Double Debut: Newton & Sahara Hit Korea’s Top Exchanges

Last week, Korea’s crypto market was marked by fresh listings and shifting retail narratives. Newton and Sahara AI drew significant attention with well-executed local campaigns—Newton leveraging a Korean-exclusive leaderboard on Kaito, while Sahara AI sustained engagement with consistent meetups and a oversubscribed token sale.

Trading volume trends highlighted persistent liquidity in majors like XRP, BTC, and ETH on both Upbit and Bithumb, while speculative plays like MOVE, SAHARA, and NEWT surged into top ranks, underscoring Korea’s appetite for mid-cap opportunities. PENGU and SEI emerged as standout gainers across both exchanges, reflecting synchronized retail enthusiasm.

Meanwhile, social buzz centered on OpenLedger’s massive meetup turnout, Circle’s stock becoming Korean investors’ top U.S. pick, and a playful meme comparing KOSPI’s rally with Ethereum’s price—collectively signaling a risk-on mood blending crypto, equities, and culture.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Newton Protocol, Sahara AI.

- Bithumb listed Defi App, Newton Protocol, Sahara AI, and Maple Finance.

| Date | Upbit | Bithumb |

|---|---|---|

| 6/23 (Mon) | ||

| 6/24 (Tue) | Newton Protocol (NEWT) | Defi App (HOME), Newton Protocol (NEWT) |

| 6/25 (Wed) | ||

| 6/26 (Thu) | Sahara AI (SAHARA) | Sahara AI (SAHARA) |

| 6/27 (Fri) | Maple Finance(SYRUP) |

Key Marketing Strategies & Takeaways

🔹 Newton Protocol (NEWT)

Newton carried out a step-by-step marketing build-up in Korea over a short period.

Starting in early to mid-May, Newton quickly climbed to the top of Kaito’s pre-TGE rankings in Korea. The project offered a variety of engagement activities, including Twitter tasks, credit point quests, dice rolls, minesweeper games, and side quests—allowing users to stay active and accumulate rewards.

A decisive move was the creation of a dedicated Korean allocation pool on Kaito, exclusively for local participants. A Korean leaderboard site was even launched, and Korean yappers could comment if their account was missing from the regional leaderboard, and it would be promptly added—demonstrating Newton’s (also Kaito’s)meticulous approach.

The official Twitter account also encouraged even small accounts to participate, highlighting that anyone producing quality content had a fair chance. Hints of a June TGE further motivated many to jump in and start yapping without delay.

Some KOLs analyzed potential earnings in detail, noting that the prize pool was substantial. Based on a fully diluted valuation (FDV) of $300 million, the total Kaito reward pool was estimated at $2.25 million, with $150,000 allocated specifically to Korean participants. With just two weeks remaining at the time, estimates suggested that if 100 winners were chosen, each could earn around $24,000; if 1,000 winners were picked, the average reward would still be $2,400 each.

As expected, many users and KOLs who actively participated enjoyed significant earnings post-TGE, leaving both the community and project stakeholders satisfied with the campaign’s success.

🔹 Sahara AI (SAHARA)

Many in Korea first came across Sahara AI during last year’s Korea Blockchain Week (KBW), where the project left a lasting impression by running an ice cream booth at the main venue and hosting a side event featuring top stars like Kwon Eun-bi and Dynamic Duo—instantly boosting its recognition among local Web3 enthusiasts.

Since then, Sahara AI has achieved notable milestones, including collaborations with internationally renowned Web2 AI companies and prestigious universities. For retail users, the project opened multiple phases of its testnet, maintaining engagement through consistent marketing efforts. Sahara also held several meetups in Korea and, in April this year, launched a Korean-exclusive Telegram community, which quickly attracted over 2,000 members, highlighting its growing popularity. As detailed later in this newsletter, Sahara is set to hold another offline meetup this week, further reinforcing its local presence.

Additionally, Sahara’s recent token distribution campaign on BuidlPad demonstrated massive interest: it raised $74 million with an oversubscription rate of 777%, drawing applications from over 103,000 users and finalizing participation from more than 30,000 verified users across 118 countries. Post-TGE, participants saw their allocations more than double in value, underscoring the campaign’s success and Sahara’s ability to deliver tangible returns to its community.

