A Quiet Market, Shifting Signals in Korea’s Crypto Scene

1. Market Overview

Last week, trading activity across Korea’s major exchanges stayed relatively steady, with volumes still concentrated in large-cap assets. On Upbit, ETH, XRP, and BTC continued to dominate turnover, showing that traders are prioritizing liquidity and “safer” majors in a soft market. USDT also remained highly active, reflecting a continued preference for flexibility and quick positioning rather than broad risk-on rotation into altcoins. Bithumb leaned even more stablecoin-heavy, with USDT leading volume again, followed by XRP and BTC. While some smaller-cap tokens briefly appeared near the top ranks, the pattern looked more like short, retail-driven bursts than sustained allocation. Price action mirrored this: Upbit’s top gainers were mostly smaller-cap names with tactical spikes, while Bithumb’s gainers were largely different—highlighting how momentum remains fragmented and exchange-specific rather than signaling a unified altcoin cycle.

2. Exchanges

2-1. Newly Listed Coins

Last week, major Korean exchanges introduced a new listing:

- Bithumb listed Allora and Stable.

| Date | Upbit | Bithumb |

|---|---|---|

| 12/8 (Mon) | ||

| 12/9 (Tue) | Allora (ALLO) | |

| 12/10 (Wed) | ||

| 12/11 (Thu) | Stable (STABLE) | |

| 12/12 (Fri) |

Key Marketing Strategies & Takeaways

🔹 Stable (STABLE)

Stable entered the Korean market at a favorable time, backed by Tether as a strong and credible supporter.

Positioned as a stablecoin infrastructure project with Tether as its backer, Stable was able to quickly build brand recognition among Korean users. This credibility served as a solid foundation for continued KOL marketing efforts, which ultimately delivered strong results.

At the early stage of its Korea entry, the Stable team focused on meeting key KOLs in the Korean market, introducing the project’s vision and learning how to effectively approach Korea’s uniquely structured Web3 ecosystem. This two-way exchange helped the team better understand local market dynamics while establishing early trust with influential voices.

Proactively organizing dedicated sessions with leading KOLs—often regarded as the primary speakers of Korea’s Web3 market—enabled faster and deeper communication. This approach allowed KOLs to gain a clearer understanding of the project, which later translated into more effective and authentic marketing activities.

Another factor that created positive synergy was the presence of Plasma, a project with a similar concept and the same Tether backing, which was preparing for its TGE around the same period. Plasma’s TGE achieved notably strong results, leading many market participants to naturally associate Stable with a project of comparable scale and potential.

As a result, KOLs organically shaped a narrative that Stable would follow a similar trajectory, fostering the expectation that participation would be highly desirable once an opportunity became available. While this could be interpreted as setting a strong upper benchmark, that benchmark was already perceived as sufficiently high, allowing Stable to leverage it indirectly rather than being constrained by it.

Following this phase, Stable further strengthened its positioning by announcing investment rounds, participating in major events such as KBW, and actively engaging with the community through AMAs. These efforts reinforced both project credibility and community trust.

All of these elements accumulated over time, leading to significant community engagement when deposits were eventually opened in a form that was realistically accessible to general users.

Overall, Stable’s Korean marketing strategy serves as a strong reference case for projects with similar concepts or scale, particularly in terms of market positioning, narrative building, expectation management, and successfully converting interest into actual participation.

