Kaito in Korea: Turning KOL Hype into Real Retail Engagement

1. Market Overview

The Korean cryptocurrency market from February 17-24 was marked by several new listings and distinctive trading patterns across major exchanges.

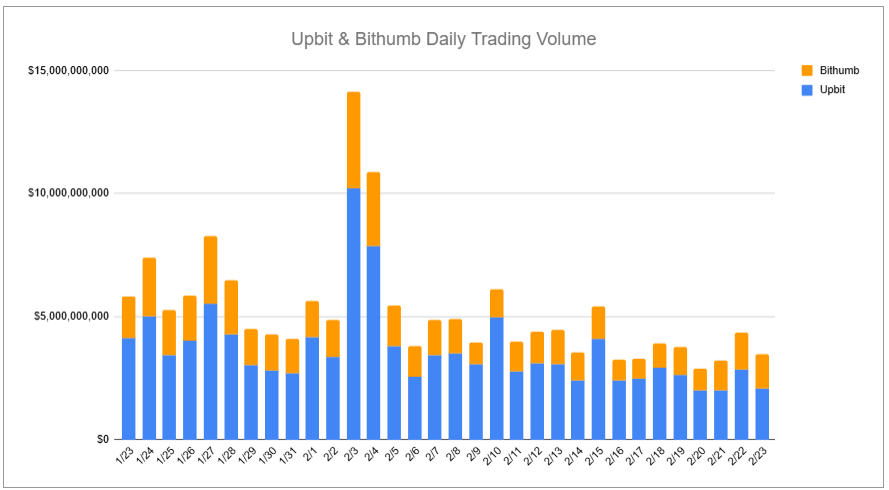

During this period, Upbit listed Jito ($JTO) on their KRW market after initially listing it on BTC/USDT market, while Bithumb introduced Gnosis ($GNO) and Kaito ($KAITO). The combined weekly trading volume between Upbit and Bithumb reached 25bn, with Upbit accounting for 17bn and Bithumb for 8bn.

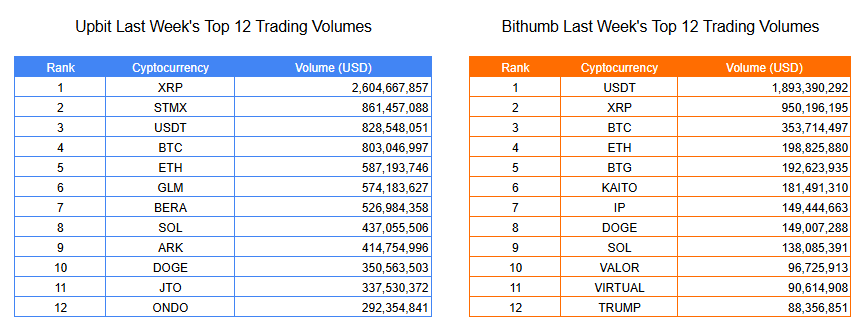

XRP ($XRP) maintained strong trading volumes on both exchanges, reflecting its continued popularity particularly among Korean investors in their 50s and 60s. Other tokens including ETH ($ETH) and Berachain ($BERA) also recorded notable trading volumes. The attention on Ethereum followed the SEC's official confirmation of 21Shares' 19b-4 filing for Ethereum ETF staking approval, though its impact on domestic exchange trading volumes remained relatively modest compared to global markets.

Among the new listings, Gnosis ($GNO) had minimal impact on the Korean market due to lack of localized education and community engagement, with only 3,399 tokens ($600K) in circulation on Bithumb. In contrast, Kaito ($KAITO) made significant waves by successfully driving engagement from Telegram to Twitter, with KOLs effectively shaping the narrative around equal participation opportunities. Jito ($JTO), building on Upbit's established preference for Solana ecosystem tokens, benefited from strategic KOL education about MEV and the growing popularity of Solana restaking. The week's trading patterns highlight how crucial localized marketing strategies and community engagement are for the success of new listings in the Korean market, with projects needing to carefully balance exclusivity with accessibility to gain traction among local traders.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Jito.

- Bithumb listed Gnosis and Kaito.

| Date | Upbit | Bithumb |

| 2/17 (Mon) | ||

| 2/18 (Tue) | ||

| 2/19 (Wed) | Gnosis($GNO) | |

| 2/20 (Thu) | Kaito($KAITO) | |

| 2/21 (Fri) | Jito($JTO) |

🔹 Gnosis($GNO)

When Gnosis listed on Bithumb, it barely made a ripple in the Korean market. Most users had no idea what the project was, and without the usual trading events that accompany new listings, it faded into obscurity. As of February 24, the circulating supply within Bithumb is only 3,399 $GNO ($600K) — a relatively tiny amount.

