From Memes to Markets: How Narrative Layers Are Driving the New Crypto Cycle

1. Market Overview

Korean crypto markets remained sluggish despite a series of new listings, with overall sentiment still flat and speculative capital flow showing signs of exhaustion. While Upbit maintained dominance over Bithumb, the weekly spot volume declined by 13% to 31.3B KRW, reinforcing the notion that retail activity is in a downtrend. The dominance of short-term trading pairs like XRP/KRW underscores a lack of conviction-driven participation.

Major listings such as COMP, FIL, and AMP failed to generate lasting momentum, with brief listing spikes followed by swift corrections. REZ initially outperformed expectations with high attention from communities like Duckmoney, but failed to maintain its upward trajectory after the initial rally. Most new tokens on both Upbit and Bithumb did not sustain any post-listing hype, signaling weak narrative traction and user fatigue.

Community activity remained low-key, with little buzz around recent listings and minimal involvement from power users or traders. Even promising launches suffered from short-lived excitement due to lack of coordinated marketing and a lack of fresh storylines. The combination of poor volume, low engagement, and shallow rotation suggests the Korean retail cycle may be entering a prolonged cooldown phase.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Compound (COMP) and Filecoin (FIL)

- Bithumb listed Renzo (REZ) and Ampera (AMP)

| Date | Upbit | Bithumb |

|---|---|---|

| 3/31 (Mon) | ||

| 4/1 (Tue) | Compound (COMP) | Renzo (REZ) |

| 4/2 (Wed) | ||

| 4/3 (Thu) | ||

| 4/4 (Fri) | Filecoin (FIL) | Ampera (AMP) |

Project Insights & Highlights

This week’s listings on Korean exchanges came with little to no localized marketing push, offering a relatively quiet rollout compared to previous launches. Below is a breakdown of each project and its context within the Korean market.

By Category:

DeFi – Compound, Renzo

Storage – Filecoin*

Payment – Ampera

*Note: Filecoin is sometimes also categorized under DePIN due to its infrastructure use cases.

🔹 Compound (COMP)

Compound remains a key protocol in the DeFi space, though in Korea, its brand perception has been mixed. While this isn’t its first appearance—having already been listed on Upbit’s BTC market and Bithumb—the project has been more often associated with governance vulnerabilities and social engineering attacks than with its core lending functionality.

There was minor chatter among Korean traders around shorting COMP post-listing, likely influenced by its reputation and lack of bullish momentum. However, the response was limited and didn’t spark widespread action.

🔹 Renzo (REZ)

Renzo gained traction in 2024 as the Ethereum restaking narrative took off. Backed by Binance Labs (now YZi Labs), it quickly captured attention in Korea, with several KOLs actively covering the project.

That early exposure has translated into continued user interest, and many Korean traders are already familiar with Renzo’s role in the restaking and LRT (liquid restaking token) ecosystem.

🔹 Filecoin (FIL)

Already listed on both Upbit (BTC market) and Bithumb, Filecoin’s recent KRW listing hasn’t changed much in terms of local visibility.

In Korea, Filecoin is more recognized as a mineable token than for its decentralized storage utility. However, as AI infrastructure and DePIN become hotter topics, some see this listing as timely—potentially setting the stage for renewed interest in Filecoin’s original use case.

🔹 Ampera (AMP)

Ampera’s listing taps into a longstanding interest in payment infrastructure, although it launched with little fanfare. The project has so far struggled to gain traction in Korea, partly due to the broader market’s bearish tone.

That said, if future regulatory narratives or institutional interest emerge—especially in areas like CBDCs or RWAs—Ampera may find renewed relevance in the Korean context.

Notably, this week’s listings revealed a curious pattern:

- Upbit listed two coins that were previously only available via BTC trading pairs.

- Bithumb listed two entirely new tokens not previously seen on Korean exchanges.

- Both exchanges made their listings on the same day—raising questions about whether this was just a coincidence, or a subtle signal of growing competition between the two major players.

