Bybit–Korbit Talks, Tax Delay Rumors, a Week With No New Listings

1. Market Overview

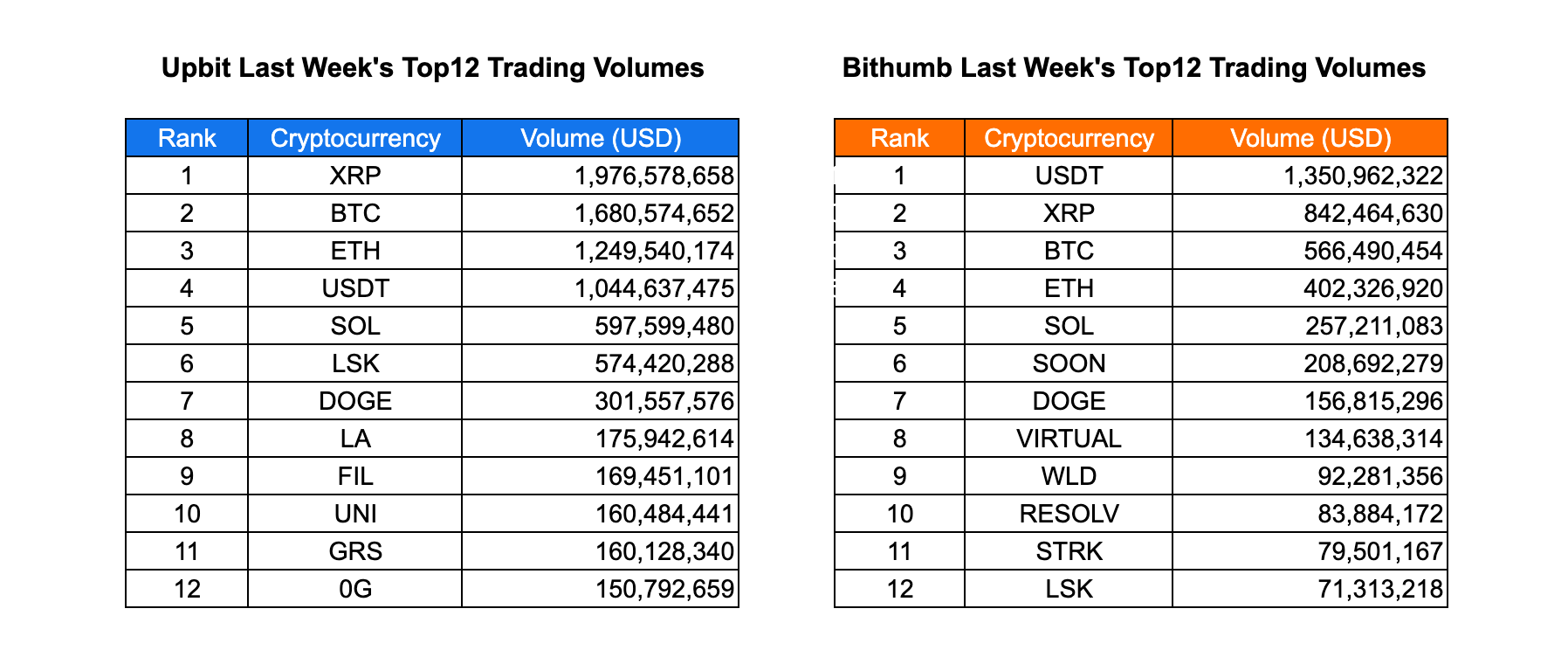

Last week, Upbit maintained a clear lead in trading activity, with XRP ($1.98B), BTC ($1.68B), and ETH ($1.25B) driving most of the volume. Bithumb showed a similar structure but with a stronger tilt toward USDT ($1.35B) as the dominant trading pair.

