Events Go Viral—and So Do Tokens

1. Market Overview

Korean exchanges kept up momentum last week, with Upbit listing Ravencoin and Bithumb adding Sophon and Lagrange—the latter continuing its aggressive support for narrative-driven tokens. Sophon, backed by top VCs, drew attention through Binance + Upbit listings and strong pre-listing campaigns.

But it was Lagrange that stole the spotlight. A high-end meetup in Seoul—featuring premium meals, iPhones, and $LA airdrops—went viral across Korean crypto circles. The event not only packed the venue but set a new bar for how community marketing can drive token awareness ahead of a listing.

In trading, XRP and BTC dominated on Upbit, while ANIME, SOPH, and MASK saw strong mid-cap momentum. Bithumb saw heavy USDT inflows and continued retail action in speculative tokens like FLOCK and MOODENG.

Top gainers included ANIME, ICX, RVN, and PCI, showing synchronized interest across both platforms in local narratives and high-volatility plays.

On the social front, all eyes were on regulation. The appointment of Kim Yong-beom as Korea’s new Presidential Policy Chief signaled a shift toward digital asset-friendly policymaking, while World Vision’s crypto sale on Upbit marked the first institutional sell-off post-rule change.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Ravencoin.

- Bithumb listed Sophon and Lagrange.

| Date | Upbit | Bithumb |

|---|---|---|

| 6/2 (Mon) | Sophon (SOPH) | |

| 6/3 (Tue) | ||

| 6/4 (Wed) | ||

| 6/5 (Thu) | Ravencoin (RVN) | Lagrange (LA) |

| 6/6 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Lagrange (LA)

Lagrange didn’t follow the typical marketing playbook most crypto projects use in Korea. Still, it made a strong impression in a short time through an unusually bold strategy — one worth highlighting.

There were some early efforts to engage Korean KOLs, but these were limited in both frequency and impact compared to what followed.

For context, Korea’s crypto scene has been unusually active since BUIDL Asia in April. Offline events, meetups, and sessions have been happening regularly — a shift from the usual concentration around BUIDL Asia or Korea Blockchain Week.

Most projects work with local agencies or managers to plan their events, with team members typically flying in to engage the community near the event date.

These events are usually modest: decent venues, simple catering, and light drinks. But Lagrange broke the mold.

In a scene where many attend mainly for food or freebies — hence the nickname “meetup collectors” — Lagrange openly announced it would serve premium meals and prepared enough for anyone interested.

They also offered generous rewards, including iPhones and hotel dining vouchers.

As a result, the venue was packed, and many were turned away at the door due to space constraints. The high-end meals ran out quickly, prompting the team to order pizza — which also disappeared in minutes.

To make up for the overcrowding, Lagrange held a separate raffle and distributed $LA token airdrops to all attendees.

While token giveaways at events aren’t new, this one stood out for its sheer scale.

After $LA’s listing, its price surged past one dollar. Attendees received 500 or 2,000 tokens, meaning some walked away with the equivalent of a typical Korean monthly salary — simply by attending and submitting a Google Form.

This made Lagrange widely known in Korea. Other projects are now beginning to include token airdrops in their own event plans — a clear sign of its influence, even if the long-term impact remains to be seen.

In a market where visibility and attention can make or break a project, Lagrange’s approach was highly effective at leaving a lasting impression.