2-2. Trading Volume

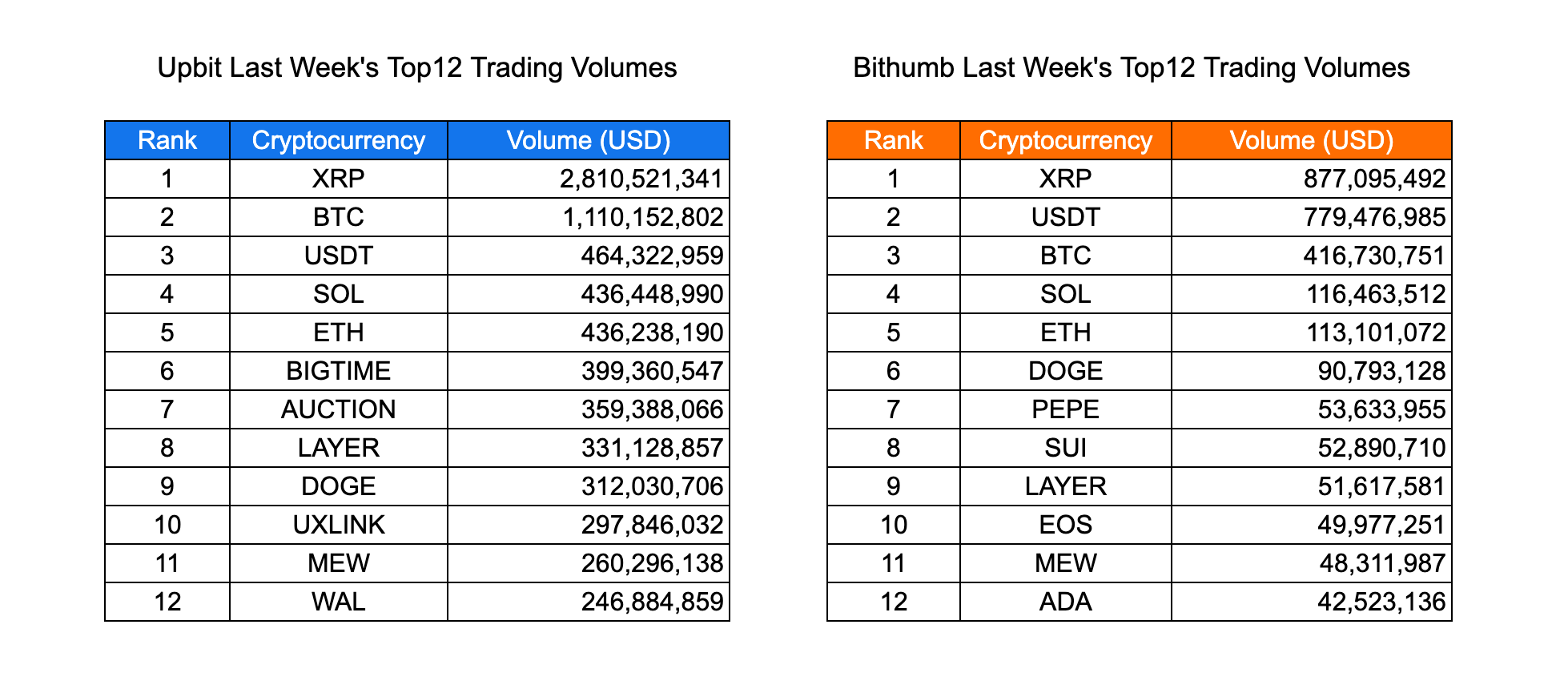

Trading activity on South Korea’s top two cryptocurrency exchanges, Upbit and Bithumb, has notably concentrated around a few select assets, particularly XRP, which topped the trading volume rankings on both platforms.

On Bithumb, XRP recorded a staggering $2.81 billion in trading volume, far surpassing Bitcoin (BTC) at $1.11 billion, and USDT at $464 million. Meanwhile, Upbit also showed similar trends, with XRP leading at $877 million, followed by USDT at $779 million, and BTC at $416 million.

Despite this activity, overall trading remains subdued, with most other tokens generating significantly lower volume. For example, coins like PEPE, SUI, LAYER, and MEW recorded modest figures ranging from $48 million to $54 million on Upbit, while BIGTIME, AUCTION, and UXLINK ranged between $297 million and $399 million on Bithumb.

Notably, DOGE maintained presence in the top rankings across both exchanges, with $312 million on Bithumb and $90 million on Upbit. Newer tokens like WAL, MEW, and LAYER also surfaced in Bithumb's top 12, highlighting a slight diversification in trader focus.