2-2. Trading Volume

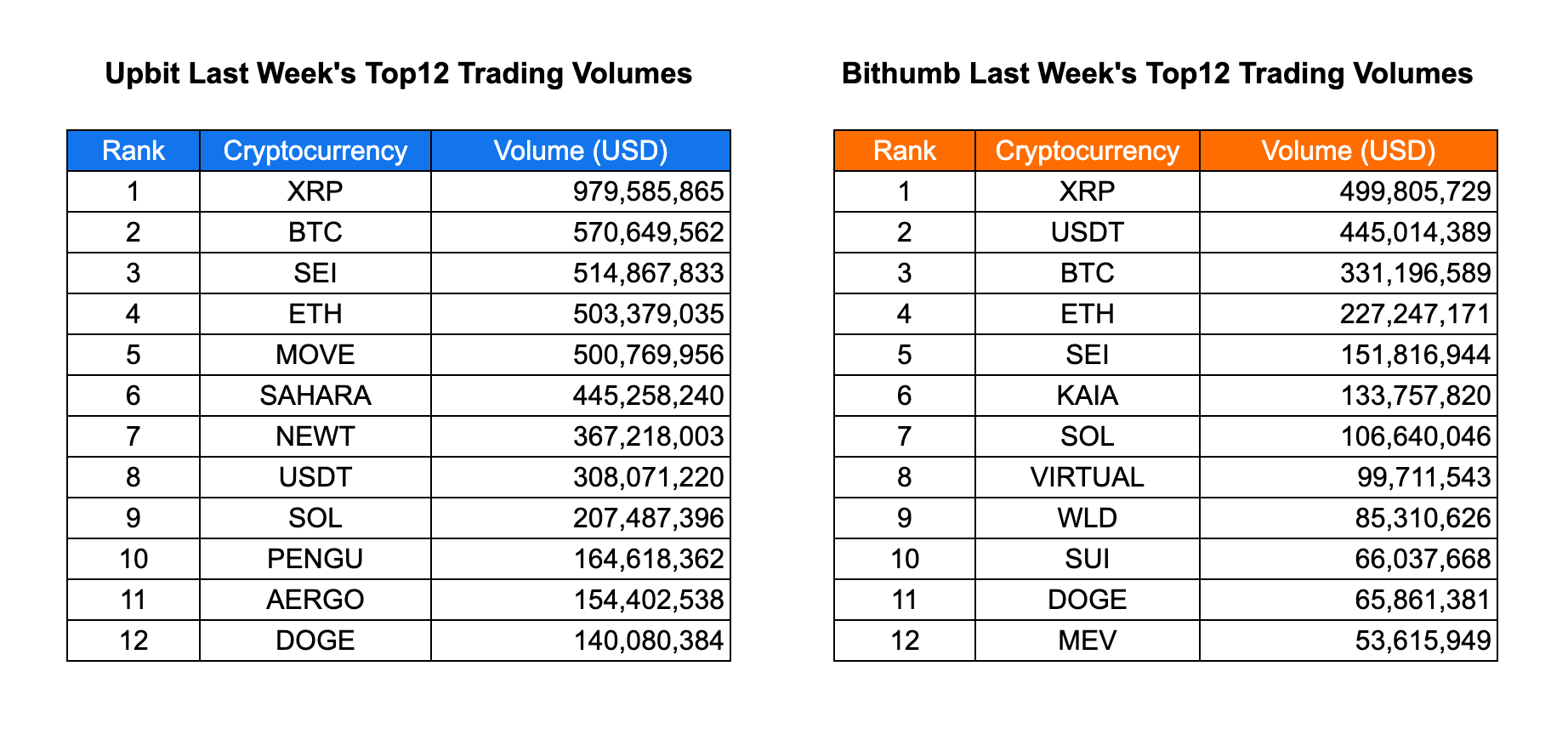

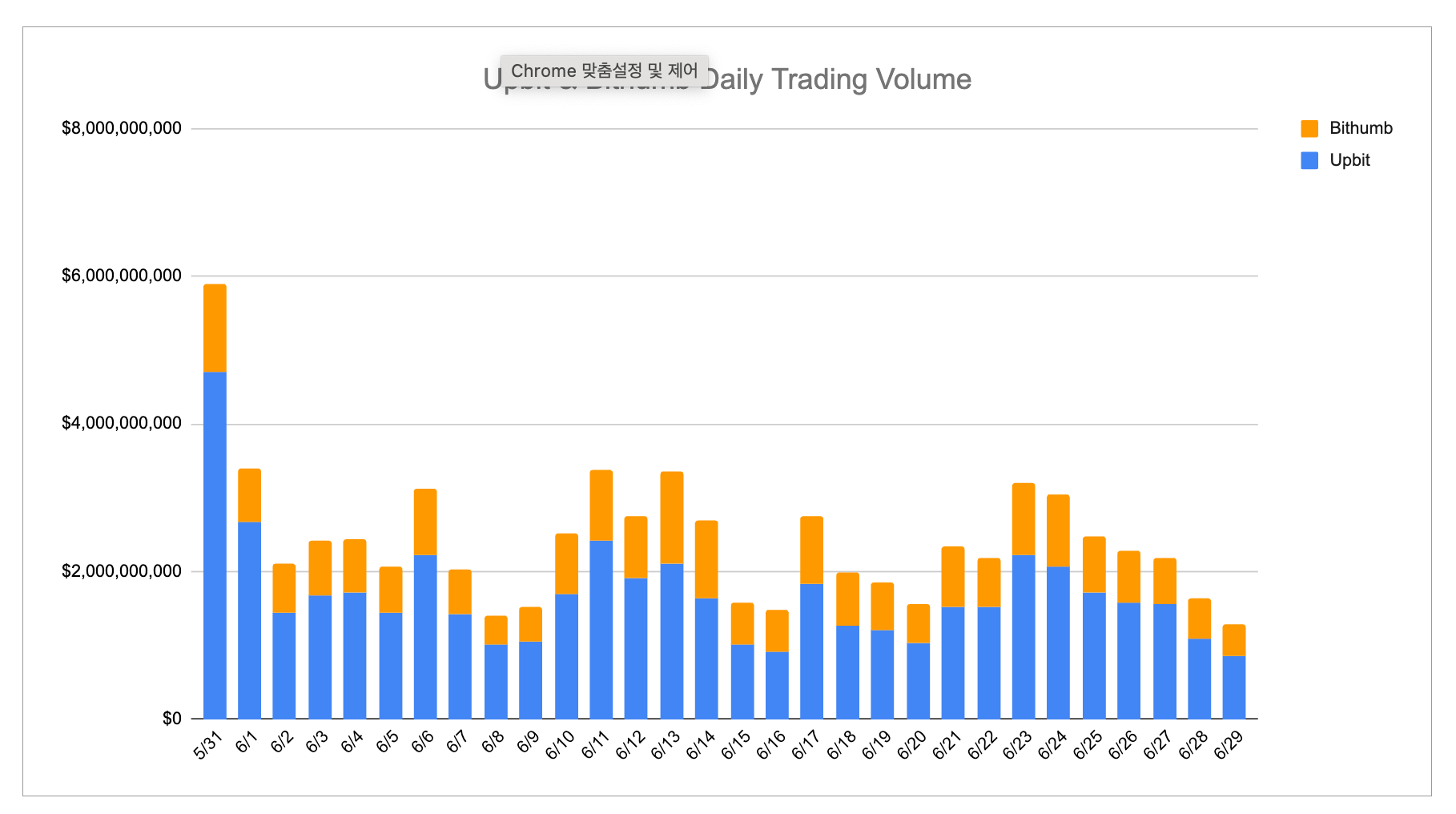

Upbit maintained strong overall trading momentum, with XRP once again taking the top spot with $979.6M in weekly volume, followed by BTC at $570.6M and SEI, which surged to $514.9M. Notably, newcomer MOVE recorded $500.8M, outperforming ETH and indicating sudden speculative demand. SAHARA, NEWT, and PENGU also entered the top 12, reflecting heightened volatility and user interest in emerging assets. Traditional majors like USDT, SOL, and DOGE remained in the top ranks, reinforcing their liquidity dominance. The overall volume trend from the monthly chart suggests a moderate rebound in June activity compared to the May trough.

On Bithumb, XRP also led with $499.8M, followed closely by USDT at $445M and BTC at $331.2M, showing alignment with Upbit on user preferences. However, SEI’s volume was significantly lower on Bithumb ($151.8M), pointing to a heavier concentration of SEI trading on Upbit. KAIA, VIRTUAL, and WLD continued to show localized interest, while MEV and SUI rounded out the chart with relatively modest but consistent volumes. The overlapping top tokens between the two exchanges—such as XRP, BTC, ETH, DOGE, and SOL—underline stable institutional and retail demand for high-liquidity assets, while divergences highlight retail-driven trends specific to each platform.

