Cooling Markets and Rising Caution in Korea

1. Market Overview

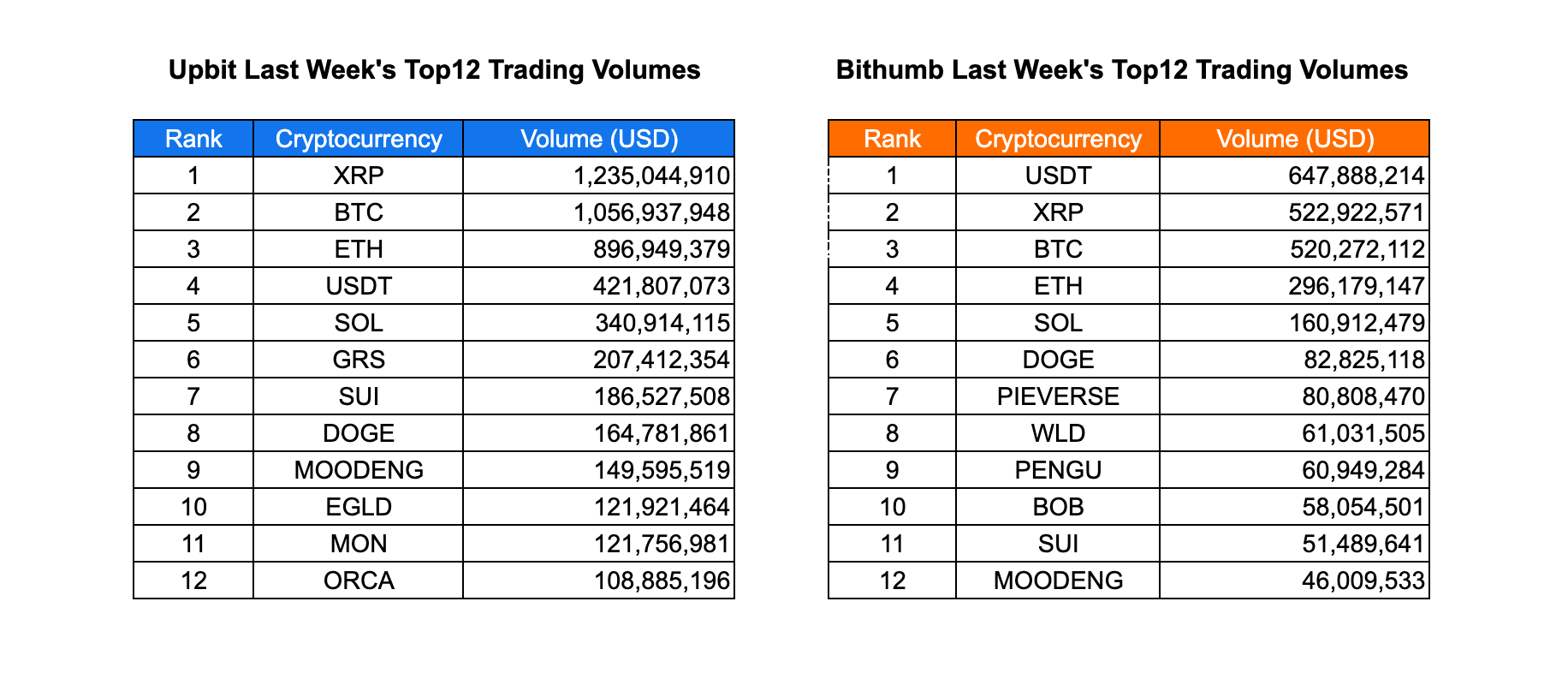

Last week, Bithumb expanded its KRW market with new listings for BOB, OriginTrail, and Sapien. Trading activity across Korean exchanges remained led by large-cap assets, with Upbit showing stronger overall volume than Bithumb throughout the week. On Upbit, XRP ($1.23B), BTC ($1.05B), and ETH ($896M) dominated turnover, while Bithumb was led by USDT ($648M) and XRP ($522M). Notably, SUI stood out as one of the few tokens ranking high on both exchanges—posting $186.5M on Upbit and $51.4M on Bithumb—highlighting sustained cross-platform interest even amid broader market rotation.

