Korea Blockchain Week and the Trading Trends Behind

1. Market Overview

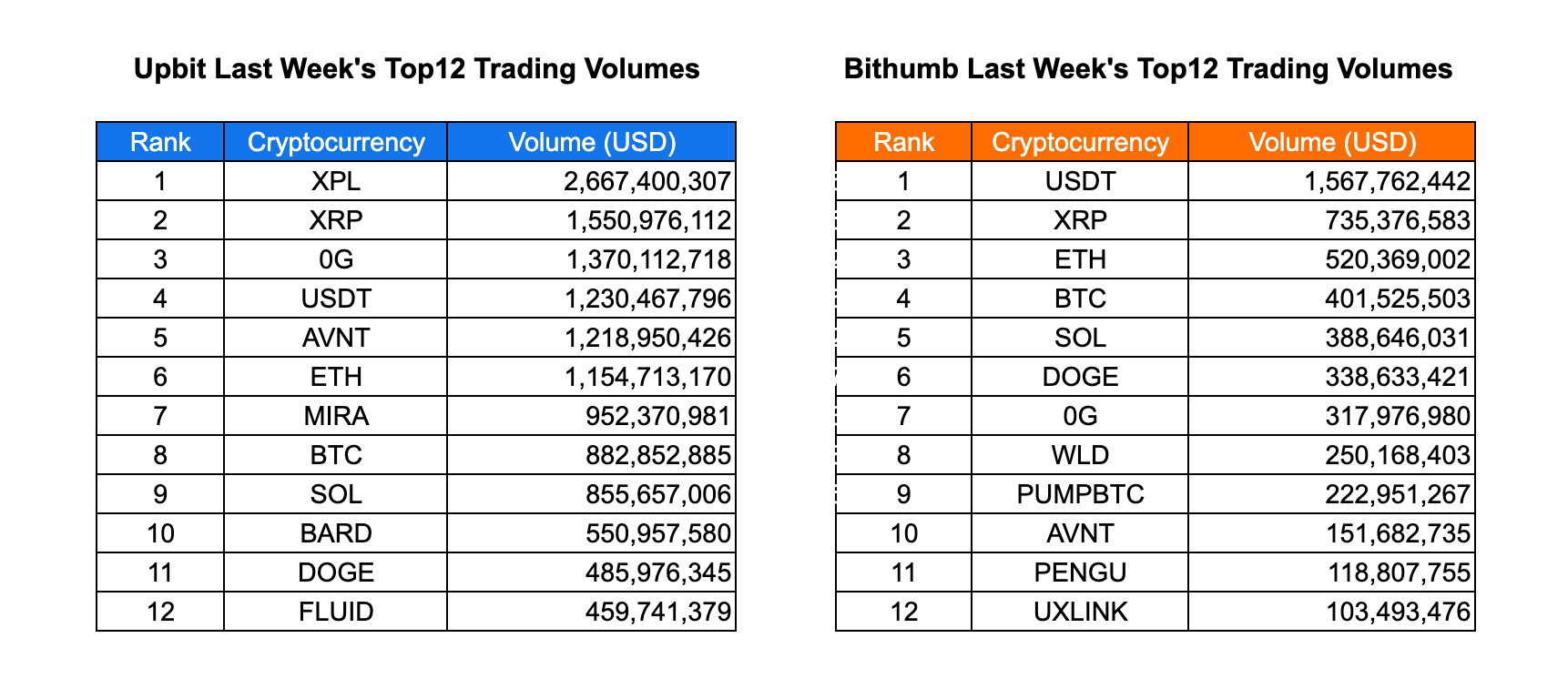

Last week brought another wave of listings in Korea, with Upbit adding Sun, 0G, Fluid, Plasma, and Mira Network, while Bithumb listed 0G, Hemi, Bitlayer, Popcat, Fluid, Cudis, and Mira Network. Trading activity on Upbit was led by XPL (USD 2.67B), followed by XRP (USD 1.55B) and OG (USD 1.37B), alongside strong volumes in majors like USDT, AVNT, ETH, BTC, and SOL. Mid-cap and emerging tokens such as MIRA, BARD, DOGE, and FLUID also showed robust activity, highlighting broad investor participation. On Bithumb, USDT (USD 1.57B) topped volumes, with XRP, ETH, BTC, and SOL remaining active while speculative names like WLD, PUMPBTC, AVNT, PENGU, and UXLINK secured meaningful traction.

