Dunamu × Naver: Korea’s Most Important Crypto–Fintech Merger Yet

1. Market Overview

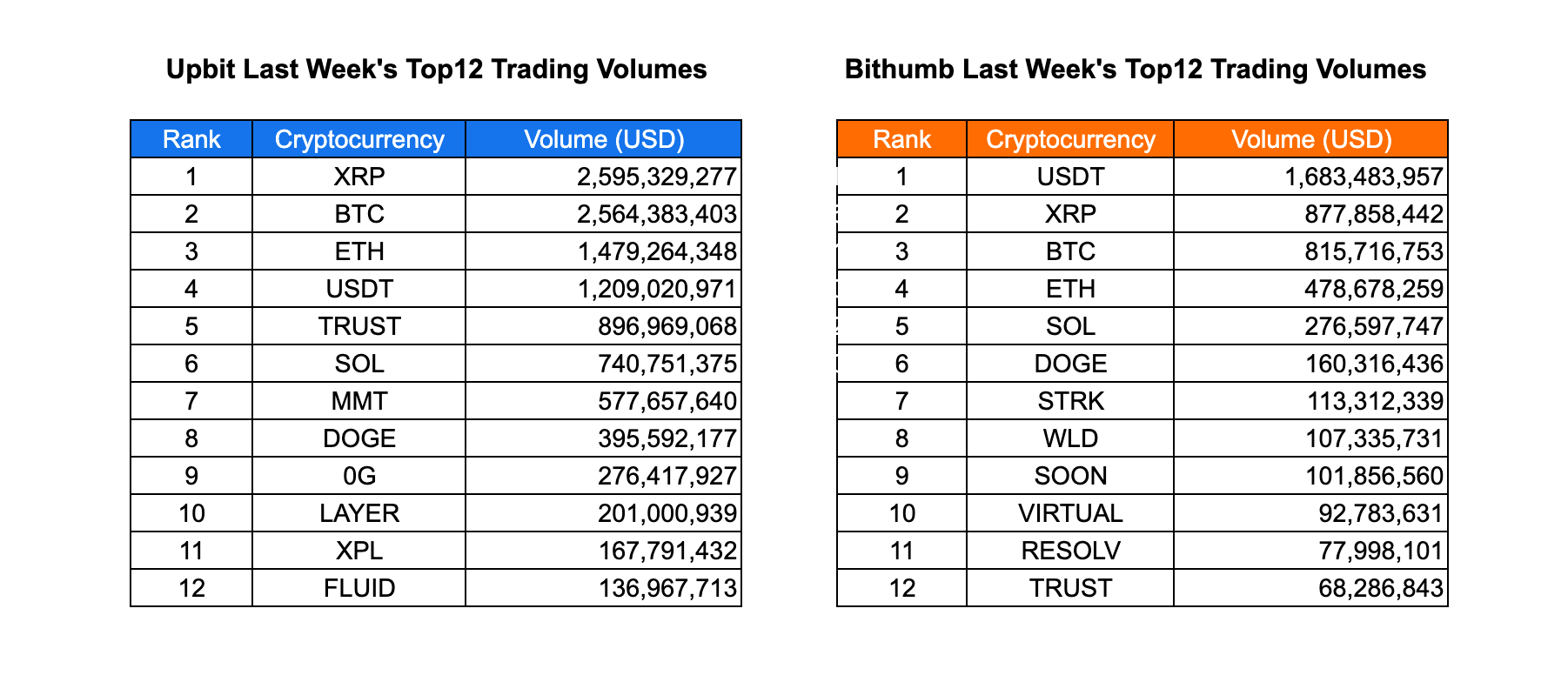

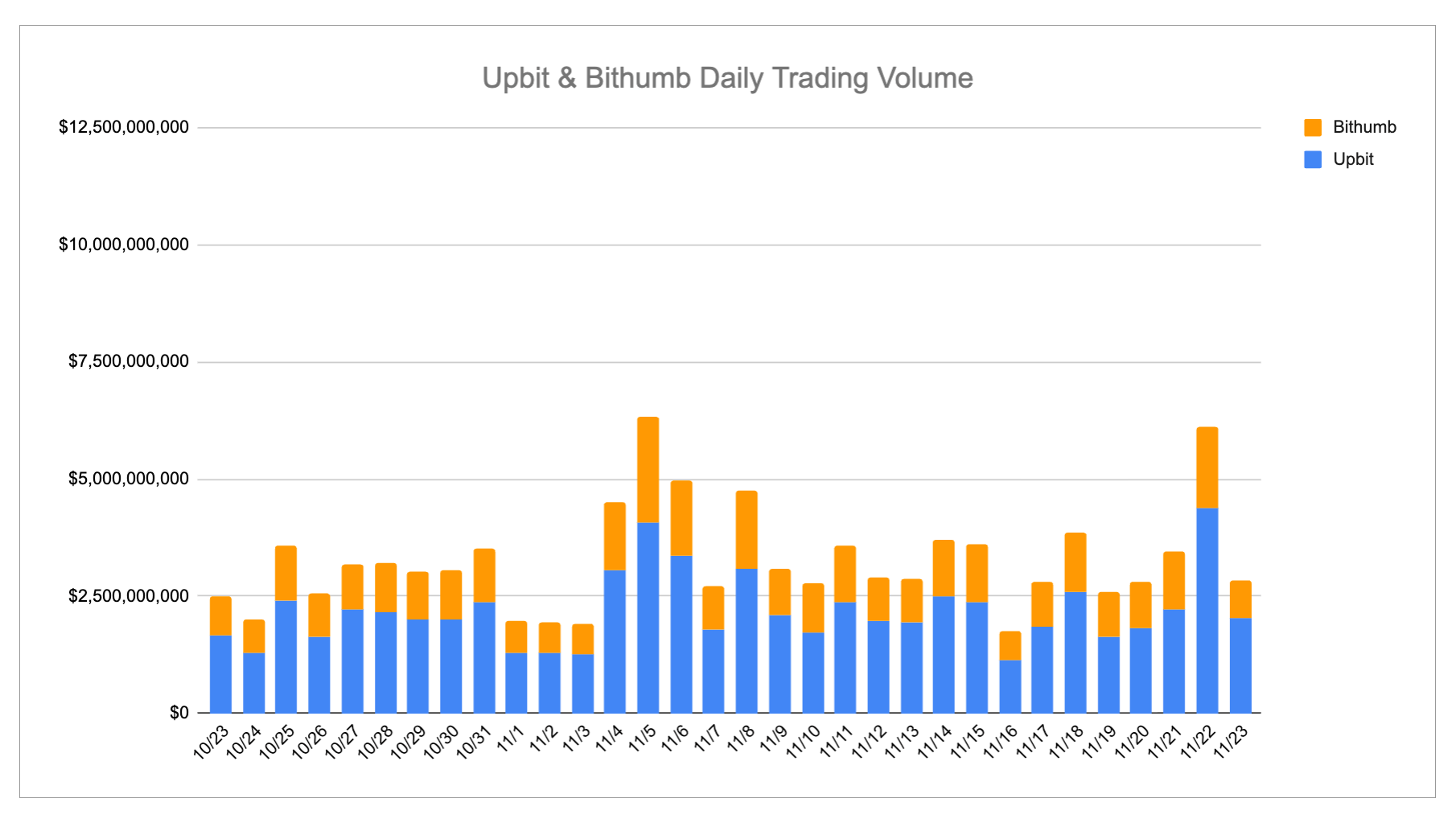

Last week, the Korean market maintained steady trading momentum despite broader macro uncertainty, with Upbit continuing to outpace Bithumb in total volume and diversity of actively traded assets. XRP and BTC remained the core liquidity drivers on Upbit at $2.59B and $2.56B, while ETH and USDT also showed consistent activity above the billion-dollar mark. On Bithumb, trading was led by USDT at $1.68B — underscoring the exchange’s heavy stablecoin-driven flow — followed by XRP and BTC. Overall, user behavior revealed a clear preference for major cryptocurrencies on both exchanges, with Upbit showing stronger appetite for mid-cap trading and Bithumb exhibiting more conservative liquidity concentration.