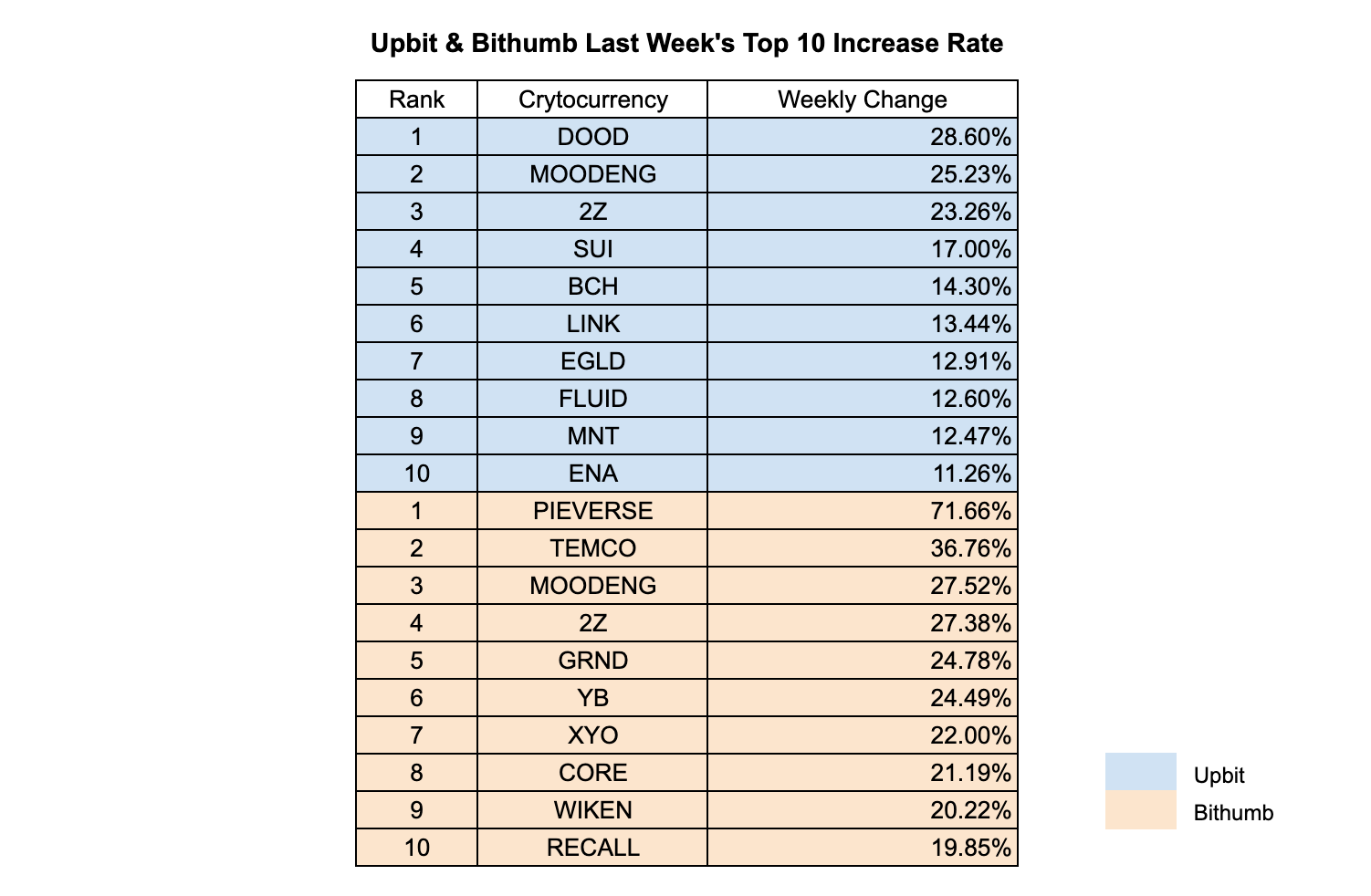

In terms of performance, Upbit gainers were led by DOOD (+28.6%), followed by MOODENG and 2Z, while SUI’s ~17% rise stood out as the most structurally meaningful move, supported by both rising price and strong dual-exchange volume. On Bithumb, PIEVERSE surged 71.66%, emerging as the most explosive mover of the week and reinforcing Bithumb’s reputation for sharp retail-driven spikes. Overall, the week’s standout narratives centered on SUI’s synchronized rise across both volume and price, DOOD’s momentum on Upbit, and PIEVERSE’s high-volatility rally on Bithumb—illustrating clear differences in trading behavior between Korea’s two major exchanges.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced a new listing:

- Bithumb listed BOB, OriginTrail and Sapien.

| Date | Upbit | Bithumb |

|---|---|---|

| 12/1 (Mon) | ||

| 12/2 (Tue) | ||

| 12/3 (Wed) | BOB (BOB) | |

| OriginTrail (TRAC) | ||

| 12/4 (Thu) | ||

| 12/5 (Fri) | Sapien (SAPIEN) |

Key Marketing Strategies & Takeaways

🔹 Sapien (SAPIEN)

Sapien was a rather unique case in that, prior to its TGE, it conducted virtually no marketing in Korea—resulting in almost no local user awareness.

After the TGE, Sapien began targeting the Korean market by leveraging major KOL channels. These KOLs started by introducing what Sapien is, then moved on to explaining its PoQ structure, token distribution, tokenomics, utility, and even post-TGE incentive activities that users could still participate in.

Rather than simply relaying information, the KOLs went further by analyzing the aggressive listing trends of Korean exchanges at the time. They highlighted that newly listed coins on Upbit tended to be projects already listed on Coinbase—something the Korean community refers to as having a “Coinbase color.” This narrative helped build strong local expectations for a potential domestic listing.

Korean crypto media outlets were also utilized to broaden awareness, allowing Sapien to reach not only active Telegram users but also a wider general audience.

