From Chuseok Holiday to Charts: Korea’s Market Rhythm Last Week

1. Market Overview

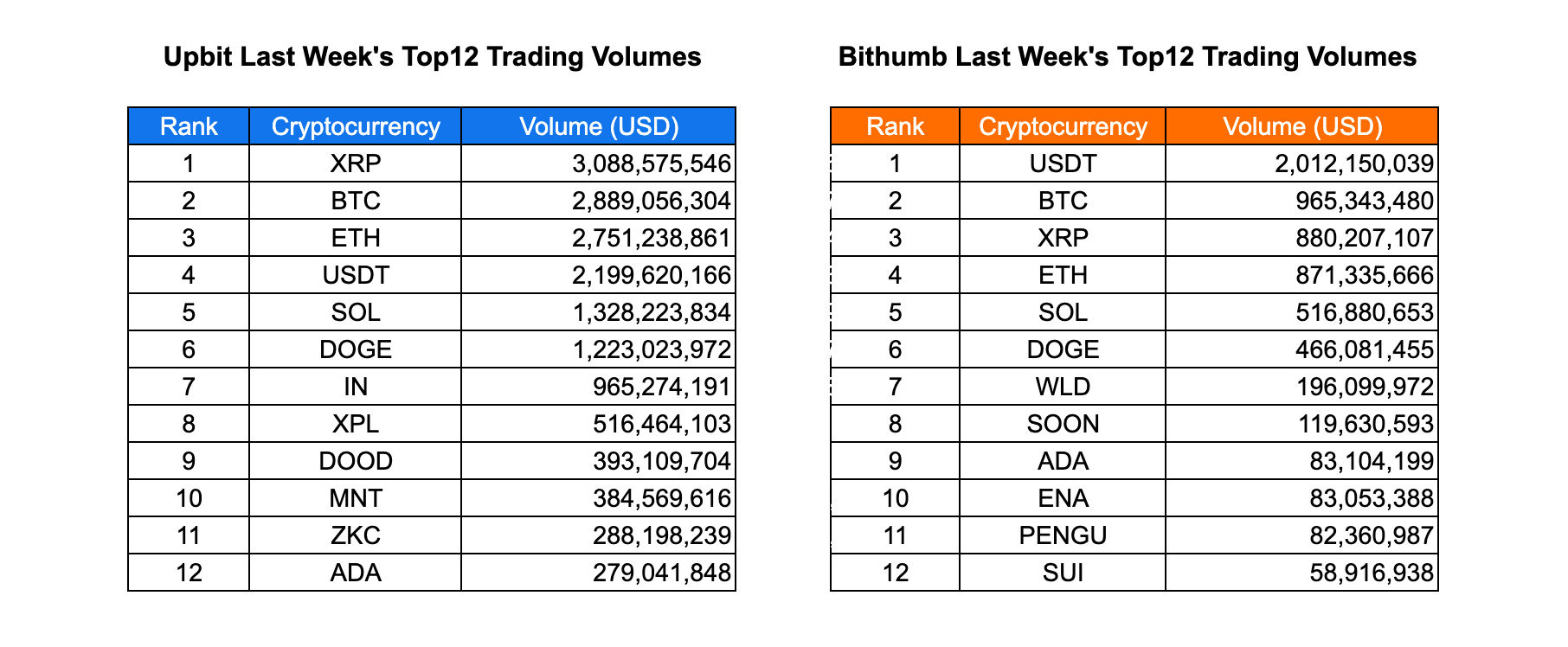

Last week, Korean exchanges continued their streak of new listings, with Upbit adding Doodles and Infinit, while Bithumb listed Anoma and Aster. Upbit maintained a clear lead in market activity, with XRP ($3.09B), BTC ($2.89B), and ETH ($2.75B) driving the bulk of trading volume. Other top performers included USDT ($2.20B) and SOL ($1.33B), while DOGE, IN, and XPL contributed between $516M–$1.22B. Despite lighter trading due to the Chuseok holiday, activity remained broadly distributed across blue-chip and mid-cap assets such as DOOD, MNT, ZKC, and ADA, signaling steady retail participation.