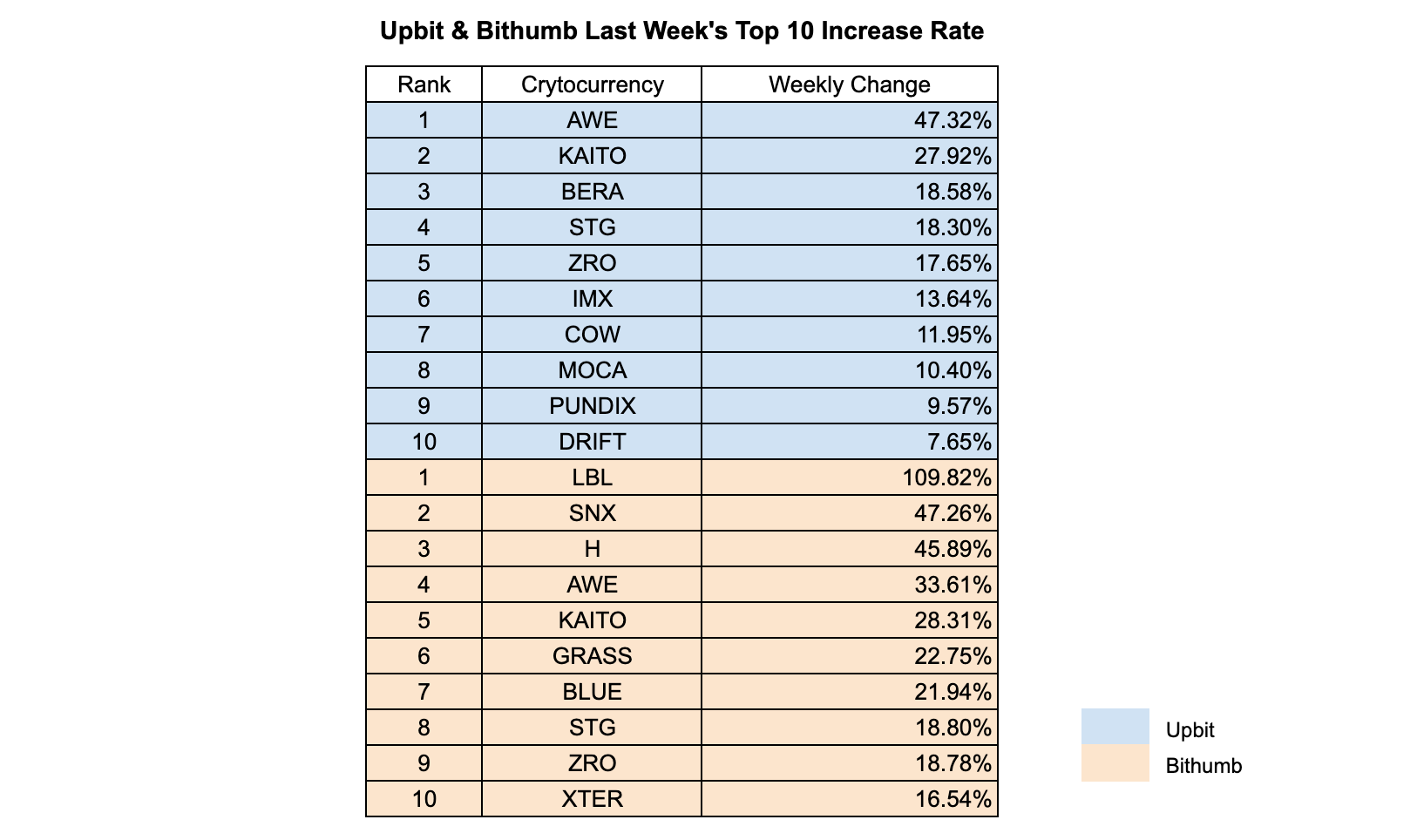

Price action reflected a diverse market dynamic. On Upbit, AWE (+47%), KAITO (+28%), and BERA (+19%) led gains, supported by steady momentum in tokens like STG, ZRO, IMX, and DRIFT. On Bithumb, LBL surged 110%, with SNX (+47%) and H (+46%) also delivering outsized returns. Overlaps in movers such as AWE, KAITO, STG, and ZRO across both exchanges reinforced strong cross-market conviction, while Bithumb’s spikes in LBL and XTER highlighted speculative surges driving short-term volatility.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Sun, 0G, Fluid, Plasma and Mira Network.

- Bithumb listed 0G, Hemi, Bitlayer, Popcat, Fluid, Cudis and Mira Network.

| Date | Upbit | Bithumb | |

| 9/22 (Mon) | Sun (SUN), 0G (0G) | 0G (0G) | |

| 9/23 (Tue) | |||

| 9/24 (Wed) | Fluid (FLUID) | Hemi (HEMI) | |

| 9/25 (Thu) | Plasma (XPL) | Bitlayer (BTR), Popcat (POPCAT) | |

| 9/26 (Fri) | Mira Network (MIRA) | Fluid (FLUID), Cudis (CUDIS), Mira Network (MIRA) |

Key Marketing Strategies & Takeaways

🔹 Mira Network (MIRA)

Mira Network’s marketing strategy serves as a strong case study in both narrative building and Korean community engagement.

From a narrative perspective, Mira Network positioned itself as a solution to one of the major challenges emerging not only in Web3 but globally with the rise of AI—particularly LLMs—namely, AI hallucinations. By introducing a node validation structure that combined Web3 incentive models, Mira Network addressed limitations of Web2 systems. This message was effectively delivered to the Korean community through key opinion leaders (KOLs).

The narrative proved especially compelling for three reasons:

- AI was a dominant global narrative, not just within crypto.

- Mira addressed real-world problems users face with AI hallucinations.

- The solution design felt natural and credible, rather than forced.

Another critical success factor was the level of participation from the Korean community. Mira conducted a 10-week campaign—considered long by crypto standards—while simultaneously running an exclusive campaign in Korea in collaboration with leading KOL WecryptoTogether (Edward).