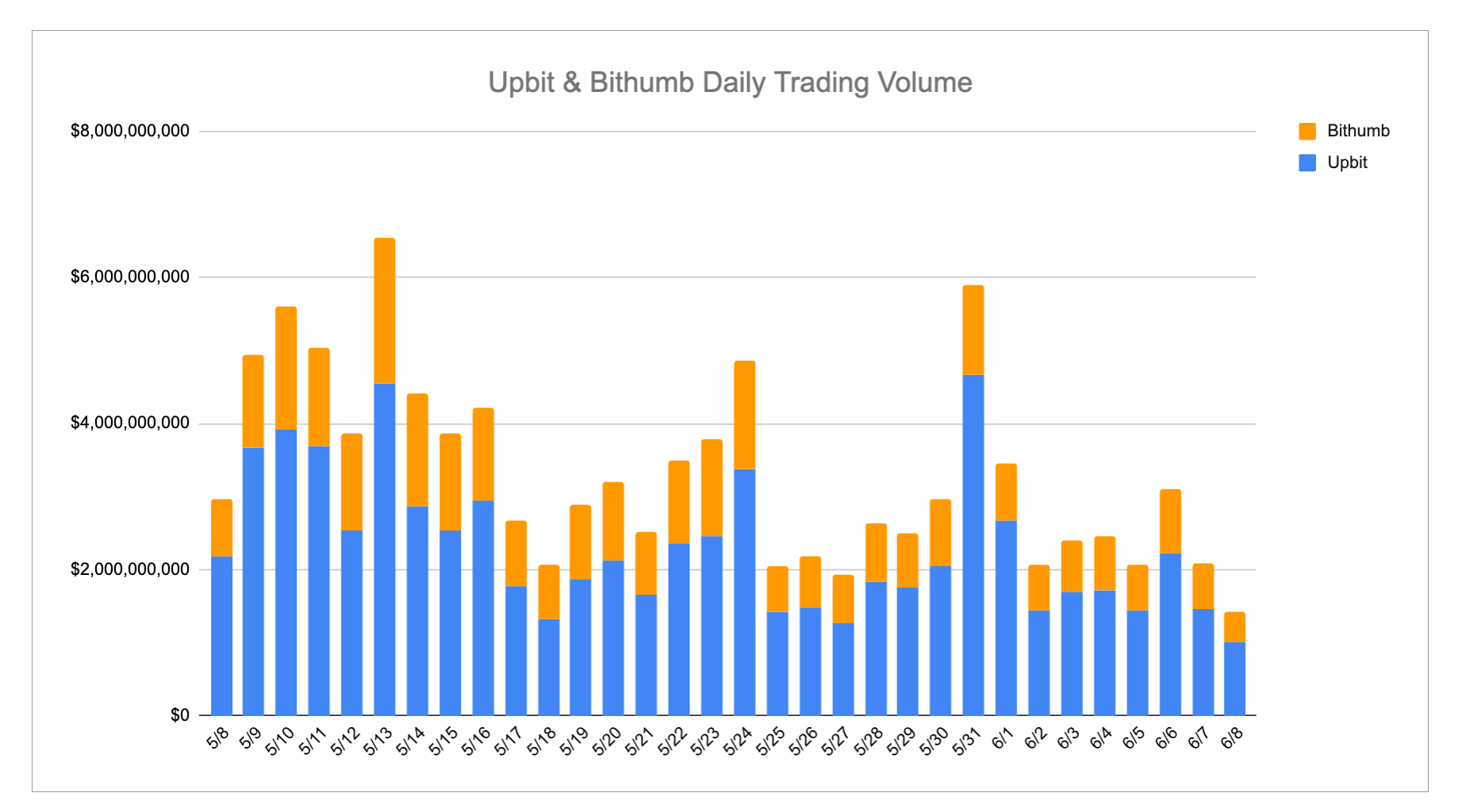

2-2. Trading Volume

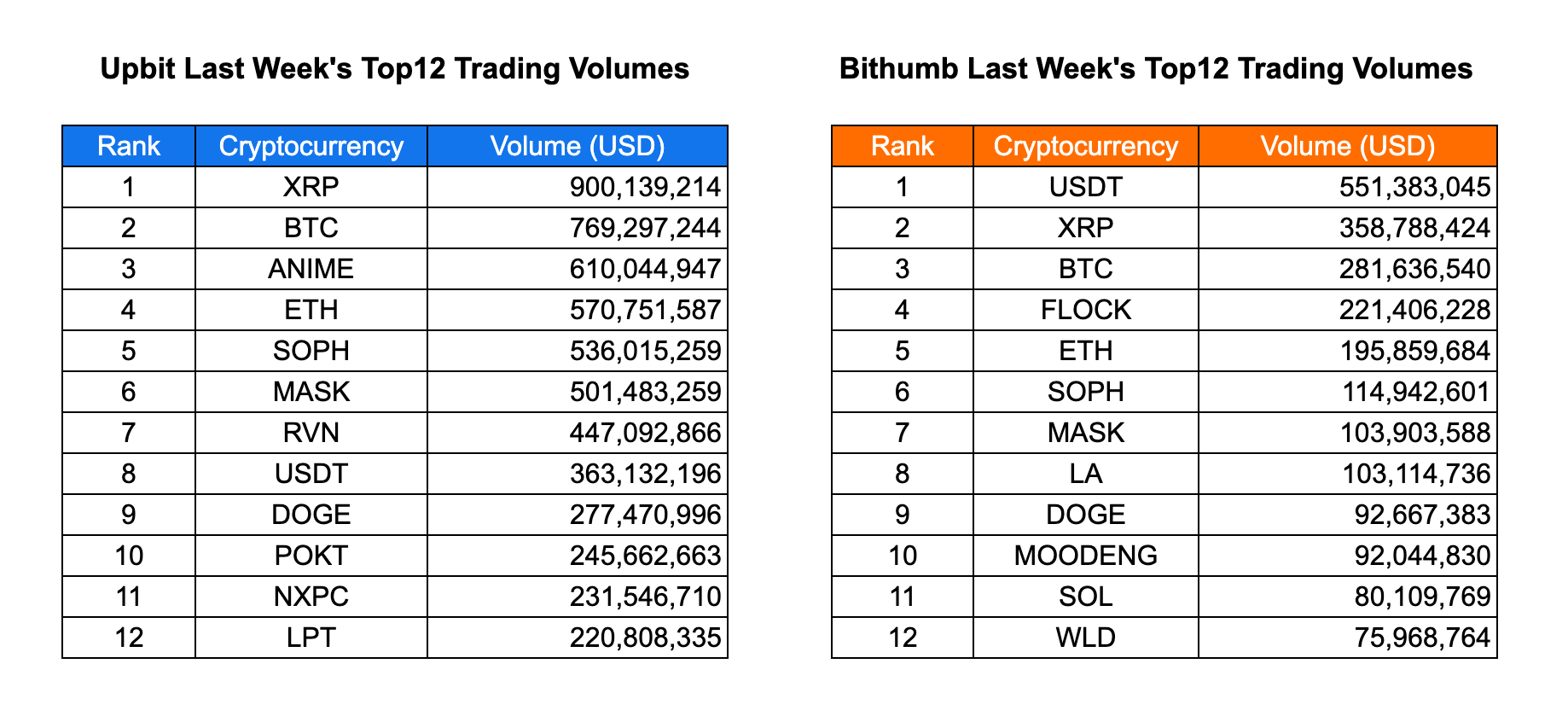

Last week’s trading activity showed clear contrasts between Upbit and Bithumb, with both platforms reflecting a strong mix of large-cap and speculative token interest.

On Upbit, XRP led the charts with nearly $900M in volume, followed by BTC and trending tokens like ANIME, SOPH, and MASK, each logging over $500M. The inclusion of mid-cap names like NXPC and POKT in the top 12 highlights Korean traders' ongoing appetite for narrative-driven altcoins.

Bithumb, on the other hand, saw USDT take the top spot with over $550M, pointing to strong liquidity movement into stablecoins. Alongside XRP and BTC, tokens like FLOCK and MOODENG also posted high volumes—reinforcing the exchange’s reputation as a speculative trading venue. SOPH, LA, and MASK appeared in both exchanges’ top rankings, signaling synchronized retail interest across platforms.

Monthly volume data from CoinGecko also shows a broader uptick on Upbit in early June, suggesting rising short-term bullish sentiment in Korea. This momentum appears to be driven by increased activity in altcoins and meme tokens, rather than fundamentals—hinting at a return of risk-on behavior among retail traders.