2-2. Trading Volume

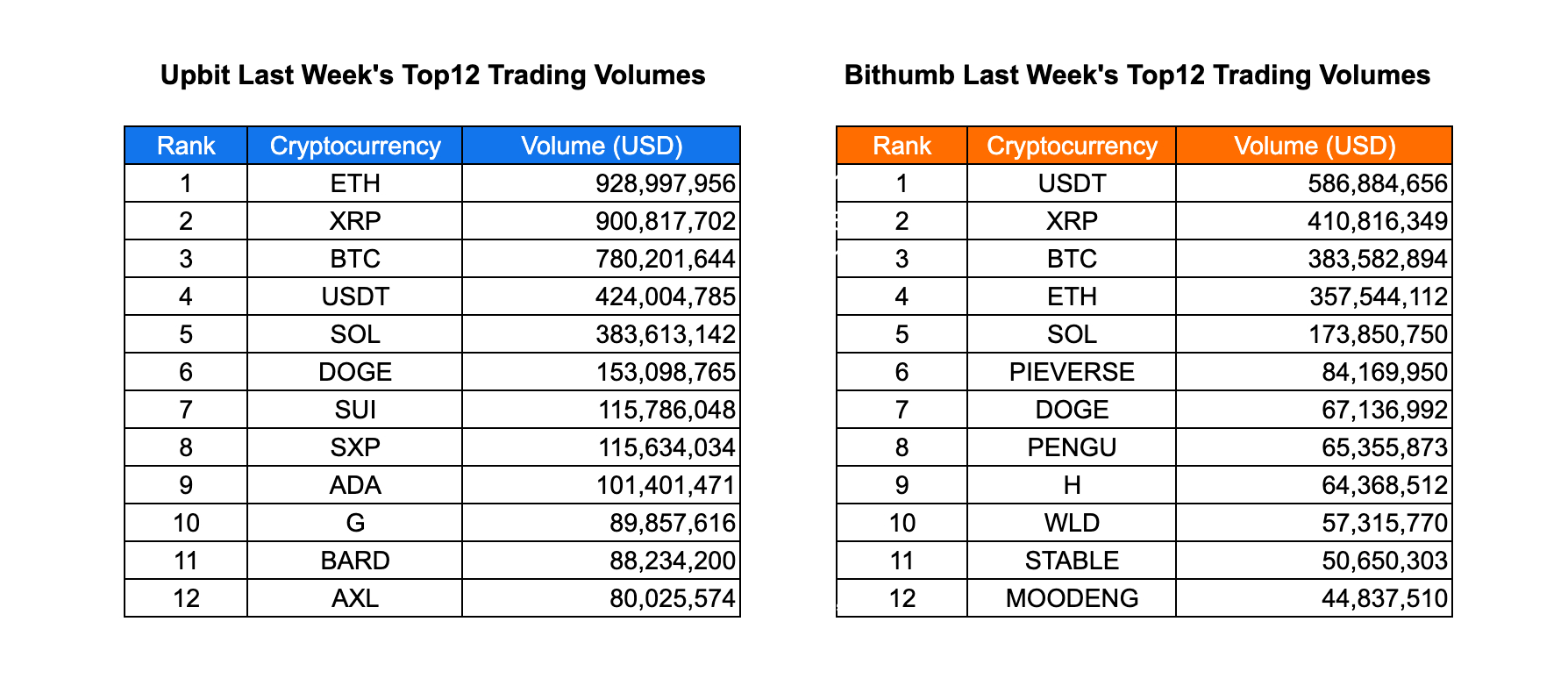

Trading activity across Korea’s two largest exchanges, Upbit and Bithumb, remained robust over the past week, with volumes largely concentrated in major cryptocurrencies while select altcoins attracted short-term speculative interest.

On Upbit, trading was dominated by large-cap assets, led by Ethereum, XRP, and Bitcoin. These three assets accounted for a significant share of total weekly volume, underscoring a market environment where capital continues to favor highly liquid and institutionally familiar tokens. Stablecoin activity was also notable, with USDT ranking among the top traded assets, reflecting ongoing demand for liquidity management amid market volatility. Beyond majors, several mid-cap altcoins recorded meaningful turnover, suggesting selective risk-taking rather than broad-based speculation. SUI, in particular, maintained a solid presence in the upper tier of traded assets, indicating sustained interest following its ecosystem expansion and recent network developments.

Bithumb displayed a slightly different composition, with USDT recording the highest trading volume for the week, followed by XRP and Bitcoin. This highlights Bithumb users’ relatively stronger preference for stablecoin-based positioning and short-term trading strategies. While Ethereum and Solana remained actively traded, a number of smaller-cap tokens entered the top rankings, pointing to localized trading themes and retail-driven momentum. Assets such as H and STABLE appeared among the top traded tokens, reflecting short-lived narrative or event-driven interest rather than long-term allocation trends.