2-3. Top 10 Gainers

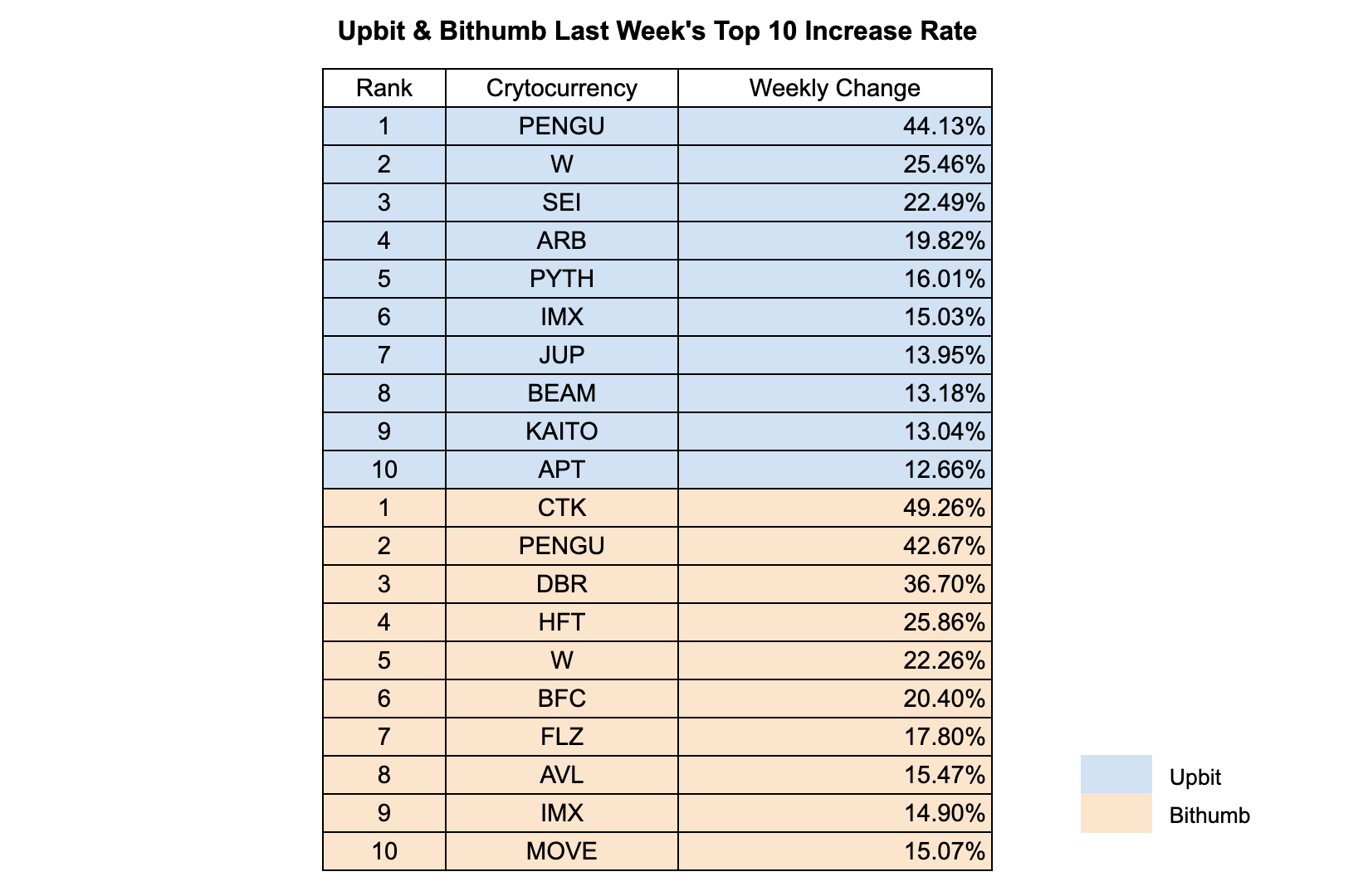

PENGU emerged as the standout performer across both Upbit and Bithumb, surging 44.13% and 42.67% respectively, fueled by retail enthusiasm and growing community traction. SEI also delivered consistent strength with a 22.49% gain on Upbit and 22.26% on Bithumb, maintaining momentum from recent ecosystem developments. Other notable winners included W (+25.46%), ARB (+19.82%), and PYTH (+16.01%) on Upbit, indicating renewed interest in Layer 2 and oracle infrastructure tokens.