Although the campaign content was the same, only Korean users were eligible for rewards. During this period, there was a high level of participation in Kaito Yapping, which was leveraged by asking users to write weekly posts on Twitter aligned with specific topics, with selected posts earning SBT rewards.

What made this campaign stand out was that participants’ understanding of Mira Network gradually deepened as the campaign progressed. The weekly topics were structured to guide users from learning the fundamentals of Mira Network to exploring its use cases and marketing strategies. This transformed the campaign into a community-driven initiative, where user participation generated insights that Mira could reflect back into its own strategies.

Another interesting observation was the change in participation over time. While the campaign initially seemed to have a high barrier to entry, resulting in lower engagement, participation more than doubled as the weeks went on.

Retweet counts of the campaign announcements illustrate this trend:

- Week 1: 128

- Week 2: 145

- Week 9: 236

- Week 10: 280

While long-term campaigns might appear less suitable for the fast-paced Web3 environment, Mira’s case suggests that the ongoing nature of the campaign reinforced a sense of scarcity and urgency, as participants realized opportunities would diminish over time.

2-2. Trading Volume

Last week, Upbit recorded XPL as the top traded asset with USD 2.67 billion in volume, followed by XRP (USD 1.55 billion) and OG (USD 1.37 billion). Core large-cap tokens including USDT (USD 1.23 billion), AVNT (USD 1.22 billion), and ETH (USD 1.15 billion) maintained strong liquidity, while MIRA (USD 0.95 billion), BTC (USD 0.88 billion), and SOL (USD 0.86 billion) also remained actively traded. Mid-tier tokens such as BARD, DOGE, and FLUID rounded out the top twelve, reflecting continued engagement across both blue-chip and emerging assets.