On Bithumb, USDT ($2.01B) led the exchange, followed by BTC ($965M), XRP ($880M), and ETH ($871M). SOL, DOGE, and WLD showed moderate volumes, while tokens like SOON, ENA, PENGU, and SUI trailed behind with smaller but consistent flows. Both exchanges experienced synchronized surges toward the end of the week on October 12, with Upbit continuing to outpace Bithumb by a wide margin. Overall, liquidity remained healthy across majors, while traders favored stability-linked tokens and mid-cap names—suggesting cautious yet active engagement as markets reopened after the holiday lull.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Doodles and Infinit

- Bithumb listed Anoma and Aster.

| Date | Upbit | Bithumb | |

|---|---|---|---|

| 10/6 (Mon) | |||

| 10/7 (Tue) | Doodles (DOOD) | Anoma (XAN) | |

| 10/8 (Wed) | |||

| 10/9 (Thu) | |||

| 10/10 (Fri) | Infinit (IN) | Aster (ASTER) |

Key Marketing Strategies & Takeaways

🔹 Aster (ASTER)

Aster’s marketing approach differed from other perpetual DEXs, as it did not emerge during the peak period of the “Perp DEX meta.” Nevertheless, it managed to attract notable demand in Korea. The key driver behind this was likely the way it was introduced through KOL channels — positioned as a “deficit” project on the BNB Chain, which indirectly (though almost explicitly) suggested a high potential for a Binance spot listing.

Another factor that appealed to Korean users was Aster’s separation of trading points(Rh) and staking points(Au). The Korean community generally dislikes the dilution of points during airdrop farming, and this structure effectively addressed that concern. In addition, staying true to its “BNB deficit” narrative, Aster offered Binance’s Hodler Airdrop rewards to users who staked BNB on its platform.

By leveraging this setup, Aster managed to turn what could have been a low-demand staking feature—given its relatively low airdrop yield compared to trading—into an attractive opportunity. The team actively amplified this narrative through extensive KOL-driven marketing across Korean crypto communities.

2-2. Trading Volume

Upbit maintained a strong lead in trading activity last week, with XRP topping the chart at 3.09 billion USD, followed by BTC at 2.89 billion USD and ETH at 2.75 billion USD. USDT and SOL also showed robust performance with volumes of 2.20 billion USD and 1.33 billion USD, respectively, reflecting steady liquidity across major assets. DOGE, IN, and XPL followed with volumes ranging from 516 million USD to 1.22 billion USD, while smaller tokens such as DOOD, MNT, ZKC, and ADA each contributed over 270 million USD, indicating a diversified trading landscape within the exchange.

Bithumb’s trading volume was led by USDT with 2.01 billion USD, followed by BTC at 965 million USD and XRP at 880 million USD. ETH and SOL maintained notable positions with 871 million USD and 517 million USD, respectively, while DOGE, WLD, SOON, and ADA recorded moderate trading activity between 83 million USD and 467 million USD. ENA, PENGU, and SUI rounded out the list, each recording volumes below 85 million USD, signaling more conservative participation across altcoins compared to Upbit.