On Bithumb, CTK led with a 49.26% rally—despite limited presence on Upbit—suggesting exchange-specific trading interest. DBR and HFT followed closely with strong double-digit gains, while BFC, FLZ, and AVL showed increasing engagement from Korean traders. IMX’s simultaneous appearance on both charts (+15.03% Upbit, +14.90% Bithumb) signals cross-platform recognition of gaming-related narratives, while MOVE’s 15.07% rise on Bithumb aligns with its sustained volume spike on Upbit earlier this month.

Overall, the week saw a shift in trader focus toward speculative mid-cap tokens and ecosystem plays, diverging slightly from the previous week's large-cap dominance.

3. Korean Community Buzz

3-1.Meetups Still Reign as the Hottest Meta

Meetups offering exclusive perks continued to dominate Korea’s crypto scene last week, with several projects drawing enthusiastic crowds. The standout was OpenLedger’s event, which saw over 1,500 registrations and more than 500 actual attendees—an unusually large turnout for a non-KBW period. Attendees remarked that they’d “never seen a crowd like this outside of KBW,” underscoring the event’s buzz. OpenLedger’s mascot, a giant octopus, became a viral sensation as photos of it being carved up circulated widely on social media.

3-2.The U.S. Stock Koreans Bought the Most

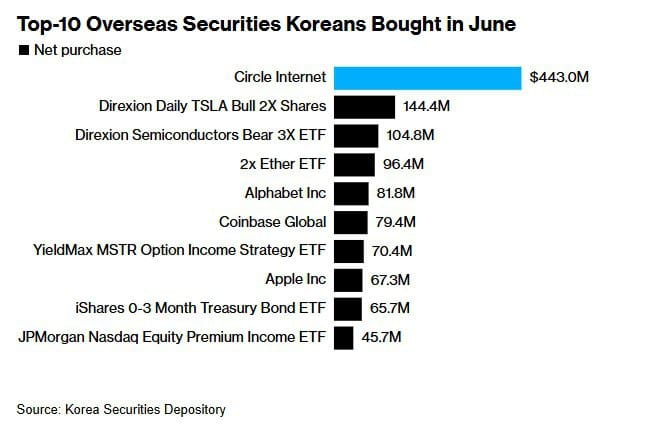

A tweet from ZeroHedge grabbed the attention of the Korean Web3 community last week:

“Thank South Korean momentum kamikazes for the insane move in CRCL shares. Circle has emerged as the hottest overseas stock among South Korean investors this month, underscoring the growing retail appetite for crypto-linked bets.” (BBG)

According to recent data, the top five U.S. stocks most purchased by Korean investors in June were:

- Circle (CRCL)

- Tesla (purchases doubled)

- X2 Ether ETF

- Alphabet

- Coinbase

Source: Infinity Hedge

3-3.Korea’s KOSPI vs. Ethereum: Who Hits 3,000 First?

A playful meme comparing Korea’s KOSPI index and Ethereum—both hovering in the high 2,000s—asked which would cross the 3,000 mark first. Last week, KOSPI claimed victory, surging past 3,100 for the first time in 3 years and 9 months. The index has climbed 19.25% over the past month and 28.82% year-to-date, the highest gain among major global stock markets.

Bloomberg attributes the rally to renewed political stability following President Lee Jae-myung’s inauguration and optimism around policies expected to strengthen retail investor protections, boosting market confidence.

Source: Naver News

4. Events

These days, there seems to be an increasing number of offline events taking place in Korea. This week, INF’d like to highlight some of the key side events that are scheduled to take place.

4.1. Sidekick Seoul · Community Mixer: Live, Trade and Earn

Sidekick Protocol is building an all-in-one real-time streaming trading platform where anyone can share live market information and trade instantly. They’re hosting an event in Korea, and a prize giveaway is also planned.

🕔 Date: Tuesday, July 1st, 6:00 PM – 9:00 PM

4.2. SAHARA AI MIXER : SEOUL 2nd Edition

Sahara AI is the first full-stack AI-native blockchain platform that enables anyone to contribute to AI development, create, and generate revenue. Having successfully completed the important milestone of its TGE, Sahara AI is kicking off the second half of 2025 by celebrating with the Korean community.

🕔 Date: Thursday, July 3rd, 6:30 PM – 9:30 PM

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!