AERGO Volatility Dominates Korean Market Amid Declining Volumes

—Meanwhile, ETH Seoul & BUIDL Asia Kept the Community Buzzing Offline

1. Market Overview

This week, the Korean crypto market showed mixed signals with declining trading volumes but significant activity in select assets. AERGO dominated as the standout performer with extreme volatility, recording $3.9 billion in trading volume on Upbit and $241 million on Bithumb after announcing a merger with Alpha Quark (AQT), though both exchanges designated these assets as cautionary.

Both major exchanges listed WalletConnect (WCT) this week, with Bithumb also adding KernelDAO (KERNEL). WalletConnect saw strong price performance post-listing, while KernelDAO traded below its listing price despite previous recognition from a Binance Labs investment. Meanwhile, the community's attention was largely focused on ETH Seoul and BUIDL Asia 2025 events, which facilitated valuable networking between Korean and international crypto participants.

On the regulatory front, the Financial Services Commission expanded its crackdown by blocking 14 Apple App Store apps linked to unregistered overseas crypto providers, following similar restrictions on Google Play last month. This suggests potential broader access restrictions in the future as Korean authorities continue to tighten regulations on unregistered virtual asset service providers.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Arkham.

- Bithumb listed Elixir, Orbiter.

| Date | Upbit | Bithumb |

|---|---|---|

| 4/14 (Mon) | ||

| 4/15 (Tue) | ||

| 4/16 (Wed) | WalletConnect (WCT), KernelDAO (KERNEL) | WalletConnect (WCT) |

| 4/17 (Thu) | ||

| 4/18 (Fri) |

Key Marketing Strategies & Takeaways

🔹 WalletConnect (WCT)

WalletConnect is already a familiar name among on-chain users — especially those active in airdrop farming — and not just retail traders on domestic exchanges. Hype around the token launch initially spiked with the release of the Season 1 airdrop checker, but momentum quickly faded due to the absence of sustained marketing efforts.

However, renewed interest emerged when news of listings on global exchanges broke. Korean KOL marketing campaigns soon followed, focusing on introducing the project, breaking down the token mechanics, and promoting the new Korean community through entry campaigns and Launchpool reminders.

This well-timed push proved effective: just two days after the overseas listing, WalletConnect was added to both Upbit and Bithumb, where it delivered strong early price performance.

🔹 KernelDAO (KERNEL)

KernelDAO began gaining attention in late 2024 after securing an investment from Binance Labs, though one of its components, KelpDAO, had already made a name for itself during the height of the restaking narrative earlier that year.

In the two months leading up to its TGE, KernelDAO ramped up efforts in the Korean market through KOL activations, ambassador programs, and strategic updates around airdrop plans, tokenomics, and development news.

This period also coincided with a spike in BNB-based activity — such as Binance Wallet IDOs and Launchpool campaigns — making KernelDAO, a BNB restaking protocol, more relevant in the local narrative.

Following last week’s listing of Babylon, KernelDAO marks Bithumb’s second consecutive BTCFi listing, suggesting a growing interest in the BTCFi sector among Korean exchanges.

*Both projects appear to have coordinated KOL marketing in Korea ahead of their TGE. However, only WalletConnect managed to convert that momentum into high trading volume and strong price performance post-listing. By contrast, KernelDAO has struggled to gain traction, with lower volume and price action currently sitting below its listing price, despite its ecosystem relevance.