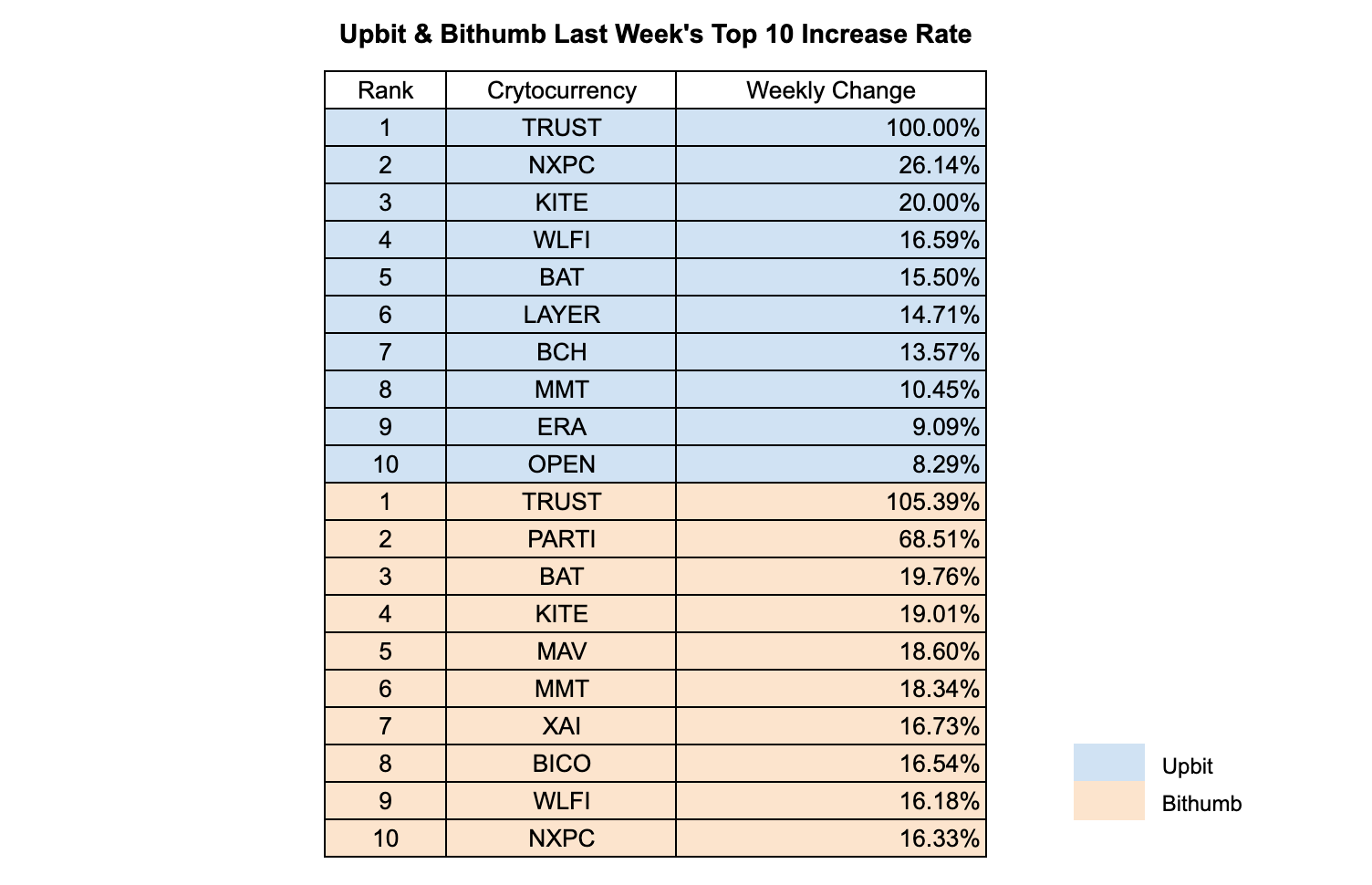

At the same time, TRUST emerged as the standout performer across both platforms, doubling in price and capturing cross-exchange retail attention. Several other mid-tier tokens such as KITE, NXPC, and BAT posted double-digit weekly gains, signaling renewed speculative activity outside the top-3 assets. While overall volumes were stable rather than explosive, market participants demonstrated selective conviction toward specific altcoins, suggesting that capital is present — just more targeted, cautious, and narrative-driven than in prior months.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced a new listing:

- Upbit listed Meteora.

- Bithumb listed Meteora.

| Date | Upbit | Bithumb | |

|---|---|---|---|

| 11/17 (Mon) | |||

| 11/18 (Tue) | Meteora (MET2) | Meteora (MET) | |

| 11/19 (Wed) | |||

| 11/20 (Thu) | |||

| 11/21 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Meteora (MET or MET2)

From a marketing perspective, Meteora executed a very basic and relatively non-aggressive strategy. However, its brand awareness within the Korean community increased organically, largely driven by real usage and exposure from several key KOLs.

It is assumed that Meteora began its KOL marketing efforts in the lead-up to its TGE, starting with core project introductions and the launch of its airdrop checker. This was followed by repeated communication regarding the TGE schedule, supported exchanges, claim procedures, and airdrop eligibility. Post-TGE, content shifted toward fostering expectations for further listings and continued market momentum.

That said, Meteora had already garnered significant attention in the Korean market well before its official marketing push. This was primarily due to a number of KOLs who provided liquidity on Meteora and publicly showcased substantial profits from their LP positions.