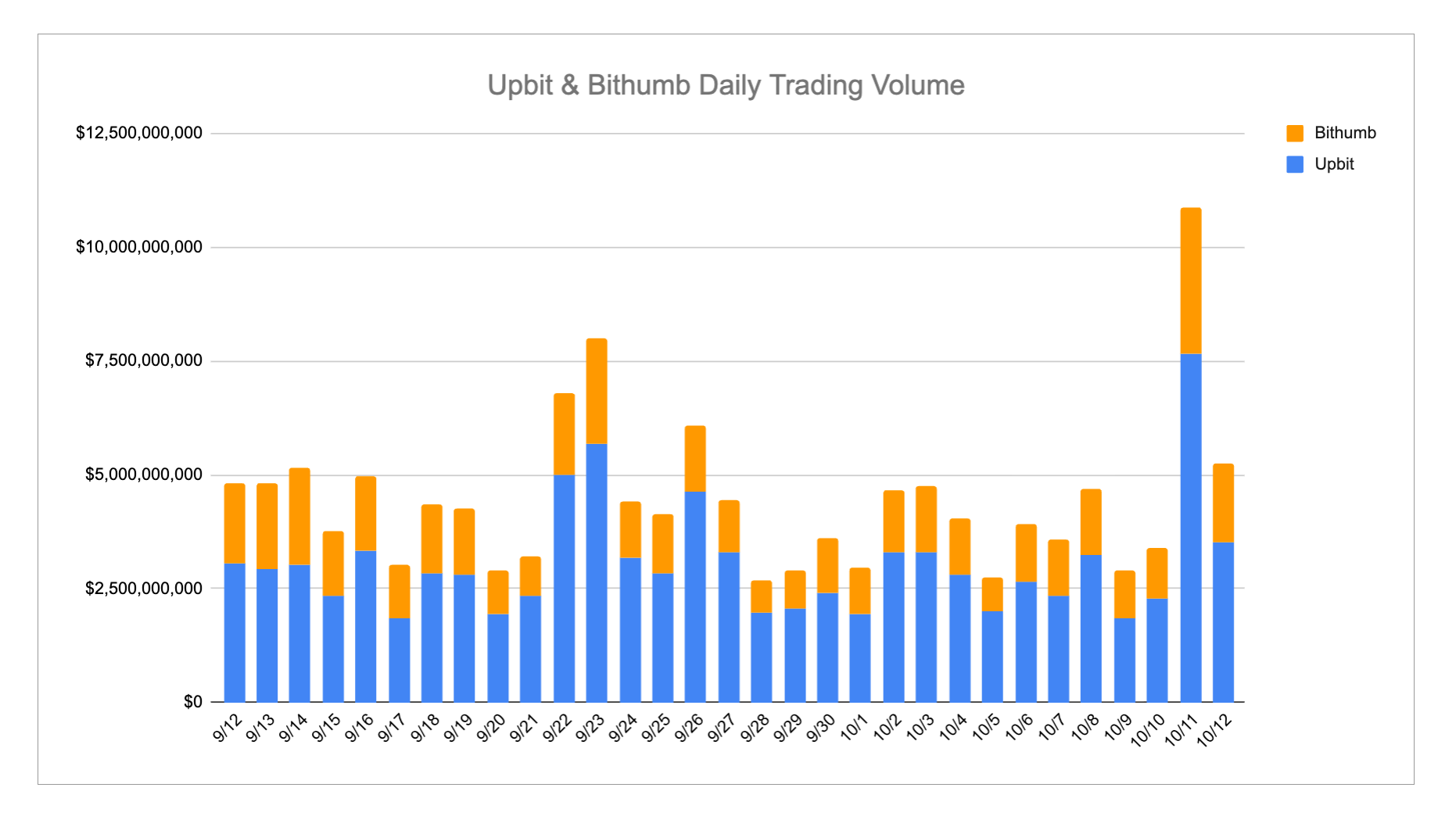

Across both exchanges, daily trading volume trends showed synchronized activity spikes, with a significant surge observed toward the end of the week on October 12. Upbit consistently outpaced Bithumb in total volume, suggesting stronger retail engagement and higher liquidity flow. Overall, trading momentum remained healthy across major assets, with XRP, BTC, and ETH continuing to dominate both platforms while mid-cap tokens maintained steady contributions to overall market turnover.