While major assets like BTC and ETH continue to be actively traded, it's clear that XRP is the dominant force in the Korean market right now — especially on Bithumb — capturing a disproportionate share of total exchange activity.

2-3. Top 10 Gainers

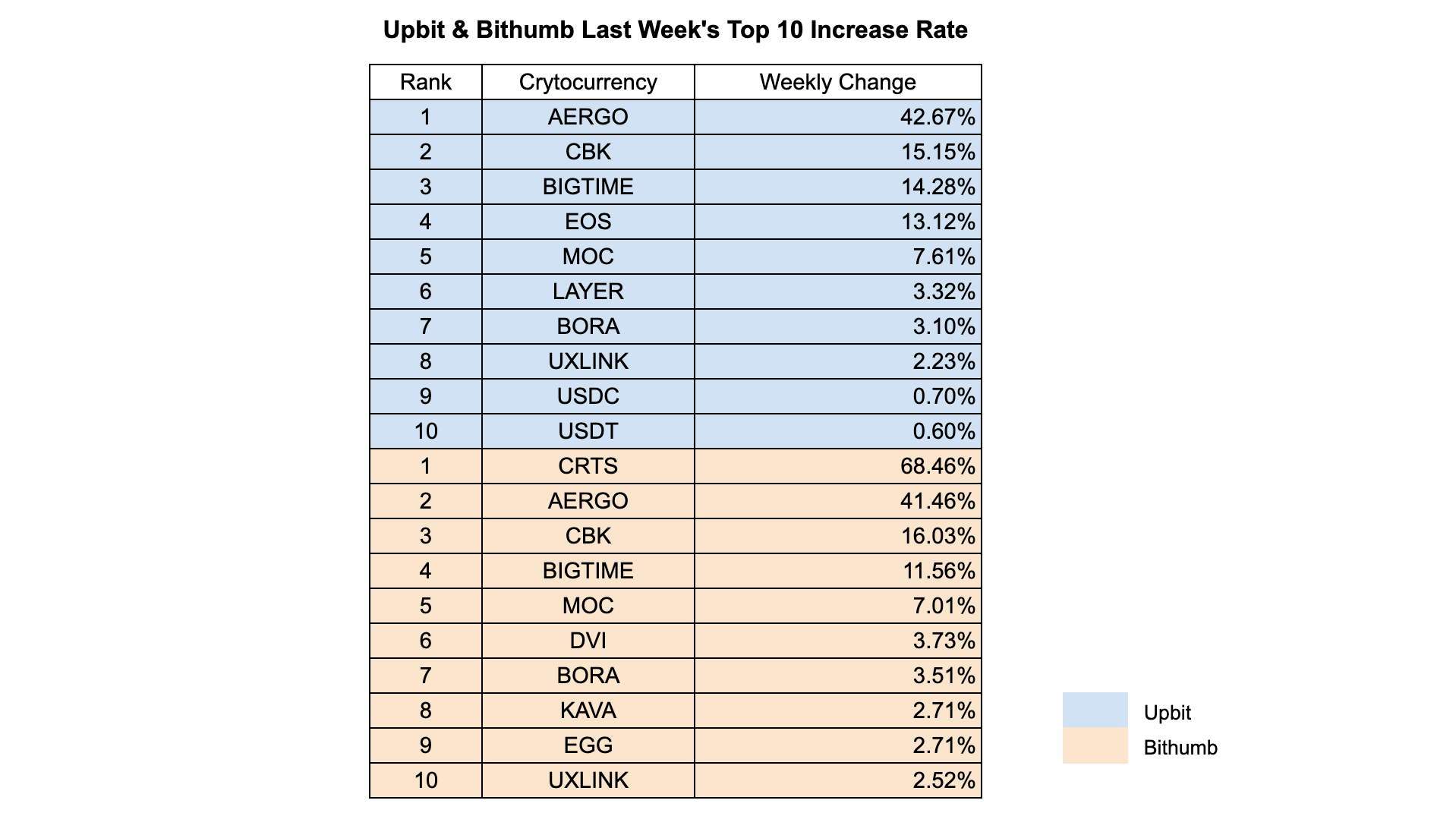

Amid a relatively muted market, Cratos (CRTS) and AERGO emerged as the top performers on South Korea’s leading exchanges.