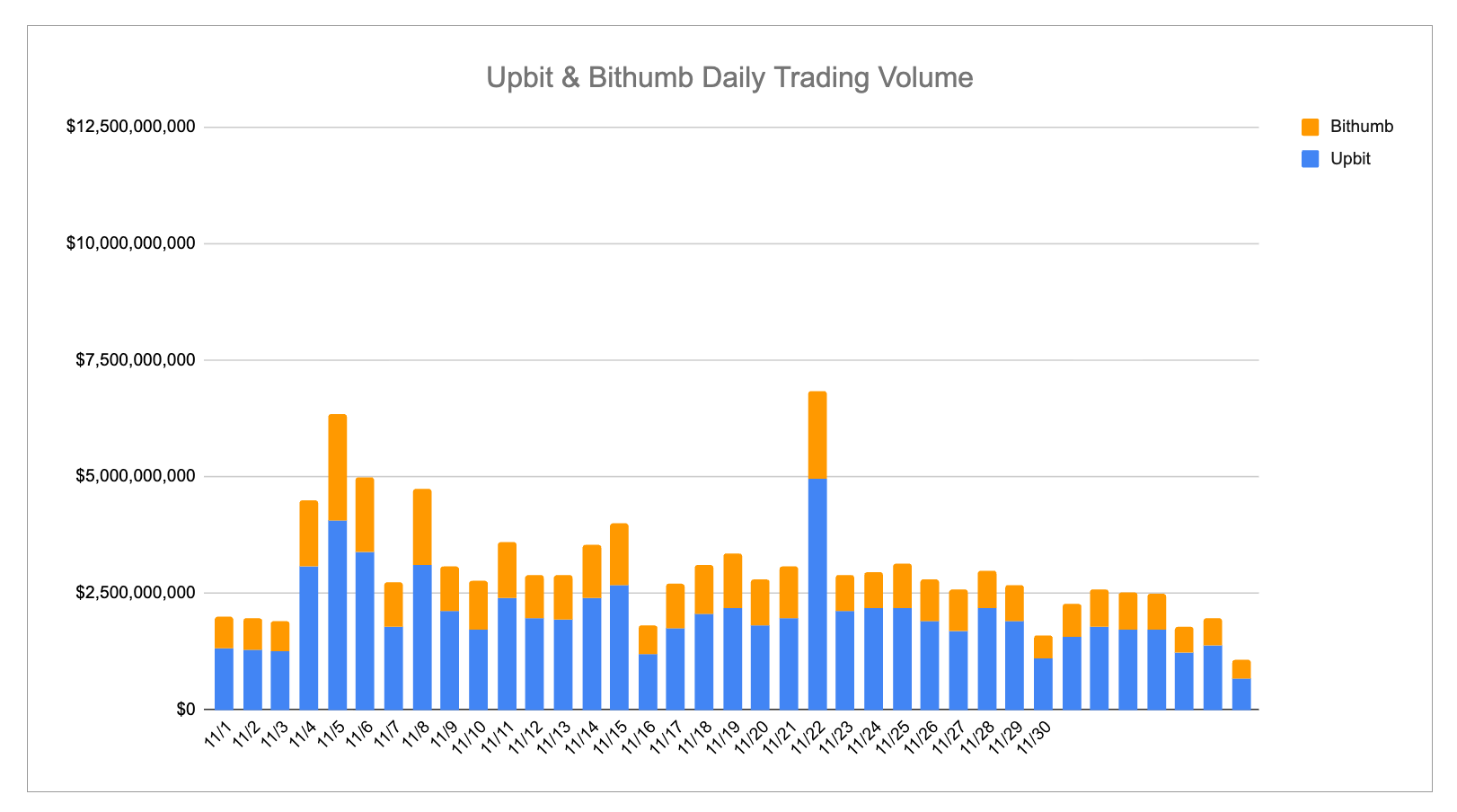

2-2. Trading Volume

Upbit recorded notably higher activity this week, led by XRP at USD 1.23B, followed by BTC at USD 1.05B and ETH at USD 896M, while Bithumb showed a more moderate profile with USDT (USD 648M) and XRP (USD 522M) at the top. Daily volumes across both exchanges showed several mid-week spikes, with Upbit consistently dominating the combined turnover. SUI stood out as one of the few assets appearing in the top-tier rankings on both exchanges, reaching USD 186.5M on Upbit and USD 51.4M on Bithumb, reflecting sustained trader interest despite broader market rotation.

XRP maintained its position as the most traded asset within Korea’s retail-driven market, with Upbit’s XRP volume more than doubling Bithumb’s, underscoring strong liquidity concentration. BTC held firm as the second most traded asset on both platforms, and its stable high-volume presence suggests persistent inflow from systematic traders. SUI joins these two as this week’s focused highlights, as its dual-exchange presence shows that interest is not isolated to a single community but distributed across both user bases, signaling that SUI continues to attract speculative and ecosystem-driven flows even in a competitive field.

2-3. Top 10 Gainers

Upbit’s weekly gainers were led by DOOD at 28.6%, followed closely by MOODENG and 2Z, but the more meaningful signal this week came from SUI, which posted a solid 17% rise. Unlike many short-lived meme rotations, SUI’s price movement aligned with its elevated trading volume on both Upbit and Bithumb, suggesting that the uptick was driven by sustained participation rather than a single liquidity pocket. BCH and LINK also delivered steady gains, contributing to a broader mid-cap recovery on the exchange.

Bithumb showed a very different profile with PIEVERSE surging 71.66%, far outpacing the rest of the list and reinforcing the exchange’s reputation for sharp, retail-driven spikes. TEMCO and MOODENG followed with strong double-digit gains, but SUI’s presence on Upbit rather than Bithumb highlights a split in investor behavior between the two platforms. Overall, the week’s standout narratives came from SUI’s concurrent rise in both volume and price, DOOD’s leadership on Upbit amid concentrated momentum, and PIEVERSE’s outsized performance on Bithumb, marking it as the week’s most explosive mover across Korean markets.