On Bithumb, USDT led activity with USD 1.57 billion, followed by XRP (USD 0.73 billion) and ETH (USD 0.52 billion). BTC (USD 0.40 billion) and SOL (USD 0.39 billion) also maintained meaningful volumes, while DOGE (USD 0.34 billion) and OG (USD 0.32 billion) captured notable retail interest. The presence of WLD, PUMPBTC, AVNT, PENGU, and UXLINK within the top twelve highlighted the exchange’s strong appetite for newly listed and speculative tokens.

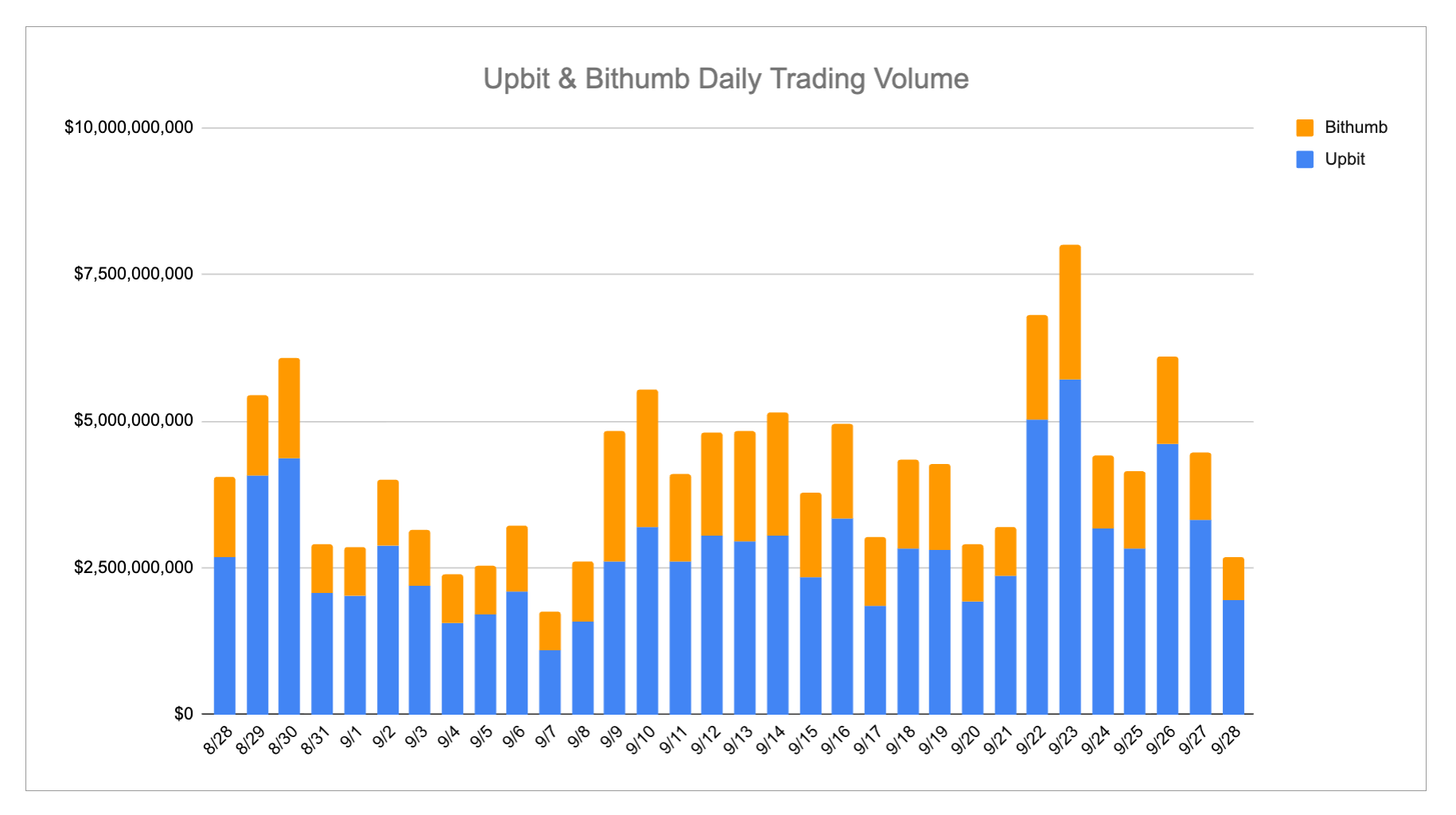

Overall, the data shows clear exchange-specific dynamics: Upbit volumes skewed toward XPL, OG, and AVNT, underscoring its role in driving liquidity for mid-cap projects, while Bithumb concentrated liquidity in USDT and speculative listings such as PUMPBTC and UXLINK. The daily trading volume chart further reflects consistent investor participation across both platforms, with notable spikes on 9/20 and 9/23, indicating heightened trading events during the week.

2-3. Top 10 Gainers

Last week, Upbit saw AWE lead price growth with a 47.32% increase, followed by KAITO (27.92%) and BERA (18.58%), while STG (18.30%) and ZRO (17.65%) also posted strong gains above 15%, reflecting steady momentum in mid-cap tokens. Additional names such as IMX, COW, MOCA, PUNDIX, and DRIFT rounded out the top ten, showing broad-based investor participation across infrastructure, DeFi, and ecosystem assets.

On Bithumb, LBL surged dramatically by 109.82%, with SNX (47.26%) and H (45.89%) also delivering significant returns, highlighting strong speculative activity. AWE (33.61%) and KAITO (28.31%) extended their gains across both exchanges, reinforcing cross-market momentum. Meanwhile, GRASS, BLUE, STG, ZRO, and XTER completed the top ten, signaling heightened attention to both established and emerging projects.