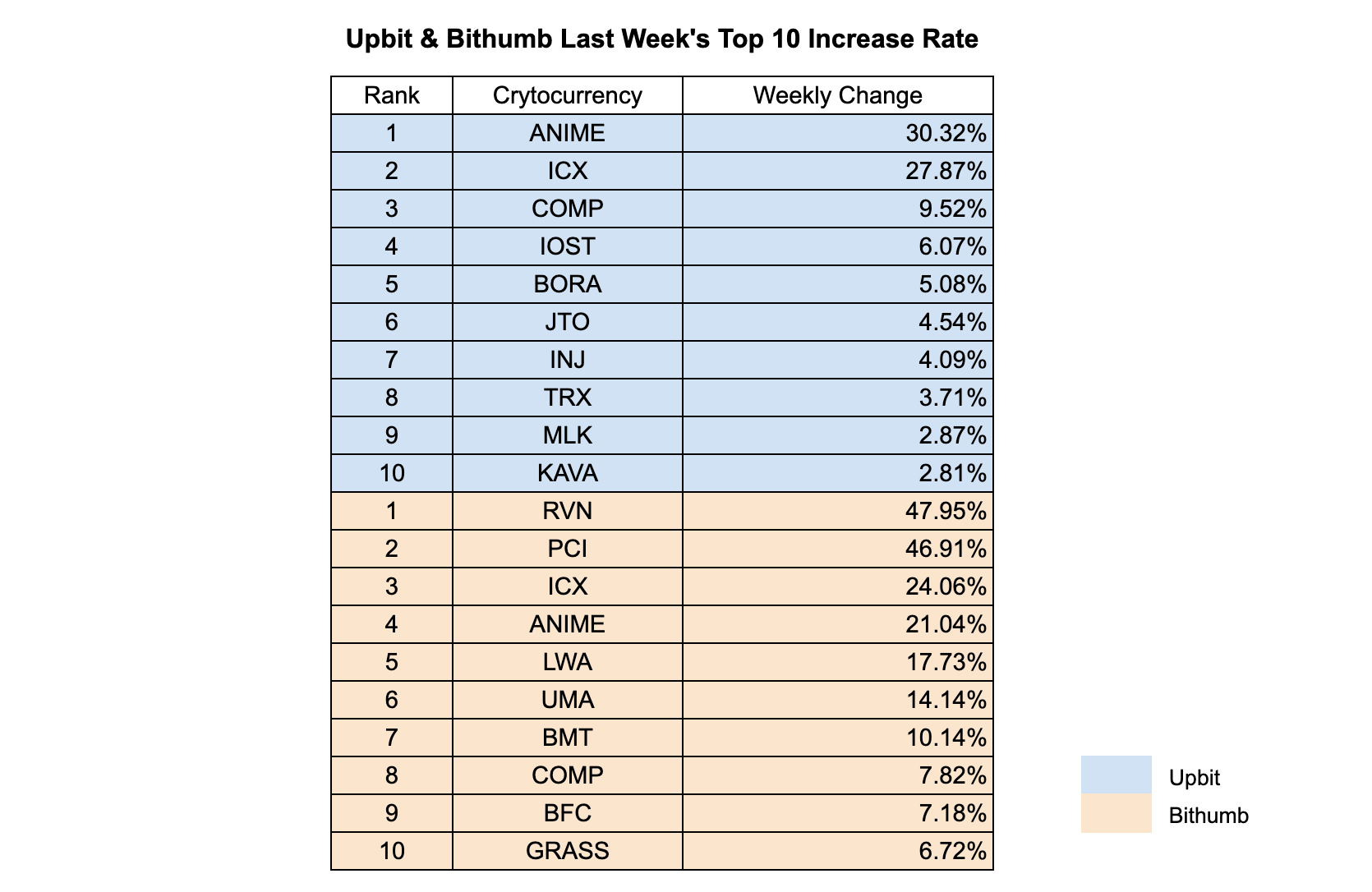

2-3. Top 10 Gainers

Top gainers over the past week revealed strong momentum in both speculative and legacy altcoins across Korean exchanges. On Upbit, ANIME surged by 30.32%, leading the pack, followed closely by ICX with a 27.87% gain, reflecting renewed interest in older Korean-led blockchain projects. Other notable performers included COMP, IOST, and BORA, each showing moderate gains between 5–10%, alongside mid-cap tokens like INJ, JTO, and KAVA, signaling broad-based bullish sentiment in altcoins.

Bithumb’s top gainers chart was led by RVN and PCI, which recorded dramatic weekly rises of 47.95% and 46.91%, respectively, indicating highly speculative trading activity. ICX and ANIME also made strong appearances here, consistent with Upbit trends, suggesting cross-exchange bullishness. Additional gainers like LWA, UMA, and BMT saw double-digit gains, while COMP and BFC rounded out the list with more modest appreciation.

Overall, the overlap of top performers such as ICX, ANIME, and COMP across both exchanges underscores a synchronized rally in select altcoins, particularly those with either strong domestic branding or DeFi-related narratives. This uptick in performance highlights a risk-on environment among Korean retail investors.

3. Korean Community Buzz

3-1. Hashed Open Research’s Kim Yong-beom appointed as new Presidential Policy Chief

Following Korea’s presidential election, major shifts are underway. One of the most talked-about moves is the appointment of Kim Yong-beom—former Vice Minister of Strategy and Finance and most recently, head of Hashed Open Research—as the new Policy Chief at the Presidential Office. Known for his dual insight into traditional finance and digital assets, his appointment signals a potential shift in regulatory stance. In parallel, the new government launched a Digital Asset Committee with over half of its 20 members from the private sector, aiming to shift away from enforcement-first approaches toward fostering industry growth.