This case highlights the importance of localized education and community activation. Even strong projects can struggle to gain traction without tailored market entry strategies. For projects eyeing the Korean market, thoughtful storytelling, KOL partnerships, and proactive community building can make the difference between a quiet listing and explosive growth.

🔹 Kaito($KAITO)

Kaito made waves in the Korean market by driving a meaningful shift from Telegram to Twitter. The project's nature gave KOLs an advantage (YAP points), leading to organic influencer-driven marketing, which had a huge impact on local adoption.

Interestingly, KOLs were careful to shape the narrative, emphasizing that anyone who put in the effort could participate equally — preventing the “whale advantage” from discouraging regular users. This approach worked: many retail participants successfully farmed rewards, creating a positive feedback loop that fueled even more engagement.

It’s a clear example of how influential KOLs can be in activating the Korean crypto community when paired with a narrative that balances exclusivity with accessibility.

🔹 JITO($JTO)

Listed on Upbit’s BTC/USDT market on February 6 and hitting the KRW market just 15 days later, Jito's swift rise felt almost inevitable. Korean users already associated Upbit with a preference for Solana ecosystem tokens (like Solayer, Drift, Magic Eden, Jupiter, and SonicSVM), so the KRW listing came as no surprise.

Leading up to the listing, some KOLs spotlighted Jito and Raydium as tokens that could benefit from a “trickle-down” effect, while others educated their followers on MEV, explaining its essential role within Solana. Combined with the recent popularity of Solana restaking (as seen with Solayer), Jito’s success seems to be the result of both strategic content and well-timed market trends.

2-2. Trading Volume

Last week, the combined daily average trading volume on Upbit and Bithumb reached approximately 3.6 billion. The cumulative trading volume over the 7-day trading period totaled 25 billion, with Upbit and Bithumb recording 17 billion and 8 billion respectively.

*Upbit and Bithumb are the dominant cryptocurrency exchanges among the five major platforms that have obtained Korea's Virtual Asset Service Provider (VASP) certification, representing approximately 95% of the domestic market share.

Reflecting its substantial presence in Korean exchanges, XRP maintained its position among the top traded assets on both exchanges for the second consecutive week. In addition to XRP, assets such as Ethereum($ETH), KAITO, STORY, Berachain($BERA), and Pi Network($PI) recorded significant trading volumes and global attention in the cryptocurrency market. While Ethereum garnered attention following the SEC's official confirmation of 21Shares' 19b-4 filing for Ethereum ETF staking approval, its impact on domestic exchange trading volumes remained relatively modest compared to global markets. Among these, Berachain (listed on Upbit), and STORY and $KAITO (both listed on Bithumb) notably recorded high trading volumes on their respective exchanges.

Berachain's recent performance appears to be primarily driven by its successful listings on major exchanges and the launch of its mainnet, contributing to both increased trading volume and price appreciation.

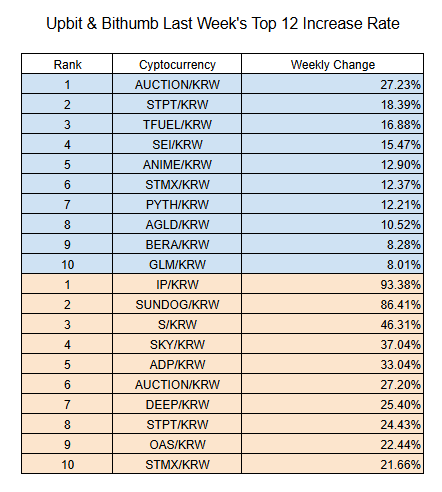

STORY, which was listed on domestic exchanges Bithumb and Coinone on the 13th, maintained its listing momentum through the launch of its IP staking feature, recording a remarkable surge of over 200% on the 21st alone. As a K-coin backed by prominent investors including Samsung and HYBE, STORY ($IP) attracted substantial interest and achieved the highest weekly return among domestic exchanges at 93.4%.

KAITO, following its listings on major international and domestic exchanges including Binance, Coinbase, and Bithumb, demonstrated strong market performance by recording the fourth-highest trading volume on Bithumb, excluding USDT and BTC pairs.

2-3. Top 10 Gainers

STORY (IP), which recorded the highest gains among domestic exchanges and generated significant buzz on Telegram, appears to have leveraged the 'new layer' narrative. Additionally, the limited circulating supply likely acted as a key price catalyst. However, market expectations regarding STORY's DeFi capabilities remain subdued.

Bounce Token ($AUCTION), which ranks first in weekly returns on Upbit and is listed on both Upbit and Bithumb, continues to maintain strong momentum in the domestic market driven by the launch of meme coin $MAL and news of its upcoming AI launchpad release this week.