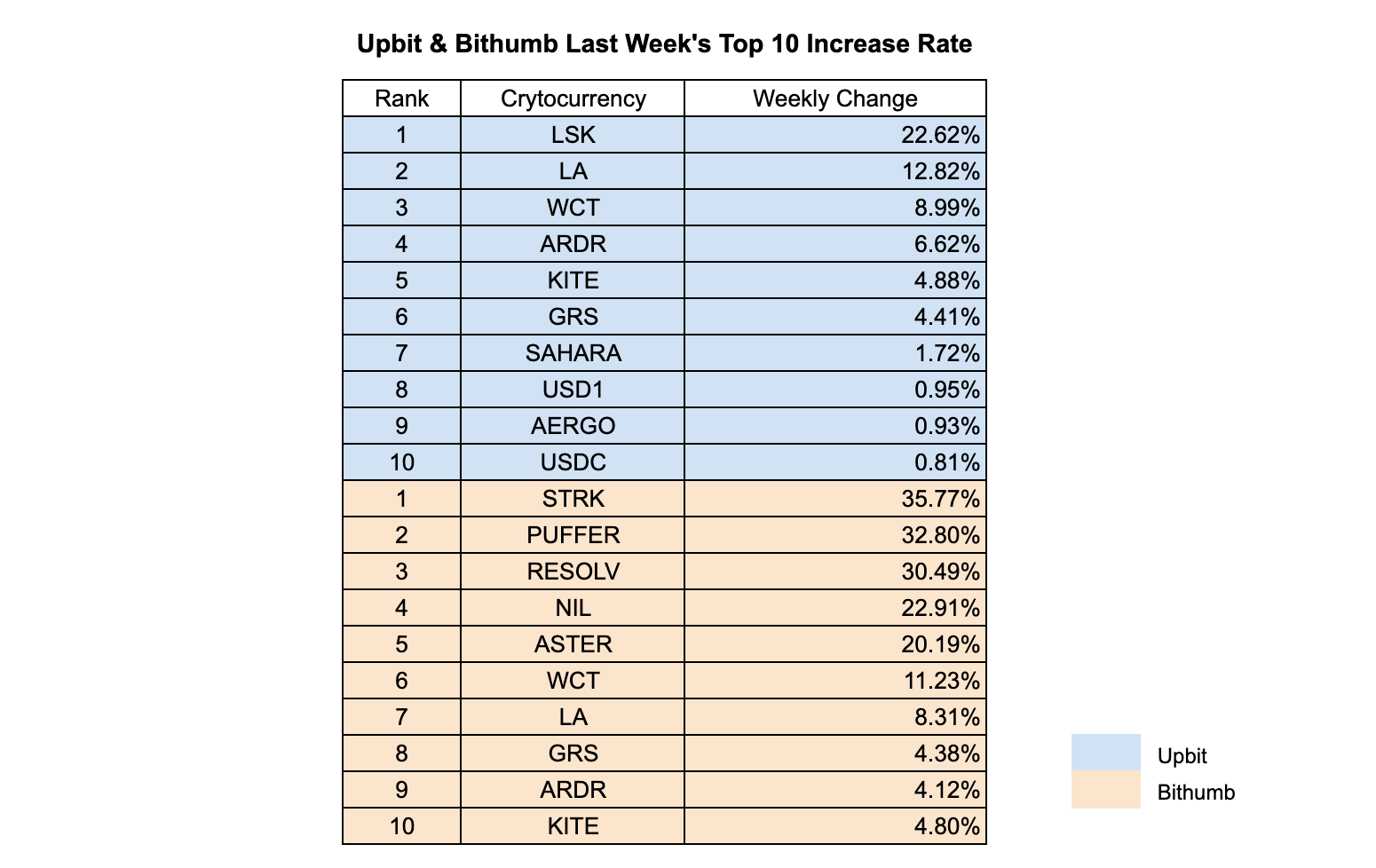

Market performance was mixed across exchanges. Upbit saw moderate gains led by LSK (+22.62%), LA (+12.82%), and WCT (+8.99%), reflecting selective demand for mid-cap assets. Meanwhile, Bithumb exhibited higher volatility, with STRK (+35.77%), PUFFER (+32.80%), and RESOLV (+30.49%) outperforming on strong speculative flows. Tokens like LA and WCT appeared in both exchanges’ top ranks, signaling consistent cross-market interest.

2. Exchanges

2-1. Newly Listed Coins

Last week, no major Korean exchanges announced any new listing.

2-2. Trading Volume

Last week, Upbit recorded XRP as the top traded cryptocurrency with a volume of $1.98 billion, followed by BTC at $1.68 billion and ETH at $1.25 billion. USDT and SOL also maintained significant trading activity, with volumes exceeding $1 billion and $597 million, respectively. On Bithumb, USDT led the trading volumes at $1.35 billion, while XRP and BTC followed with $842 million and $566 million, respectively. ETH and SOL also showed notable activity with $402 million and $257 million in trading volumes.