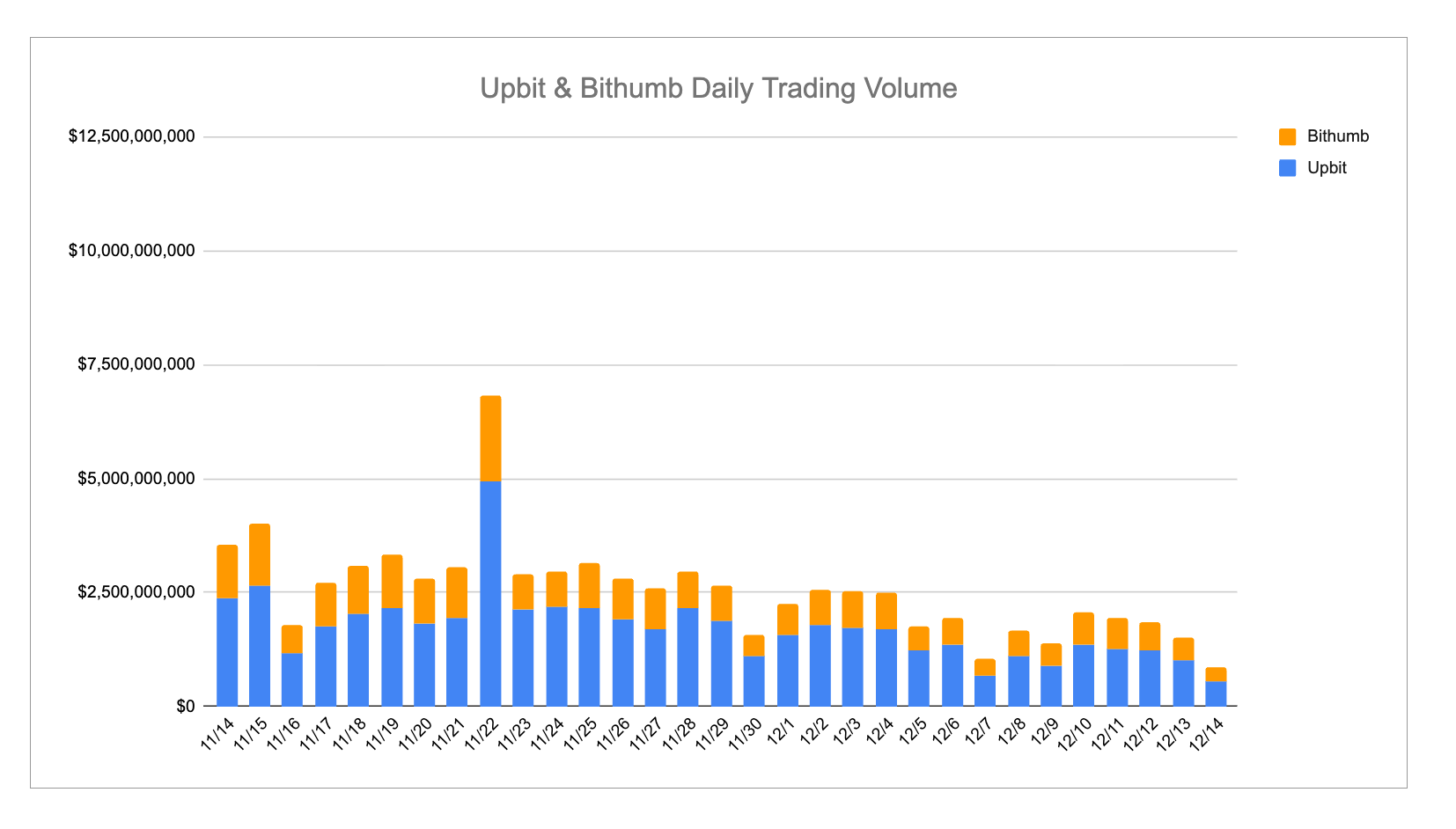

From a temporal perspective, daily trading volumes on both exchanges peaked in the early part of the week before gradually tapering off toward the weekend. This pattern suggests that initial catalysts or macro-driven sentiment triggered concentrated trading activity, followed by normalization as price movements stabilized. Despite the decline in daily volumes later in the week, overall turnover remained elevated relative to recent averages, indicating that market participation stayed healthy rather than retreating sharply.