On Bithumb, CRTS recorded an impressive 68.46% gain over the week, followed by AERGO at 41.46%, and Cobak (CBK) at 16.03%. BIGTIME and MOC also posted double- and high-single-digit gains of 11.56% and 7.01% respectively.

Meanwhile on Upbit, AERGO took the top spot with a 42.67% gain, narrowly edging out CBK at 15.15%, and BIGTIME at 14.28%. EOS also stood out with a 13.12% increase, while MOC, LAYER, and BORA posted more modest gains between 3% to 8%.

Despite the relatively low market momentum, a handful of tokens managed to generate significant weekly returns, especially AERGO and CBK, which ranked in the top three across both exchanges.

3. Key News from Social Media

3-1. Ongoing Wildfire Relief Efforts from Web3 and Beyond

Support continues to pour in from the Web3 community in response to Korea’s devastating wildfires — now considered even more severe than California’s most infamous fire seasons.

This week, Bithumb’s CSR arm, Bithumb Nanum, donated emergency supplies worth 200 million KRW (~$150K) to affected regions. Employees also volunteered on-site, delivering items like ramen, snacks, drinks, towels, and blankets, and assisting with cleanup and aid distribution.

Bithumb Nanum was launched with a 10 billion KRW endowment from Bithumb to manage social impact efforts more systematically — and their wildfire response marks one of the initiative’s most visible efforts to date.

3-2. Binance Wallet Sales Attract Mass Attention

Two more projects, $PUMP and $STO, held IDO sales via Binance Wallet last week. Despite the short sale windows, participation was intense — $PUMP attracted over 115,000 users, even though it launched at 1AM KST.

Interestingly, the events gained traction outside traditional Web3 circles, with posts circulating in popular Web2 finance forums like ‘Honey Jar’, a Korean community known for sharing ways to earn passive income.

As the secret gets out, some early Web3 users joked that “the honey jar has been broken,” lamenting the sudden influx of new competition.

3-3. President Yoon Removed from Office — Political Tokens React

In a shocking turn of events, the Constitutional Court of Korea unanimously upheld the impeachment of President Yoon Suk-yeol on April 4. He is now the second Korean president in history to be removed from office, and a new election will be held within 60 days.

Naturally, the crypto community quickly turned its attention to ‘impeachment-themed tokens’.

- $BORA saw an uptick due to its association with Kakao Games, which had previously faced regulatory pressure under Yoon’s administration. Some traders speculate the change in leadership may ease that risk — even though BORA and Kakao's actual connection is quite limited.

- $CRTS (Cratos), a platform for voting on real-time political and social issues, also surged. Whether the price spike is due to real demand or market manipulation remains unclear, but CRTS briefly topped Bithumb’s gainers list during the announcement.

4. Events

ETH Seoul event is approaching, and we’re starting to see Web3 projects gradually announce AMAs and side event updates!

4-1. AMA with Wecrypto x MystenLabs

This AMA was hosted by Adeniyi, Co-founder of Mysten Labs, and WeCrypto (a Korean KOL), with interpretation support provided by KATE from the INF team. It was a successful session, with over 400 Korean users participating. The AMA primarily focused on updates about Walrus, its future vision, the concept of dynamic data management and how it differs from other protocols, community token allocations, Sui and DeepBook, future protocol plans beyond Walrus, SuiPlay0x1, and the recent platform acquisition news from Mysten Labs. The discussion covered a wide range of topics and encouraged active engagement with the community.

4.2. All about ETH Seoul’s Side Event!

Starting from April 14, 2025, with ETH Seoul, many side events will be held daily.

As various events kick off, this Sunday (April 13th), INF also will be hosting the "Building Real Finance On-Chain" event!

Projects such as Injective, Mantra, Plume, LayerZero, ITCEN, and XPINNETWORK are also expected to participate, so we look forward to your interest and support.

On Tuesday, April 15, INFCL will be hosting an AI-related event titled “Road to an Agentic Future” featuring various Web3 AI projects.

Projects such as Aethir, Gaia, Virtual Protocol, Habili.ai, IRYS, and Nillion will share introductions to their platforms along with recent updates.

We look forward to your active participation!

- Building Real Finance On-Chain Luma: Unleashing the Potential of On-Chain Finance · Luma

- Road to an Agentic Future Luma: https://lu.ma/ckllwp97

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!