3. Korean Community Buzz

3-1. High FX Pressure Returns as KRW Weakness Persists

Korea’s prolonged high FX environment has become a growing concern not only for Web3 users who rely heavily on USDT, but also for U.S. stock traders and corporate treasury managers. With the KRW continuing to weaken, many in the market believe increased liquidity in the system has contributed to the currency’s depreciation. While the Bank of Korea acknowledged that overall liquidity has expanded, it denied deliberate monetary easing, framing the situation instead as the result of asset reallocation.

In response, the government has begun applying direct pressure on financial institutions to defend the won. Measures include urging large corporations to reduce USD hoarding by linking policy loans to FX conversion behavior, and launching inspections on securities firms’ overseas investment marketing. Among traders, the consensus is that currency volatility is now a macro risk factor that cannot be ignored in crypto positioning.

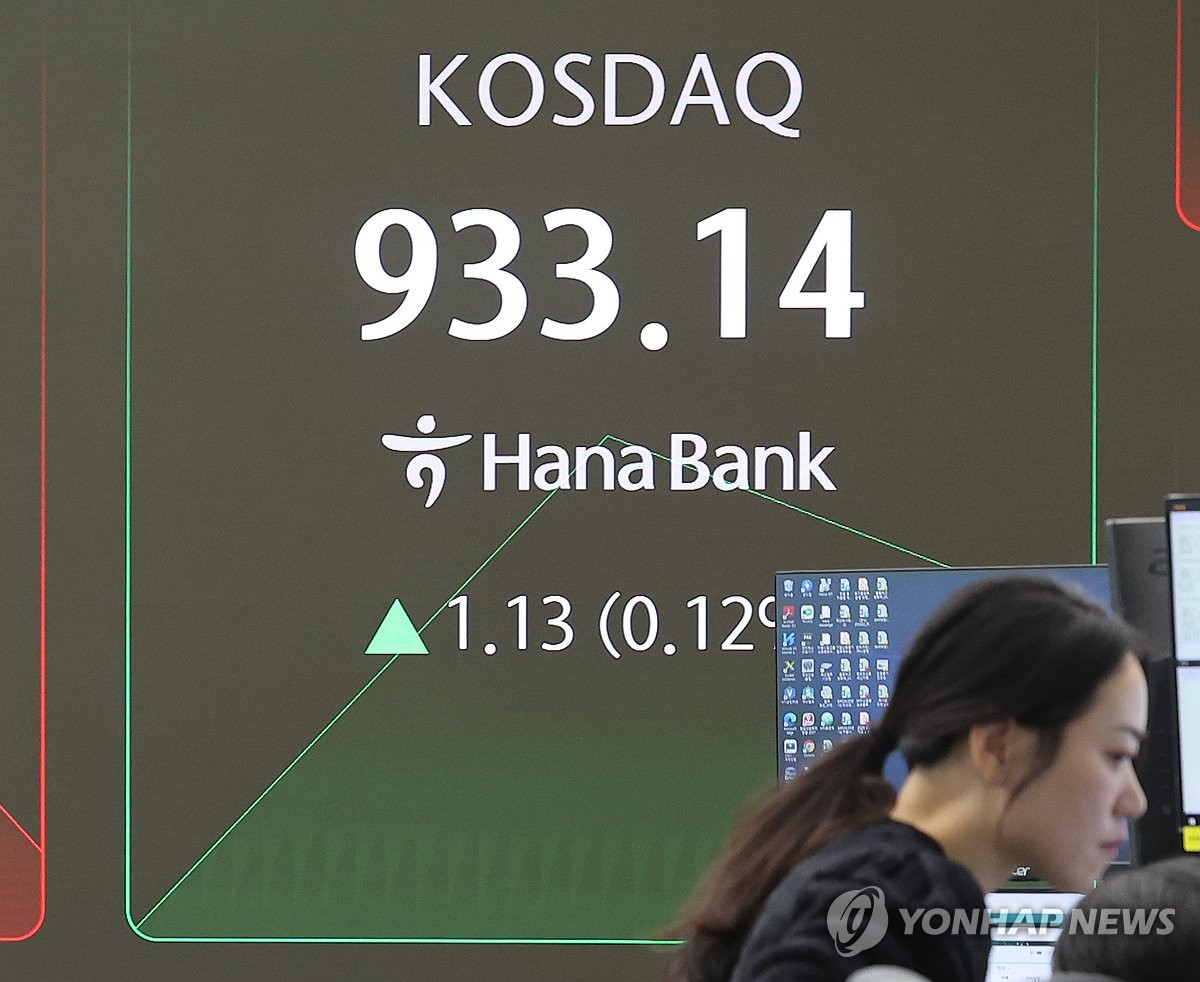

3-2. Korean Government Moves to Revive KOSDAQ

Capital has started to rotate into KOSDAQ as the government shifts its focus toward stimulating the venture-capital ecosystem. Since the new administration took office, KOSPI has surged 48%, while KOSDAQ lagged with a 23% rise—until recently. On July 4, KOSDAQ’s intraday market capitalization surpassed KRW 500 trillion for the first time, signaling a change in momentum.

Policy discussions now center on expanding tax benefits for KOSDAQ venture funds and increasing pension fund allocations into smaller-cap equities. While past government-led KOSDAQ boosts typically lost steam within a year, investors are watching closely to see whether this iteration—backed by more concrete capital flow mechanisms—can drive a longer-term shift in risk appetite across traditional and digital asset markets.

3-3. Massive Personal Data Leak Triggers Security Alarm in Crypto Community