Overall, the week’s top gainers illustrated a diverse mix of infrastructure tokens, DeFi projects, and niche assets. The overlap of AWE, KAITO, STG, and ZRO across both Upbit and Bithumb underscores strong cross-exchange conviction, while sharp rallies in tokens such as LBL emphasized speculative surges driving short-term market dynamics.

3. Korean Community Buzz

3-1. Korea Blockchain Week Wraps Up with Record Attendance

Korea Blockchain Week officially closed after a packed week of events. The main conference at Walkerhill drew 28,000 attendees, with 35% international participation, marking a 76% increase from last year. Exhibition booths also nearly doubled, from 60 to over 110. The biggest spotlight went to keynote appearances by Donald Trump Jr. and Eric Trump.

Community chatter, however, was dominated by complaints about transportation and logistics. Many noted difficulties with shuttles, traffic congestion, and crowded venues due to the high turnout. Beyond the main stage, KBW saw over 450 side events across Seoul and participation from more than 5,200 companies, reaffirming Korea’s role as a rising global hub for blockchain innovation.

3-2. Naver × Upbit Rumors Spark Market Buzz

On August 25, Naver confirmed that its subsidiary Naver Financial is exploring deeper cooperation with Dunamu, the operator of Upbit, spanning stablecoins, unlisted stock trading, and equity swaps. The market quickly speculated whether this could lead to Naver fully acquiring Dunamu, a deal compared to “Google buying Coinbase” in scale.

While both sides denied any acquisition talks, the ongoing collaborations keep the possibility alive. The potential Naver–Upbit tie-up is seen as a major turning point for Korea’s digital finance ecosystem. Meanwhile, rival groups like Bithumb × Toss are also accelerating their own stablecoin initiatives, adding further intrigue to the competitive landscape.

Read more:

- What If: Naver Acquires Dunamu?

