ETH & XRP Lead as Korean Trading Activity Surges Ahead of KBW

1. Market Overview

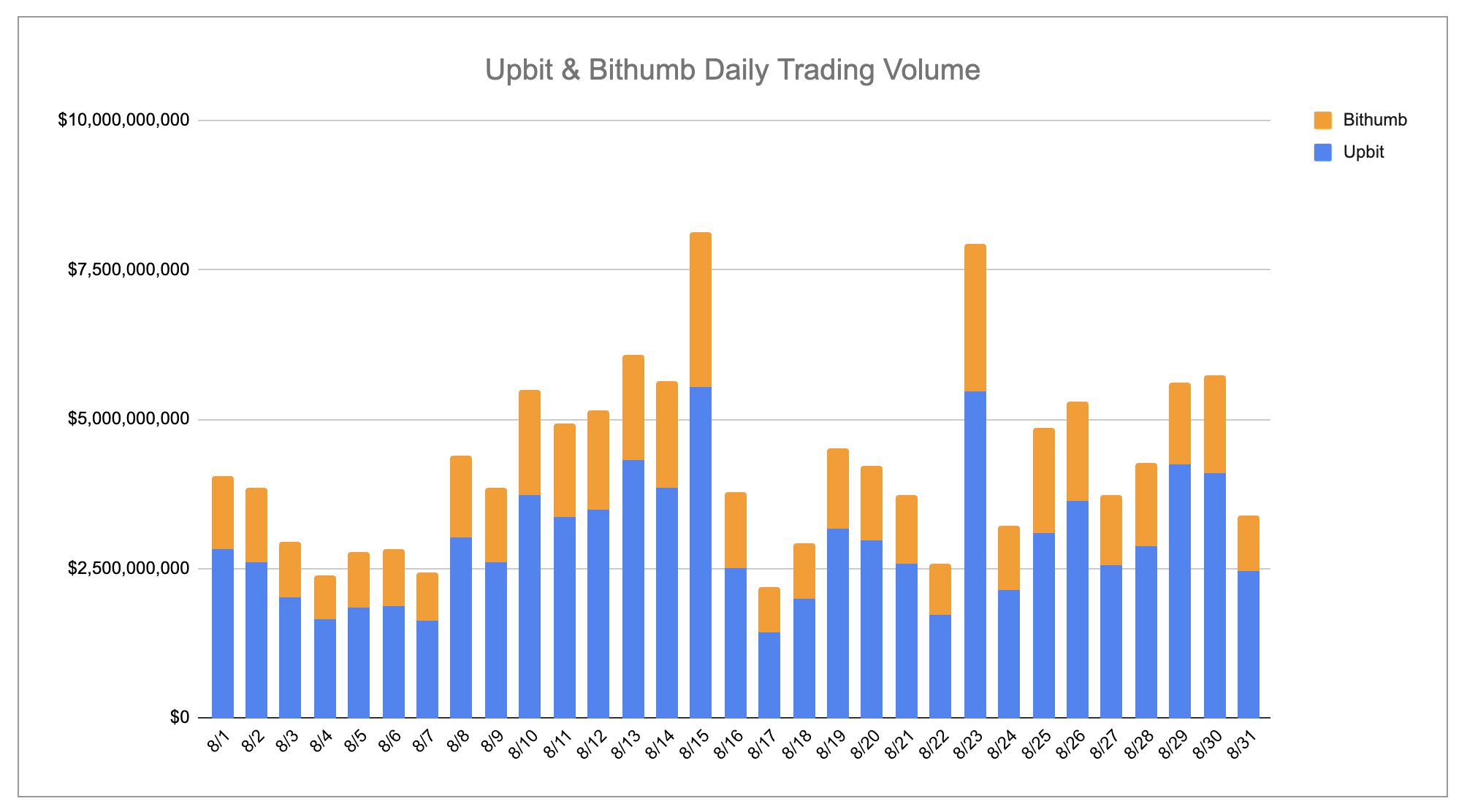

Last week, major Korean exchanges introduced several new listings, including Treehouse on Upbit and Stader and Camp Network on Bithumb. Trading activity remained heavily concentrated on Upbit, where daily volumes frequently exceeded $5 billion and occasionally approached $7.5 billion, maintaining a clear lead over Bithumb’s more modest $1–2 billion range.

Across both exchanges, ETH and XRP dominated trading, each recording over $2 billion on Upbit, while CRO, SOL, and BTC followed closely. PYTH also stood out with $1.1B in volume, reflecting rising retail interest in newer narratives. Bithumb’s rankings showed similar asset preferences, with ETH, XRP, and USDT leading activity, while mid-cap tokens like ENA, CRO, and PENGU saw steady engagement at smaller scales. With Korea Blockchain Week around the corner in September, the market is set for increased volatility as side events and community activity accelerate.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Treehouse.