Overall, last week’s trading volume data points to a market characterized by structural stability led by major cryptocurrencies, complemented by episodic bursts of activity in select altcoins. While speculative interest continues to rotate across smaller tokens, the dominance of assets such as ETH, BTC, and XRP suggests that market participants remain cautious and liquidity-focused. The continued visibility of SUI within the top trading ranks further signals that projects with active ecosystems and clear growth narratives are able to sustain attention even in a more selective trading environment.

2-3. Top 10 Gainers

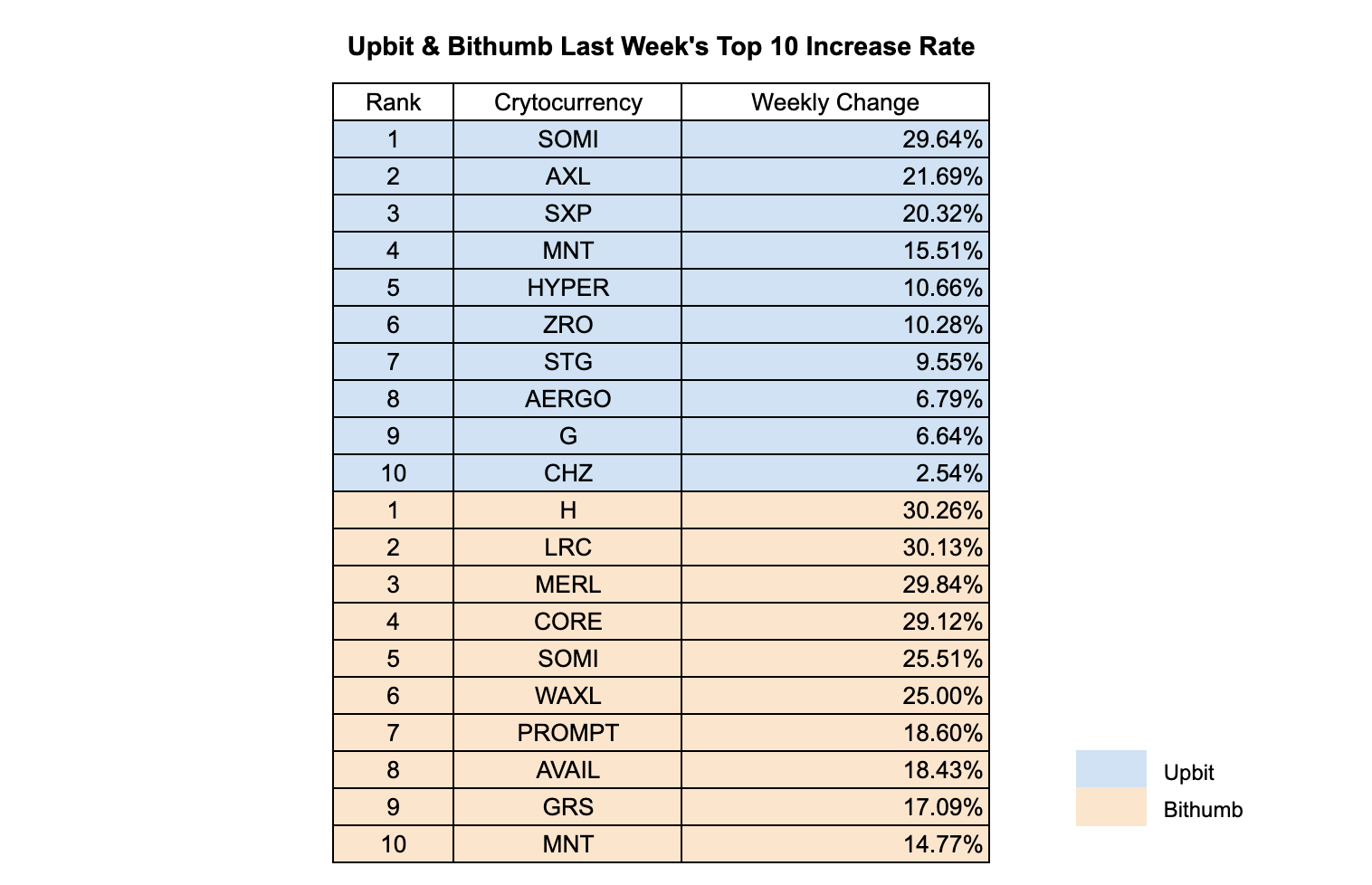

Price performance across Upbit and Bithumb last week highlighted a clear divergence between liquidity-driven trading in major assets and momentum-driven rotations into smaller-cap tokens. While overall market activity remained anchored around large-cap cryptocurrencies, the top gainers list was dominated by mid- to low-cap assets exhibiting sharp weekly increases.

On Upbit, the strongest performers were largely composed of smaller-cap tokens that experienced concentrated inflows over a short period. SOMI led the rankings with a weekly gain of nearly 30%, followed by AXL and SXP, both posting gains above 20%. Other notable movers such as MNT, HYPER, and ZRO recorded double-digit increases, suggesting a pattern of selective speculation rather than a broad-based altcoin rally. The dispersion of gains across unrelated projects indicates that price action was driven more by individual catalysts or localized narratives than by sector-wide momentum.

Bithumb’s top gainers showed an even stronger skew toward short-term price acceleration. H recorded the highest weekly increase at just over 30%, closely followed by LRC, MERL, and CORE, all of which posted gains near the 30% level. Several of these assets also appeared prominently in Bithumb’s trading volume rankings, implying that heightened price appreciation was accompanied by elevated turnover and retail participation. Tokens such as PROMPT, AVAIL, and GRS further reinforced the view that trader interest rotated quickly into specific names rather than persisting within a single theme.