Each time meme coins or major tokens were launched within the Solana ecosystem, these KOLs demonstrated — via Telegram — how they supplied liquidity on Meteora and generated notable short-term returns. This visibility directly led to a surge of interest in concentrated liquidity provision, prompting many users to study and engage with the model themselves. (This is by no means an exaggeration.)

Ultimately, this case clearly illustrates that profitability remains the top priority in the market. At the same time, Meteora serves as a strong example of how projects that demonstrably generate returns — particularly in DeFi — can most effectively gain traction in the Korean market through real, visible performance rather than overt promotional tactics.

*In the case of Upbit, since the previously listed Metronome token used the ticker MET, Meteora was listed under the ticker MET2 to avoid confusion.

2-2. Trading Volume

Last week, Upbit saw XRP leading the trading volumes with over $2.59 billion, closely followed by BTC at $2.56 billion and ETH at $1.48 billion, while stablecoins like USDT also maintained significant activity at $1.21 billion. Mid- to lower-tier assets such as TRUST, SOL, and MMT recorded volumes ranging from $577 million to $897 million, indicating active trading beyond the top-tier coins.

On Bithumb, USDT dominated the market with $1.68 billion in trading volume, nearly double that of the second-ranked XRP at $878 million. BTC and ETH volumes were $816 million and $479 million, respectively, while altcoins such as SOL, DOGE, and STRK saw moderate activity between $113 million and $277 million. TRUST, a top performer on Upbit, had notably lower trading on Bithumb at $68 million, reflecting platform-specific liquidity differences.

Overall, daily trading patterns on both exchanges suggested consistent activity in major cryptocurrencies, with stablecoins capturing a sizable share of trading volume. The discrepancy in altcoin volumes between Upbit and Bithumb highlights varied user preferences and liquidity concentration across the two platforms.