- Bithumb listed Stader and Camp Network.

| Date | Upbit | Bithumb |

|---|---|---|

| 8/25 (Mon) | ||

| 8/26 (Tue) | Stader (SD) | |

| 8/27 (Wed) | ||

| 8/28 (Thu) | Treehouse (TREE) | |

| 8/29 (Fri) | Camp Network (CAMP) |

Key Marketing Strategies & Takeaways

🔹 Camp Network (CAMP)

Camp’s Korean KOL marketing serves as a strong case study, as it combines both traditional Korean market practices and the latest marketing trends.

They began by emphasizing their core keywords — AI + IP — and introduced what the project is about, how much investment it has secured, and how users can participate. This information was delivered to the Korean community through KOL channels.

In addition, Camp leveraged aspects of Story, a project that had already paved the way in the market with the same keywords and IP, making use of elements like investment highlights and valuation comparisons in their marketing.

Camp also actively adopted more modern marketing trends such as social engagement. Rather than stopping at running the Kaito leaderboard to drive user engagement, they distributed weekly stablecoin rewards, offered whitelist spots through campaigns, and continuously encouraged user participation.

To further amplify social activity, Camp even introduced an exclusive reward pool for Korean users, a bold move that significantly increased visibility and engagement.

On top of that, Camp also conducted AMAs and WL events with top KOLs, while operating and managing the Korean community through various events.

🔹 Treehouse (TREE)

Please refer to our past research:

https://blog.infcl.co.kr/korean-crypto-volumes-surge-with-proves-breakout/

2-2. Trading Volume

Upbit continued to dominate the Korean crypto trading landscape over the past week, consistently maintaining higher volumes compared to Bithumb. Daily trading activity on Upbit frequently surpassed the $5 billion mark, with occasional peaks approaching $7.5 billion, while Bithumb’s contribution remained comparatively modest, typically ranging between $1–2 billion per day.