2-2. Trading Volume

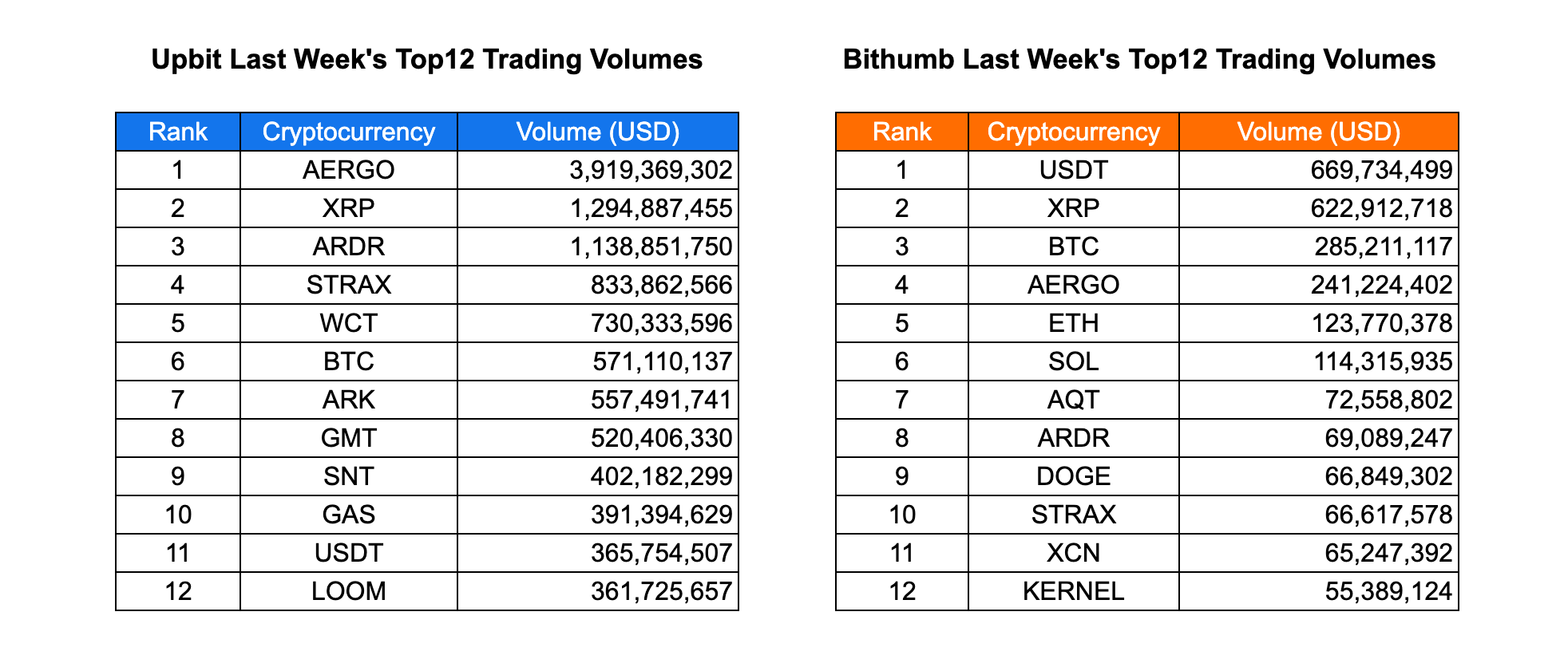

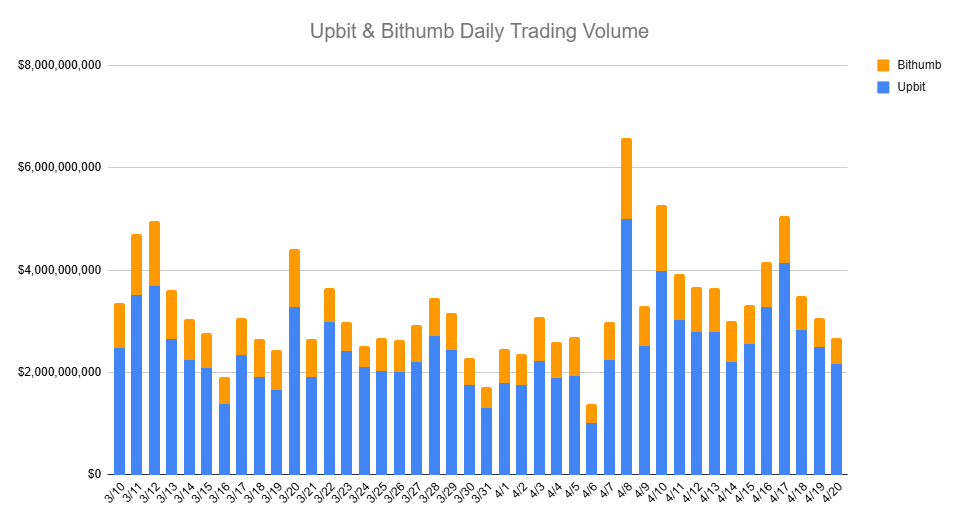

Trading activity on South Korea's top two cryptocurrency exchanges, Upbit and Bithumb, showed daily average volumes of $2.8 billion and $727 million respectively last week. While overall trading volume decreased compared to the previous week, the market exhibited bearish characteristics, with trading activity notably concentrated around a few select assets, particularly XRP, which topped the trading volume rankings on both platforms.

The standout token in terms of trading volume this week was AERGO. Despite the overall bearish market conditions, it recorded the highest trading volume on both major exchanges, with approximately $3.9 billion on Upbit and $241 million on Bithumb. AERGO, a Korea-originated token (often referred to as a "Kimchi Coin"), experienced extreme volatility over the past ten days—surging more than 10x, then plunging over 75% in a single day.