2-3. Top 10 Gainers

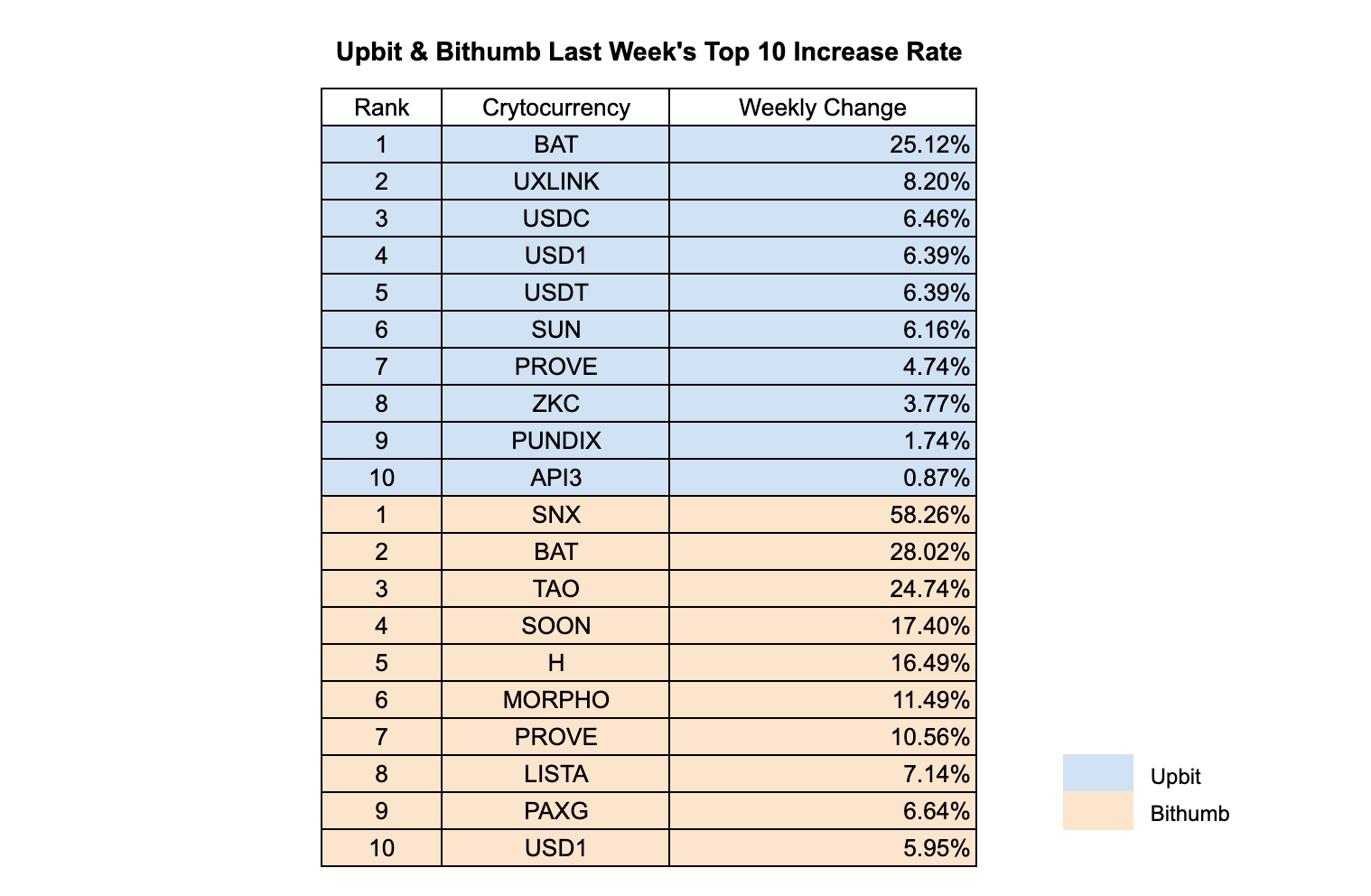

Last week, Upbit’s market saw moderate upward movements led by BAT, which climbed 25.12%, followed by UXLINK at 8.20% and USDC at 6.46%. Stablecoins such as USD1 and USDT both rose 6.39%, reflecting sustained demand for on-chain liquidity. SUN, PROVE, and ZKC also showed positive momentum with gains between 3.77% and 6.16%, while PUNDIX and API3 recorded more limited increases below 2%, indicating selective buying interest among traders focusing on utility and DeFi-related assets.

