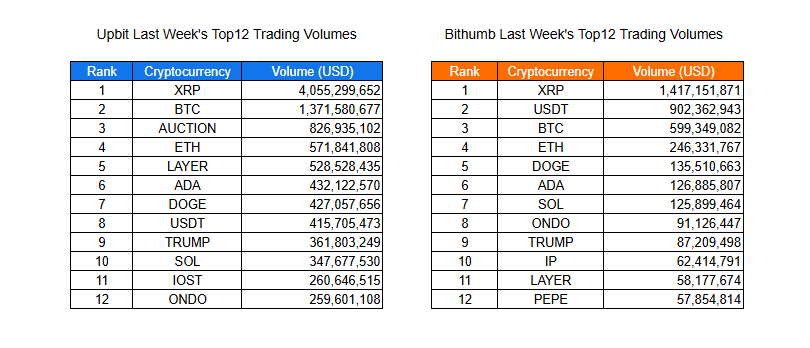

2-2. Trading Volume

Last week, the combined daily average trading volume on Upbit and Bithumb reached approximately 3.5 billion, showing a dramatic decline of nearly 50% compared to the previous week. The cumulative trading volume over the 7-day trading period totaled 24 billion, with Upbit and Bithumb recording 17.9 billion and 6.3 billion respectively.

*Upbit and Bithumb are the dominant cryptocurrency exchanges among the five major platforms that have obtained Korea's Virtual Asset Service Provider (VASP) certification, representing approximately 95% of the domestic market share.

Both exchanges saw Ripple ($XRP) dominating trading volume last week. On a weekly basis, Upbit and Bithumb recorded $4 billion and $1.4 billion in USD trading volume respectively, significantly outperforming Bitcoin's volume. Ripple benefited from positive news that its SEC lawsuit is entering the final stages and that it received an official regulatory license from the Dubai Financial Services Authority. On Upbit, Bounce Token ($AUCTION) showed meaningful trading volume, while overall trading patterns reflected the bearish market trend similar to the previous week.

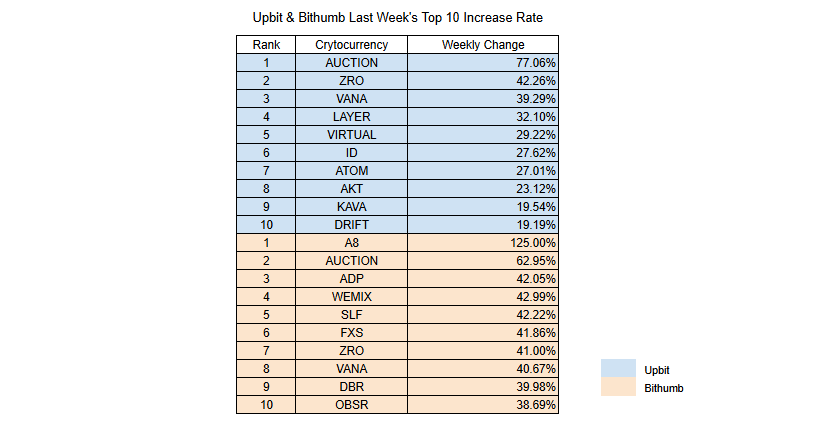

2-3. Top 10 Gainers

While overall trading volume decreased for individual coins, they showed better returns compared to the previous week. The recent rise of Bounce($AUCTION) appears to have been positively influenced by its announcement of plans to tokenize stocks of major companies like Apple, Amazon, and Nvidia.

Additionally, due to differences in listed coins between Upbit and Bithumb, the top-performing coins varied between the exchanges, with only Bounce Token, LayerZero, and BANA showing strong returns across both platforms. Particularly, along with the market weakness, there was a low number of KRW-paired coin listings on domestic exchanges (1 on Upbit, 2 on Bithumb), resulting in poor performance for newly listed coins.

3. Key News from Social Media

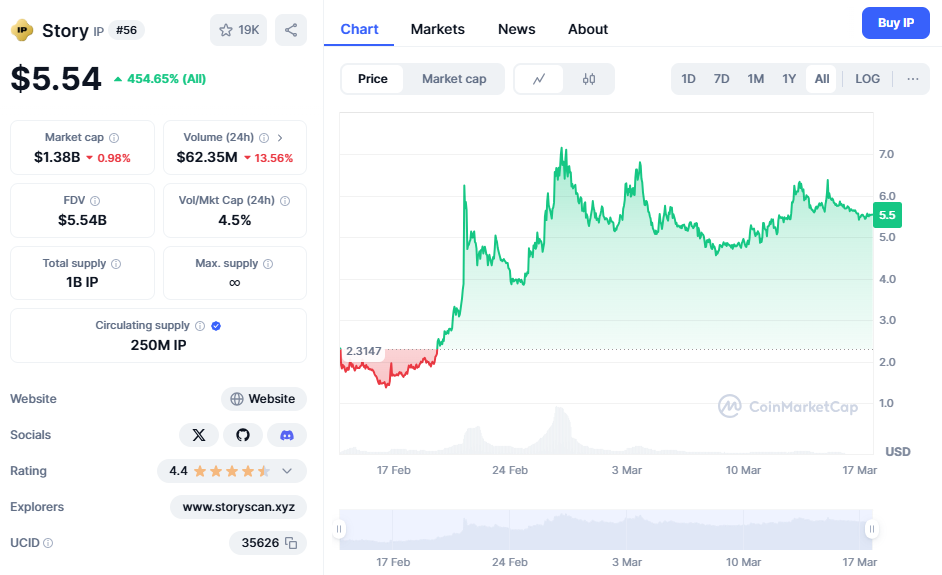

3-1. Story Protocol Holds Strong Amid Market Volatility

With the market swinging wildly, Story Protocol ($IP) has been holding its ground, drawing attention from the Korean community. Some traders compared it to Sui ($SUI), noting both projects had strong backing early on and launched with significant institutional support.

