A Week of New Listings and Cross-Exchange Momentum

1. Market Overview

Last week, Korea saw coordinated listings across both major exchanges, with Upbit and Bithumb each adding Kite AI, Momentum, and Intuition.

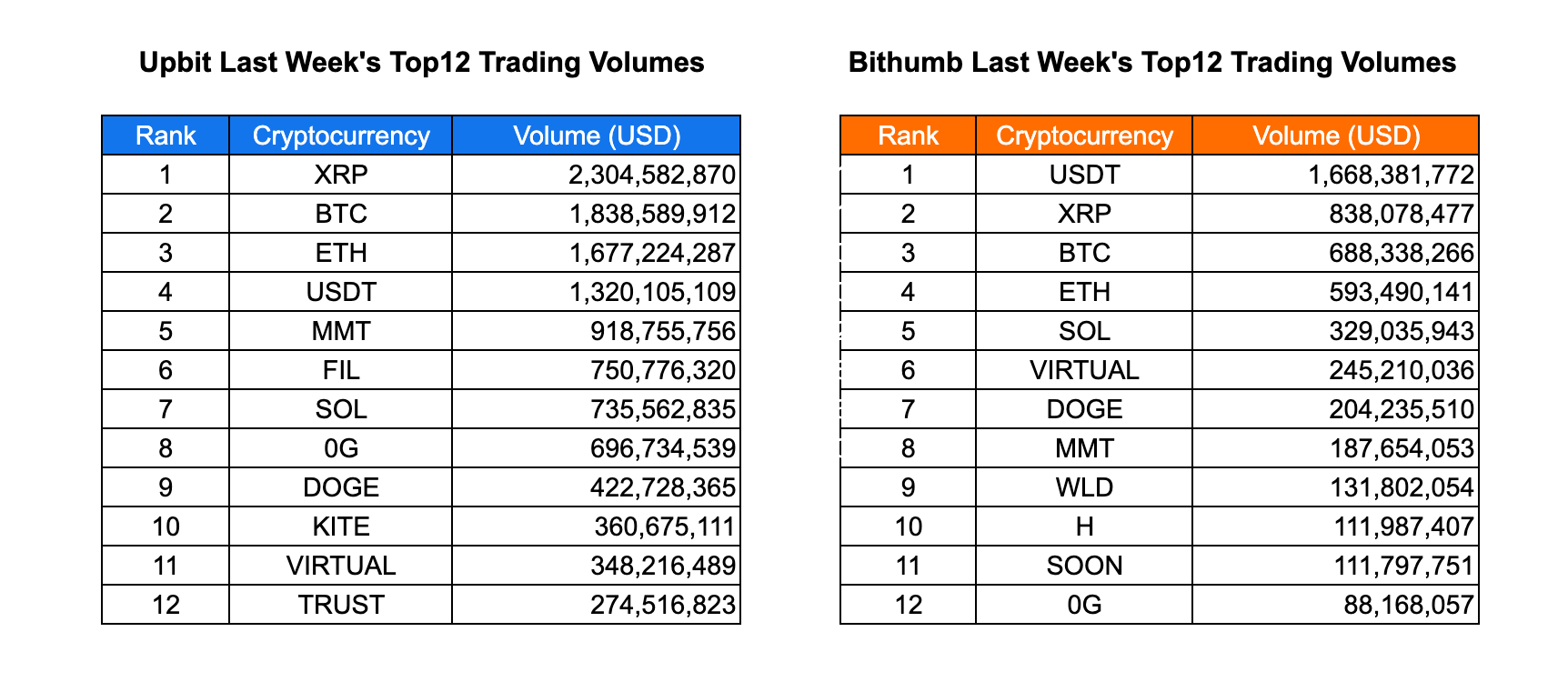

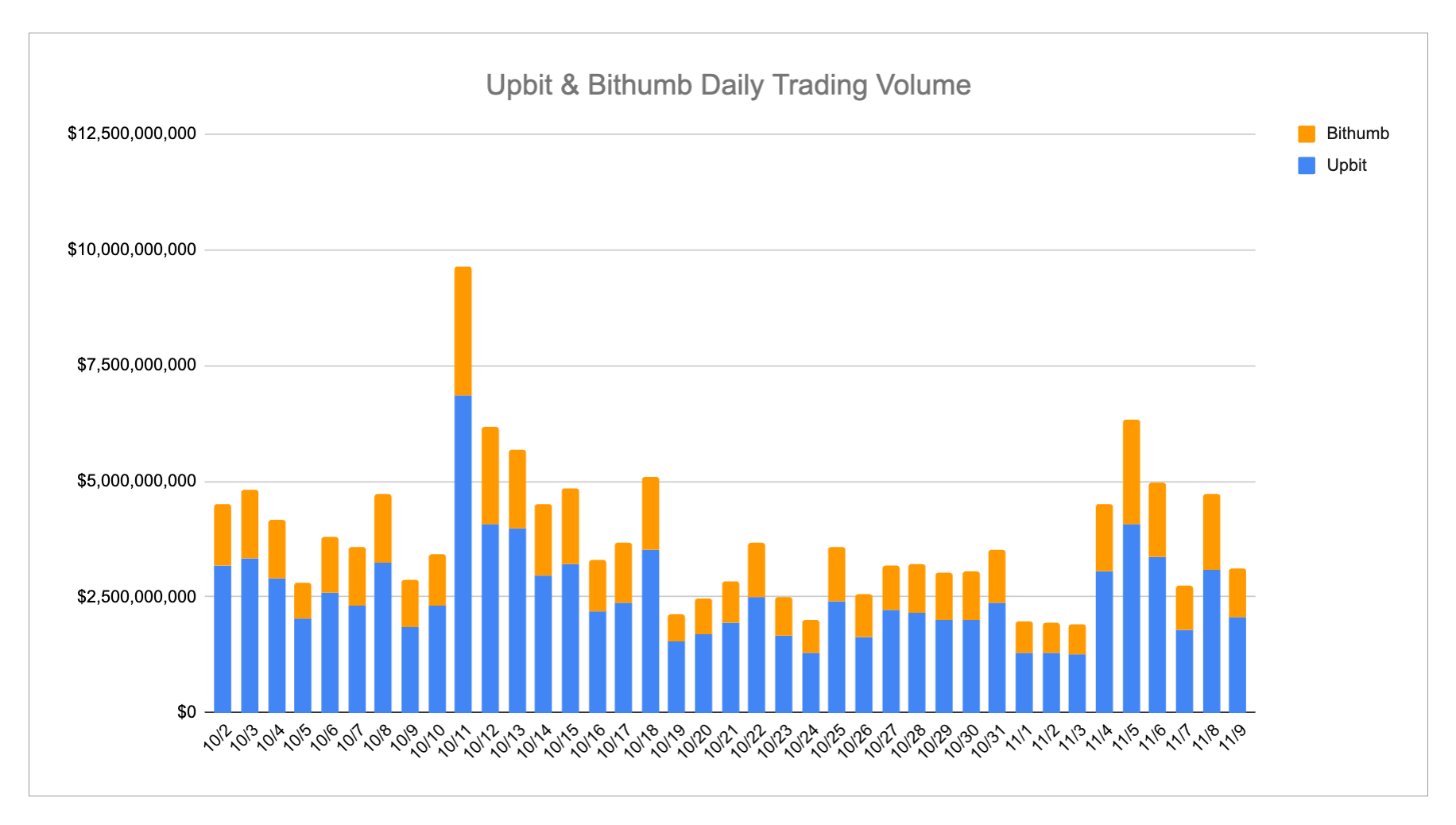

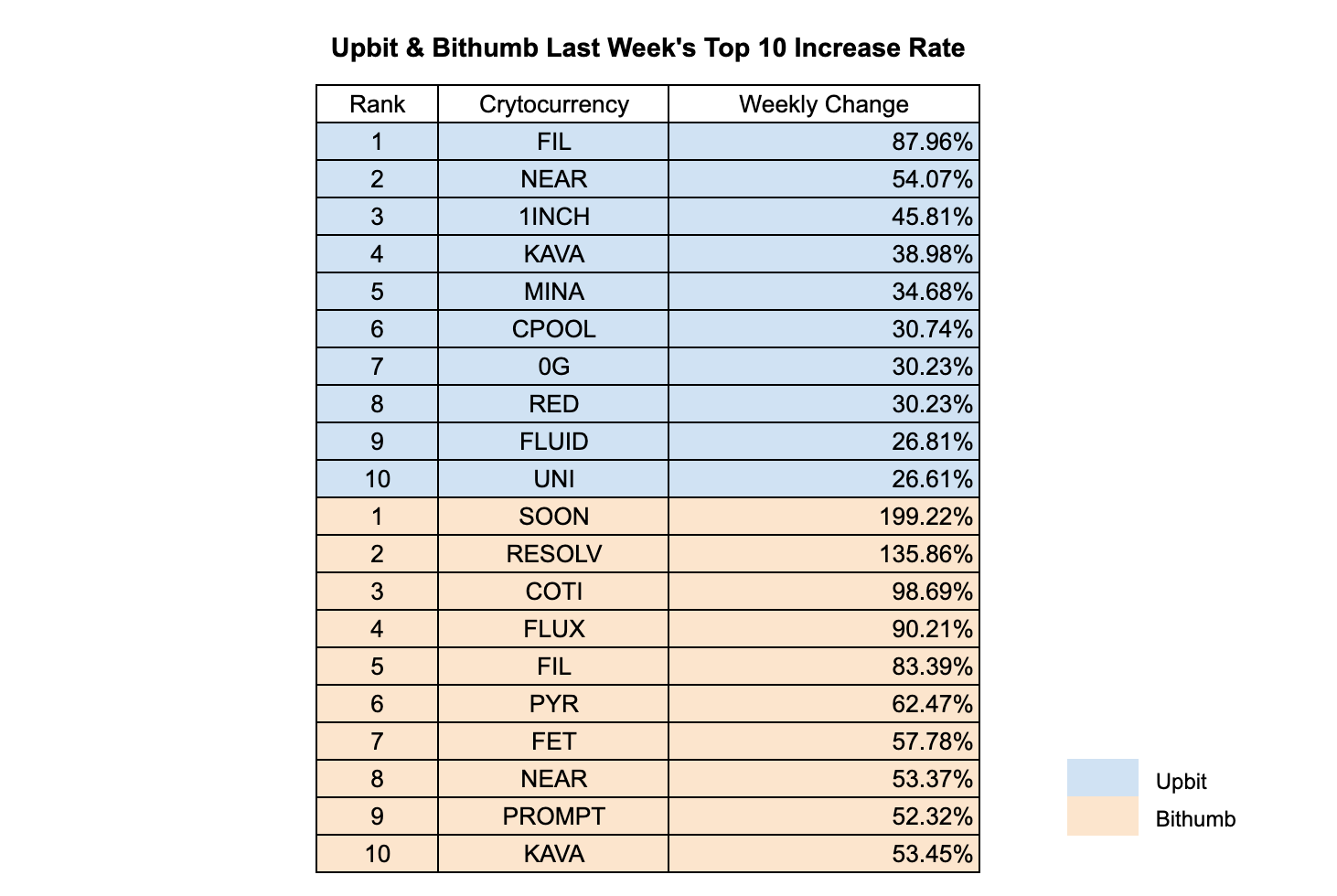

On the trading side, Upbit maintained clear volume dominance, led by XRP ($2.3B), BTC ($1.8B), and ETH ($1.68B), while Bithumb activity remained more stablecoin-driven with USDT ($1.67B) topping the exchange. Mid-tier tokens like MMT, SOL, and DOGE appeared across both platforms, but liquidity was significantly deeper on Upbit. Multiple volume spikes occurred throughout the week, including a major peak near $10B combined volume on 10/12, primarily driven by Upbit trades. Performance-wise, FIL (+87.96%), NEAR (+54.07%), and 1INCH (+45.81%) led gains on Upbit, while SOON (+199.22%) and RESOLV (+135.86%) posted outsized surges on Bithumb. The pattern reinforced a familiar dynamic: Upbit favoring large-cap momentum and balanced mid-caps, while Bithumb showed sharper speculative flows into smaller assets.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced several new listings:

- Upbit listed Kite AI, Momentum and Intuition

- Bithumb listed Kite AI, Momentum and Intuition

| Date | Upbit | Bithumb | |

|---|---|---|---|

| 11/3 (Mon) | Kite AI (KITE) | Kite AI (KITE) | |

| 11/4 (Tue) | Momentum (MMT) | ||

| 11/5 (Wed) | Momentum (MMT), Intuition (TRUST) | Intuition (TRUST) | |

| 11/6 (Thu) | |||

| 11/7 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Kite AI (KITE)

Kite AI was a project that some early Korean Web3 users discovered and participated in during its initial stages. Recognizing this early traction, the Kite AI team became interested in the Korean market, later visiting the country and realizing the need for a localized marketing strategy. As a result, Kite AI’s Korean marketing initiative can be seen as a textbook example of a well-executed KOL-driven campaign.

The campaign began by announcing Kite AI’s investment from PayPal Ventures—a narrative that strongly resonated with market sentiment at the time—through major Korean KOL channels. This announcement effectively marked the beginning of Kite AI’s marketing activities in Korea. Following this, the team launched a Korean Telegram community and organized opening events to attract and engage new members.

During Korea Blockchain Week (KBW), Kite AI co-hosted an event with PayPal Ventures and held side events alongside other well-known projects in Korea. Through these activities, the project not only strengthened its presence within the local Web3 community but also expanded its recognition among retail users.

Shortly thereafter, Kite AI initiated a multi-week joint campaign involving several Korean KOLs—a strategy that has recently become common in the Korean market. Each week, participants were encouraged to engage with KOL posts, listen to AMAs, or complete specific missions, and then create organic content such as personal insights, reviews, or research-style posts. Top contributors were rewarded with Kite AI NFTs or local gift items like department store vouchers, coffee coupons, and fried chicken gift cards.

This approach effectively encouraged the community to gain a deeper understanding of the project while generating significant social exposure. As a result, many Web3 projects have begun adopting similar KOL-based marketing strategies in Korea.

Kite AI’s campaign achieved exceptionally high engagement rates and generated high-quality community content, ultimately contributing to the project’s successful KRW pair listings on both Upbit and Bithumb, Korea’s leading exchanges.

2-2. Trading Volume

Last week, Upbit and Bithumb showed distinct trading volume patterns, reflecting differing investor preferences on each platform. Upbit’s total trading was heavily led by XRP, BTC, and ETH, with XRP reaching $2.3 billion, followed by BTC at $1.8 billion and ETH at $1.68 billion, indicating strong activity in major cryptocurrencies. Meanwhile, Bithumb’s trading volume was dominated by USDT at $1.67 billion, followed by XRP and BTC, highlighting stablecoin-driven trading on that exchange. Smaller-cap tokens like MMT, SOL, and DOGE also appeared in the top ranks on both exchanges, though volumes were comparatively lower on Bithumb.

Daily trading trends illustrate several spikes throughout the week, with a notable peak around 10/12 where combined volumes from both exchanges nearly reached $10 billion, driven primarily by Upbit activity. Overall, Upbit maintained consistently higher daily volumes than Bithumb, reflecting stronger engagement on its platform, while Bithumb contributed a significant but smaller portion of the total trading activity.

The distribution of top-performing assets further emphasizes platform-specific preferences: Upbit traders favored XRP, BTC, and ETH, whereas Bithumb saw USDT leading the volumes, suggesting higher stablecoin trading demand. Both exchanges showed activity across mid-tier tokens, reflecting investor interest beyond the largest cryptocurrencies, though Upbit displayed broader diversity in its top 12 traded assets.

2-3. Top 10 Gainers

Last week, the Korean crypto market saw notable rallies across multiple tokens, with both Upbit and Bithumb exhibiting strong momentum in different segments. On Upbit, FIL led the surge with an 87.96% increase, followed by NEAR at 54.07% and 1INCH at 45.81%, reflecting growing investor interest in layer-1 and interoperability-focused projects. KAVA, MINA, and CPOOL also saw double-digit gains above 30%, indicating broader market appetite for mid-cap tokens. Overall, the Upbit top 10 gainers displayed a balanced mix of DeFi, NFT-related, and infrastructure tokens, signaling diversified market enthusiasm.