Notably, there was limited overlap between the top gainers on Upbit and Bithumb, underscoring the exchange-specific nature of momentum trading in the Korean market. Differences in user base composition, liquidity conditions, and short-term narratives appear to have played a significant role in shaping price performance across the two platforms. Even where the same asset appeared on both lists, the magnitude and timing of gains varied, suggesting opportunistic rather than coordinated trading behavior.

Overall, the top gainers data points to a market environment where upside performance is increasingly fragmented. Rather than a sustained altcoin cycle, gains were concentrated in a rotating set of tokens driven by short-lived catalysts and localized liquidity surges. This pattern reinforces the importance of monitoring exchange-specific flows and highlights that, despite stable participation in major assets, risk appetite in the current market remains tactical and highly selective.

3. Korean Community Buzz

3-1. Bear market anxiety grows as hacks and shutdowns continue

As the market downturn deepens, Korean retail sentiment has grown increasingly cautious amid a series of hacks, project pivots, and shutdown announcements. TerminalFi announced the termination of its business following delays to the Ethena Convergence mainnet, while Kuzco—where node operators reportedly invested hundreds of millions of KRW—also ceased operations. Farcaster, after more than four years as a decentralized social protocol, announced a strategic pivot toward becoming a wallet-focused product, citing the structural limits of social platforms.

Meanwhile, following the Upbit hack two weeks ago, the exchange disclosed on December 8 that it had successfully frozen approximately KRW 2.6B worth of stolen assets and requested cooperation from the global crypto community to accelerate recovery efforts. Upbit also stated that it had fully compensated KRW 38.6B in withdrawn customer assets using its own reserves, ensuring no direct financial loss to users. While this response eased some concerns, the broader market narrative remains focused on operational risk and project sustainability in a prolonged downtrend.

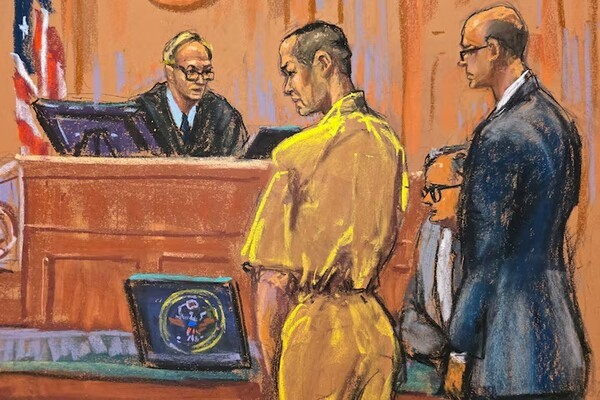

3-2. Do Kwon sentenced to 15 years in the U.S.