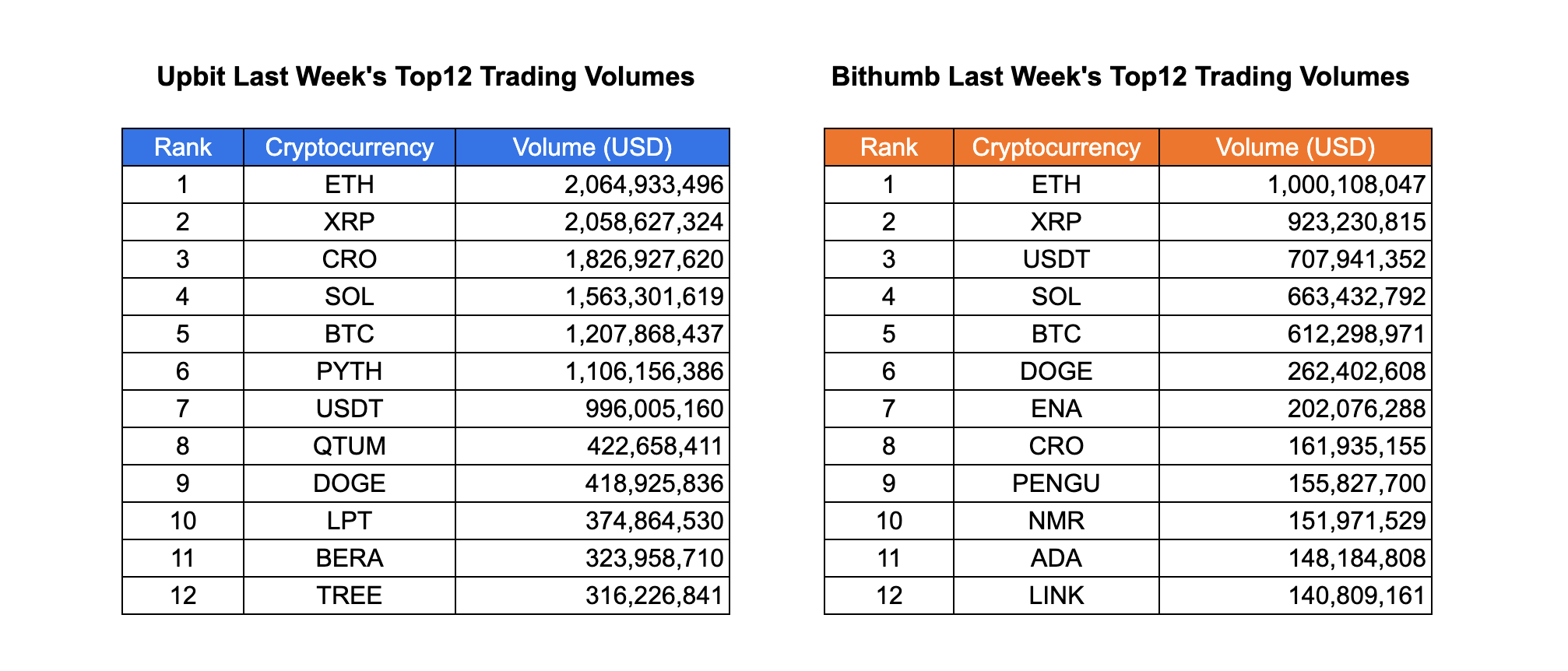

In terms of individual assets, ETH and XRP were the clear leaders across both exchanges. On Upbit, ETH ($2.06B) ranked first, followed closely by XRP ($2.06B) and CRO ($1.82B). Other major contributors included SOL ($1.56B) and BTC ($1.21B), highlighting continued investor focus on large-cap tokens. Interestingly, PYTH also emerged with a notable $1.1B in weekly volume, indicating growing traction in Korea.

On Bithumb, ETH ($1.0B) and XRP ($923M) dominated as well, followed by USDT ($708M) and SOL ($663M). While the distribution was similar to Upbit’s, the overall scale was significantly smaller. Mid-cap tokens like ENA, CRO, and PENGU also made the list but with more moderate trading volumes compared to Upbit.

Overall, the data reinforces the structural dominance of Upbit as the primary liquidity hub in Korea, with the exchange capturing a far larger share of retail and institutional activity. Meanwhile, Bithumb continues to play a secondary role, with trading volumes spread more thinly across both blue-chip and emerging tokens.