Bithumb presented a slightly different landscape, with SOON achieving an extraordinary 199.22% increase, and RESOLV rising 135.86%, highlighting the platform’s more speculative activity and response to smaller-cap tokens. COTI and FLUX also posted substantial gains of 98.69% and 90.21%, respectively, while FIL, PYR, and FET gained between 57% and 83%, overlapping partially with Upbit’s trending assets. The divergence between the two exchanges’ top performers suggests that Bithumb saw heavier activity in emerging, high-volatility projects, whereas Upbit’s gains were concentrated among more established tokens.

Cross-exchange trends indicate FIL and NEAR were consistent performers, appearing in the top 10 on both platforms with over 50% growth, reflecting strong cross-market demand. KAVA also showed synchronized growth across exchanges, while other tokens such as SOON and RESOLV experienced outsized gains predominantly on Bithumb. The mix of mainstream and high-risk, high-reward tokens in this week’s top gainers points to continued investor interest in both established crypto assets and smaller speculative projects.

3. Korean Community Buzz

3-1. Dunamu hit with 35.2B KRW fine

Korea’s FIU imposed a 35.2 billion KRW (≈ 24M USD) fine on Dunamu (Upbit operator) after identifying ~8.6 million violations related to customer verification and transaction restrictions under the Special Financial Information Act.

While the penalty amount was lower than many feared, the community response is mixed. Some see this as a positive turning point — resolving a year-long regulatory issue that may speed up Upbit’s business license renewal. Others worry this may set a precedent for similar or harsher measures on remaining exchanges. Bithumb and Coinone are now in the spotlight as traders speculate on who might face the next ruling, and whether any exchange could be forced to suspend operations.

(Source)

3-2. Will Korea approve a Bitcoin spot ETF?

Korea’s ruling party publicly urged financial regulators to allow Bitcoin spot ETFs, stating that if law changes are required, they will push for amendments during the current parliamentary session.

The announcement immediately ignited community debate:

- Optimists see this as a path toward long-awaited institutional money and a sign that Korea may align with the U.S., Hong Kong, and other global markets.

- Skeptics question whether political promises will translate into real action, emphasizing that Korean regulators have historically taken a conservative stance on crypto financial products.

Still, this is the strongest political message to date advocating for domestic Bitcoin spot ETF approval — and the market is watching closely.

(Source)

3-3. Stable deposit fever

Phase 2 of the stablecoin deposit program opened at 11 p.m. KST, and participation remained intense. Throughout the afternoon, users shared tips on how to pre-approve USDC via contract to speed up deposits, and when the page finally went live, thousands were waiting to enter at the exact second.

However, the experience was far from smooth.

During Phase 1, the community discovered that insiders and VCs had already deposited before any public announcement, which created significant backlash. For Phase 2, the team emphasized that deposits would only be possible through the official website at launch time — leading many to believe lessons were learned.

But in the middle of the event, the project abruptly reversed its rules, changing from a strict per-person cap of $1M to unlimited deposits with proportional allocation. On top of that, users struggled with the site failing to sign transactions properly, forcing some to try dozens of different country VPNs.

As a result, concerns grew about site reliability, transparency, and whether user funds are truly safe. KOLs like WeCryptoTogether stepped in to collect complaints and communicate directly with the team. For those who succeeded, allocation day was a win — but overall sentiment now reflects a mix of excitement, distrust, and fatigue from repeated technical issues.

4. How many event updates are waiting for us this week?

4.1 Theoriq Community Meetup

✔️Date: Nov 10th

✔️Time: 18:00 PM - 22:00 PM KST

✔️Space: RVSP

4.2 [a16z] zerochat with johann / ursa

✔️Date: Nov 12th

✔️Time: 11:00 AM - 12:00PM KST

✔️Space: RVSP

4.3 Billions Korean Meetup — Yappers & Community

✔️Date: Nov 14th

✔️Time: 17:00 PM - 20:00 PM KST

✔️Space: RSVP

It’s been an exciting week in Korea, with various events taking place and a dynamic market keeping us all on our toes! Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!