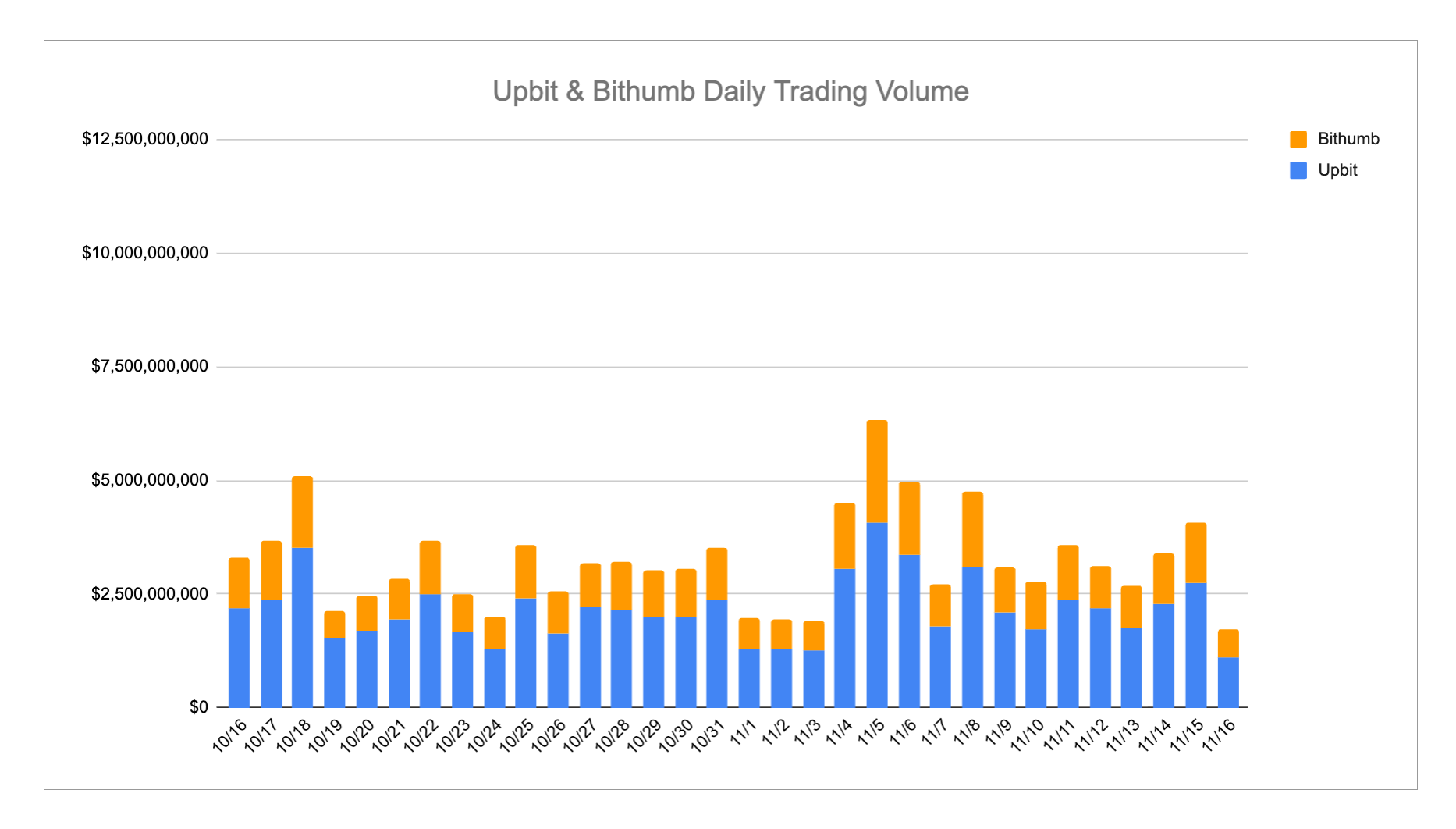

Daily trading volume analysis shows that Upbit consistently contributed the majority of combined volume across the week, with peaks observed around 11/16. Bithumb’s volume, while lower than Upbit on most days, spiked notably in mid-week, reflecting increased market activity on certain days. Overall, the total daily volumes indicate a steady level of trading engagement, with occasional surges likely driven by high-volume transactions in the top cryptocurrencies.