2-3. Top 10 Gainers

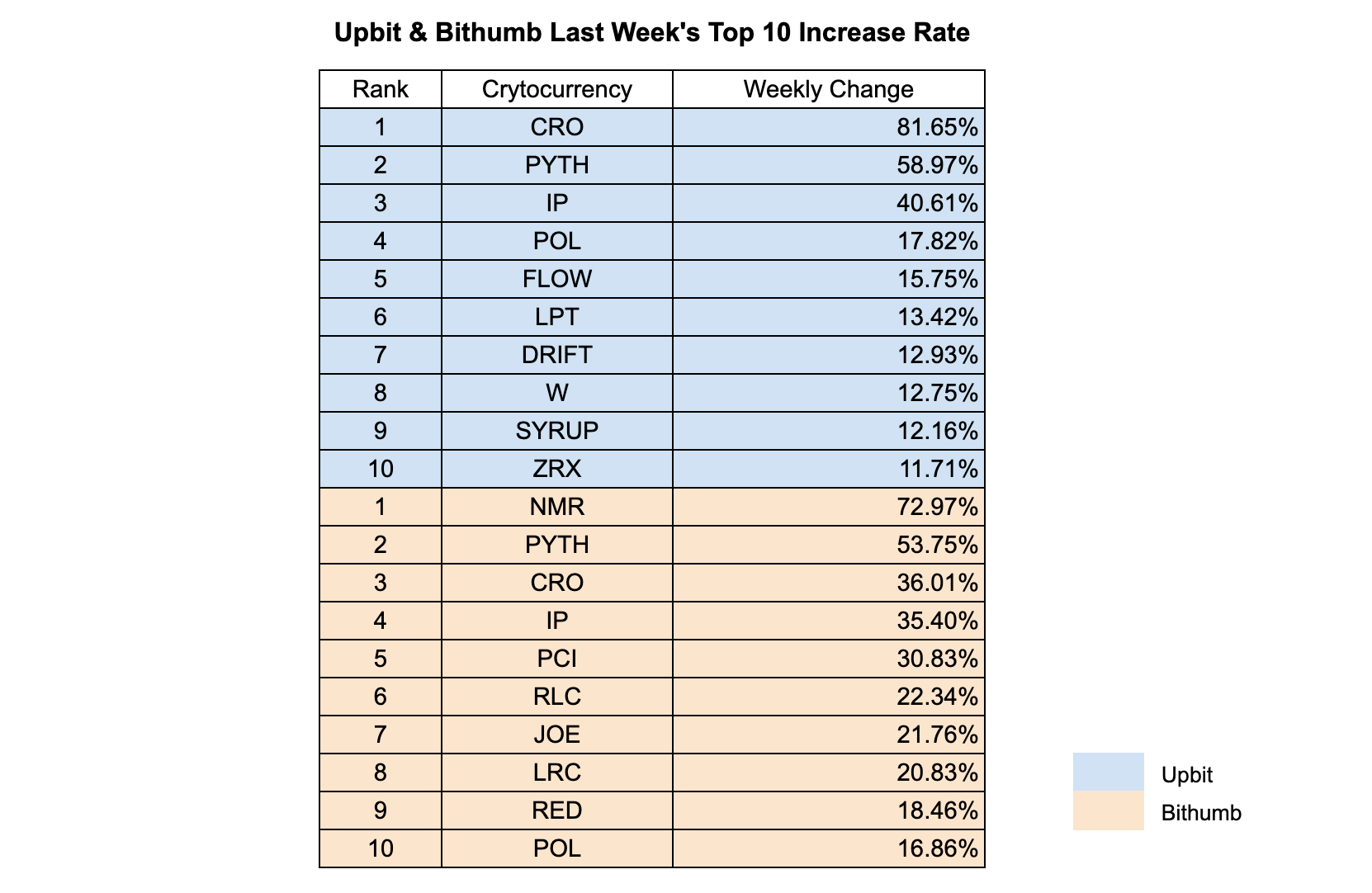

Last week’s top gainers highlighted notable differences between Upbit and Bithumb, with certain tokens showing remarkable surges across both platforms.

On Upbit, CRO led the market with an impressive +81.65%, followed by PYTH (+58.97%) and IP (+40.61%), reflecting strong interest in mid-cap and emerging tokens. Other notable gainers included POL (+17.82%), FLOW (+15.75%), and LPT (+13.42%), while tokens such as DRIFT, W, and SYRUP also posted solid double-digit weekly growth.

Meanwhile, Bithumb’s gainers list was topped by NMR (+72.97%), which saw strong momentum during the week. PYTH (+53.75%) and CRO (+36.01%) also performed well, showing consistency across both major exchanges. Additional gainers included IP (+35.40%), PCI (+30.83%), and RLC (+22.34%), as well as smaller-cap tokens like JOE, LRC, and RED, each recording around +20% or higher.

3. Korean Community Buzz

3-1 Meetups Continues in Korea

The Korean crypto community is still buzzing over the ongoing meetup meta. One user compiled a list of airdrops he’ve received from attending recent events including Lagrange, Succinct, Eclipse, Memecore and more, totaling around $10K in confirmed rewards, with potentially more still pending. The post went viral, gathering over 15K views, and sparked plenty of conversation in the community.

While many were impressed by the sheer numbers, with comments like “Why work when you can just go to meetups?”, others raised concerns about how sustainable this trend is. With KBW just around the corner, all eyes are on whether the Korean meetup culture will evolve after the event, and how projects will adapt their strategies moving forward.

3-2 U.S.– Korea Summit

The recent U.S.–Korea summit ran longer than planned, lasting 2 hours and 20 minutes instead of the scheduled 1 hour and 45 minutes. The two leaders focused on North Korea and economic cooperation. President Trump mentioned the possibility of meeting Kim Jong-un again, while President Lee requested stronger U.S. involvement in maintaining peace on the Korean Peninsula.

Economically, the summit announced 11 agreements worth $150B across strategic sectors, including shipbuilding, nuclear energy, aviation, and energy. Korean companies are joining the U.S. MASGA project to help revitalize the American shipbuilding industry. However, unresolved issues around agricultural imports, steel, aluminum, and semiconductor tariffs sparked debate over whether the deals offer sufficient real-world benefits.

Crypto communities reacted as well, despite the summit’s collaborative tone, markets dipped during the announcement, triggering discussions on whether geopolitical developments are overshadowed by macroeconomic conditions.

3-3 KOSPI vs. Crypto Traders

The Korean government recently unveiled its new Economic Growth Strategy, emphasizing “productive finance” and a shift in capital flows from real estate toward the stock market. While there’s no explicit mention of the KOSPI 5000 target set by the previous administration, the plan aims to strengthen Korea’s position and address the so-called “Korea Discount.”

Crypto traders have been watching closely, as KOSPI’s performance often influences sentiment in Korea’s crypto markets. While the recent stock market rally could boost retail risk appetite and drive more participation in mid-cap tokens and altcoin trading, the opposite scenario is also possible. As traditional markets attract increasing capital, investor focus could shift away from crypto, potentially slowing trading activity in higher-volatility assets.

(Source)

4. Web3 Event

Finally, the busy Korea Blockchain Week is coming this September. Throughout this month, starting from mid-September, a variety of Web3 side events are expected to take place. To make it easier for you to keep track, we are sharing the KBW Sheet.

Through this sheet, you can check events, registrations, locations, and more throughout the month.

✅ All about Korea Blockchain Week 2025 ➡ Link

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!