The rally was primarily driven by the announcement of a merger with Alpha Quark (AQT) earlier this month, which was perceived as a bullish catalyst. In response to the heightened volatility and speculative activity, both Upbit and Bithumb designated AERGO and AQT as cautionary assets. Despite the warning labels, trading activity intensified, ultimately fueling a sharp price spike followed by a rapid correction.

In contrast, other major tokens showed relatively muted activity. XRP posted volumes of $1.3 billion on Upbit and $623 million on Bithumb, while Bitcoin saw $571 million on Upbit and $285 million on Bithumb—figures that did not stand out significantly in the current market context.

2-3. Top 10 Gainers

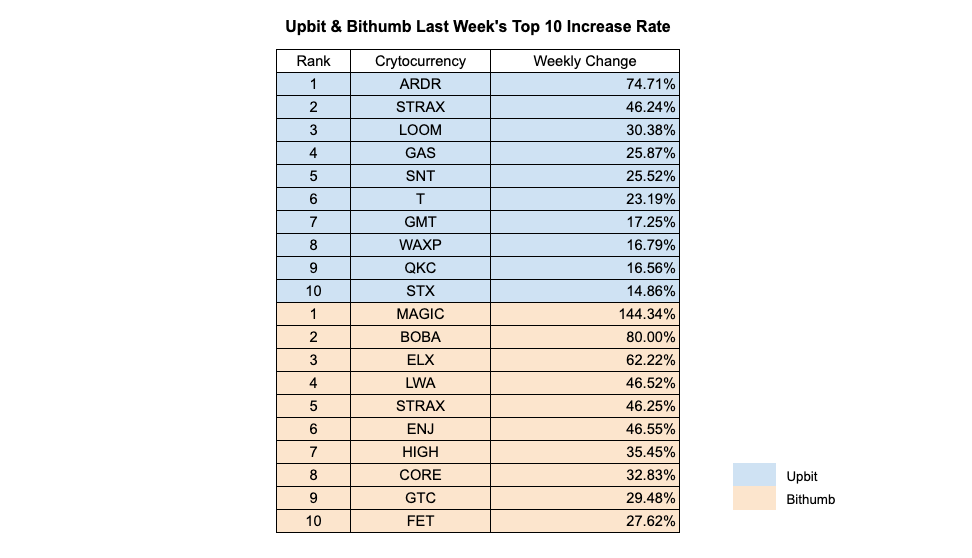

In contrast to the previous week, the top-performing assets on Upbit and Bithumb showed significant divergence, with no overlapping tokens in the top 10 performers except for STRAX.