The distribution of trading volumes suggests that XRP, BTC, and ETH remain the core drivers of market liquidity on both exchanges, while USDT’s dominance on Bithumb highlights its role as a primary stablecoin for trading. SOL, DOGE, and other altcoins contributed smaller portions but maintained steady activity, indicating diversified investor interest across both platforms.

2-3. Top 10 Gainers

Last week, Upbit and Bithumb exhibited divergent momentum in cryptocurrency performance, with notable strength observed across mid-cap tokens. Upbit’s market showed moderate gains led by LSK, which surged 22.62%, followed by LA at 12.82% and WCT at 8.99%, indicating a steady investor interest in projects with active developments and liquidity support. The lower end of the top 10 saw smaller increments, with USDC and AERGO registering under 1%, reflecting stable demand for utility and stablecoins.

On Bithumb, the top gainers demonstrated more pronounced volatility. STRK led the pack with a 35.77% increase, while PUFFER and RESOLV rose 32.80% and 30.49%, respectively, signaling speculative trading and short-term accumulation. NIL and ASTER also recorded double-digit growth, highlighting a broader market appetite for emerging altcoins. Mid-tier tokens like WCT and LA showed moderate gains, bridging both platforms’ overlapping interests.

Overall, LSK, STRK, and PUFFER emerged as the most noteworthy performers across the two exchanges, with WCT and LA maintaining consistent presence in both top 10 lists. The week reflected selective optimism in smaller-cap projects, while larger-cap stablecoins and utility tokens remained relatively steady.

3. Korean Community Buzz

3-1. Bybit reportedly moves to acquire Korbit

Global crypto exchange Bybit, currently ranked second worldwide by derivatives volume, is reportedly in talks to acquire Korbit, Korea’s fourth-largest exchange. Founded in 2018, Bybit rose quickly on the back of user-friendly futures trading and is now making its first direct move into the Korean market.

This follows Binance’s acquisition of Gopax last month, signaling a new wave of foreign exchanges entering Korea via M&A. Regulatory sentiment also appears to be shifting — the

Financial Intelligence Unit (FIU) recently approved Binance’s executive change request for Gopax after two and a half years of review, which many interpret as a green light for foreign exchanges to establish a domestic presence.

3-2. Fourth delay possible for Korean crypto tax

The Capital Market Research Institute has raised the possibility of a fourth postponement of Korea’s long-awaited crypto tax implementation. Research Fellow Kim Gap-rae noted that despite multiple legislative attempts, the 2025 income tax reform bill still lacks core updates necessary for fair taxation of digital assets.

As of mid-2024, Korea had over 10.7 million verified exchange users, nearly matching the number of domestic stock investors. Yet, due to ongoing gaps in tax infrastructure and unclear classification of crypto income, the introduction of a crypto tax has been delayed three times since 2021 and may be pushed back once again.

3-3. Upbit’s “UPclass” quiz campaign for college entrance exam week

Phase 2 of the stablecoin deposit program opened at 11 p.m. KST, and participation remained intense. Throughout the afternoon, users shared tips on how to pre-approve USDC via contract to speed up deposits, and when the page finally went live, thousands were waiting to enter at the exact second.

However, the experience was far from smooth.

During Phase 1, the community discovered that insiders and VCs had already deposited before any public announcement, which created significant backlash. For Phase 2, the team emphasized that deposits would only be possible through the official website at launch time — leading many to believe lessons were learned.

But in the middle of the event, the project abruptly reversed its rules, changing from a strict per-person cap of $1M to unlimited deposits with proportional allocation. On top of that, users struggled with the site failing to sign transactions properly, forcing some to try dozens of different country VPNs.

As a result, concerns grew about site reliability, transparency, and whether user funds are truly safe. KOLs like WeCryptoTogether stepped in to collect complaints and communicate directly with the team. For those who succeeded, allocation day was a win — but overall sentiment now reflects a mix of excitement, distrust, and fatigue from repeated technical issues.

4. How many event updates are waiting for us this week?

4.1 K-Builders Meetup

✔️Date: Nov 20th

✔️Time: 17:00 PM - 16:00 PM KST

✔️Space: RVSP

4.2 Billions x Lagrange Soccer Meetup

✔️Date: Nov 29th

✔️Time: 15:00 PM - 17:00PM KST

✔️Space: RVSP

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!