2-3. Top 10 Gainers

Last week, TRUST showed exceptional growth on both Upbit and Bithumb, surging 100% and 105.39% respectively, reflecting strong market momentum and investor interest. On Upbit, NXPC and KITE followed with weekly increases of 26.14% and 20.00%, while altcoins such as WLFI, BAT, and LAYER also recorded double-digit gains, indicating a broad-based rally among mid-cap tokens.

Bithumb saw similarly strong performance in altcoins, with PARTI climbing 68.51% and KITE up 19.01%, alongside BAT at 19.76% and MMT at 18.34%. Other assets like MAV, XAI, BICO, and WLFI posted gains between 16% and 18%, highlighting a diverse set of high-performing tokens across the platform.

Overall, the data indicates that while stable and large-cap cryptocurrencies maintained steady trading, high volatility and notable gains were concentrated in specific altcoins, with TRUST emerging as a clear leader across both exchanges.

3. Korean Community Buzz

3-1. Naver–Dunamu merger set for Nov. 26

According to local financial media, Naver Financial and Dunamu (operator of Upbit) are preparing to hold board meetings on November 26 to finalize their share-swap agreement. Current market estimates place Naver Financial’s valuation at ~ KRW 4.7–5T, while Dunamu is valued at ~ KRW 14–15T, signaling a likely exchange ratio of 1:3.

The merger discussions were previously delayed due to scheduling conflicts with APEC Summit activities in Korea, but both companies have reportedly already communicated the structural and strategic rationale to regulators. After board approval, the merger will still require an extraordinary shareholder resolution — though given Naver’s 70% ownership and Mirae Asset’s 30%, passage is seen as likely.

Community reaction has been mixed: “It feels like Dunamu is giving up too much value,” “Upbit is worth way more in Korea than Naver Financial,” and “This could reshape digital finance in Korea — but I wonder who benefits more.”

(Source)

3-2. Crypto sell-off sparks “Black Friday”

Last week brought a painful downturn for both crypto and U.S. equities, leaving Korean traders exhausted as prices kept sliding. The sentiment across Korean Telegram and X communities swung toward sarcasm and dark humor, with many referring to the market as: “Black Friday pricing,” “Bitcoin is bleeding,” “My portfolio is unrecognizable,” and “We are at maximum fear mode.”

Although some contrarians are watching for a bottom, most retail participants have shifted to defensive risk tolerance, focusing on capital protection over dip-buying. The prevailing mood: distress over losses and hesitation to re-enter the market.

3-3. Coinbase KYC surge amid Monad token sale

The Monad token sale on Coinbase became a major discussion point in Korea, largely because this time Coinbase allowed KYC verification for Korean users, which is not always the case. As a result, many Korean traders signed up specifically to participate in the sale.

KOLs quickly shared guides titled: “How to clear Coinbase KYC smoothly,” “What documents you need,”. Success posts began spreading rapidly, fueling FOMO across trading communities. Meanwhile, Monad’s price briefly touched its sale valuation, generating a mix of optimism and skepticism.

Many are now watching whether Monad, after three years of development, will deliver meaningful technical adoption and real-world relevance beyond the initial trading excitement.

4. The weather is getting colder, but Meetups are becoming so popular that people don’t want to miss them. What kind of offline meet ups are waiting for us this week?

4.1 zkPass) The Verifiable Nights

✔️Date: Nov 24th

✔️Time: 18:00 PM - 23:00 PM KST

✔️Space: RVSP

4.2 OVERTAKE) BlueBid: 2025 Winter Auction

✔️Date: Nov 27th

✔️Time: 17:00 PM - 22:00PM KST

✔️Space: RVSP

4.3 Digital Dollar Summit by CaveDAO

✔️Date: Nov 27th

✔️Time: 19:00 PM - 21:30PM KST

✔️Space: RVSP

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!