3. Key News from Social Media

3-1. Monad Testnet Open

The Korean crypto community has been buzzing with activity as Monad’s testnet goes live. Everyone seems to be gearing up for potential airdrops, with KOLs actively sharing guides on how to farm testnet tokens. New channels are popping up, strategizing which projects to focus on — many speculate that, like Berachain, future airdrop criteria may hinge on how many Monad ecosystem projects you’ve interacted with.

Meanwhile, multiple NFT collections (like open editions) are launching within the Monad ecosystem, mintable with testnet tokens ($MON). People are diving in, not just for potential farming rewards, but also in hopes that their participation might count toward future contributor perks.

3-2. SUI Warlus Airdrop

On the 19th, Mysten Labs' data storage protocol, Walrus, airdrops landed, flooding KOL channels with users flaunting their loot. Some received tens of thousands of tokens, triggering speculation about Walrus' price based on DeepBook trading activity. Given last year’s price surges for other Mysten Labs tokens ($SUI, $DEEP, $NS), optimism is high that Walrus might follow suit.

Those who missed the airdrop have shifted their focus to Talus, hoping for another chance. Meanwhile, there’s growing curiosity about how much SuiPlay might distribute next, with IKA and Talus gaining traction as the next watchlist projects.

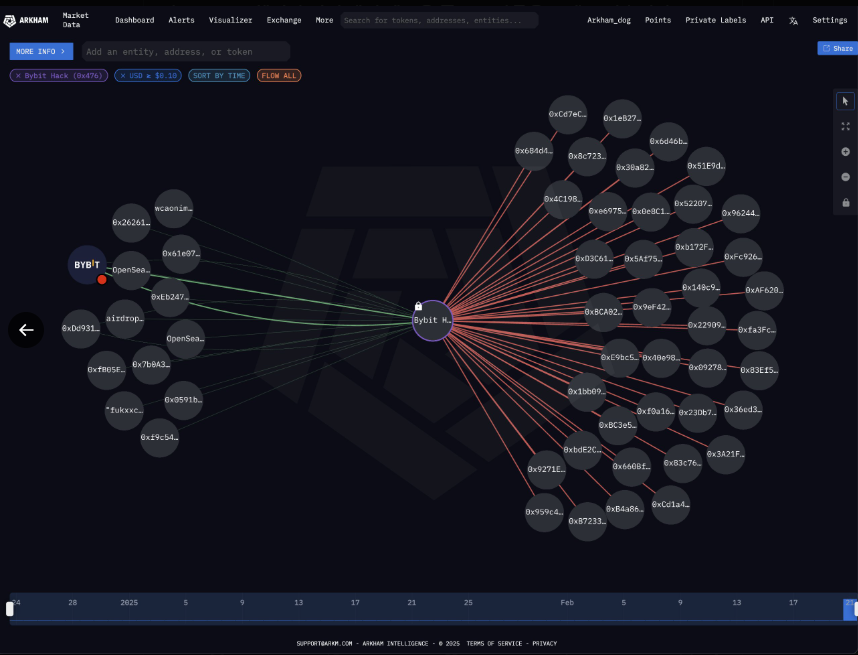

3-3. Bybit Hack Fallout

Bybit was hit by a sophisticated attack, losing around $1.5 billion from an ETH cold wallet. The exploit involved manipulating the signing interface of a multisig wallet, altering the underlying smart contract logic. Bybit has assured users that other cold wallets and client funds are safe, with operations continuing as usual, but the incident sent shockwaves through the community.

In Korea, many users rushed to withdraw funds and spread the word. The incident even sparked heated debates on Crypto Twitter over the weekend: Bitcoin maximalists argued this wouldn’t have happened with BTC, while devs pointed out that any asset with a compromised signing UI would be at risk. The discussion spun into detailed breakdowns of proxy contracts, signature architecture, and wallet security.

Despite the chaos, it was an oddly educational weekend for the crypto scene.

4. Events

Sharing the Web3 events that took place over the past week!

This week, mainly focusing on two major highlight AMAs hosted by KOLs.

4-1. [KOL AMA] Marin x Mind Network

A brief introduction to Mind Network, which aims to address privacy and security for blockchain commercialization through FHE. Since the TGE has not yet occurred, the communication has mainly focused on current ongoing updates and the absence of specific schedules.

4-2. [KOL AMA] Wecrypto x Injective

The AMA covered an introduction to Injective, its goals, and recent updates. Over 300 Korean users has been commented on his X. It feels like interest from Koreans has increased after the AMA.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!

About INFCL

INFCL is a leading South Korea crypto marketing agency offering GTM strategy, KOL marketing, SEO, PR, events, and B2B development. Collaborated with global projects like Sui, Aethir, and 0G Labs.

contact us: TG @annnzel