On Upbit, ARDR led the gains with a 74% weekly return, followed by STRAX at 46% and LOOM at 30%. The remainder of the top-performing tokens saw moderate gains in the mid-teens to mid-20% range, showing a pattern similar to the previous week.

On Bithumb, performance was notably stronger, with MAGIC surging 144%, making it the week's standout performer across both exchanges. BOBA followed with an impressive 80% gain, while ELX posted 62%. Other notable assets included LWA, STRAX, and ENJ, all recording gains of approximately 46%.

This divergence in weekly returns highlights the differing momentum and trading dynamics between South Korea's two largest exchanges.

3. Key News from Social Media

3-1. ETH Seoul & BUIDL Asia Take Over the Week

Last week was all about ETH Seoul and BUIDL Asia 2025, and the Korean crypto community was buzzing both online and offline. Telegram channels were flooded with meetup recaps, and one theme stood out above the rest: food.

It seems the narrative that “you have to serve good food at crypto events” has taken hold in Korea — and most organizers stepped up. Many attendees commented that the quality of meals was surprisingly high, even at casual gatherings.

Some critics joked that these events were turning into "food meetups with a side of crypto,” but others highlighted the value of global projects flying in to engage directly with the Korean market. For many international guests, it was their first time hearing local insights directly from Korean builders and users.

For industry folks, the value was clear: free venue, free food, and everyone you’d want to meet in one place. Whether you’re a developer, founder, investor, or community manager, it was a rare opportunity to connect — and many attendees shared that they made great contacts.

3-2. Bithumb Highlights Female Crypto Traders on YouTube

Bithumb’s YouTube series "B-Salon" gained popularity thanks to appearances by well-known Korean crypto KOLs — and their latest episode took a fresh angle.

Titled “Quitting My Job to Go Full-Time Crypto: Stories from Female Traders,” the video featured three women: a YouTuber, a Telegram KOL, and a former Bithumb Trading Competition winner. They shared their personal journeys in crypto trading, sparking conversations around gender and risk-taking in the Korean Web3 scene.

🔗 Click to watch the full video

3-3. FSC Expands App Blocklist to Apple Devices

On April 11, Korea’s Financial Services Commission (FSC) began blocking 14 Apple App Store apps linked to unregistered overseas virtual asset providers.

This move follows the March 25 block on Google Play apps and targets the same group of exchanges: KuCoin, MEXC, Phemex, Bitrue, CoinW, CoinEX, ZoomEX, Poloniex, BTCC, Blofin, CoinCatch, DOEX, WEEX, and BitMart.

As these enforcement actions continue, many expect Korea’s Broadcasting and Communications Commission to implement broader access restrictions in cooperation with FSC.

🔗 Official FSC announcement (KR)

4. Events

ETH Seoul has wrapped up successfully, and everyone is slowly returning to their everyday routines. BTC has now surpassed $86K, and here in Korea, we’re welcoming a warm and vibrant spring.

We’d like to share another AMA update—this time, not about one that already happened, but about an upcoming AMA happening this week.

4.1. STP Network x Wecrypto

STP Network AMA today at 10 PM KST on WeCrypto’s X Space.

STP is about to undergo a rebranding to AWE, and they’re preparing to launch a new product that combines the concept of Autonomous Worlds with AI elements. Join us for the AMA to hear more details directly from the team!

4.2 Falcon AMA with Fireant x Wecrypto

An AMA about Falcon, the stable coin developed by DWF, will be held on April 22 at 9 PM KST. It will be a great opportunity to hear detailed information and the latest updates directly from the team!

The AMA will be proceed through the Discord

4.3 Sui AMA with Fireant

Sui, currently ranked in the TOP 15 by market cap, will be joining Fireant KOL for an AMA this Wednesday at 9 PM KST. (Youtube channel)

Pre-submitted questions for the AMA are open to anyone who has always been curious or wanted to ask the team something. So, if you have any questions about Sui or the Sui ecosystem, now is a great time to ask!

Kelly, who manages the Sui Korean community, will also be participating in the AMA!

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!