On Bithumb, market performance was more volatile, with SNX surging 58.26% and BAT following closely with a 28.02% increase. TAO and SOON also posted strong weekly gains of 24.74% and 17.40%, while H and MORPHO rose 16.49% and 11.49%, respectively. Mid-tier tokens such as PROVE, LISTA, PAXG, and USD1 posted smaller but consistent advances between 5.95% and 10.56%, reflecting diverse speculative activity across new and existing listings.

Overall, Bithumb demonstrated stronger short-term rallies, particularly in DeFi and AI-linked tokens, while Upbit’s increases were steadier and concentrated among stablecoins and utility assets. This contrast highlights differing investor appetites—Bithumb traders leaning toward high-volatility opportunities, while Upbit participants favored more stable and liquidity-driven assets.

3. Korean Community Buzz

3-1. A Week-Long Holiday

Last week marked one of Korea’s longest holiday stretches, with National Foundation Day (Oct 3), Chuseok (Oct 5–8), and Hangul Day (Oct 9) combining into a full week off. Trading and community activity were relatively quiet, though a few listings went live. Bitcoin’s new all-time high during the break lifted overall sentiment, giving Korean crypto users a cheerful start to the holidays.

As Chuseok is Korea’s version of Thanksgiving, many KOL channels hosted joint giveaway campaigns. According to one community tracker, there were nine major events involving 8–24 KOL groups each, with prizes ranging from five MacBooks and one iPad Pro to 17 million KRW ($12K) in gift cards, 27 premium Korean beef sets, 240 fried chickens, and over 1,900 coffee vouchers—plus $10,000 worth of Edge Points.

3-2. Trump’s Tariff Shock and Korea’s Market Reaction

On Oct 10, former U.S. President Donald Trump announced an additional 100% tariff on Chinese goods, triggering the largest crypto liquidation event in history—$19 billion in total. The news broke around 6 a.m. KST on Saturday, catching many Korean traders off guard. Some KOLs said they woke up to alerts and even called peers to warn them.

Tether prices surged to 1,653 KRW on Upbit and 5,400 KRW on Bithumb, while emergency live streams and analyses flooded YouTube and Telegram over the weekend. With the won weakening and premiums persisting above 5% even by Oct 13, users debated whether this was a “buy-the-dip” moment or a warning sign of deeper structural risks.

3-3. Capital Outflows and Regulatory Pressure

According to Korea’s Financial Supervisory Service, over 101 trillion KRW (≈$73 billion) worth of crypto assets moved overseas in the first half of 2025. Experts say the lack of access to derivatives and margin trading in Korea is pushing investors toward foreign exchanges.

This figure has steadily climbed from 29.7 trillion KRW in early 2023 to 101.6 trillion KRW in mid-2025, reflecting accelerating capital flight. Industry voices argue that restrictive regulations are weakening domestic competitiveness. One analyst noted, “While the U.S., EU, and Japan have institutional frameworks enabling corporate crypto trading, Korea remains isolated, reinforcing its ‘crypto Galápagos’ status.”

(Source)

4. Web3 AMA Lists for this week

4.1 Magic Eden AMA with Cobacknam

✔️Date: Oct 13th

✔️Time: 9 PM KST

✔️Space: Cobacknam X Space

4.2 GAIB AMA with Fireant

✔️Date: Oct 13th

✔️Time: 10 PM KST

✔️Space: Fireant Youtube

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!