A major personal data breach at Coupang last week exposed information from over 30 million users, potentially leading to regulatory fines exceeding KRW 1 trillion based on last year’s revenue. Public reaction escalated quickly, with signs of mass account deletions, boycott movements, and class-action lawsuits already forming. Fears of secondary damage continue to spread among consumers.

Inside the Korean crypto community, the incident directly reignited security discussions. Traders emphasized stricter self-protection measures such as mandatory OTP usage, diversified password patterns, and full 2FA adoption across exchanges and wallets. The breach served as yet another reminder that in Web3, operational security is increasingly seen as an individual responsibility—not just a platform issue.

4. Upcoming Meetup

FOLKS Seoul Meetup: Leading Crosschain DeFi

📆 Date: 12. 08 (Mon) 19:00 ~ 23:00

💼 Host: FOLKS

Luma: https://luma.com/74jh88ie?tk=2VDzgE

ORBS Year-End Meetup

📆 Date: 12. 09 (Tue) 19:00 ~ 22:00

💼 Host: ORBS

Luma: https://luma.com/4zgy4cfl?tk=pvFn9h

Sentient Winter Social Hour — Seoul Edition

📆 Date: 12. 09 (Tue) 19:00 ~ 22:00

💼 Host: Sentient

Luma: https://luma.com/5334k9r0?tk=iwHzxZ

Fraction AI Seoul Summit

📆 Date: 12. 10 (Wed) 18:00 ~ 21:00

💼 Host: Fraction AI

Luma: https://luma.com/dujjpfug?tk=HFKLJD

Katana Korea Community Meetup

📆 Date: 12. 11 (Thu) 19:00 ~ 22:00

💼 Host: Katana

Luma: https://luma.com/6vzzvwsh?tk=iAyNT8

Onchain on the Ground: Korea

📆 Date: 12. 12 (Fri) 18:00 ~ 23:30

💼 Host: Uniswap

Luma: https://luma.com/418juk78?tk=EhawDS

Decibel x Merkle: Seoul Christmas Perp Day

📆 Date: 12. 13 (Sat) 12:00 ~ 15:00

💼 Host: Decibel x Merkle

Luma: https://luma.com/ip5hkvfw?tk=cR5oB2

Fogo Day in Korea - Mainnet Party

📆 Date: 12. 13 (Sat) 14:00 ~ 17:00

💼 Host: Fogo

Luma: https://luma.com/FogoKR?tk=iRKgJe

Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!