Despite its resilience, some feel that Story’s ecosystem still lacks engaging use cases, making its long-term potential unclear. That said, with its steady momentum, some are hoping for future rewards linked to past sales like Aria and Benjamin. For now, traders are keeping an eye on whether Story can turn its solid foundation into something more than just price stability.

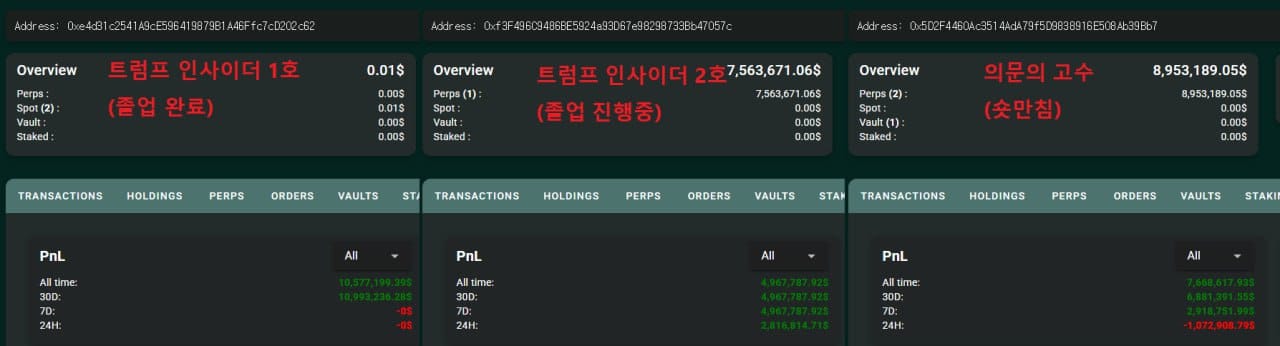

3-2. The Hyperliquid Controversy – Insider Trading or Smart Strategy?

Korean traders are buzzing about a series of high-stakes trades on Hyperliquid, where three wallets made millions in profits under suspicious circumstances. Two wallets, dubbed "Trump Insiders," took 50x BTC & ETH longs just before major Trump-related events, securing $11M and $7.5M, respectively. Meanwhile, a mysterious trader made $9M by shorting BTC at 20–30x leverage within the $67K–$74K range.

With Hyperliquid operating without KYC, some see this as proof that on-chain perpetuals attract aggressive traders, while others worry it’s becoming a money-laundering hub. Analysts suggest these traders may have hedged on CEXs while manipulating price action for maximum profit.

Hyperliquid responded by reducing max leverage, but the community doubts this is enough. While this strategy may not work in a full-fledged bull market, it’s raising serious questions about risk management in decentralized perpetual futures.

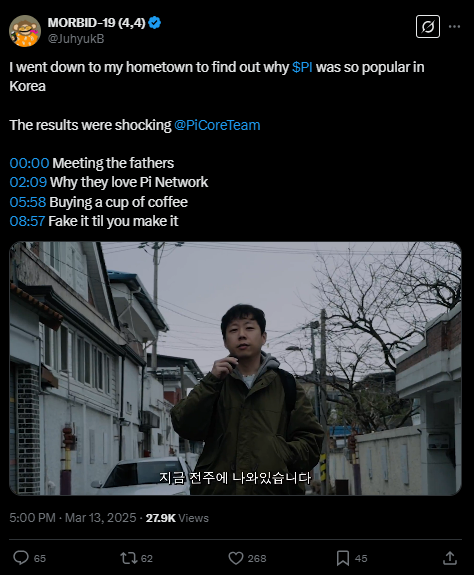

3-3. Pi Day Content Goes Viral in Korean Crypto Circles

March 14 (Pi Day) took an unexpected turn when a Korean crypto content creator dropped a documentary-style video exploring why Pi Network ($PI) is so popular in Korea. The video, which followed the creator’s journey back to their hometown to investigate the PI ecosystem, quickly went viral, racking up 27.8K views, 62 retweets, and 65 comments.

The community reaction was just as interesting as the content itself. Some called it "groundbreaking," while others debated the difference between short-term Ethereum holders vs. long-term Pi believers. Many were also curious about how PI transactions actually work, wondering whether payments were peer-to-peer transfers. One thing was clear—Pi Network has built a dedicated community, and this video just made that even more obvious.

🔗 Check out the video: JuhyukB’s Pi Day Post

4. Events

Even in the bear market, with Bitcoin price hit around the 81K range, the popularity of AMAs doesn’t seem to be declining. Last week, several projects held AMAs with Korean KOLs, and INF would like to share some of the highlights.

4-1. Mantle AMA

The AMA was conducted with KOLs BQ and Raoni, who are very interested in Mantle. The discussion focused on how they utilize CeDeFi within the Mantle ecosystem.

March 14th in Korea is called 'White Day,' when men give candy to women. It was a sweet AMA where candy was given to users who participated.

4.2. Sign x Fireant

The Sign project, which has recently gained popularity in Korea through a semi-singing contest, held an AMA with Fireant KOL, following their Wecrypto AMA last week.

The AMA covered various topics, such as the percentage allocated for the community airdrop, how the Sign project aims to grow its ecosystem in broader ways, which VCs have invested in the Sign project, and more.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!