Do Kwon, the former CEO of Terraform Labs and central figure behind the Terra–Luna collapse, was sentenced to 15 years in prison by a U.S. court. Before any potential transfer to Korea, he is required to serve at least half of this sentence in the United States, after which additional charges are expected to be pursued domestically.

The verdict drew intense attention from the Korean crypto community. Reactions ranged from criticism that the sentence felt too lenient, to questions around where fines and forfeited assets would ultimately go, and whether compensation for Luna victims would materialize. For many retail investors, the ruling reopened unresolved frustration surrounding accountability and restitution from one of the industry’s most damaging collapses.

3-3. FX controls tighten as KRW weakness persists

Starting January next year, Korea will unify the annual no-document overseas remittance limit at USD 100,000, regardless of institution type. Previously, regulatory gaps between banks and non-bank entities (securities firms, card companies, fintech platforms) allowed users to bypass limits by splitting transfers across providers. The new rule is expected to significantly restrict this practice.

Against the backdrop of prolonged KRW weakness, the move is widely interpreted as a signal that authorities are tightening control over foreign exchange flows. Within the crypto community, discussions quickly emerged around potential implications for USDT premiums and cross-border capital movement. Some viewed the policy as further evidence that crypto rails may become increasingly relevant in a high-FX, capital-controlled environment, while others expressed concern over reduced flexibility for legitimate global transactions.

(Source)

4. Upcoming Meetup

Somnia Christmas : 솜니아마스 선물 (스테이블 코인, 스테이킹)

📆 Date: 12. 16, 19:00 ~ 22:00

💼 Host: Somnia

Luma: https://luma.com/xcnk1ydd?tk=QTbrRP

Kite Global Tour: Seoul Station

📆 Date: 12. 16, 19:00 ~ 22:00

💼 Host: Kite

Luma: https://luma.com/ljn2fg9g?tk=mwLZwM

Pudgy Korea Year-End Charity Event

📆 Date: 12. 17, 19:00 ~ 22:00

Luma: https://luma.com/14hnnlte?tk=4CBISL

Chainlink x Lighter Seoul Meetup

📆 Date: 12. 17, 19:00 ~ 22:00 💼 Host: Chainlink x Lighter

Luma: https://luma.com/Chainlink_Lighter?tk=PP0XsT

🎒 Backpack Endgame: Global Trading Competition Hosted by ReboundX

📆 Date: 12. 18, 17:00 ~ 22:00

💼 Host: Backpack

Luma: https://luma.com/c9weaq22?tk=sB4p0l

The Web3 Year-End Gala: Seoul 2025

📆 Date: 12. 18, 19:00 ~ 24:00

💼 Host: ZOOMEX LAB, Tencent Cloud Event

Luma: https://luma.com/yiayus1r?tk=hoFsyd

OpenLedger Christmas Mixer in on a Rooftop of Seou

📆 Date: 12. 18, 19:00 ~ 24:00

💼 Host: OpenLedger

Luma: https://luma.com/OpenledgerXmasMixer?tk=DlNB3r

Scoop AI Hackathon: Seoul Bowl

📆 Date: 12. 20, 14:00 ~ 18:00

💼 Host: neo

Luma: https://luma.com/hzx0ffcg?tk=El9ZMt

Cardano Summit 2025 – Community-Led Event in Seoul, South Korea

📆 Date: 12. 20, 14:00 ~ 18:00

💼 Host: Cardano

Luma: https://luma.com/2plulp61?tk=bOhsWi

THE FIRST GLOW: FINAL STAGE PARTY

📆 일정 : 12. 20, 20:00 ~ 23:00

💼 Host: FIRST GLOW

Luma: https://luma.com/vxkd1azk?tk=REGXOb

Stay tuned for more updates, and if you'd like to receive this report every week, make sure to subscribe. For the latest news and insights on the Korean market, follow us on Twitter for all the action!