- (Kor) [Exclusive] Upbit Operator Dunamu Pursues Comprehensive Share Swap with Naver Financial, Expected to Join Naver’s Affiliates

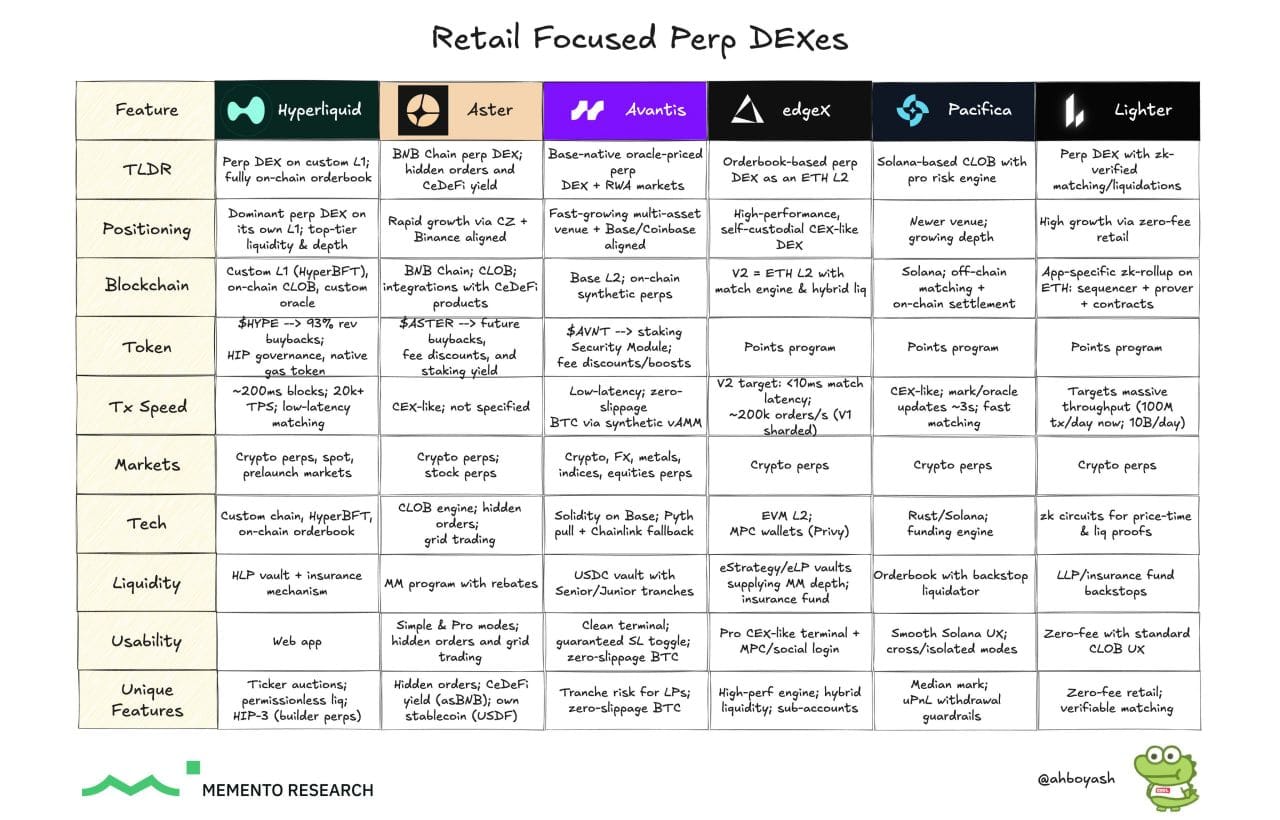

3-3. The Perp DEX Frenzy in Korea

Perpetual DEXs (Perp DEXs) are now the hottest sector among Korean traders. Inspired by Hyperliquid’s rise and Aster’s success, retail users are actively experimenting with platforms like Lighter, Pacifica, edgeX, and Backpack—often running at least one trade per project.

The main driver is the belief that early participants benefit from token buybacks funded by protocol fees, making entry a no-brainer for many. Still, the frenzy is sparking caution. Some argue the sector is overheated, and since perps inherently carry high leverage risk, whales and bots may soon crowd out smaller traders. For now, though, Korea remains in the grip of a Perp DEX boom, with both excitement and skepticism shaping the narrative.

4. Good Bye KBW!

The busy and fast-paced KBW2025 has come to a close.

Web3 friends, developers, and builders in Korea are now getting ready and boarding flights to attend Token2049 in Singapore. ✈️

KBW was packed with great content, but what exciting things await us at Token2049?

✅ All about Token2049 ➡ Link

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!