Source

3-2. First Institutional Crypto Sale on Upbit: World Vision Sells Donated ETH

As of June 1, Korean nonprofits can legally sell crypto holdings. The first such case occurred on Upbit: international NGO World Vision sold 0.55 ETH donated in a previous fundraising campaign. This marked a symbolic start for crypto donations and conversions entering Korea’s nonprofit space.

Source

3-3. Korean Crypto Meetups Heat Up — with Token Rewards

Crypto meetups in Korea are gaining serious momentum. Lagrange’s May 21 event (Luma) rewarded participants with up to 2,000 $LA tokens. One attendee even posted a screenshot showing it was their 110th meetup, calling the token reward “the most generous” yet. With back-to-back events happening weekly, Korean crypto communities are showing strong offline engagement—especially when combined with real incentives.

4. Events

What AMAs are waiting for us this week?

Let’s dive into the never-ending series of weekly AMAs!

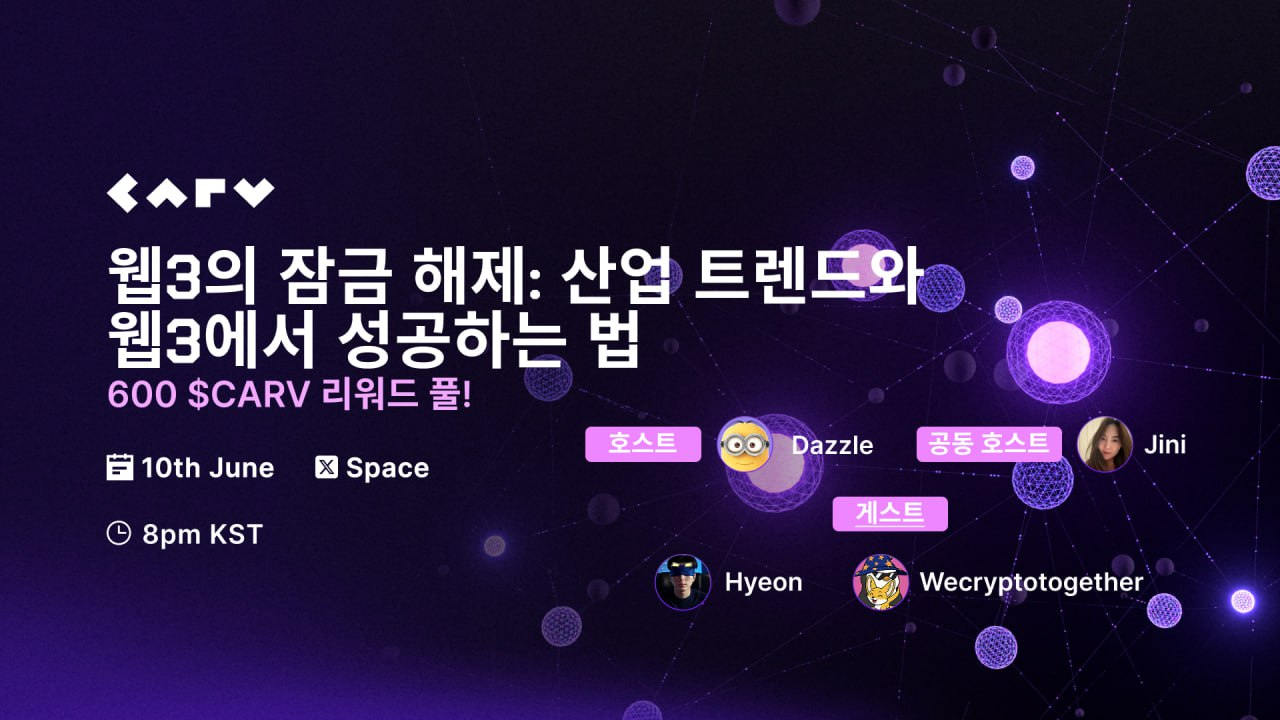

4.1. Carv AMA with Wecrypto

On June 10th at 8 PM (KST), Wecrypto and Hyeon will be hosting an AMA on Carv’s Twitter Space.

They’ll briefly discuss Carv staking updates and current Web3 trends. There will also be a Carv giveaway for participants of the AMA.

4.2. Lighter AMA with Magic

The recap of last week’s AMA with Lighter has been published.

The AMA began with a brief introduction of CEO Vlad, followed by discussions on Lighter’s business model, plans to implement ZK technology, their own L1 chain roadmap, the point system, and strategies for earning high scores in the point program.

For more details, check out the link below.

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!